UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 22, 2015

TransDigm Group Incorporated

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 001-32833 | | 41-2101738 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

1301 East 9th Street, Suite 3000, Cleveland, Ohio | | 44114 |

(Address of principal executive offices) | | (Zip Code) |

(216) 706-2960

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants’ under any of the following provisions (see General Instruction A.2. below):

|

| |

¨

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements for Certain Officers. |

Employment Agreements with Joel Reiss and Roger Jones

On October 22, 2015 and October 26, 2015, TransDigm Group Incorporated (the “Company”) entered into employment agreements with Joel Reiss and Roger Jones, respectively, pursuant to which each will serve as an executive vice president of the Company. Unless earlier terminated by the Company or Mr. Reiss or Mr. Jones, the term of each employment agreement expires on October 1, 2020. Under the terms of each employment agreement, the executive is entitled to receive an annual base salary of not less than $360,000 and is eligible to participate in the Company’s annual bonus plan with a bonus target set at 65% of his annual base salary. In addition, under the terms of each employment agreement, the executive is entitled to participate in employee benefit plans, programs and arrangements that the Company may maintain from time to time for its senior officers.

Each employment agreement provides that if Mr. Reiss or Mr. Jones is terminated for any reason, he will be entitled to payment of any accrued but unpaid base salary through the termination date, any unreimbursed expenses, an amount for accrued but unused sick and vacation days, and benefits owing to him under the benefit plans and programs sponsored by the Company. In addition, if Mr. Reiss’ or Mr. Jones’ employment is terminated without cause, if he terminates his employment for customary good reasons, or if his employment terminates due to his death or disability, the Company will pay him, in substantially equal installments over a 12-month period, an amount equal to 1.25 times his salary plus 1.25 times the greater of the all of the bonuses paid or payable to him for the prior fiscal year (excluding any extraordinary bonus) or the target bonuses for the year in which his employment terminates, determined in accordance with the Company’s bonus program(s) if any.

During the term of employment and following any termination thereof, for a period of 12 or 24 months (depending on the type of termination), Mr. Reiss and Mr. Jones will be prohibited from engaging in any business that competes with any business of the Company or its subsidiaries. In addition, during the term of his employment and for the two-year period following the termination of his employment for any reason, each executive will be prohibited from soliciting or inducing any person who is or was employed by, or providing consulting services to, the Company or any of its subsidiaries during the 12-month period prior to the date of the termination of his employment, to terminate their employment or consulting relationship with the Company or such subsidiary. Under the terms of each employment agreement, each executive is also subject to certain confidentiality and non-disclosure obligations, and the Company has agreed, so long as the applicable executive is not in breach of certain of his obligations under his employment agreement, to, among other things, indemnify him to the fullest extent permitted by Delaware law against all costs, charges and expenses incurred or sustained by him in connection with any action, suit or proceeding to which he may be made a party by reason of his being or having been a director, officer or employee of ours or his serving or having served any other enterprise as a director, officer or employee at our request.

The foregoing description of the terms of the employment agreements is qualified in its entirety by the full text of the form of employment agreement, a copy of which is filed herewith as Exhibit 10.1.

In addition, consistent with amendments made to option awards of the Company’s other executive officers, on October 22, 2015, the Compensation Committee of the Company’s Board of Directors approved an amendment to all of Mr. Reiss’ and Mr. Jones’ outstanding option award agreements to extend the period of exercisability of options post-termination to the remainder of the term of the option in the event of termination for death, disability, without cause or for good reason (as defined in the employment agreements). As previously disclosed, the amendments to extend the period of exercisability of options for executive officers are made in light of the significant option holdings of the executive officers and the Company’s significant stock ownership requirements.

The foregoing description of the terms of the amendment is qualified in its entirety by the full text of the amendment, a copy of which is filed herewith as Exhibit 10.2.

Amendments to Existing Employment Agreements

W. Nicholas Howley, Terrance Paradie, Bernt Iversen, Robert Henderson, Kevin Stein, Peter Palmer, James Skulina and Jorge Valladares

On or about October 22, 2015, the outstanding employment agreements for Messrs. W. Nicholas Howley, Terrance Paradie, Bernt Iversen, Robert Henderson, Kevin Stein, Peter Palmer, James Skulina and Jorge Valladares were amended.

The purpose of the amendments was to eliminate the right to subsidized COBRA after a termination of employment. Instead, upon a termination of employment without cause, a resignation for good reason, or termination by reason of death or disability, the executive will get the difference between the monthly COBRA continuation coverage rate and the executive’s cost of health coverage as of the date of termination times 18 (corresponding to the 18-month period for which COBRA coverage is available). The amount will be payable over 12 months.

In addition, other minor changes were made to the employment agreements to try to ensure that applicable safe harbors

under Internal Revenue Code Section 409A are met.

The foregoing description of the terms of the amendments is qualified in its entirety by the full text of the amendment for Mr. Howley, a copy of which is filed herewith as Exhibit 10.3, the full text of the amendment for Mr. Stein, a copy of which is filed herewith as Exhibit 10.4, and the form of amendment for Messrs. Paradie, Iversen, Henderson, Palmer, Skulina and Valladares, a copy of which is filed as Exhibit 10.5.

Gregory Rufus

On October 22, 2015, the outstanding employment agreement for Mr. Gregory Rufus was amended. All of the changes described above were made. In addition, the term of Mr. Rufus’ employment agreement (which was scheduled to expire on December 31, 2015) was extended to October 1, 2016.

The foregoing description of the terms of the amendment is qualified by the full text of the amendment, a copy of which is filed as Exhibit 10.6.

John Leary

On October 22, 2015, the outstanding employment agreement for Mr. John Leary was amended. All of the changes described above were made. In addition, the term of Mr. Leary’s employment agreement (which expired on October 1, 2015) was extended to October 1, 2017, but Mr. Leary will only be expected to work 30 hours per week. His minimum base salary will be $300,000.

The foregoing description of the terms of the amendment is qualified by the full text of the amendment, a copy of which is filed as Exhibit 10.7.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is being filed with this Current Report on Form 8-K:

|

| | | | |

Exhibit 10.1 | Form of Employment Agreement, dated October 2015, between TransDigm Group Incorporated and each of Joel Reiss and Roger Jones |

|

| |

Exhibit 10.2 | Text of Option Amendments adopted October 22, 2015 for Joel Reiss and Roger Jones |

| | | | |

Exhibit 10.3

| Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and W. Nicholas Howley |

|

| | | | |

Exhibit 10.4 | Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and Kevin Stein |

|

| | | | |

Exhibit 10.5 | Form of Amendment to Employment Agreement, dated October 2015, between TransDigm Group Incorporated and each of Terrance Paradie, Bernt Iversen, Robert Henderson, Peter Palmer, James Skulina and Jorge Valladares |

|

| | | | |

Exhibit 10.6 | Second Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and Gregory Rufus |

|

| | | | |

Exhibit 10.7 | Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and John Leary |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

TRANSDIGM GROUP INCORPORATED |

| |

By | | /s/ Terrance Paradie |

| | Terrance Paradie |

| | Executive Vice President and Chief Financial Officer |

Date: October 27, 2015

Exhibit Index

|

| | | | |

Exhibit 10.1 | Form of Employment Agreement, dated October 2015, between TransDigm Group Incorporated and each of Joel Reiss and Roger Jones |

|

| | | | |

Exhibit 10.2 | Text of Option Amendments adopted October 22, 2015 for Joel Reiss and Roger Jones |

| | | | |

Exhibit 10.3 | Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and W. Nicholas Howley |

|

| | | | |

Exhibit 10.4 | Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and Kevin Stein |

|

| | | | |

Exhibit 10.5 | Form of Amendment to Employment Agreement, dated October 2015, between TransDigm Group Incorporated and each of Terrance Paradie, Bernt Iversen, Robert Henderson, Peter Palmer, James Skulina and Jorge Valladares |

|

| | | | |

Exhibit 10.6 | Second Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and Gregory Rufus |

|

| | | | |

Exhibit 10.7 | Amendment to Employment Agreement, dated October 22, 2015, between TransDigm Group Incorporated and John Leary |

|

| | | | |

| | | | |

Exhibit 10.1

FORM OF EMPLOYMENT AGREEMENT FOR JOEL REISS AND ROGER JONES

THIS AGREEMENT, dated as of October [22/26], 2015, is made by and between TransDigm Group Incorporated, a Delaware corporation (the “Company”), and [Joel Reiss/Roger Jones] (the “Executive”).

RECITALS:

WHEREAS, the Executive holds the position of Executive Vice President of the Company; and

WHEREAS, the parties would like to enter into an employment agreement on the terms and subject to the conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the parties hereto agree as follows:

1. Certain Definitions.

(a) “Annual Base Salary” shall have the meaning set forth in Section 4(a).

(b) “Board” shall mean the Board of Directors of the Company.

(c) “Cause” shall mean either of the following: (i) the repeated failure by the Executive, after written notice from the Board, substantially to perform his material duties and responsibilities as an officer or employee or director of the Company or any of its subsidiaries (other than any such failure resulting from incapacity due to reasonably documented physical or mental illness), or (ii) any willful misconduct by the Executive that has the effect of materially injuring the business of the Company or any of its subsidiaries, including, without limitation, the disclosure of material secret or confidential information of the Company or any of its subsidiaries.

(d) “COBRA” shall mean the Consolidated Omnibus Budget Reconciliation Act of 1985, as may be amended from time to time.

(e) “Code” shall mean the Internal Revenue Code of 1986, as amended. Reference to a Section of the Code includes all rulings, regulations, notices, announcements, decisions, orders and other pronouncements that are issued by the United States Department of the Treasury, the Internal Revenue Service, or any court of competent jurisdiction that are lawful and pertinent to the interpretation, application or effectiveness of such Section.

(f) “Common Stock” shall mean the common stock of the Company, $0.01 par value per share.

(g) “Company” shall have the meaning set forth in the preamble hereto.

(h) “Compensation Committee” shall mean the Compensation Committee of the Board whose members shall be appointed by the Board from time to time.

(i) “Date of Termination” shall mean (i) if the Executive’s employment is terminated by reason of his death, the date of his death, and (ii) if the Executive’s employment is terminated pursuant to Sections 5(a)(ii) - (vi), the date specified in the Notice of Termination.

(j) “Disability” shall mean the Executive’s absence from employment with the Company due to: (i) his inability to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve months; or (ii) such medically determinable physical or mental impairment, which can be expected to result in death or can be expected to last for a continuous period of not less than twelve months, and for which the Executive is receiving income replacement benefits for a period of not less than three months under an accident and health plan covering the Company’s employees.

(k) “Effective Date” shall mean the date of this Agreement.

(l) “Equity Compensation Agreements” shall mean any written agreements between the Company and the Executive pursuant to which the Executive holds or is granted options to purchase Common Stock, including, without limitation, agreements evidencing options granted under any option plan adopted or maintained by the Company for employees generally, and any management deferred compensation or similar plans of the Company.

(m) “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

(n) “Executive” shall have the meaning set forth in the preamble hereto.

(o) “Good Reason” shall mean the occurrence of any of the following: (i) a material diminution in the Executive’s title, duties or responsibilities, without his prior written consent, or (ii) a reduction of the Executive’s aggregate cash compensation (including bonus opportunities), benefits or perquisites, without his prior written consent, (iii) the Company requires the Executive, without his prior written consent, to be based at any office or location that requires a relocation greater than 30 miles from [Pasadena, California/Cleveland, Ohio], or (iv) any material breach of this Agreement by the Company.

(p) “Notice of Termination” shall have the meaning set forth in Section 5(b).

(q) “Payment Period” shall have the meaning set forth in Section 6(b).

(r) “Specified Employee” shall have the meaning set forth in Code Section 409A

(s) “Term” shall have the meaning set forth in Section 2.

2. Employment. The Company shall employ the Executive, for the period set forth in this Section 2, in the position(s) set forth in Section 3 and upon the other terms and conditions herein provided. The term of employment under this Agreement (the “Term”) shall be for the period beginning on the Effective Date and ending on October 1, 2020 unless earlier terminated as provided in Section 5.

3. Position and Duties. During the Term, the Executive shall serve as Executive Vice President of each of the Company and its subsidiary, TransDigm, Inc. (“TransDigm”), with such customary responsibilities, duties and authority as may from time to time be assigned to the Executive by the Chief Executive Officer. During the Term, the Executive shall devote substantially all his working time and efforts to the business and affairs of the Company and TransDigm; provided, that it shall not be considered a violation of the foregoing for the Executive to (i) with the prior consent of the Board (which consent shall not unreasonably be withheld), serve on corporate, industry, civic or charitable boards or committees, and (ii) manage his personal investments, so long as none of such activities significantly interferes with the Executive’s duties hereunder.

4. Compensation and Related Matters.

(a) Annual Base Salary. During the Term (commencing as of the first pay period following the date of this Agreement), the Executive shall receive a base salary at a rate of $360,000 per annum, payable in accordance with the Company’s normal payroll practices, which shall be reviewed by the Compensation Committee annually and may be increased, but not decreased, upon such review (the “Annual Base Salary”).

(b) Bonus. For each fiscal year during the Term, the Executive shall be eligible to participate in the Company’s annual cash bonus plan in accordance with terms and provisions which shall be consistent with the Company’s executive bonus policy in effect as of the date hereof. The Executive’s target bonus for fiscal year 2016 and thereafter will be 65% of his Annual Base Salary.

(c) Non-Qualified Deferred Compensation. During the Term, the Executive shall be eligible to participate in any non-qualified deferred compensation plan or program (if any) offered by the Company to its executives.

(d) Long Term Incentive Compensation. During the Term, the Executive shall be entitled to participate in the Option Plan or any successor plan thereto.

(e) Benefits. During the Term, the Executive shall be entitled to participate in the other employee benefit plans, programs and arrangements of the Company now (or, to the extent determined by the Board or Compensation

Committee, hereafter) in effect which are applicable to the senior officers of the Company generally, subject to and on a basis consistent with the terms, conditions and overall administration thereof (including the right of the Company to amend, modify or terminate such plans).

(f) Expenses. Pursuant to the Company’s customary policies in force at the time of payment, the Executive shall be reimbursed for all expenses properly incurred by the Executive on the Company’s behalf in the performance of the Executive’s duties hereunder.

(g) Vacation. The Executive shall be entitled to an amount of annual vacation days, and to compensation in respect of earned but unused vacation days in accordance with the Company’s vacation policy as in effect as of the Effective Date. The Executive shall also be entitled to paid holidays in accordance with the Company’s practices with respect to same as in effect as of the Effective Date.

5. Termination.

(a) The Executive’s employment hereunder may be terminated by the Company or the Executive, as applicable, without any breach of this Agreement only under the following circumstances and in accordance with subsection (b):

(i) Death. The Executive’s employment hereunder shall terminate upon his death.

(ii) Disability. If the Company determines in good faith that the Executive has incurred a Disability, the Company may give the Executive written notice of its intention to terminate the Executive’s employment. In such event, the Executive’s employment with the Company shall terminate effective on the 30th day after receipt of such notice by the Executive, provided that within such 30 day period the Executive shall not have returned to full-time performance of his duties. The Executive shall continue to receive his Annual Base Salary until the 90th day following the date of the Notice of Termination.

(iii) Termination for Cause. The Company may terminate the Executive’s employment hereunder for Cause.

(iv) Resignation for Good Reason. The Executive may terminate his employment hereunder for Good Reason.

(v) Termination without Cause. The Company may terminate the Executive’s employment hereunder without Cause.

(vi) Resignation without Good Reason. The Executive may resign his employment hereunder without Good Reason.

(b) Notice of Termination. Any termination of the Executive’s employment by the Company or by the Executive under this Section 5 (other than termination pursuant to subsection (a)(i)) shall be communicated by a written notice from the Chief Executive Officer of the Company or the Executive to the other indicating the specific termination provision in this Agreement relied upon, (and, in the case of Resignation for Good Reason, setting forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under Section 5(a)(iv), and specifying a Date of Termination which, in the case of Resignation for Good Reason or Resignation without Good Reason pursuant to Section 5(a)(iv) or 5(a)(vi), respectively, shall be at least 90 days following the date of such notice (a “Notice of Termination”). In the event of the Executive’s Resignation for Good Reason pursuant to Section 5(a)(iv), the Company shall have the right, if the basis for such Good Reason is curable, to cure the same within 30 days following the receipt of the Notice of Termination, and Good Reason shall not be deemed to exist if the Company cures the event giving rise to Good Reason within such 30 day period. The Executive shall continue to receive his Annual Base Salary, annual bonus and all other compensation and perquisites referenced in Section 4 through the Date of Termination.

6. Severance Payments.

(a) Termination for any Reason. In the event the Executive’s employment with the Company is terminated for any reason, the Company shall pay the Executive (or his beneficiary in the event of his death) any unpaid Annual Base Salary that has accrued as of the Date of Termination, any unreimbursed expenses due to the Executive in accordance with the Company’s expense reimbursement policy and an amount equal to compensation for accrued but unused sick days and vacation days. The Company shall permit the Executive to elect to continue health plan coverage in accordance with the requirements of applicable law (e.g. COBRA coverage), at the applicable monthly cost charged for such coverage (the “Monthly COBRA Coverage Continuation Rate”). The Company may require the Executive to complete and file any election forms that are generally required of other employees to obtain COBRA coverage; and the Executive’s COBRA coverage may be terminable in accordance with applicable law. The Executive shall also be entitled to accrued, vested benefits under the Company’s benefit plans and programs as provided therein. The Executive shall be entitled to the additional payments and benefits described below only as set forth herein.

(b) Termination without Cause, Resignation for Good Reason or Termination by Reason of Death or Disability. Subject to Sections 6(c) and (d) and the restrictions contained herein, in the event of the Executive’s Termination without Cause (pursuant to Section 5(a)(v)), Resignation for Good Reason (pursuant to Section 5(a)(iv)) or termination by reason of death or Disability (pursuant to Section 5(a)(i) or (ii), respectively), the Company shall pay to the Executive the amounts described in subsection (a). In addition, subject to Sections 6(c) and (d) and the restrictions contained herein, and in the case of Termination without Cause (pursuant to Section 5(a)(v), Resignation for Good Reason (pursuant to Section 5(a)(iv) or Disability (pursuant to Section 5(a)(ii)) subject to the Executive’s execution and non-revocation of a customary release in favor of the Company (the “Release”) no later than thirty (30) days following the Date of Termination, the Company shall pay to the Executive (or his beneficiary in the event of his death) an amount equal to the “Severance Amount” described below. For purposes of this Agreement the Severance Amount is equal to the sum of:

(i) 1.25 times his Annual Base Salary,

(ii) 1.25 times the greater of (A) the total of all bonuses paid (or payable) to executive in respect of the fiscal year ending immediately prior to the Date of Termination, excluding any bonuses that are extraordinary in nature (e.g., a transaction related bonus) or (B) the target bonuses for the fiscal year in which the Date of Termination falls, determined in accordance with the Company’s bonus program or programs, if any, and

(iii) 18.0 times the difference of (A) the Monthly COBRA Continuation Coverage Rate determined as of the Date of Termination for the Executive’s applicable health plan coverage as in effect on such date, less (B) the monthly cost to Executive that is being charged for such coverage as of the Date of Termination.

The Severance Amount as so determined shall be payable to the Executive (or his beneficiary) in substantially equal installments over the 12 month period following the Date of Termination (the “Payment Period”) commencing no later than thirty (30) days following the execution and non-revocation of the Release, in accordance with the Company’s regular payroll practices. The first installment payment shall include all amounts that would have otherwise been paid to the Executive during the period beginning on the Date of Termination and ending on the first installment payment date. Notwithstanding the foregoing, in the event that the end of the thirty (30) day notice and revocation period for the Release would result in the first installment payment occurring in the taxable year following the year in which the Date of Termination occurs, the first installment payment shall be made in the taxable year following the year in which the Date of Termination occurs.

(c) Benefits Provided Upon Termination of Employment. If the Executive’s termination or resignation does not constitute a “separation from service,” as such term is defined under Code Section 409A, the Executive shall nevertheless be entitled to receive all of the payments and benefits that the Executive is entitled to receive under this Agreement on account of his termination of employment. However, the payments and benefits that the Executive is entitled to under this Agreement shall not be provided to the Executive until such time as the Executive has incurred a “separation from services” within the meaning of Code Section 409A.

(d) Payments on Account of Termination to a Specified Employee. Notwithstanding the foregoing provisions of Sections 6(a) or 6(b), in the event that the Executive is determined to be a Specified Employee at the time of his termination of employment under this Agreement (or, if later, his “separation from service” under Code Section 409A), to the extent that a payment, reimbursement or benefit under Section 6(b) is considered to provide for a “deferral of compensation” (as determined under Code Section 409A), then such payment, reimbursement or benefit shall not be paid or provided until six months after the Executive’s separation from service, or his death, whichever occurs first. Any payments, reimbursements or benefits that are withheld under this provision for the first six months shall be payable in a lump sum on the 181st day after such termination of employment (or, if later, separation from service). The restrictions in this Section 6(d) shall be interpreted and applied solely to the minimum extent necessary to comply with the requirements of Code Section 409A(a)(2)(B). Accordingly, payments, benefits or reimbursements under Section 6(b) or any other part of this Agreement may nevertheless be provided to Executive with the six-month period following the date of Executive’s termination of employment under this Agreement (or, if later, his “separation from service” under Code Section 409A), to the extent that it would nevertheless be permissible to do so under Code Section 409A because those payments, reimbursements or benefits are (i) described in Treasury Regulations Section 1.409A-1(b)(9)(iii) (i.e., payments within the limitations therein that are being

made on account of an involuntary termination or termination for good reason, within the meaning of the Treasury Regulations), or (ii) described in Treasury Regulation Section 1.409A-1(b)(4) (i.e., payments which are treated as short-term deferrals within the meaning of the Treasury Regulations), or (iii) benefits described in Treasury Regulations Section 1.409A-1(b)(9)(v) (e.g. health care benefits).

7. Competition; Nonsolicitation.

(a) During the Term and, following any termination of Executive’s employment, for a period equal to (i) the Payment Period, in the case of a termination of employment for which payments are made pursuant to Section 6(b) hereof, or (ii) 24 months from the date of such termination in the event of a voluntary termination of employment by the Executive without Good Reason, or a termination by the Company for Cause, the Executive shall not, without the prior written consent of the Board, directly or indirectly engage in, or have any interest in, or manage or operate any person, firm, corporation, partnership or business (whether as director, officer, employee, agent, representative, partner, security holder, consultant or otherwise) that engages in any business (other than a business that constitutes less than 5% of the relevant entity’s net revenue and a proportionate share of its operating income) which competes with any business of the Company or any entity owned by it anywhere in the world; provided, however, that the Executive shall be permitted to acquire a stock interest in such a corporation provided such stock is publicly traded and the stock so acquired does not represent more than one percent of the outstanding shares of such corporation.

(b) During the Term and for a period of two years following any termination of the Executive’s employment, the Executive shall not, directly or indirectly, on his own behalf or on behalf of any other person or entity, whether as an owner, employee, service provider or otherwise, solicit or induce any person who is or was employed by, or providing consulting services to, the Company or any of its subsidiaries during the twelve-month period prior to the date of such termination, to terminate their employment or consulting relationship with the Company or any such subsidiary.

(c) In the event the agreement in this Section 7 shall be determined by any court of competent jurisdiction to be unenforceable by reason of its extending for too great a period of time or over too great a geographical area or by reason of its being too extensive in any other respect, it shall be interpreted to extend only over the maximum period of time for which it may be enforceable, and/or over the maximum geographical area as to which it may be enforceable and/or to the maximum extent in all other respects as to which it may be enforceable, all as determined by such court in such action.

8. Nondisclosure of Proprietary Information.

(a) Except as required in the faithful performance of the Executive’s duties hereunder or pursuant to subsection (c), the Executive shall, in perpetuity, maintain in confidence and shall not directly, indirectly or otherwise, use, disseminate, disclose or publish, or use for his benefit or the benefit of any person, firm, corporation or other entity any confidential or proprietary information or trade secrets of or relating to the Company, including, without limitation, information with respect to the Company’s operations, processes, products, inventions, business practices, finances, principals, vendors, suppliers, customers, potential customers, marketing methods, costs, prices, contractual relationships, regulatory status, compensation paid to employees or other terms of employment, except for such information which is or becomes publicly available other than as a result of a breach by the Executive of this Section 8, or deliver to any person, firm, corporation or other entity any document, record, notebook, computer program or similar repository of or containing any such confidential or proprietary information or trade secrets. The parties hereby stipulate and agree that as between them the foregoing matters are important, material and confidential proprietary information and trade secrets and affect the successful conduct of the businesses of the Company (and any successor or assignee of the Company).

(b) Upon termination of the Executive’s employment with the Company for any reason, the Executive shall promptly deliver to the Company all correspondence, drawings, manuals, letters, notes, notebooks, reports, programs, plans, proposals, financial documents, or any other documents concerning the Company’s customers, business plans, marketing strategies, products or processes and/or which contain proprietary information or trade secrets.

(c) The Executive may respond to a lawful and valid subpoena or other legal process but shall give the Company the earliest possible notice thereof, shall, as much in advance of the return date as possible, make available to the Company and its counsel the documents and other information sought and shall assist such counsel in resisting or otherwise responding to such process.

9. Injunctive Relief. It is recognized and acknowledged by the Executive that a breach of the covenants contained in Sections 7 and 8 will cause irreparable damage to the Company and its goodwill, the exact amount of which will be difficult or impossible to ascertain, and that the remedies at law for any such breach will be inadequate. Accordingly, the Executive agrees that in the event of a breach of any of the covenants contained in Sections 7 and 8, in addition to any other remedy which may be available at law or in equity, the Company shall be entitled to specific performance and injunctive relief.

10. Survival. The expiration or termination of the Term shall not impair the rights or obligations of any party hereto which shall have accrued hereunder prior to such expiration.

11. Binding on Successors. This Agreement shall be binding upon and inure to the benefit of the Company, the Executive and their respective successors, assigns, personnel and legal representatives, executors, administrators, heirs, distributees, devisees, and legatees, as applicable.

12. Governing Law. This Agreement shall be governed, construed, interpreted and enforced in accordance with the substantive laws of the State of Ohio.

13. Validity. The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement, which shall remain in full force and effect.

14. Notices. Any notice, request, claim, demand, document or other communication hereunder to any party shall be effective upon receipt (or refusal of receipt) and shall be in writing and delivered personally or sent by telex, telecopy, or certified or registered mail, postage prepaid, as follows:

(a) If to the Company, to:

TransDigm Group Incorporated

The Tower at Erieview

1301 E. 9th Street, Suite 3000

Cleveland, Ohio 44114

Attention: W. Nicholas Howley, CEO and Chairman

(b) If to the Executive, to him at the address set forth below under his signature;

or at any other address as any party shall have specified by notice in writing to the other party in accordance with this Section 14.

15. Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

16. Entire Agreement; Prior Employment Agreement. The terms of this Agreement, together with the Equity Compensation Agreements are intended by the parties to be the final expression of their agreement with respect to the employment of the Executive by the Company and may not be contradicted by evidence of any prior or contemporaneous agreement. The parties further intend that this Agreement, and the aforementioned contemporaneous documents, shall constitute the complete and exclusive statement of its terms and that no extrinsic evidence whatsoever may be introduced in any judicial, administrative, or other legal proceeding to vary the terms of this Agreement.

17. Amendments; Waivers. This Agreement may not be modified, amended, or terminated except by an instrument in writing, signed by the Executive and the Chief Executive Officer. By an instrument in writing similarly executed, the Executive or the Company may waive compliance by the other party or parties with any provision of this Agreement that such other party was or is obligated to comply with or perform; provided, however, that such waiver shall not operate as a waiver of, or estoppel with respect to, any other or subsequent failure. No failure to exercise and no delay in exercising any right, remedy or power hereunder shall preclude any other or further exercise of any other right, remedy or power provided herein or by law or in equity.

18. No Inconsistent Actions. The parties hereto shall not voluntarily undertake or fail to undertake any action or course of action inconsistent with the provisions or essential intent of this Agreement. Furthermore, it is the intent of the parties hereto to act in a fair and reasonable manner with respect to the interpretation and application of the provisions of this Agreement.

19. Arbitration. Any dispute or controversy arising under or in connection with this Agreement shall be settled exclusively by arbitration, conducted before a panel of three arbitrators in Cleveland, Ohio, in accordance with the rules of the American Arbitration Association then in effect. Judgment may be entered on the arbitrator’s award in any court having jurisdiction; provided, however, that the Company shall be entitled to seek a restraining order or injunction in any court of competent jurisdiction to prevent any continuation of any violation of the provisions of Section 7 or 8 of this Agreement and the Executive hereby consents that such restraining order or injunction may be granted without the necessity of the Company’s posting any bond; and provided further, that the Executive shall be entitled to seek specific performance of his right to be paid until the Date of Termination during the pendency of any dispute or controversy arising under or in connection with this Agreement. Each of the parties hereto shall bear its share of the fees and expenses of any arbitration hereunder.

20. Indemnification and Insurance; Legal Expenses. During the Term and so long as the Executive has not breached any of his obligations set forth in Sections 7 and 8, the Company shall indemnify the Executive to the fullest extent permitted by the laws of the State of Delaware, as in effect at the time of the subject act or omission, and shall advance to the Executive reasonable attorneys’ fees and expenses as such fees and expenses are incurred (subject to an undertaking from the Executive to repay such advances if it shall be finally determined by a judicial decision which is not subject to further appeal that the Executive was not entitled to the reimbursement of such fees and expenses) and he shall be entitled to the protection of any insurance policies the Company shall elect to maintain generally for the benefit of its directors and officers (“Directors and Officers Insurance”) against all costs, charges and expenses incurred or sustained by him in connection with any action, suit or proceeding to which he may be made a party by reason of his being or having been a director, officer or employee of the Company or any of its subsidiaries or his serving or having served any other enterprise as a director, officer or employee at the request of the Company (other than any dispute, claim or controversy arising under or relating to this Agreement). The Company covenants to maintain during the Term for the benefit of the Executive (in his capacity as an officer and director of the Company) Directors and Officers Insurance providing customary benefits to the Executive.

(SIGNATURE PAGE FOLLOWS)

IN WITNESS WHEREOF, the parties have executed this Agreement on the date and year first above written.

|

| | |

| |

|

TRANSDIGM GROUP INCORPORATED |

| |

By: | | /s/ W. Nicholas Howley |

Name: | | W. Nicholas Howley |

Title: | | Chief Executive Officer |

|

EXECUTIVE |

|

[/s/ Joel Reiss/Roger Jones] |

[Joel Reiss/Roger Jones] |

Exhibit 10.2

TEXT OF OPTION AMENDMENTS FOR JOEL REISS AND ROGER JONES

"3.3 Expiration of Option. The Option may not be exercised to any extent by anyone after the first to occur of the following events:

(a) The expiration of ten years from the Grant Date;

(b) If this Option is designated as an Incentive Stock Option and the Participant owned (within the meaning of Section 424(d) of the Code), at the time the Option was granted, more than 10% of the total combined voting power of all classes of stock of the Company of any "subsidiary corporation" of the Company or any "parent corporation" of the Company (each within the meaning of Section 424 of the Code), the expiration of five years from the Grant Date;

(c) The opening of business on the day of the Participant's Termination of Services by reason of the Participant's Termination of Employment by reason of a termination by the Company for Cause (as defined in the Participant's employment agreement, if applicable), unless the Committee, in its discretion, determines that a longer period is appropriate;

(d) The expiration of six months from the date of the Participant's Termination of Services, unless such termination occurs by reason of (i) the Participant's death, (ii) the Participant's termination for Cause (as defined in the Participant's employment agreement, if applicable), (iii) the Participant's retirement (pursuant to Section 3.3(e)), (iv) the Participant's termination for Cause (as defined in the Participant's employment agreement, if applicable), or (v) if the Participant has an employment agreement that defines a termination for "Cause" and/or "Good Reason," a termination by the Company without Cause (as defined in the Participant's employment agreement) or a termination by the Participant for Good Reason (as defined in Participant's employment agreement), provided, however, that any portion of this Option that is an Incentive Stock Option shall cease to be an Incentive Stock Option on the expiration of three months from the Participant's Termination of Services (and shall thereafter by a Non-Qualified Stock Option), provided, further, that to the extent that the Participant is prohibited from selling shares of Stock pursuant to the Company's insider trading policy at all times during such six-month period, with the exception of an open trading window of less than seven days, the Option shall expire on the seventh day following the opening of the first open trading window trading window thereafter; or

(e) The expiration of one year from the date of the Participant's Termination of Services by reason of the retirement, after a minimum of ten years of service, of a Participant who is at least 55 years old, provided, however, that to the extent that the Participant is prohibited from selling shares of Stock pursuant to the Company's insider trading policy at all times during such one-year period, with the exception of an open trading window of less than seven days, the Option shall expire on the seventh day following the opening of the first open trading window thereafter; or

(f) The expiration date set forth in clause (a), (i) if the Participant has an employment agreement that defines a termination for "Cause" and/or "Good Reason," upon a Participant's Termination of Services by the Company without Cause (as defined in Participant's employment agreement) or a Termination of Services by the Participant for Good Reason (as defined in Participant's employment agreement) or (ii) upon the Participant's death or Disability or (iii) upon the Participant's retirement from employment after at least 15 years of service after age 60 or after at least ten years of service after age 65."

Exhibit 10.3

AMENDMENT TO EMPLOYMENT AGREEMENT

THIS AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”), dated as of October 22, 2015 is made by and between TransDigm Group Incorporated, a Delaware corporation (the “Company”), and W. Nicholas Howley (“Executive”).

W I T N E S S E T H:

WHEREAS, the Company and Executive are parties to the Third Amended and Restated Employment Agreement, dated as of August 28, 2015 (the “Employment Agreement”) setting forth certain terms and conditions of Executive’s employment with the Company; and

WHEREAS, the Company and Executive desire to amend the Employment Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the parties hereto agree as follows:

| |

a. | The penultimate sentence of Section 5(b) is deleted and replaced with the following: “In the event of the Executive’s Resignation for Good Reason pursuant to Section 5(a)(iv), the Company shall have the right, if the basis for such Good Reason is curable, to cure the same within 30 days following the receipt of the Notice of Termination and Good Reason shall not be deemed to exist if the Company cures the event giving rise to Good Reason within such 30-day period.” |

| |

b. | Section 6(a) is amended to insert after the first sentence: “The Company shall permit the Executive to elect to continue health plan coverage in accordance with the requirements of applicable law (e.g., COBRA coverage), at the applicable monthly cost charged for such coverage (the “Monthly COBRA Coverage Continuation Rate”). The Company may require the Executive to complete and file any election forms that are generally required of other employees to obtain COBRA coverage; and the Executive’s COBRA coverage may be terminable in accordance with applicable law. |

| |

c. | Delete Section 6(b) in its entirety and replace it with the following: |

“(b) Termination without Cause, Resignation for Good Reason or Termination by Reason of Death or Disability. Subject to Sections 6(c) and (d) and the restrictions contained herein, in the event of the Executive’s Termination without Cause (pursuant to Section 5(a)(v)), Resignation for Good Reason (pursuant to Section 5(a)(iv)) or termination by reason of death or Disability (pursuant to Section 5(a)(i) or (ii), respectively), the Company shall pay to the Executive the amounts described in subsection (a). In addition, subject to Section 6(c) and (d) and the restrictions contained herein, the Company shall pay to the Executive (or his beneficiary in the event of his death) an amount equal to the “Severance Amount” described below. For purposes of this Agreement the Severance Amount is equal to the sum of:

(i) 2.0 times his Annual Base Salary, and

(ii) 2.0 times the greater of (A) the total of all bonuses paid (or payable) to executive in respect of the fiscal year ending immediately prior to the Date of Termination, excluding any bonuses that are extraordinary in nature (e.g., a transaction related bonus) or (B) the target bonuses for the fiscal year in which the Date of Termination falls, determined in accordance with the Company’s bonus program or programs, if any.

(iii) 18.0 times the difference of (A) the Monthly COBRA Continuation Coverage Rate determined as of the Date of Termination for the Executive’s applicable health plan coverage as in effect on such date, less (B) the monthly cost to Executive that is being charged for such coverage as of the Date of Termination.

The Severance Amount as so determined shall be payable to the Executive (or his beneficiary) in substantially equal installments of the 12 month period following the Date of Termination (the “Payment Period”) in accordance with the Company’s regular payroll practices.”

| |

d. | Delete the last sentence of Section 6(d) and replace it with the following: “Accordingly, payments, benefits or reimbursements under Section 6(b) or any other part of this Agreement may nevertheless be provided to Executive with the six-month period following the date of Executive’s termination of employment under this Agreement (or, if later, his “separation from service” under Code Section 409A), to the extent that it would nevertheless be permissible to do so under Code Section 409A because those payments, reimbursement or benefits are (i) described in Treasury Regulations Section 1.409A-1(b)(9)(iii) (i.e., payments within the limitations therein that are being made on account of an involuntary termination or termination for good reason, within the meaning of the Treasury Regulations), or (ii) described in Treasury Regulation Section 1.409A-1(b)(4) (i.e., payments which are treated as short-term deferrals within the meaning of the Treasury Regulations, or (iii) benefits described in Treasury Regulations Section 1.409A-1(v)(9)(v) (e.g., health care benefits). |

2. Counterparts. This Amendment may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

3. Governing Law. This Amendment shall be governed, construed, interpreted and enforced in accordance with the substantive laws of the State of Ohio.

4. Full Force and Effect. Except as expressly amended by this Amendment, all other terms and conditions of the Employment Agreement shall remain in full force and effect and unmodified hereby.

IN WITNESS WHEREOF, the parties have executed this Amendment on the date and year first above written.

TRANSDIGM GROUP INCORPORATED

By: /s/ Terrance Paradie_____________

Name: Terrance Paradie

Title: E.V.P. and C.F.O.

EXECUTIVE

/s/ W. Nicholas Howley______________

W. Nicholas Howley

Exhibit 10.4

AMENDMENT TO EMPLOYMENT AGREEMENT

THIS AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”), dated as of October 23, 2015 is made by and between TransDigm Group Incorporated, a Delaware corporation (the “Company”), and Kevin Stein (“Executive”).

W I T N E S S E T H:

WHEREAS, the Company and Executive are parties to the Employment Agreement, dated as of October 29, 2014 (the “Employment Agreement”) setting forth certain terms and conditions of Executive’s employment with the Company; and

WHEREAS, the Company and Executive desire to amend the Employment Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the parties hereto agree as follows:

| |

a. | The third to last sentence of Section 5(b) is deleted and replaced with the following: “In the event of the Executive’s Resignation for Good Reason pursuant to Section 5(a)(iv), the Company shall have the right, if the basis for such Good Reason is curable, to cure the same within 30 days following the receipt of the Notice of Termination and Good Reason shall not be deemed to exist if the Company cures the event giving rise to Good Reason within such 30-day period.” |

| |

b. | Section 6(a) is amended to insert after the first sentence: “The Company shall permit the Executive to elect to continue health plan coverage in accordance with the requirements of applicable law (e.g., COBRA coverage), at the applicable monthly cost charged for such coverage (the “Monthly COBRA Coverage Continuation Rate”). The Company may require the Executive to complete and file any election forms that are generally required of other employees to obtain COBRA coverage; and the Executive’s COBRA coverage may be terminable in accordance with applicable law. |

| |

c. | Delete Section 6(b) in its entirety and replace it with the following: |

“(b) Termination without Cause, Resignation for Good Reason or Termination by Reason of Death or Disability. Subject to Sections 6(c) and (d) and the restrictions contained herein, in the event of the Executive’s Termination without Cause (pursuant to Section 5(a)(v)), Resignation for Good Reason (pursuant to Section 5(a)(iv)) or termination by reason of death or Disability (pursuant to Section 5(a)(i) or (ii), respectively), the Company shall pay to the Executive the amounts described in subsection (a). In addition, subject to Section 6(c) and (d) and the restrictions contained herein, the Company shall pay to the Executive (or his beneficiary in the event of his death) an amount equal to the “Severance Amount” described below. For purposes of this Agreement the Severance Amount is equal to the sum of:

(i) 1.0 times his Annual Base Salary (except that for a termination for Good Reason under clause (v) of the definition thereof, the amount shall be 1.5 times his Annual Base Salary), and

(ii) 1.0 times the greater of (A) the total of all bonuses paid (or payable) to executive in respect of the fiscal year ending immediately prior to the Date of Termination, excluding any bonuses that are extraordinary in nature (e.g., a transaction related bonus) or (B) the target bonuses for the fiscal year in which the Date of Termination falls, determined in accordance with the Company’s bonus program or programs, if any (except that for a termination for Good Reason under clause (v) of the definition thereof, the amount shall be 1.5 times the greater of the foregoing clauses (A) or (B)).

(iii) 18.0 times the difference of (A) the Monthly COBRA Continuation Coverage Rate determined as of the Date of Termination for the Executive’s applicable health plan coverage as in effect on such date, less (B) the monthly cost to Executive that is being charged for such coverage as of the Date of Termination.

The Severance Amount as so determined shall be payable to the Executive (or his beneficiary) in substantially equal installments of the 12 month period following the Date of Termination (the “Payment Period”) in accordance with the Company’s regular payroll practices.”

| |

d. | Delete the last sentence of Section 6(d) and replace it with the following: “Accordingly, payments, benefits or reimbursements under Section 6(b) or any other part of this Agreement may nevertheless be provided to Executive with the six-month period following the date of Executive’s termination of employment under this Agreement (or, if later, his “separation from service” under Code Section 409A), to the extent that it would nevertheless be permissible to do so under Code Section 409A because those payments, reimbursement or benefits are (i) described in Treasury Regulations Section 1.409A-1(b)(9)(iii) (i.e., payments within the limitations therein that are being made on account of an involuntary termination or termination for good reason, within the meaning of the Treasury Regulations), or (ii) described in Treasury Regulation Section 1.409A-1(b)(4) (i.e., payments which are treated as short-term deferrals within the meaning of the Treasury Regulations, or (iii) benefits described in Treasury Regulations Section 1.409A-1(v)(9)(v) (e.g., health care benefits). |

2. Counterparts. This Amendment may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

3. Governing Law. This Amendment shall be governed, construed, interpreted and enforced in accordance with the substantive laws of the State of Ohio.

4. Full Force and Effect. Except as expressly amended by this Amendment, all other terms and conditions of the Employment Agreement shall remain in full force and effect and unmodified hereby.

REMAINDER OF PAGE LEFT INTENTIONALLY BLANK

IN WITNESS WHEREOF, the parties have executed this Amendment on the date and year first above written.

TRANSDIGM GROUP INCORPORATED

By: /s/ W. Nicholas Howley

Name: W. Nicholas Howley

Title: Chief Executive Officer

EXECUTIVE

/s/ Kevin Stein

Kevin Stein

Exhibit 10.5

FORM OF AMENDMENT TO EMPLOYMENT AGREEMENT FOR

TERRANCE PARADIE, BERNT IVERSEN, ROBERT HENDERSON, PETER PALMER,

JAMES SKULINA AND JORGE VALLADARES

THIS AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”), dated as of October __, 2015 is made by and between TransDigm Group Incorporated, a Delaware corporation (the “Company”), and [EXECUTIVE NAME] (“Executive”).

W I T N E S S E T H:

WHEREAS, the Company and Executive are parties to the Employment Agreement, dated as of [DATE OF EMPLOYMENT AGREEMENT AND AMENDMENTS, IF APPLICABLE] (the “Employment Agreement”) setting forth certain terms and conditions of Executive’s employment with the Company; and

WHEREAS, the Company and Executive desire to amend the Employment Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the parties hereto agree as follows:

| |

a. | The penultimate sentence of Section 5(b) is deleted and replaced with the following: “In the event of the Executive’s Resignation for Good Reason pursuant to Section 5(a)(iv), the Company shall have the right, if the basis for such Good Reason is curable, to cure the same within 30 days following the receipt of the Notice of Termination and Good Reason shall not be deemed to exist if the Company cures the event giving rise to Good Reason within such 30-day period.” |

| |

b. | Section 6(a) is amended to insert after the first sentence: “The Company shall permit the Executive to elect to continue health plan coverage in accordance with the requirements of applicable law (e.g., COBRA coverage), at the applicable monthly cost charged for such coverage (the “Monthly COBRA Coverage Continuation Rate”). The Company may require the Executive to complete and file any election forms that are generally required of other employees to obtain COBRA coverage; and the Executive’s COBRA coverage may be terminable in accordance with applicable law. |

| |

c. | Delete Section 6(b) in its entirety and replace it with the following: |

“(b) Termination without Cause, Resignation for Good Reason or Termination by Reason of Death or Disability. Subject to Sections 6(c) and (d) and the restrictions contained herein, in the event of the Executive’s Termination without Cause (pursuant to Section 5(a)(v)), Resignation for Good Reason (pursuant to Section 5(a)(iv)) or termination by reason of death or Disability (pursuant to Section 5(a)(i) or (ii), respectively), the Company shall pay to the Executive the amounts described in subsection (a). In addition, subject to Section 6(c) and (d) and the restrictions contained herein, the Company shall pay to the Executive (or his beneficiary in the event of his death) an amount equal to the “Severance Amount” described below. For purposes of this Agreement the Severance Amount is equal to the sum of:

(i) 1.0 times his Annual Base Salary, and

(ii) 1.0 times the greater of (A) the total of all bonuses paid (or payable) to executive in respect of the fiscal year ending immediately prior to the Date of Termination, excluding any bonuses that are extraordinary in nature (e.g., a transaction related bonus) or (B) the target bonuses for the fiscal year in which the Date of Termination falls, determined in accordance with the Company’s bonus program or programs, if any.

(iii) 18.0 times the difference of (A) the Monthly COBRA Continuation Coverage Rate determined as of the Date of Termination for the Executive’s applicable health plan coverage as in effect on such date, less (B) the monthly cost to Executive that is being charged for such coverage as of the Date of Termination.

The Severance Amount as so determined shall be payable to the Executive (or his beneficiary) in substantially equal installments of the 12 month period following the Date of Termination (the “Payment Period”) in accordance with the Company’s regular payroll practices.”

| |

d. | Delete the last sentence of Section 6(d) and replace it with the following: “Accordingly, payments, benefits or reimbursements under Section 6(b) or any other part of this Agreement may nevertheless be provided to Executive with the six-month period following the date of Executive’s termination of employment under this Agreement (or, if later, his “separation from service” under Code Section 409A), to the extent that it would nevertheless be permissible to do so under Code Section 409A because those payments, reimbursement or benefits are (i) described in Treasury Regulations Section 1.409A-1(b)(9)(iii) (i.e., payments within the limitations therein that are being made on account of an involuntary termination or termination for good reason, within the meaning of the Treasury Regulations), or (ii) described in Treasury Regulation Section 1.409A-1(b)(4) (i.e., payments which are treated as short-term deferrals within the meaning of the Treasury Regulations, or (iii) benefits described in Treasury Regulations Section 1.409A-1(v)(9)(v) (e.g., health care benefits). |

2. Counterparts. This Amendment may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

3. Governing Law. This Amendment shall be governed, construed, interpreted and enforced in accordance with the substantive laws of the State of Ohio.

4. Full Force and Effect. Except as expressly amended by this Amendment, all other terms and conditions of the Employment Agreement shall remain in full force and effect and unmodified hereby.

IN WITNESS WHEREOF, the parties have executed this Amendment on the date and year first above written.

TRANSDIGM GROUP INCORPORATED

By: ________________________________

Name: W. Nicholas Howley

Title: Chief Executive Officer

EXECUTIVE

____________________________________

[EXECUTIVE NAME]

Exhibit 10.6

SECOND AMENDMENT TO EMPLOYMENT AGREEMENT

THIS SECOND AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”), dated as of October 22, 2015 is made by and between TransDigm Group Incorporated, a Delaware corporation (the “Company”), and Gregory Rufus (“Executive”).

W I T N E S S E T H:

WHEREAS, the Company and Executive are parties to the Second Amended and Restated Employment Agreement, dated as of February 24, 2011, as amended in October 2012 (the “Employment Agreement”) setting forth certain terms and conditions of Executive’s employment with the Company; and

WHEREAS, the Company and Executive desire to amend the Employment Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the parties hereto agree as follows:

| |

a. | Delete Section 2 in its entirety and replace it with the following: |

“2. Employment. The Company shall employ the Executive, for the period set forth in this Section 2, in the position(s) set forth in Section 3 and upon the other terms and conditions herein provided. The term of employment under this Agreement (the “Term”) shall be for the period beginning on the Effective Date and ending on October 1, 2016 unless earlier terminated as provided in Section 5.”

| |

b. | The penultimate sentence of Section 5(b) is deleted and replaced with the following: “In the event of the Executive’s Resignation for Good Reason pursuant to Section 5(a)(iv), the Company shall have the right, if the basis for such Good Reason is curable, to cure the same within 30 days following the receipt of the Notice of Termination and Good Reason shall not be deemed to exist if the Company cures the event giving rise to Good Reason within such 30-day period.” |

| |

c. | Section 6(a) is amended to insert after the first sentence: “The Company shall permit the Executive to elect to continue health plan coverage in accordance with the requirements of applicable law (e.g., COBRA coverage), at the applicable monthly cost charged for such coverage (the “Monthly COBRA Coverage Continuation Rate”). The Company may require the Executive to complete and file any election forms that are generally required of other employees to obtain COBRA coverage; and the Executive’s COBRA coverage may be terminable in accordance with applicable law. |

| |

d. | Delete Section 6(b) in its entirety and replace it with the following: |

“(b) Termination without Cause, Resignation for Good Reason or Termination by Reason of Death or Disability. Subject to Sections 6(c) and (d) and the restrictions contained herein, in the event of the Executive’s Termination without Cause (pursuant to Section 5(a)(v)), Resignation for Good Reason (pursuant to Section 5(a)(iv)) or

termination by reason of death or Disability (pursuant to Section 5(a)(i) or (ii), respectively), the Company shall pay to the Executive the amounts described in subsection (a). In addition, subject to Section 6(c) and (d) and the restrictions contained herein, the Company shall pay to the Executive (or his beneficiary in the event of his death) an amount equal to the “Severance Amount” described below. For purposes of this Agreement the Severance Amount is equal to the sum of:

(i) 1.0 times his Annual Base Salary, and

(ii) 1.0 times the greater of (A) the total of all bonuses paid (or payable) to executive in respect of the fiscal year ending immediately prior to the Date of Termination, excluding any bonuses that are extraordinary in nature (e.g., a transaction related bonus) or (B) the target bonuses for the fiscal year in which the Date of Termination falls, determined in accordance with the Company’s bonus program or programs, if any.

(iii) 18.0 times the difference of (A) the Monthly COBRA Continuation Coverage Rate determined as of the Date of Termination for the Executive’s applicable health plan coverage as in effect on such date, less (B) the monthly cost to Executive that is being charged for such coverage as of the Date of Termination.

The Severance Amount as so determined shall be payable to the Executive (or his beneficiary) in substantially equal installments of the 12 month period following the Date of Termination (the “Payment Period”) in accordance with the Company’s regular payroll practices.”

| |

e. | Delete the last sentence of Section 6(d) and replace it with the following: “Accordingly, payments, benefits or reimbursements under Section 6(b) or any other part of this Agreement may nevertheless be provided to Executive with the six-month period following the date of Executive’s termination of employment under this Agreement (or, if later, his “separation from service” under Code Section 409A), to the extent that it would nevertheless be permissible to do so under Code Section 409A because those payments, reimbursement or benefits are (i) described in Treasury Regulations Section 1.409A-1(b)(9)(iii) (i.e., payments within the limitations therein that are being made on account of an involuntary termination or termination for good reason, within the meaning of the Treasury Regulations), or (ii) described in Treasury Regulation Section 1.409A-1(b)(4) (i.e., payments which are treated as short-term deferrals within the meaning of the Treasury Regulations, or (iii) benefits described in Treasury Regulations Section 1.409A-1(v)(9)(v) (e.g., health care benefits). |

2. Counterparts. This Amendment may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

3. Governing Law. This Amendment shall be governed, construed, interpreted and enforced in accordance with the substantive laws of the State of Ohio.

4. Full Force and Effect. Except as expressly amended by this Amendment, all other terms and conditions of the Employment Agreement shall remain in full force and effect and unmodified hereby.

IN WITNESS WHEREOF, the parties have executed this Amendment on the date and year first above written.

TRANSDIGM GROUP INCORPORATED

By: /s/ W. Nicholas Howley

Name: W. Nicholas Howley

Title: Chief Executive Officer

EXECUTIVE

/s/ Gregory Rufus

Gregory Rufus

Exhibit 10.7

AMENDMENT TO EMPLOYMENT AGREEMENT

THIS AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”), dated as of October 22, 2015 is made by and between TransDigm Group Incorporated, a Delaware corporation (the “Company”), and John Leary (“Executive”).

W I T N E S S E T H:

WHEREAS, the Company and Executive are parties to the Employment Agreement, dated as of July 30, 2012 (the “Employment Agreement”) setting forth certain terms and conditions of Executive’s employment with the Company; and

WHEREAS, the Company and Executive desire to amend the Employment Agreement on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the parties hereto agree as follows:

| |

a. | Delete Section 2 in its entirety and replace it with the following: |

“2. Employment. The Company shall employ the Executive, for the period set forth in this Section 2, in the position(s) set forth in Section 3 and upon the other terms and conditions herein provided. The term of employment under this Agreement (the “Term”) shall be for the period beginning on the Effective Date and ending on October 1, 2017 unless earlier terminated as provided in Section 5.”

| |

b. | Delete Section 3 in its entirety and replace it with the following: |

“3. Position and Duties. During the Term, the Executive shall serve as Executive Vice President of each of the Company and its subsidiary, TransDigm, Inc. (“TransDigm”), with such responsibilities, duties and authority as may from time to time be assigned to the Executive by the Chief Executive Officer. During the Term, the Executive shall devote 30 hours of working time per week to the business and affairs of the Company and TransDigm.”

| |

c. | Delete Section 4(a) in its entirety and replace it with the following: |

“(a) Annual Base Salary. During the Term (commencing as of January 1, 2016), the Executive shall receive a base salary at a rate that is no less than $300,000 per annum, in each case payable in accordance with the Company’s normal payroll practices, which shall be reviewed by the Compensation Committee on or prior to each anniversary of the Effective Date during the Term and may be increased, but not decreased, upon such review (the “Annual Base Salary”).”

| |

d. | The penultimate sentence of Section 5(b) is deleted and replaced with the following: “In the event of the Executive’s Resignation for Good Reason pursuant to Section 5(a)(iv), the |

Company shall have the right, if the basis for such Good Reason is curable, to cure the same within 30 days following the receipt of the Notice of Termination and Good Reason shall not be deemed to exist if the Company cures the event giving rise to Good Reason within such 30-day period.”

| |

e. | Section 6(a) is amended to insert after the first sentence: “The Company shall permit the Executive to elect to continue health plan coverage in accordance with the requirements of applicable law (e.g., COBRA coverage), at the applicable monthly cost charged for such coverage (the “Monthly COBRA Coverage Continuation Rate”). The Company may require the Executive to complete and file any election forms that are generally required of other employees to obtain COBRA coverage; and the Executive’s COBRA coverage may be terminable in accordance with applicable law. |

| |

f. | Delete Section 6(b) in its entirety and replace it with the following: |

“(b) Termination without Cause, Resignation for Good Reason or Termination by Reason of Death or Disability. Subject to Sections 6(c) and (d) and the restrictions contained herein, in the event of the Executive’s Termination without Cause (pursuant to Section 5(a)(v)), Resignation for Good Reason (pursuant to Section 5(a)(iv)) or termination by reason of death or Disability (pursuant to Section 5(a)(i) or (ii), respectively), the Company shall pay to the Executive the amounts described in subsection (a). In addition, subject to Section 6(c) and (d) and the restrictions contained herein, the Company shall pay to the Executive (or his beneficiary in the event of his death) an amount equal to the “Severance Amount” described below. For purposes of this Agreement the Severance Amount is equal to the sum of:

(i) 1.0 times his Annual Base Salary, and

(ii) 1.0 times the greater of (A) the total of all bonuses paid (or payable) to executive in respect of the fiscal year ending immediately prior to the Date of Termination, excluding any bonuses that are extraordinary in nature (e.g., a transaction related bonus) or (B) the target bonuses for the fiscal year in which the Date of Termination falls, determined in accordance with the Company’s bonus program or programs, if any.

(iii) 18.0 times the difference of (A) the Monthly COBRA Continuation Coverage Rate determined as of the Date of Termination for the Executive’s applicable health plan coverage as in effect on such date, less (B) the monthly cost to Executive that is being charged for such coverage as of the Date of Termination.

The Severance Amount as so determined shall be payable to the Executive (or his beneficiary) in substantially equal installments of the 12 month period following the Date of Termination (the “Payment Period”) in accordance with the Company’s regular payroll practices.”

| |

g. | Delete the last sentence of Section 6(d) and replace it with the following: “Accordingly, payments, benefits or reimbursements under Section 6(b) or any other part of this Agreement may nevertheless be provided to Executive with the six-month period following the date of Executive’s termination of employment under this Agreement (or, if later, his “separation from service” under Code Section 409A), to the extent that it would nevertheless be permissible to do so under Code Section 409A because those payments, reimbursement or benefits are (i) described in Treasury Regulations Section 1.409A-1(b)(9)(iii) (i.e., payments within the limitations therein that are being made on account of an involuntary termination or termination for good reason, within the meaning of the |

Treasury Regulations), or (ii) described in Treasury Regulation Section 1.409A-1(b)(4) (i.e., payments which are treated as short-term deferrals within the meaning of the Treasury Regulations, or (iii) benefits described in Treasury Regulations Section 1.409A-1(v)(9)(v) (e.g., health care benefits).

2. Counterparts. This Amendment may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

3. Governing Law. This Amendment shall be governed, construed, interpreted and enforced in accordance with the substantive laws of the State of Ohio.

4. Full Force and Effect. Except as expressly amended by this Amendment, all other terms and conditions of the Employment Agreement shall remain in full force and effect and unmodified hereby.

IN WITNESS WHEREOF, the parties have executed this Amendment on the date and year first above written.

TRANSDIGM GROUP INCORPORATED

By: /s/ W. Nicholas Howley

Name: W. Nicholas Howley

Title: Chief Executive Officer

EXECUTIVE

/s/ John Leary

John Leary

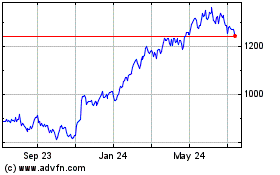

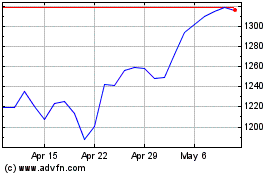

Transdigm (NYSE:TDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transdigm (NYSE:TDG)

Historical Stock Chart

From Apr 2023 to Apr 2024