TAL International Group, Inc. (NYSE:TAL), one of the

world’s largest lessors of intermodal freight containers and

chassis, today reported results for the fourth quarter and full

year ended December 31, 2015.

Highlights:

- TAL reported Adjusted pre-tax income of

$4.40 per fully diluted common share for the year ended

December 31, 2015, a decrease of 24.3% from 2014. TAL reported

leasing revenues of $608.0 million for the year ending

December 31, 2015, an increase of 2.4% from 2014.

- TAL reported Adjusted pre-tax income of

$0.79 per fully diluted common share for the fourth quarter of

2015, a decrease of 46.6% from the fourth quarter of 2014. TAL

reported leasing revenues of $153.8 million for the fourth quarter

of 2015, a decrease of 0.1% from the fourth quarter of 2014.

- TAL continued to achieve solid

operational performance. Utilization averaged 93.7% for the fourth

quarter of 2015 and averaged 96.0% for the full year.

- TAL announced a quarterly dividend of

$0.45 per share payable on March 24, 2016 to shareholders of

record as of March 10, 2016.

- TAL continues to make progress on its

announced merger with Triton Container International Limited. All

required anti-trust approvals have been received and the SEC review

process of the S-4 registration statement filed by Triton

International Limited is progressing. Detailed integration planning

is well underway, and the merger is expected to close in the first

half of 2016.

Financial Results

The following table depicts TAL’s selected key financial

information for the fourth quarter and full year ended

December 31, 2015 and 2014 (dollars in millions, except per

share data):

Three Months Ended

December 31, Twelve Months Ended

December 31,

2015

2014

%

Change

2015

2014

%

Change

Adjusted pre-tax income(1) $ 25.9 $ 49.5 (47.7 %) $ 145.0 $

195.5 (25.8 %)

Adjusted pre-tax income per share(1) $ 0.79 $

1.48 (46.6 %) $ 4.40 $ 5.81 (24.3 %)

Leasing revenues $

153.8 $ 154.0 (0.1 %) $ 608.0 $ 594.0 2.4 %

Adjusted

EBITDA(1) $

128.1

$ 148.4

(13.7

%) $

548.7

$

577.1

(4.9

%)

Adjusted net income(1) $ 16.7 $ 32.4 (48.5 %) $ 93.8 $

128.0 (26.7 %)

Adjusted net income per share(1) $ 0.51 $

0.97 (47.4 %) $ 2.84 $ 3.80 (25.3 %)

Net income $ 13.3 $

32.1 (58.6 %) $ 88.2 $ 124.0 (28.9 %)

Net income per share $

0.40 $ 0.96 (58.3 %) $

2.67 $ 3.68 (27.4 %) Note: All per

share data is per fully diluted common share.

TAL considers Adjusted pre-tax results as the best measure of

its operating performance since it considers gains and losses on

interest rate swaps, the write-off of deferred financing costs, and

transaction costs related to the pending merger with Triton

Container International Limited ("Triton") to be unrelated to

operating performance and since it does not expect to pay any

significant income taxes for a number of years due to the

availability of accelerated tax depreciation on its existing

container fleet and anticipated future equipment purchases.

Operating Performance

“TAL achieved solid results in 2015, while facing very difficult

market conditions,” commented Brian M. Sondey, President and CEO of

TAL International. “We generated Adjusted pre-tax income of $145.0

million in 2015, representing $4.40 per share. TAL also grew

leasing revenue 2.4% from 2014, and continued to achieve a high

level of returns. In 2015, we generated an Adjusted pre-tax return

on tangible equity(1) of 14.0%.”

“While our results for the full year of 2015 were solid,

pressure on our earnings increased throughout the year as the

operating impacts of the difficult market conditions accumulated.

In the fourth quarter of 2015, TAL generated $25.9 million of

Adjusted pre-tax income, which represents a decrease of 48% from

the fourth quarter of 2014 and a decrease of 29% from the third

quarter of 2015.”

“Market conditions in 2015 were extremely challenging. Market

lease rates reached all-time low levels due to a large drop in

steel and new container prices, and lease re-pricing pressures

accelerated. We also faced unusually low leasing demand in 2015 as

containerized trade growth fell well below expectations. The gap

between expected and actual growth led to an over-supply of

containers in 2015 since leasing companies and shipping lines

placed large orders for new containers at the beginning of the year

in anticipation of solid growth. The combination of low demand and

excess supply led to reduced pick-up volumes, increased drop-off

volumes and a substantial decrease in TAL's utilization. Lower new

container prices and reduced leasing demand has also led to an

increase in disposal volumes and a roughly 20% decrease in sale

prices for used containers.”

“The large decrease in used container sale prices in 2015 turned

our historical gains on container disposals into disposal losses,

and TAL recognized an $8.7 million loss on disposals in the fourth

quarter of 2015. Roughly half of TAL’s disposal losses in the

fourth quarter were caused by marking-to-market TAL’s inventory of

containers waiting for sale. The negative mark-to-market will

shrink when used container sale prices stabilize.”

“While down, our utilization remains at a high level and

continues to support our profitability. Our utilization averaged

93.7% in the fourth quarter of 2015, and finished the quarter at

93.0%. Our utilization currently stands at 92.1%. The resiliency of

our utilization during these extreme market conditions reflects the

underlying strength of our lease portfolio. As of December 31,

2015, 76.4% of our containers on-hire were covered by long-term or

finance leases, and these leases have an average remaining duration

of 42 months assuming no leases are renewed. Our containers are

also supported by our lease structuring discipline, especially in

ensuring the vast majority of our containers on lease must be

returned to traditionally strong export locations. Over 95% of our

dry container leasing inventory is located in Asia, which should

allow us to push the containers back on-hire when leasing demand

improves.”

“We purchased approximately $625 million of new and

sale-leaseback containers for delivery in 2015. Most of our new

container investment in 2015 was placed early in the year, while we

invested in sale leaseback transactions throughout the year. This

solid level of investment in a challenging year reflects TAL’s

strong supply capability and close customer relationships.”

Outlook

Mr. Sondey continued, “The first quarter is typically our

weakest quarter of the year since it represents the slow season for

dry containers, and market conditions are unlikely to improve

during this seasonally weak period. We expect our utilization and

other key operating metrics will continue to deteriorate, and

expect our negative earnings trend will continue through the first

quarter of 2016.”

“We expect that the supply / demand balance for containers will

improve after the first quarter if trade growth is at least

moderately positive. New container production has been limited

since the middle of 2015, and leasing companies and shipping lines

are generally accelerating their disposals of older containers. As

a result, positive trade growth should create demand for our

existing containers and allow us to recapture some of our lost

utilization. On the other hand, lease pricing pressure will

continue as long as steel and new container prices remain low. We

expect our Adjusted pre-tax income will decrease from 2015 to 2016,

though our quarterly earnings in 2016 may improve sequentially

after the first quarter if TAL is successful in pushing utilization

back up.”

Dividend

TAL’s Board of Directors has approved and declared a $0.45 per

share quarterly cash dividend on its issued and outstanding common

stock, payable on March 24, 2016 to shareholders of record at

the close of business on March 10, 2016. Based on the

information available today, we believe this distribution will

qualify as a return of capital rather than a taxable dividend for

U.S. tax purposes. Investors should consult with a tax adviser to

determine the proper tax treatment of this distribution.

Announced Merger with Triton Container

International Limited

Mr. Sondey concluded, “We are making good progress on our

announced merger with Triton Container International to create the

world's largest, most efficient and most capable container leasing

company. We have received all required anti-trust approvals and the

SEC review process of the S-4 registration statement filed by

Triton International Limited is progressing. We are also making

good progress with integration planning. Much of the commercial

leadership for the combined company has been identified, and we

expect our systems integration plan will be developed well ahead of

the merger closing. We believe we will be able to achieve roughly

$40 million of administrative cost reductions which should be fully

implemented by the end of 2016. We continue to expect the

transaction will generate more than 30% earnings per share

accretion for TAL’s shareholders once the anticipated merger

benefits are fully realized.”

Investors’ Webcast

TAL will hold a Webcast at 9 a.m. (New York time) on Thursday,

February 25, 2016 to discuss its fourth quarter and full year

results. An archive of the Webcast will be available one hour after

the live call through Friday, April 8, 2016. To access the

live Webcast or archive, please visit TAL’s website at

http://www.talinternational.com.

About TAL International Group, Inc.

TAL is one of the world’s largest lessors of intermodal freight

containers and chassis with 17 offices in 11 countries and

approximately 230 third-party container depot facilities in 40

countries. TAL’s global operations include the acquisition,

leasing, re-leasing and subsequent sale of multiple types of

intermodal containers and chassis. TAL’s fleet consists of

approximately 1,531,000 containers and related equipment

representing approximately 2,513,000 twenty-foot equivalent units

(TEUs). This places TAL among the world’s largest independent

lessors of intermodal containers and chassis as measured by fleet

size.

Important Cautionary Information Regarding Forward-Looking

Statements

Certain statements included in this communication are not

historical facts but are forward-looking statements for purposes of

the safe harbor provisions under The Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally are

accompanied by words such as “may”, “should”, “would”, “plan”,

“intend”, “anticipate”, “believe”, “estimate”, “predict”,

“potential”, “seem”, “seek”, “continue”, “future”, “will”,

“expect”, “outlook” or other similar words, phrases or expressions.

These forward-looking statements include statements regarding our

views, estimates, plans and outlook, industry, future events, the

proposed transaction between Triton Container International Limited

(“Triton”) and TAL International Group, Inc. (“TAL International”)

, the estimated or anticipated future results and benefits of

Triton and TAL International following the transaction, including

estimated synergies, the likelihood and ability of the parties to

successfully close the proposed transaction, future opportunities

for the combined company, and other statements that are not

historical facts. These statements are based on the current

expectations of Triton and TAL International management and are not

predictions of actual performance. These statements are subject to

a number of risks and uncertainties regarding Triton’s and TAL

International’s respective businesses and the transaction, and

actual results may differ materially. These risks and uncertainties

include, but are not limited to, changes in the business

environment in which Triton and TAL International operate,

including inflation and interest rates, and general financial,

economic, regulatory and political conditions affecting the

industry in which Triton and TAL International operate; changes in

taxes, governmental laws, and regulations; competitive product and

pricing activity; difficulties of managing growth profitably; the

loss of one or more members of Triton’s or TAL International’s

management team; the ability of the parties to successfully close

the proposed transaction; failure to realize the anticipated

benefits of the transaction, including as a result of a delay in

completing the transaction or a delay or difficulty in integrating

the businesses of Triton and TAL International; uncertainty as to

the long-term value of Triton International Limited (“Holdco”)

common shares; the expected amount and timing of cost savings and

operating synergies; failure to receive the approval of the

stockholders of TAL International for the transaction, and those

discussed in TAL International’s Annual Report on Form 10-K for the

year ended December 31, 2014 under the heading “Risk Factors,” as

updated from time to time by TAL International’s Quarterly Reports

on Form 10-Q and other documents of TAL International on file with

the Securities and Exchange Commission ("SEC") and in the

registration statement on Form S-4 that was filed with the SEC by

Holdco. There may be additional risks that neither Triton nor TAL

International presently know or that Triton and TAL International

currently believe are immaterial which could also cause actual

results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements provide

Triton’s and TAL International’s expectations, plans or forecasts

of future events and views as of the date of this communication.

Triton and TAL International anticipate that subsequent events and

developments will cause Triton’s and TAL International’s

assessments to change. However, while Triton and TAL International

may elect to update these forward-looking statements at some point

in the future, Triton and TAL International specifically disclaim

any obligation to do so. These forward-looking statements should

not be relied upon as representing Triton’s and TAL International’s

assessments as of any date subsequent to the date of this

communication.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Additional Information

This communication is not a solicitation of a proxy from any

stockholder of TAL International. In connection with the proposed

transaction, Holdco has filed with the SEC a registration statement

on Form S-4 that includes a preliminary prospectus of Holdco and

also includes a preliminary proxy statement of TAL International.

The SEC has not yet declared the registration statement effective.

After it is declared effective, TAL International will mail the

proxy statement/prospectus to its stockholders. INVESTORS ARE URGED

TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS

AND SUPPLEMENTS THERETO) BECAUSE IT CONTAINS IMPORTANT INFORMATION.

You are able to obtain the proxy statement/prospectus, as well as

other filings containing information about TAL free of charge, at

the website maintained by the SEC at www.sec.gov. Copies of the

proxy statement/prospectus and the filings with the SEC that are

incorporated by reference in the proxy statement/prospectus can

also be obtained, free of charge, by directing a request to TAL

International Group, Inc., 100 Manhattanville Road, Purchase, New

York 10577, Attention: Secretary.

The respective directors and executive officers of Triton, TAL

International and Triton International Limited (“Holdco”) and other

persons may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information

regarding TAL International’s directors and executive officers is

available in its proxy statement filed with the SEC on March 19,

2015. Other information regarding the participants in the proxy

solicitation and their respective interests are included in the

proxy statement/prospectus and will be contained in other relevant

materials to be filed with the SEC when they become available.

These documents can be obtained free of charge from the sources

indicated above.

(1) Adjusted pre-tax income, Adjusted EBITDA, Adjusted net

income, and Adjusted pre-tax return on tangible equity are non-GAAP

measurements we believe are useful in evaluating our operating

performance. TAL’s definition and calculation of Adjusted pre-tax

income, Adjusted EBITDA, Adjusted net income, and Adjusted pre-tax

return on tangible equity are outlined in the attached

schedules.

Please see Financial Tables below for a detailed reconciliation

of these financial measurements.

-Financial Tables Follow-

TAL INTERNATIONAL

GROUP, INC.

Consolidated Balance Sheets

(Dollars in thousands, except share

data)

December 31, 2015

December 31, 2014 ASSETS:

Leasing equipment, net of accumulated

depreciation and allowances of $1,218,826 and$1,055,864

$ 3,908,292 $ 3,674,031 Net investment in finance leases, net of

allowances of $805 and $1,056 177,737 219,872 Equipment held for

sale 74,899 59,861

Revenue earning assets

4,160,928

3,953,764

Unrestricted cash and cash equivalents 58,907 79,132 Restricted

cash 30,302 35,649 Accounts receivable, net of allowances of $1,314

and $978 95,709 85,681 Goodwill 74,523 74,523 Other assets 13,620

11,400 Fair value of derivative instruments 87

1,898

Total assets $ 4,434,076 $

4,242,047

LIABILITIES AND STOCKHOLDERS' EQUITY:

Equipment purchases payable $ 20,009 $ 88,336 Fair value of

derivative instruments 20,348 10,394 Accounts payable and other

accrued expenses 56,096 57,877 Net deferred income tax liability

456,123 411,007 Debt, net of unamortized deferred financing costs

of $25,245 and $32,937 3,216,488 3,007,905

Total liabilities

3,769,064

3,575,519

Stockholders' equity: Preferred stock, $0.001 par value,

500,000 shares authorized, none issued — —

Common stock, $0.001 par value,

100,000,000 shares authorized, 37,167,134 and 37,006,283shares

issued respectively

37 37 Treasury stock, at cost, 3,911,843 and 3,829,928 shares

(75,310 ) (71,917 ) Additional paid-in capital 511,297 504,891

Accumulated earnings 248,183 246,766 Accumulated other

comprehensive (loss) (19,195 ) (13,249 )

Total

stockholders' equity 665,012 666,528

Total liabilities and stockholders' equity $

4,434,076 $ 4,242,047

TAL INTERNATIONAL

GROUP, INC.

Consolidated Statements of

Income

(Dollars and shares in thousands,

except earnings per share)

Three Months Ended December

31, Twelve Months Ended December

31, 2015 2014

2015 2014 Leasing revenues:

Operating leases $ 150,057 $ 149,346 $ 591,665

$ 573,778 Finance leases 3,474 4,237 15,192 18,355 Other revenues

234 409 1,147

1,873

Total leasing revenues 153,765

153,992 608,004

594,006 Equipment trading revenues

13,512 11,410 62,195 56,436 Equipment trading expenses (13,444 )

(9,796 ) (58,001 )

(49,246 )

Trading margin 68 1,614

4,194 7,190

Net (loss) gain on sale of leasing equipment (8,683 ) 560 (13,646 )

6,987

Operating expenses: Depreciation and

amortization 62,422 59,515 242,538 224,753 Direct operating

expenses 17,067 7,840 48,902 33,076 Administrative expenses 16,843

11,122 51,154 45,399 Provision for doubtful accounts 65

154 133 212

Total operating expenses 96,397 78,631

342,727 303,440

Operating income 48,753 77,535 255,825 304,743

Other

expenses: Interest and debt expense 28,958 28,063 118,280

109,265 Write-off of deferred financing costs — 120 895 5,192 Net

(gain) loss on interest rate swaps (809 ) 370

205 780

Total other

expenses 28,149 28,553

119,380 115,237 Income before

income taxes 20,604 48,982 136,445 189,506 Income tax expense 7,330

16,927 48,233

65,461

Net income $ 13,274

$ 32,055 $ 88,212

$ 124,045 Net income per common share—Basic $ 0.40

$ 0.97 $ 2.68

$ 3.70 Net income per common share—Diluted $

0.40 $ 0.96 $ 2.67

$ 3.68 Cash dividends paid per common share $

0.45 $ 0.72 $ 2.61 $ 2.88 Weighted average number of common shares

outstanding—Basic 32,865 33,110 32,861 33,482 Dilutive stock

options and restricted stock 109 228

118 182 Weighted average

number of common shares outstanding—Diluted 32,974

33,338 32,979

33,664

TAL INTERNATIONAL

GROUP, INC.

Consolidated Statements of Cash

Flows

(Dollars in thousands)

Year Ended December 31, 2015

2014 2013 Cash flows from operating

activities: Net income $ 88,212 $ 124,045 $ 143,166

Adjustments to reconcile net income to net

cash provided by operatingactivities:

Depreciation and amortization 242,538 224,753 205,073 Amortization

of deferred financing costs 7,602 7,729 7,260

Amortization of net loss on terminated

derivative instruments designated ascash flow hedges

2,618 2,479 3,020 Amortization of lease intangibles 3,713 130 — Net

loss (gain) on sale of leasing equipment 13,646 (6,987 ) (26,751 )

Net loss (gain) on interest rate swaps 205 780 (8,947 ) Write-off

of deferred financing costs 895 5,192 4,000 Deferred income taxes

48,233 65,461 77,699 Stock compensation charge 6,452 5,984 5,216

Changes in operating assets and liabilities: Net equipment

(purchased) sold for resale activity (4,878 ) (6,671 ) (11,186 )

Net realized loss on interest rate swaps

terminated prior to their contractualmaturities

— (4,953 ) (24,235 ) Accounts receivable (10,028 ) (11,507 ) (2,811

) Net (deferred revenue) (7,098 ) (5,696 ) (1,572 ) Accounts

payable and other accrued expenses 8,123 (720 ) (3,982 ) Income

taxes payable — 67 (220 ) Other assets 245 (1,279 ) 958

Net cash provided by operating activities 400,478

398,807 366,688

Cash flows from investing

activities: Purchases of leasing equipment and investments in

finance leases (704,178 ) (670,529 ) (660,492 ) Proceeds from sale

of equipment, net of selling costs 125,525 165,990 140,724 Cash

collections on finance lease receivables, net of income earned

42,860 47,607 39,470 Other (101 ) (253 ) 84

Net cash

(used in) investing activities (535,894 ) (457,185 ) (480,214 )

Cash flows from financing activities: Purchases of treasury

stock (4,446 ) (34,382 ) —

Stock options exercised, related activity,

and excess tax benefits from stockcompensation

38 (234 ) (235 ) Financing fees paid under debt facilities (805 )

(16,702 ) (13,897 ) Borrowings under debt facilities and proceeds

under capital lease obligations 665,000 1,828,545 1,206,735

Payments under debt facilities and capital lease obligations

(464,183 ) (1,605,666 ) (993,011 ) Decrease (increase) in

restricted cash 5,347 (6,523 ) 6,711 Common stock dividends paid

(85,760 ) (96,403 ) (89,745 )

Net cash provided by financing

activities 115,191 68,635 116,558

Net

(decrease) increase in unrestricted cash and cash equivalents $

(20,225 ) $ 10,257 $ 3,032 Unrestricted cash and cash equivalents,

beginning of period 79,132 68,875 65,843

Unrestricted cash and cash equivalents, end of period $

58,907 $ 79,132 $ 68,875

Supplemental

disclosures: Interest paid $ 108,488 $ 99,895 $ 101,535 Income

taxes (refunded) paid $ — $ (67 ) $ 225

Supplemental non-cash

investing activities: Accrued and unpaid purchases of equipment

$ 20,009 $ 88,336 $ 112,268

The following table sets forth TAL’s equipment fleet

utilization(2) as of and for the quarter and year ended

December 31, 2015:

Average and Ending Utilization for

theQuarter Ended December 31, 2015

Average Utilization Ending Utilization

93.7 % 93.0 %

(2) Utilization is computed by dividing TAL’s total units on

lease (in CEUs) by the total units in TAL’s fleet (in CEUs)

excluding new units not yet leased and off-hire units designated

for sale.

The following table provides the composition of TAL’s equipment

fleet as of December 31, 2015 (in units, TEUs and cost

equivalent units, or “CEUs”):

December 31, 2015 Equipment Fleet in Units

Equipment Fleet in TEUs Dry 1,351,170

2,190,940

Refrigerated 70,505 134,204

Special 56,118

102,081

Tank 11,243 11,243

Chassis 21,216

38,210

Equipment leasing fleet 1,510,252 2,476,678

Equipment trading fleet 21,135 35,989

Total

1,531,387 2,512,667

December 31, 2015

Equipment Fleet in CEUs Operating leases 2,801,607

Finance leases 197,225

Equipment trading fleet

107,079

Total 3,105,911

Non-GAAP Financial Measures

We use the terms "EBITDA", “Adjusted EBITDA”, "Adjusted pre-tax

income", "Adjusted net income", and "Adjusted pre-tax return on

tangible equity" throughout this press release.

EBITDA is defined as net income before interest and debt

expense, income tax expense, depreciation and amortization, and the

write-off of deferred financing costs. Adjusted EBITDA is defined

as EBITDA excluding gains and losses on interest rate swaps, plus

principal payments on finance leases, plus non-recurring

transaction costs related to the pending merger with Triton.

Adjusted pre-tax income is defined as income before income taxes

as further adjusted for certain items which are described in more

detail below, which management believes are not representative of

our operating performance. Adjusted pre-tax income excludes gains

and losses on interest rate swaps, the write-off of deferred

financing costs, and transaction costs related to the pending

merger with Triton. Adjusted net income is defined as net income

further adjusted for the items discussed above, net of income

tax.

Adjusted pre-tax return on tangible equity is defined as the

annual Adjusted pre-tax income divided by the Average adjusted

tangible equity. Adjusted tangible equity is defined as total

stockholders' equity plus net deferred income tax liability and the

net fair value of derivative instruments less goodwill.

EBITDA, Adjusted EBITDA, Adjusted pre-tax income, Adjusted net

income, and Adjusted pre-tax return on tangible equity are not

presentations made in accordance with U.S. GAAP. EBITDA, Adjusted

EBITDA, Adjusted pre-tax income, Adjusted net income, and Adjusted

pre-tax return on tangible equity should not be considered as

alternatives to, or more meaningful than, amounts determined in

accordance with U.S. GAAP, including net income, or net cash from

operating activities.

We believe that EBITDA, Adjusted EBITDA, Adjusted pre-tax

income, Adjusted net income, and Adjusted pre-tax return on

tangible equity are useful to an investor in evaluating our

operating performance because:

-- these measures are widely used by securities analysts and

investors to measure a company’s operating performance and

available liquidity to service debt and fund investments without

regard to debt or capital structure, income tax rates and

depreciation policy estimates, which can vary substantially from

company to company;

-- these measures help investors to more meaningfully evaluate

and compare the results of our operations from period to period by

removing the impact of our capital structure, our asset base and

certain non-routine events which we do not expect to occur in the

future; and

-- these measures are used by our management for various

purposes, including as measures of operating performance and

liquidity, to assist in comparing performance from period to period

on a consistent basis, in presentations to our board of directors

concerning our financial performance and as a basis for strategic

planning and forecasting.

We have provided a reconciliation of net income, the most

directly comparable U.S. GAAP measure, to EBITDA in the tables

below for the three and twelve months ended December 31, 2015 and

2014. We have also provided reconciliations of income before income

taxes and net income, the most directly comparable U.S. GAAP

measures, to Adjusted pre-tax income and Adjusted net income in the

tables below for the three and twelve months ended December 31,

2015 and 2014.

We have also provided reconciliations of Operating cash flows to

Adjusted EBITDA and Adjusted pre-tax return on tangible equity in

the tables below for the current quarter.

TAL INTERNATIONAL GROUP, INC.

Non-GAAP Reconciliations of Adjusted

Pre-tax Income and Adjusted Net Income (Dollars and Shares

in Thousands, Except Per Share Data)

Three Months EndedDecember

31,

Twelve Months EndedDecember

31,

2015 2014 2015

2014 Income before income taxes $ 20,604

$ 48,982 $ 136,445 $

189,506 Add: Write-off of deferred financing costs — 120 895 5,192

Net (gain) loss on interest rate swaps (809 ) 370 205 780

Transaction costs related to pending merger 6,100

— 7,500 — Adjusted

pre-tax income $ 25,895 $ 49,472

$ 145,045 $ 195,478 Adjusted pre-tax

income per fully diluted common share $0.79

$1.48 $4.40 $5.81

Weighted average number of common shares outstanding—Diluted 32,974

33,338 32,979 33,664

Three Months EndedDecember

31,

Twelve Months EndedDecember

31,

2015 2014 2015

2014 Net income $ 13,274 $ 32,055 $ 88,212 $

124,045 Add:

Write-off of deferred financing costs, net

of tax

— 78 579 3,398

Net (gain) loss on interest rate swaps,

net of tax

(521 ) 242 133 511

Transaction costs related to pending

merger, net of tax

3,929 — 4,849

—

Adjusted net income

$ 16,682 $ 32,375 $

93,773 $ 127,954 Adjusted net income per fully

diluted common share $0.51 $0.97

$2.84 $3.80 Weighted average number of

common shares outstanding—Diluted 32,974 33,338 32,979 33,664

TAL INTERNATIONAL GROUP, INC. Non-GAAP

Reconciliations of EBITDA(Dollars in Thousands)

Three Months EndedDecember

31,

Twelve Months EndedDecember

31,

2015 2014 2015

2014 Net income $ 13,274 $

32,055 $ 88,212 $ 124,045 Add: Depreciation and

amortization 62,422 59,515 242,538 224,753 Interest and debt

expense 28,958 28,063 118,280 109,265 Write-off of deferred

financing costs — 120 895 5,192 Income tax expense 7,330

16,927 48,233

65,461 EBITDA $ 111,984 $ 136,680

$ 498,158 $ 528,716

TAL INTERNATIONAL GROUP, INC.Non-GAAP

Reconciliations of Operating Cash Flows to Adjusted EBITDA

(Dollars in Thousands)

Twelve Months Ended December

31,

2015 2014 Net cash provided by

operating activities $ 400,478 $ 398,807 Non-cash

expenses (20,385 ) (16,322 ) (Loss) gain on sale of equipment

(13,646 ) 6,987 Changes in operating assets & liabilities

13,636 30,759 Interest expense 118,280 109,265 Principal payments

on finance leases 42,860 47,607

Transaction costs related to pending

merger

7,500

—

Adjusted EBITDA $

548,723

$ 577,103

TAL

INTERNATIONAL GROUP, INC.

Non-GAAP Reconciliations of Adjusted

Pre-tax Return on Tangible Equity

(Dollars in Thousands)

Balance as ofDecember 31,

2015

Balance as ofDecember 31,

2014

Total stockholders' equity $ 665,012 $ 666,528 Net

deferred income tax liability 456,123 411,007 Net fair value of

derivative instruments liability 20,261 8,496 Goodwill (74,523 )

(74,523 ) Total adjusted tangible equity $ 1,066,873

$ 1,011,508 Average adjusted tangible

equity(a) $ 1,039,191 Adjusted pre-tax income $ 145,045 Adjusted

pre-tax return on tangible equity 14.0%

(a) Calculated by taking the average of

the current year's and the prior year's ending total Adjusted

tangible equity.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160224006648/en/

TAL International Group, Inc.Investor RelationsJohn

Burns, 914-697-2900Senior Vice President and Chief Financial

Officer

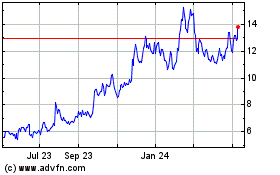

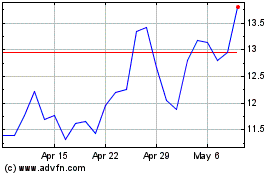

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024