UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 28, 2015

TransDigm Group Incorporated

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

001-32833

(Commission

File Number)

41-2101738

(IRS Employer Identification No.)

|

|

|

| 1301 East 9th Street, Suite 3000, Cleveland, Ohio |

|

44114 |

| (Address of principal executive offices) |

|

(Zip Code) |

(216) 706-2960

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants’ under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure |

On July 28, 2015, TransDigm Group Incorporated (NYSE: TDG) announced that

it has entered into a definitive agreement to acquire PneuDraulics, Inc. (“PneuDraulics”) for approximately $325 million in cash. The purchase price includes approximately $107 million of tax benefits to be realized by TransDigm over a 15

year period beginning in 2015. TransDigm expects to finance the acquisition through existing cash on hand. PneuDraulics manufactures proprietary, highly engineered aerospace pneumatic and hydraulic components and sub-systems for commercial

transport, regional, business jet and military applications.

A copy of the July 28, 2015 press release announcing the definitive agreement to

acquire PneuDraulics is attached to this Report as Exhibit 99.1.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

The following exhibit is being filed with this Report on Form 8-K:

| |

99.1 |

Press Release issued July 28, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| TRANSDIGM GROUP INCORPORATED |

|

|

| By: |

|

/s/ Terrance Paradie |

|

|

Terrance Paradie |

|

|

Executive Vice President and Chief Financial Officer |

Date: July 28, 2015

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release of TransDigm Group Incorporated, dated July 28, 2015. |

Exhibit 99.1

TransDigm to Acquire PneuDraulics, Inc.

CLEVELAND, July 28, 2015 /PRNewswire/ — TransDigm Group Incorporated (NYSE: TDG) announced today that it has entered into a definitive agreement to

acquire PneuDraulics, Inc. (“PneuDraulics” or “the Company”) for approximately $325 million in cash. The purchase price includes approximately $107 million of tax benefits to be realized by TransDigm over a 15 year period

beginning in 2015. TransDigm expects to finance the acquisition through existing cash on hand.

Located in Rancho Cucamonga, California, PneuDraulics

employs approximately 275 people. The Company manufactures proprietary, highly engineered aerospace pneumatic and hydraulic components and sub-systems for commercial transport, regional, business jet and military applications. Nearly 100% of the

revenues are proprietary. Aftermarket content accounts for approximately 35% of the revenues, while commercial aerospace content accounts for approximately 85% of the revenues.

W. Nicholas Howley, Chairman and CEO of TransDigm Group Incorporated, stated, “PneuDraulics is a long standing manufacturer of proprietary, sole source

products with established positions on a number of high use platforms, strong aftermarket content and an outstanding reputation. The highly engineered products will allow us to expand our content on a number of substantial platforms, including

Boeing 787 and Airbus A350. PneuDraulics fits well with our consistent product and acquisition strategy. As with all TransDigm acquisitions, we see opportunities for significant value creation.”

The acquisition, which is expected to close before the end of fiscal year 2015, is subject to regulatory approvals and customary closing conditions.

Houlihan Lokey served as exclusive financial advisor to PneuDraulics.

About TransDigm Group

TransDigm Group, through its

wholly-owned subsidiaries, is a leading global designer, producer and supplier of highly engineered aircraft components for use on nearly all commercial and military aircraft in service today. Major product offerings, substantially all of which are

ultimately provided to end-users in the aerospace industry, include mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric

motors and generators, NiCad batteries and chargers, engineered latching and locking devices, rods and locking devices, engineered connectors and elastomers, cockpit security components and systems, specialized cockpit displays, aircraft audio

systems, specialized lavatory components, seatbelts and safety restraints, engineered interior surfaces and related components, lighting and control technology, military personnel parachutes and cargo loading, handling and delivery systems.

Forward-Looking Statements

Statements in this press release that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995.Words such as “believe,” “may,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” or

“continue” and other words and terms of similar meaning may identify forward-looking statements.

All forward-looking statements involve risks

and uncertainties which could affect TransDigm Group’s actual results and could cause its actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, TransDigm Group. These

risks and uncertainties include but are not limited to failure to complete or successfully integrate the acquisition; that the acquired business does not perform in accordance with our expectations; and other factors. Further information regarding

important factors that could cause actual results to differ materially from projected results can be found in TransDigm Group’s Annual Report on Form 10-K and other reports that TransDigm Group or its subsidiaries have filed with the Securities

and Exchange Commission. Except as required by law, TransDigm Group undertakes no obligation to revise or update the forward-looking statements contained in this press release.

|

|

|

| Contact: |

|

Liza Sabol |

|

|

Investor Relations |

|

|

(216) 706-2945 |

|

|

ir@transdigm.com |

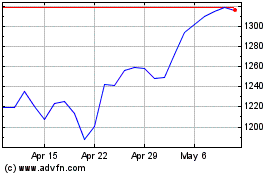

Transdigm (NYSE:TDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

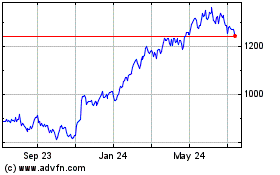

Transdigm (NYSE:TDG)

Historical Stock Chart

From Apr 2023 to Apr 2024