Filed by TAL International Group, Inc.

pursuant to Rule 425 under the U.S. Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: TAL International Group, Inc.

Commission File No. 001-32638

Date: November 12, 2015

The following Investor Conference Call Transcript, dated November 10, 2015, corrects certain typographical errors contained in the Investor Conference Call Transcript filed with the U.S. Securities and Exchange Commission on November 10, 2015.

Triton and TAL International to Merge

Investor Conference Call Transcript

November 10, 2015

Operator: Good morning, and welcome to today’s conference call to discuss the merger of Triton and TAL International. All lines have been placed on mute and, after the speakers’ remarks, there will be a question and answer session. You may ask a question during this time by pressing star 1 on your telephone keypad.

Thank you. I will now turn the conference over to TAL International’s Senior Vice President and Chief Financial Officer, John Burns. Thank you. You may begin the conference.

John Burns: Thank you. Good morning, and thank you for joining us on today’s call. We are here to discuss yesterday afternoon’s announcement that Triton Container International Limited — or Triton — and TAL International — or TAL — have reached an agreement to combine an all-stock merger of equals.

Joining me on this morning’s call are Ed Schneider, Chairman and Co-Founder of Triton; Brian Sondey, President and CEO of TAL and Simon Vernon, President and CEO of Triton.

During this call, we will be reviewing the merger presentation which is available on both company’s websites.

Before I turn the call over to Brian, I would like to point out that this conference call may contain forward-looking statements, as the term is defined under the Private Securities Litigation Reform Act of 1995. It is possible that future financial performance may differ from expectations due to a variety of factors.

Any forward-looking statements made on this call are based on certain assumptions and analysis made by the companies that they believe are appropriate. And any such statements are not a guarantee of future performance, and actual results may vary materially from those projected.

Finally, the company’s (views), estimates, plans and outlook as described in this call may change subsequent to this discussion. The companies are under no obligation to modify or update any or all of the statements that are made herein, despite any subsequent changes.

These statements involve risks and uncertainties, are only predictions and may differ materially from actual future events or results. For a discussion of such risks and uncertainties, please see the risk factors located in TAL’s annual report filed on form 10-K with the SEC and the proxy and prospectus which will be filed with the SEC in conjunction with this transaction in due course.

With these formalities out of the way, I will now turn the call over to Brian.

Brian Sondey: Thanks, John. Good morning, everyone, and thanks for joining our call.

I’m very excited to talk with you today about the merger of TAL International and Triton Container. The combined company, which will be named Triton International, is going to be a truly special organization.

Triton Container has been a private company since inception, and many of our investors may not be familiar with them. But Triton is a company we have watched closely for many years as a real innovator in the container industry.

We are thrilled to be joining together with Triton to form the world’s largest, most efficient and most capable container leasing company.

Turning now to page 4, you can see that the benefits from the combination of Triton and TAL International are obvious and compelling.

The combined company will have much improved operating scale and cost efficiency. We are targeting $40 million of annual cost savings and believe

these can be fully implemented during 2016. Our cost (ratios, lowest) in the industry by far.

The merged company will retain Triton’s Bermuda domicile and, as a result, we expect the GAAP tax rate for the combined company to reduce over time, with minimal impact on combined cash taxes.

For TAL shareholders, we expect the merger synergies will improve our GAAP net income by 30 percent or more.

Triton and TAL International are ideal partners. Our customer and product line strengths are highly complementary, allowing us to fill in each other’s gaps.

We also share a common commitment to customer service, operational excellence and investment discipline.

We both focus on building strong long-term relationships with our customers and vendors and seek to find win-win solutions wherever possible.

Our merger is being completed as 100 percent stock-for-stock transaction. We will preserve the balance sheet strength and ample liquidity we each bring to the combination.

After closing, we plan to maintain TAL’s annual dividend of $1.80 per share. We also plan to repurchase up to $250 million of shares using our existing borrowing facilities and liquidity.

We are increasing the share buyback authorization from the $150 million previously announced for TAL International due to the larger cash flows and the compelling value we see in the merged company.

It is not practically possible to repurchase shares while we wait for transaction approvals. So the share repurchase plan will be implemented after the transaction closes.

The share repurchases will be significantly (accretive) to net income and our dividend capacity, if we’re successful in purchasing a large number of shares.

I will now hand the call over to Ed Schneider, Co-Founder and Chairman of Triton.

Ed Schneider: Thank you, Brian, and good morning, everyone. Let me begin by saying that I’m very excited about this merger of equals with TAL International, a company that we have known and respected for many years.

Before I talk more about this powerful combination, I would like to spend a moment on how we at Triton got to this announcement.

Over the past 35 years, we have built Triton into an industry leader, and we are proud of everything that we’ve accomplished. But as we looked ahead, we recognized that the industry is rapidly evolving and that we and our competitors had to change to remain competitive.

That meant we needed to become a stronger competitor. And in merging with TAL International, we firmly believe that we have found the ideal partner to write the next great chapter in our history.

This is a transformational transaction that brings together two companies that have complementary expertise, container fleets and operating platforms. This combination will create the world’s largest and most efficient intermodal container lessor.

Together, we will be a larger, stronger organization, better positioned to respond to our industry’s challenges and opportunities both today and well into the future. In short, Triton and TAL International are a logical fit — not only from a business perspective but culturally as well.

TAL has proven leadership under Brian and strong corporate values that are focused on operational excellence, customer service and investment discipline, just as we have at Triton.

Let me now turn to slide 5.

I realize some of you on the call may not be fully familiar with Triton, so let me briefly describe our company.

Founded in 1980, Triton is one of the largest container leasing and fleet management companies in the world. We operate a container fleet of 2.4 million TEUs and serve our global customer base through 19 subsidiary locations in 13 countries.

We are well known for our container quality and reliability along with our operational and financial acumen. Domiciled in Bermuda, Triton is owned by a consortium of private investors, including Warburg Pincus and Vestar Capital Partners, both of whom are fully supportive of this transaction.

On a personal note after 35 years at Triton, I will retire when the transaction closes. Until then, I will continue to work closely with Brian and our combined teams to complete the merger. And like our sponsors I, too, will remain a shareholder of the combined (company).

I am confident that under Brian, Simon and John’s leadership of Triton International, we will be well-positioned for continuing future success.

With that, let me turn the call back over to Brian.

Brian Sondey: Thanks, Ed. I’ll now turn to slide 6.

Most participants on this call are already familiar with TAL International. But I’ll point out a few highlights.

Like Triton, we’ve been a leader in the container leasing business for many years. We were founded in 1963 and have been a (stand alone) public company since 2005.

Like Triton, we have a strong focus on operational excellence, customer service and quality assurance. We have strong and deep customer relationships.

Our fleet includes just over 2.4 million (TEU of) containers. We offer a wide variety of container types to meet our customers’ needs.

We’re highly focused on (lease) structuring discipline. This (lease) structuring discipline and our re-marketing capabilities typically allow us to maintain high utilization and get long life from our container fleets.

We also have a long history of outstanding financial performance. Our earnings are currently being pressured by very tough market conditions, but we’re still generating solid returns and a high level of equity cash (flow).

I’ll now turn to page 7 to provide a few details on the merger.

No incremental debt will be needed to complete this 100 percent stock-for-stock combination. TAL International shareholders will receive one share of Triton International for each share of TAL and will own 45 percent of the new company.

Triton shareholders will receive new shares that will represent 55 percent of the total. TAL shareholders will also receive a special dividend — 54 cents per share — at close. The 45 percent-55 percent split had been negotiated at a time when TAL’s quarterly dividend was 72 cents per share. This special dividend is a true-up, intended to keep the split of economics as we had originally intended.

The transaction will be treated as a taxable sale of shares for TAL shareholders. The new company will be traded on the New York Stock Exchange.

The combination will be structured as a true merger of equals. The senior management team will be a mix of executives from TAL International and Triton. Our operations will be built out using the best people and adopting the best processes from each organizations.

As I’ve mentioned, the product and regional strengths of TAL International and Triton are highly complementary so that we’ll able to preserve the core strength of each company as we combine our operations.

In regards to the senior management team, I will be the chief executive for Triton International. (Simon Vernon), President and CEO of Triton, will be

President and John Burns, the CFO for TAL International, will be CFO for the combined company. We estimate that the merger will close during the first half of 2016 — after the receipt of needed regulatory approvals — and Triton’s and TAL’s shareholder votes.

I’m (going to) hand the call over to (Simon Vernon).

(Simon Vernon) Thank you, Brian. Moving to slide 8, you can see the compelling strategic and financial benefits that make this an excellent combination. Our enhanced commercial platform will better enable us to deliver quality containers when and where our customers need them. We will have the industry’s largest and most diverse (fleet) of containers, a world class operations team and a service-oriented culture — all geared towards providing the integrated global container support service that customers are increasingly demanding.

By leveraging our highly complementary regional and product line strengths, the combined company will have strong operating positions in all major geographic locations. In addition, the new company will have the opportunity to bring efficiencies and optimization to its combined depot network through systems enhancements and economies of scale.

While John will talk more about the new company’s capital structure and balance sheet momentarily, I wanted to note that, as a larger public company, we will have greater access to the capital markets to support our future growth but will maintain a conservative debt structure.

Similarly, our two management teams are disciplined in their investment approaches, and we expect that will continue into the future.

Slide 9 highlights the improved (scale) that our combined fleet size provides. The chart on the left shows that, together, we will be the largest lessor of intermodal freight containers with a fleet of nearly 5 million 20-foot equivalent units.

This represents approximately 25 percent of the industry’s supply. And on the right, you can see that by leveraging the core strengths of each company, we will have a more diverse fleet of revenue(-earning) assets spread across dry

(vans), refrigerated containers and specials. Combined, it will be nearly $8.7 billion.

Moving to slide 10. As we bring together our two global organizations, we will create a more cost-efficient and nimble company by combining our systems and optimizing our infrastructure network. Through these efforts, we expect to achieve $40 million in annual cost savings. As a result, our (SG&A) as a percentage of leasing revenue will be considerably lower than our peers. It is important to note that, at the same time, we expect to maintain the customer responsiveness that is a hallmark of both companies.

We believe our ability to reduce costs while preserving our operational flexibility is critical to our ability to successfully navigate the current soft operating environment as well as to position us to take full advantage of new opportunities when the market recovers.

Of course, we are 100 percent focused on making the transition as seamless as possible for our customers and suppliers.

I will now turn the call over to John, who will provide a financial overview of the combined company.

John Burns: Thank you, Simon. The chart on slide 11 provides the operational and financial details of the combined company. I won’t go through the entire slide but will make a couple of observations.

First, the combined company had leasing revenues of $1.3 billion, an adjusted pre-tax income of $343 million for the 12 months ending September 30. Our stronger financial profile better enables us to invest in our business to meet the needs and expectations of our customers in both the near- and long-term.

On the operations side, the average age of our combined fleet will be 6.4 years. And together, we will double our cost equivalent units, or CEUs, to 6.1 million.

Moving now to slide 12. Our balance sheet, as noted earlier — as noted earlier, is a stock-for-stock merger and, therefore, neither company will need to raise

additional debt to close the transaction. Both companies existing (debt) facilities are largely unaffected by the transaction. There are no material impacts from change of control or purchase accounting on each entity’s existing facilities.

We anticipate that both entities’ leverage will trend down slightly from the current levels between now and the close of the transaction — and again, not be impacted by the merger.

In the short- to medium-term after close, each company will continue to finance containers at the existing borrowing entities to capitalize on the existing debt facilities and structures.

Over time, we will look to harmonize the financing as our capital structures become fully integrated.

Historically, both companies have been focused on locking in interest expense to minimize exposure to the risk of rising interest rates. Triton has used the market as their preferred source of long-term fixed rate debt while TAL has utilized a variety of structures, including the fixed rate ABS market and the bank term debt market combined with interest rate (swaps).

As a combined company, we expect to (continue to) focus on locking in our interest expense through the use of long-term fixed rate debt facilities or long term interest rate (swaps). Our balance sheet is strong, and we have sufficient liquidity to execute our share buyback program from existing liquidity while at the same time preserving our ability to take full advantage of future opportunities.

In addition, we will maintain the existing TAL International annual dividend of $1.80 per share.

Moving to slide 13. The combination will enable us to reduce the combined companies’ GAAP tax rate significantly with minimal impact on the amount of cash (taxes paid). This will improve our GAAP earnings relative to cash earnings, and we (believe) GAAP earnings are how the market currently values companies in our space.

This change should make it easier to value our company using the same metrics by which our peers are valued. We are able to achieve this improvement by retaining Triton’s existing domicile in Bermuda. We anticipate this corporate structure will enable us to place a majority of future container procurement in a Bermuda subsidiary and move certain existing U.S., domiciled assets to an offshore subsidiary with minimal cash tax impact.

We anticipate that these changes will result in an initial reduction in GAAP tax rate from roughly 20 percent to 15 percent and generally improving thereafter, with minimal impact on cash taxes.

I will now return the call to Brian.

Brian Sondey: Thanks, John.

We’ve been working with Triton to structure this transaction for some time now, and our integration planning is under way. We put together a highly capable senior management team. We’ve also developed an outline for how we will integrate the organizations after the closing. We are confident that we’ll be able to achieve significant savings, also preserving the core strengths of each company. We will also make sure that the integration will be seamless for our customers.

We’ll be spending a lot of time now — between now and closing — on systems integration planning.

We are confident that either of our original systems are powerful and flexible enough to handle the combined business.

We plan to make significant progress on systems integration planning before we close though will likely run in parallel for a while after close.

Given the strong fit between the companies, our similar approaches to the business and the advanced planning we’ve been able to do, we expect that we’ll be able to complete the integration by the end of 2016. This should allow us to enjoy the full cost savings in our second year together.

I’ll now finish up the merger presentation with a few concluding thoughts.

As you’ve heard this morning, both leadership teams are very excited about the merger and what we can accomplish together as Triton International. This is the right transaction with the right partners at the right time.

Together, we will be the largest, most efficient container leasing company in the world. Our organizations will combine many of the best people in the industry. Our product line and customer strengths are highly complementary. We fill in each other’s strategic gaps in addition to building our operating scale.

Our shared commitments to operational excellence, investment discipline, customer service and teamwork will make the integration smoother and help us form one cohesive culture. The merger synergies will drive net income accretion of 30 percent or more, which will be increased by our stock buyback program.

The power of this combination will better enable us to navigate the current soft operating environment and will give us tremendous upside when market conditions improve.

I hope all of you are as excited about this transaction as we are. Thank you for your support, and I will now open up the call for questions.

Operator: At this time, I would like to remind everyone in order to ask a question, please press star 1 on your telephone keypad. Again, to ask a question, please press star 1.

We’ll pause for just a moment to compile the Q&A roster.

Your first question comes from the line of Art Hatfield with Raymond James.

Art Hatfield: Hey. Morning, Brian. Can you hear me?

Brian Sondey: Yes. Sure, Art. How are you?

Art Hatfield: Good. How are you? Hey, congratulations on this deal.

You really kind of walked through this very well, and I appreciate that. But I just kind of want to get your thoughts. And you somewhat touched on this. But you and I go back a long (technical difficulty) first kind of got involved with TAL after the IPO — you know, I would — some of the (conversations) we had was about a potential large acquisition or combination within the industry.

And I think at the time, a lot of your concerns were there wasn’t really a lot of synergies or maybe there weren’t companies that matched up with TAL. Can you maybe talk a little bit, just address what has changed in your mind to make this much more appealing?

Brian Sondey: Sure. So I think when we first started working together, most of the acquisitions or mergers that were out there involved very small companies being (technical difficulty). There was a series of acquisitions, you know, done by Textainer mostly, where they took over management rights of fleets that had been operated by, again, very small kind of second or third tier companies.

And our concern with those was that you’re not really adding any strategic value. You’re not adding any new customer relationships. You’re not adding any new capabilities. And it was purely a financial transaction — you know, could — how much money could you make from the extra management fees versus how much would you have to pay for those management rights?

And we always felt that there was, you know, kind of a cannibalization, too, of your existing customer relationships and good leasing opportunities — that they have to spread across these containers that you don’t even own that made us feel that just the net financial impact of those transactions wasn’t worth the cost of them and the risk of them and sort of the internal turmoil that any acquisition involves.

You know, this is a very different situation here. You know, as we’ve tried to lay out, we think that the two of us — TAL International and Triton — really represent already even on a stand alone basis some of the best companies, the best people, the best customer relationships in the industry. And so we really think this is a transaction that adds not just the opportunity for cost savings but

really creates a new competitor that just has some pretty outstanding characteristics.

Art Hatfield: Do you have much customer overlap with these two companies?

Brian Sondey: You know, we certainly do have customer overlap. I think both we and Triton probably have some business with almost every shipping line that’s of substance in the world.

But one of the things we found as we did start this conversation and one of the things that made us excited about it is that we found is we learned more about each other that a lot of our strengths are fairly complementary. And that’s true on a product line basis and also true on a customer basis.

And so, let’s say, for product lines that we’re both very strong in dry containers Triton has a much bigger presence than we do in reefers. We have a much bigger and more extensive presence than them in specials. And so that fits together very well.

Similarly in terms of customers, again while we have — you know, all have some business with just about everyone — that we found that our — really that the closest relationships, the biggest (amounts of equipment on hire) were generally complementary so that we weren’t necessarily stacking each other’s strengths on top of each other.

There are a few relationships where we are both very strong. And, you know, of course we are going to spend a lot of time with those customers to make them comfortable with this. I think it is ultimately going to be a great thing for our customers as well in terms of our supply capability and cost efficiency and so on. And just, again, the best people and processes to (give) good customer service.

But it’s a very good fit. It’s one of the things that made us excited about (technical difficulty).

Simon Vernon: I don’t think there’s much more to add than that.

This is Simon Vernon, by the way.

Just to say as Brian has said is that there’s a very complementary fit in terms of geographies, a complementary fit in terms of container types. Again, as Brian said, even as far as hemispheres go, we’ve kept our presence in the southern hemisphere perhaps a little bit more than TAL (have). And we see that there’s going to be synergies as far as coverage and making sure that we could provide the best levels of services that we can to our customer base going forward.

And again, we feel that the combination of the two companies will improve that level of service.

Art Hatfield: And just — I know you just announced this last night. But have you had any feedback from any customers at this point in time?

Brian Sondey: You know, we’ve had — as I imagine, you know, Triton probably has, too — we’ve had some notes from customers. I think mostly at this point, just kind of congratulatory notes.

Art Hatfield: OK.

Brian Sondey: You know, we certainly plan to make it a major initiative over the next few days to reach out to all of our key customers and, again, hopefully just explain the transaction in more detail. And I do think that this is something that, you know, should be received favorably and hopefully will be.

Art Hatfield: One last question. Then I’ll turn it over, Brian. You know, one of these things that you’ve been struggling with is this bubble of containers you’re renewing in this weaker lease rate environment. Does the combination of the two companies kind of smooth that out a little bit and mitigate that — the risk to earnings related to the (trough) you’re working through?

Brian Sondey: You know, I think everyone in our business has a lot of exposure to lease repricing right now. And also it’s just a feature of the industry that initial leases tend to run from, you know, five to maybe seven years. And so, you know, frankly they’re very similar to us in terms of lease exposure.

Simon Vernon: I would say very similar. I think neither company has a (cliff) in 2016 or ‘17. The expirations certainly of our portfolio and I’m sure TAL’s is smooth over the next three to five years.

Art Hatfield: But just to be clear, Simon, you guys were — Triton was heavy investors in that (10 through 12) period. So you do have a lot coming up for renewal now.

Simon Vernon: Yes. We...

Art Hatfield: OK.

Simon Vernon: ...we were investors like TAL during those years — post the financial crisis, exactly.

Art Hatfield: Right. Thank you. That’s all I have this morning.

Male: Thanks, Art.

Male: Thanks, Art.

Operator: Your next question comes from the line of Doug Mewhirter with SunTrust.

Doug Mewhirter: I had a — may have a more strategic question than a specific numbers-type question.

First on the strategic part, (has) the impending merger put any constraints on how you have to operate your business until closing to sort of meet certain financial hurdles?

So, for example, CapEx (plans) — I mean, I know there’s not a lot of CapEx in the industry anyway. But are there sort of — do you — are there now sort of hard caps on what you can spend leading up to closing?

Brian Sondey: No. We — you know, I think each company is going to operate as it always has between now and closing and continue, you know, going about our business and serving customers, investing where we think it’s appropriate and rewarding.

And, you know, of course there’ll be distractions. I think obviously our staff and management will be dually focused on both running the business and getting ready for the integration.

But there’s no constraints. I mean, this is — again, this is a deal we’re doing because we think it’s a very powerful and strategic combination. And, you know, if there’s investment opportunities, we’ll take them.

Of course, we can’t coordinate any of that. And so we’re going to have to make our decisions independently and — but again, I think we’ll — we want to make this business a business that will grow and thrive and invest. And if there’s opportunities in the meantime, you know, we’ll certainly take them.

Simon Vernon: Yes. I think that just — I’m sure Brian feels the same way. But certainly for customer requirements, customer needs (out) there in the months ahead we’re certainly going to look to support those.

As you said, the dry (van) market is very quiet at the moment. We’re going into a slightly stronger time of year for refrigerated containers. So we’ll certainly be looking at supporting CapEx on that side of business certainly in the months ahead leading up to — leading up to close. That’s certainly from Triton’s perspecctive.

Doug Mewhirter: Thanks. That’s very helpful.

Male: My second and final question. Could you go into a little bit more detail? You probably don’t have all the numbers yet on the purchase accounting adjustments which I’m sure were sort of forced upon you by the vagaries of purchase accounting. Looks like you’re going to write down (your) earning assets because I’m assuming just the market rate of containers, and you’re going to write up — I guess you’re going to write up the value or capitalize the value of some of your “above market” lease rates.

And could you give me an idea of maybe the proportions of that? Are those going to be — two things going to be roughly equal? A general percentage of the asset value or anything that could help me understand that better?

Yes, certainly. And maybe I’ll start by saying, you know, it’s a — as we’ve said, it’s a merger of equals. And therefore, we’ll have to go through a little bit of a process to decide on which entity is going to be — for accounting purposes, is going to have the purchase accounting applied to their fleet.

So that’s not decided yet.

And (that’ll break) purchase accounting into two pieces. You know, first as you note on the balance sheet side the process of going through purchase accounting is to fair value the assets. You know, the key asset obviously is the containers, given the current marketplace, there will be whichever entity is purchase accounted for, there’ll be a write down of the (steel), if you will, or the containers.

But similarly, there’ll be a write-up or a capitalization, as you note, of the above market value of the in place leases.

So that’s the biggest impact on the balance sheet.

You know, you move back then to the P&L and, by writing down the containers, on a go forward basis, your depreciation is lower. And then you move to the capitalized leases, you’ll run off that — you’ll amortize the capitalized leases over the remaining life of the leases that were capitalized.

And then that impact of that will be negative in the first year. We think it’ll be about neutral in the second year and then positive thereafter — again, because the amortization of the leases will expire (and) a lower depreciation on those assets written down will continue.

Doug Mewhirter: OK, thanks. And just to — just to follow up, if I may be able to persist (is) the — will the value of the dollar amount of the write up and the write down be roughly — do you have any idea of the rough percentage of asset value or book value that that number would be? Just in a range?

You know, we don’t. And again, we have to get through the decision making on which entity will be purchase accounted for.

But again, I think the percentages — from our standpoint, more importantly is the impact on the P&L as you look forward. You know, would it be positive as you go past the second year?

And the impact will have no impact. And (then) purchase accounting entries will be made at the (top co) and not at the facilities that are financing the assets.

Doug Mewhirter: OK, thanks. That’s all my questions.

Operator: Your next question comes from the line of Helane Becker with Cowen.

Helane Becker, Cowen and Company (Analyst): Thanks, Operator. Hi, guys.

Can I just follow that up? On slide 18, where you talk about example accretion calculation, is that just adding — does that assume any level of purchase accounting and write downs and so on? Or is that just kind of adding what you guys have earned year to date?

Brian Sondey: No. That does not include any purchase accounting.

Helane Becker: OK. So that’s just kind of year to date earnings.

Brian Sondey: That’s correct.

Helane Becker: OK. And then my other question is when you move to one — so based on your comments, I’m assuming that you’re going to run two separate entities until some point in the future when IP is on one platform? Is that — is that what you’re saying?

Brian Sondey: Yes. That’s right. So you know, we — to get the merger synergies, we need to bring the companies fully together operationally. And that certainly includes combining the company to a — you know, to one system platform. And ultimately combining the fleets — you know, to a one system platform.

You know, we’ve spent some time already evaluating each of the systems. And fortunately, either system has the power and flexibility to be the remaining system.

We’re going to go through a process over the next few weeks of kind of coming up to a conclusion on which system will make sense for the combined company and then start the process of planning the integration. And so that we’ll be fully ready to get a quick start on the actual integration as soon as the transaction closes.

Helane Becker: OK. So in terms of regulatory approval, what do you need?

Brian Sondey: Just I think typical — we’ll need approval from TAL’s shareholders. You know, we’ll also need approval from Triton shareholders, although they’ve already entered into voting agreements pledging to vote in favor of the transaction for Triton shareholders.

Helane Becker: (Very good).

Brian Sondey: We’ll need some anti-trust approvals — although we’re hopeful that that process won’t take so long just given the anti-trust approvals that we think we need to do.

But obviously those timelines can be unpredictable.

You know, we’re hopeful that the transaction will be closed again some time end of first quarter, early second quarter. But again, it really just depends on the timing of the approval process.

Helane Becker: Is it only U.S., Brian? Or are there international entities that have to approve?

Brian Sondey: Yes. No, we — you know, I think the analysis that we’ve come up with is we need to get the U.S., and then I think Germany and South Korea. But we are — you know, that’s still going to be evaluated over the coming weeks just to make sure that’s 100 percent (firm) view. But that’s what we’re planning at the moment.

Helane Becker: OK. And then in terms of investment, if there were to be any investment, are you — is each company going to, like, respond to customer requests individually? Or are you going to talk about it between now and then?

Like, what can you actually do prior to closing so that you don’t bid against each other without stepping over regulatory issues?

You know what I mean?

Simon Vernon: We will — this — again, this is Simon Vernon here.

We will function completely as independent companies as far as that’s concerned right up until close.

So it’s conceivable that Triton and TAL will compete on new — on new business, just as we will with our existing fleet.

So we’ll remain separated, apart and functioning on a very independent basis as far as the market is concerned and as far as our customers are concerned right up to close.

Helane Becker: OK. I think all my other questions were really covered over. Thank you.

Male: Thanks, Helane.

Operator: Your next question comes from the line of Vincent Caintic with Macquarie.

Vincent Caintic Great. Thanks very much, guys. A couple of questions on Triton since it’s a new company, I think, for many of us.

Some — the lease portfolio rate relative to the market rate. I think that was useful data that (TAL) disclosed in the past. Do you have that for Triton?

And (then) also how we should think about the average carrying value of those containers on Triton’s balance sheet.

Male: Right now the information that we have for Triton is what’s been disclosed in the earnings — the press release and the (deck). You know, we will file a registration roughly 30 days before we file that — which, at that time, there will be much more information available.

But at this time, it’s just the information that’s in the deck.

Brian Sondey: Yes, I would just say obviously we’ve done a lot more due diligence. And, you know, I think in general we find that the businesses — as we (tried) to portray — are very similar. That we, our investment patterns are not exactly the same but, you know, relatively similar over the last few years.

We both, I think, have a lot of focus on lease structure and discipline and lease pricing discipline. And so, you know, as we’ve thought about it, we think obviously that the actual trends that are going to happen in the market are unpredictable. But we think that those trends, whatever they may be, will impact the companies in a very similar way.

Vincent Caintic: OK. Got it. And then just a couple of more modeling accounting questions. But on the third quarter earnings call for TAL, (so) you already alluded to the value of — the present value of the leases. And this was to a question about, say, the debt versus the asset values.

Do you have a calculation (or) care to disclose what you think the net present value of the leases are?

Brian Sondey: So as John described in purchase accounting, you know, we’re going to have to do that calculation for one of the companies and capitalize that number — you know, for the lease intangible asset. You know, as I understand that that calculation (will) be done based upon what lease rates happen to be at the time the transaction closes. And so it’s partially dependant on, you know, what happens with container prices and what happens with interest rates — which typically drive down lease rates — over the next, you know, somewhere between four and six months.

You know, we don’t want to disclose anything now. It’s not (statistically) a number that we’ve shared. Because mainly it just involves a whole bunch of assumptions that — you know, it’s much more of an analytical number that you try to guess as best you can at rather than a number that you can typically disclose as, you know say, something as accounting. But of course to do purchase accounting, we’re going to have to go through that analytical exercise. And we’ll see it at that time.

Male: And I’ll just add that those are all non-cash accounting entries and don’t affect the cash flows of the (companies).

Vincent Caintic: Got it. Thanks. And one last one for me, and I think you touched on it in your prepared remarks.

The tax implications in domiciling in Bermuda. So I appreciate that the GAAP tax rate of the combined entity is going to decline. What happens to the DTL for TAL? And how is that treated?

Male: You know, it stays there. And we will continue to structure so that we minimize any cash taxes. And that’s a combination, as we noted, of investing overseas through the Bermuda entity but also strategies that allow us to move some of the existing assets offshore and, you know, other strategies that we believe will continue to make a non-cash — or minimal cash taxes from the existing entities, thereby preserving the DTL.

Brian Sondey: And so, I think as we try to describe what will happen on a practical basis after closing is a portion of TAL’s assets will remain in the U.S. And a portion of TAL’s assets will likely be put into a new subsidiary that will have an immediate benefit to the combined companies GAAP tax rate. And then, over time, we will allocate new investment between the U.S., and offshore in a way that helps us get the GAAP tax rate down further but also preserves our cash tax position.

Vincent Caintic: OK. Got it. Thanks very much, guys.

Operator: Again, to ask a question, please press star 1 on your telephone keypad.

And your next question comes from the line of Ken Hoexter with Bank of America.

Ken Hoexter: Hey, congrats Brian, John, Ed and Simon.

John, I just wondered — I was just going to follow up on the tax issue there that — I just want to understand the time to transition. So maybe just a little bit more in depth on that.

Is it that — I just want to understand the clarification there. Is it all new assets are going to be bought internationally so we have a long transition of that tax rate down? Or I just want to understand it. Did you say there’s a way to expedite that? Or is (this) that one bump down and then you’re going to allocate between the two of them?

Male: Yes. No, as Brian mentioned, there’s an initial opportunity to move existing U.S., assets that are currently generating profits and therefore GAAP tax (accrual) offshore and therefore get the immediate benefit.

And, you know, we estimate that that’s roughly on a combined basis moving from 20 percent combined, which is just taking a roughly 4 percent and a 35 percent divided by two — moving that, then, from 20 down to 15 quickly. And then ongoing investment offshore and, you know, other strategies that (will) pick up a (point or two) on an annual basis going forward from there.

Ken Hoexter: And is there a floor that you get to on that tax rate? Or is it that you’ll always have some U.S., assets? So they’ll always remain?

Male: (Multiple speakers) there’ll be some U.S., assets in order to continue to maintain — you know, not completely (reverse) the DTL and minimize our cash tax position — there is a floor.

Ken Hoexter: OK. And then just — any reason why TAL didn’t do that on its own before for the new containers, given the ongoing benefits you would accrue from it?

Brian Sondey: Yes. So if we did it on a stand alone basis, we could do it with, say, an offshore subsidiary — you know, in a location where many of the companies are already domiciled in terms of peers.

But the problem of doing it ourselves is we would still have a U.S., parent company. And so then you end up with, you know, cash in a location that you (can’t) (inaudible).

You know, now since...

Male: Hello?

Brian Sondey: we’re going to be continuing with Triton’s existing domicile in Bermuda, we don’t have that problem of trapped cash.

Male: (Ah, very good). Thanks.

Ken Hoexter: Wonderful. Thanks for the insights.

Operator: Your next question comes from the line of Michael Webber with Wells Fargo.

Michael Webber, Wells Fargo (Analyst): Hello?

Male: Hey, (Mike).

Michael Webber: Hey. Yes. (I’m sorry). Yes. So (I’m) doing this remotely, so my apologies if my connection’s bad.

(You) just handled the questions on the taxes. I guess I did see the slide around — I guess when you (laid) out that (effective) GAAP tax rate moving lower.

I’m just curious. In year five on that slide, John, what’s the implication there between the split between U.S., and foreign domiciled assets?

John Burns: Well, again, the starting point is 20 percent, which again is just the (our 35) and a roughly 4 percent for Triton.

And then, you know, as we noted, we’re going to take existing US TAL assets and move them to the foreign domicile, which gives us an immediate bump, you know, of roughly 5 percent. And then as we go forward, you know, future investment offshore allows us to keep that trend down from there.

Michael Webber: OK. All right. I can follow up offline on the taxes. Just — I didn’t see it at least anywhere in the release — and (I’m scrollling through to) my Blackberry, but the — is there a lockup on the PE equity on a go forward basis?

Brian Sondey: Yes. There’ll be a six-month lockup. That’s (actually in) the agreement.

Michael Webber: OK. And then, I guess, (finally) this might be just an oversimplified question. But are you guys planning just to rebrand the container fleet associated with the new name? And is there any sort of long tail associated with those costs?

Brian Sondey: No. So just the existing containers will keep their existing markings.

I guess there’s a question for us are we creative enough to come up with a new logo to — you know, to symbolize this new powerful combination. But, you know, that’s something we’ll think about later, I think.

But there won’t be any cost associated with sort of combining the fleets in that way.

Michael Webber: Great. OK. I’ll follow up offline. Thanks, guys.

Brian Sondey: (Inaudible).

Operator: Your next question comes from the line of Jim (Delisle) with (Wasatch) Advisors.

Jim Delisle Hello. Congratulations, and all that. Is it — am I correct in assuming that, depending upon when this closes, you’ll — this will be a taxable event for maybe a) longer term basis for all existing shareholders of TAL?

Male: Yes.

Brian Sondey: Yes. That’s correct. It will be a taxable event for TAL shareholders?

Jim Delisle: And do you have any broad estimates as to where that is? Obviously, you have two different — you have a lot of shareholders who are looking at the difference between long-term capital losses. You also have a significant percent of your shareholders (hoping) to translate short-term capital gains into long-term capital gains.

So the timing of the transaction for tax purposes will be important. Do you have any broad estimates as to when that will be?

Brian Sondey: Well, we tried to mention that. You know, the timing is really just dependant on, you know, how quickly we can move through the regulatory approval, shareholder approvals.

Certainly, we’re mindful of the tax consequences to investors. But I think we will nonetheless try to push forward as quickly as possible through all those approvals just so we can get, you know, through this period of — this sort of intermediate period here and get on with the merger which, again, we think really is what provides the upside for our shareholders.

You know, I think unfortunately we’ve seen a situation for our shareholders where the share prices have come down quite a bit in the last year. And so while there certainly will be shareholders that, you know, have tax consequences, I think at least — again, not that it’s a good reason, but — that we mitigate it to some extent by just trajectory of the stock over the last 12 months.

Jim Delisle: I’m going to press again. But rough guess. Are we talking 2Q16, 3Q16, 1Q16? Just (market) not held here.

Brian Sondey: Our hope is that it could be end of first quarter, early second quarter. But again, that’s — (you know, we’ll) be pushing as hard as we can from our side. And it’s just a matter of how quickly we can push through all the approvals.

Jim Delisle: Understandable. Thank you very much.

Operator: Your next question comes from the line of Vincent Caintic with Macquarie.

(Vincent Caintic, Macquarie Capital Analyst): I’m sorry. Just one more guys — a strategic question.

Now that you’re going to become the largest container leasing company, is there any pricing power benefit that you guys can or hope to achieve by being the largest to your customers?

Simon Vernon: I think that’s (technical difficulty) to answer. And I think for the time being, we’ll probably just stay neutral on that. And we don’t (believe so).

Brian Sondey: Yes. Certainly, you know, we’re going to be a big player and hopefully a great offering to customers in terms of the combination of our supply capability, the quality of our people and the ease of doing business with us, and our cost efficiency.

But it is an industry that has — you know, there’s a lot of production capacity to — you know, that can produce containers. And if we were to try to get super-aggressive on pricing — similarly, you know, our customers typically purchase something close to half of the containers every year.

And then also what leasing companies can charge and then, you know, there’s still going to be a lot of competition out in the leasing industry for every transaction.

And so, you know, for us, when we did the — sort of (evaluated) the benefits of the deal, it was not really any opportunity we think to say change the pricing dynamics. It was much more of an opportunity to improve our internal product offering and the supply capability, the quality of our people and processes and our cost efficiency.

Vincent Caintic: OK. Got it. Thank you.

Operator: Your next question comes from the line of Michael Webber with Wells Fargo.

Michael Webber: Figured I’d hop in for a couple more.

Just curious, I guess, longer term I guess if we think about how this plays out on (a) return basis. But I guess structurally, can you talk a bit about your — how similar the return provisions are within the two portfolios, if you think about things that could maybe erode or even enhance returns? Maybe similarities within the depot footprint and/or anything you can do to try to bridge the gap from differences between the way the two companies are set up now that actually take back the (inaudible)?

Simon Vernon: Yes. I think the two — the two companies are reasonably similar in the way we manage our portfolios. Obviously, as I think Brian said earlier, we spent a lot of time — certainly as far as Triton is concerned — thinking about where

containers come back. We like them to come back in stronger demand markets, stronger export markets.

In terms of being complementary in some ways, as I said in my comments some time before is that we’ve got I think a very strong presence in some of the secondary markets in the southern hemisphere. We’ve also over time created a specialist niche in some of the more niche markets and shorter term leasing environment. And I think that’s going to complement certainly a larger company in terms of being able to recycle equipment back on to lease.

We’ll obviously have a broader customer base. We’re in the East-West trades. We’re in the North-South trades. We spend a lot of time on the logistical side of our business moving containers from surplus areas to demand areas. And that’s certainly both as far as the leasing industry or the leasing demand is concerned but also as far as selling the containers that we ear-mark up for retirement.

So I think there’s got to be a lot of [complementarity] as far as logistics is concerned, as far as the redelivery limits that the two companies have together. And we see that really as a strength going forward. And just in terms of some of the flexibility that we can offer our customer base, we think we can — we can improve on that, too.

Michael Webber: OK. That’s helpful. And then I guess one more for Brian. When we think about — I guess the (competitive) dynamics of the space. And you said that the three (Ts). And now it’s kind of big (T), little (T) and kind of a bunch of other smaller players.

You know, one, do you think this ends up driving a bit more of a (inaudible) deal elsewhere and then, two, when we think about what the combined entity looked like and maybe investment on a go forward basis, are there kind of pockets I guess within the new pro forma fleet where we’re going to see — we’ll just see more investment (in) specials going forward on the reefer side?

(Just) maybe how does it shift where you guys think the pro forma long-term capital allocation goes just given the different mix going forward and the different customer (inquiry)?

Brian Sondey: Yes. So I think in terms of investment — you know, one of the reasons we — again, we’re very excited about this deal is we think it actually gives us the ability to continue to drive investment.

You know, I think we’ve talked a lot over the last few quarters with investors about just how very tough the market has been from a pricing standpoint. And, you know, with (a) combined company as Simon outlined in the presentation is really going to have just a great cost structure. And that’s going to let us, I think, actually have more confidence that the investments we’re making are going to create value for the company. And so certainly our plan is that, you know, one plus one from an investment standpoint should equal two. And maybe if we get lucky, it can equal more than just given that we’re going to have again a lot of cost leadership in (this thing)..

You know, in terms of whether there’ll be competitor reactions or further consolidation, you know, of course, it’s hard to know. You know, I think again we’ve talked — at least we have — with investors that we do think that M&A makes a lot of sense in this space, that customers generally I think benefit from having (larger) suppliers and — you know, that can handle all their needs whenever they have container requirements wherever they might have them.

Again, the cost advantages in a world that’s very price driven also has a lot of value.

And so, you know, I think we’ll see other consolidating deals probably just because they make sense — and perhaps the fact that we’ve, you know, taken a (very) big step in our transaction might motivate others to look even harder. But I think they would have been looking already.

And so it’s, again, very hard to predict. But I wouldn’t be surprised if we see other transactions.

Michael Webber: OK. Thanks for the time, guys.

Operator: We have time for one final question. It comes from the line of Jim (Delisle) with (Wasatch) Advisors.

Jim Delisle: Thank you, again. This is more geared towards Triton, with a history of being much more of a private player. Are you seeing — are the economics such that you’re seeing any private money coming into the container market — (do you know) right now?

Ed Schneider: This is Ed Schneider. We are not presently seeing private money coming into the container market. We believe that what we are doing here is in this combination creating an entity of scale such that we can be a low-cost producer. But we’ve never been — and neither has TAL ever been — the low-cost provider in this business.

We invest on the basis of our customer demands and the needs of our customers. We don’t speculate on the provision of equipment. We buy in response to either expressed need or need that’s fully anticipated on the basis of information that’s available to us, given our networks around the world, of customers, depots, suppliers, et cetera.

So no, we’ve not seen in a — in a market that is as difficult as this presently is, any influx of new private investment.

Jim Delisle: That — OK, that’s great. And the second question is, it seems that most of the downward pressure on boxes now has come from the (expiry) of existing leases and very little coming from new production out of the major manufacturers.

Do you see — is that the way you imagine to see the supply profile of boxes to look in the (intermediate) future? Or is there any appetite to be producing below $1,500?

Brian Sondey: Yes, maybe — this is Brian. You know, I think the price of new containers and the lease pricing pressure in our existing portfolio are certainly related — you know, that the price of new containers is what drives market lease rates. And it’s the difference between market lease rates and our portfolio lease rates that’s creating the pricing pressure.

You know, if you just look at the average rates in our portfolio, they’ve been coming down. That’s actually mostly as a function of adding new containers to the fleet. But there also has been an element of repricing as leases have rolled off and the containers are put on to other leases at lower rates or we renegotiate a lower rate extension.

But, you know, as I think we tried to explain, we certainly intend to be very active investors going forward. You know, again, as Ed mentioned, we typically aren’t price leaders. But we’ll be cost leaders. And so at the market rate of investment, we’re going to make better returns than everybody else due to just the thoughtfulness (in) the way that we invest, the quality of our relationships and the good (look) that we get at the best deals and then just our cost efficiency as well.

So certainly, we’re going to be active in buying containers. And we’re going to be also active in managing our existing portfolio to get the — you know, to try to get the best outcome for whatever leases do expire.

Jim (Delisle): All right. And any comment on the existing new box price? Is $1,500 a good number to use for our models?

Simon Vernon: Yes. I think that’s a reasonable — a reasonable number. We don’t think it’s going to stay there. We hope it’s not going to stay there for very long. It’s very close to break even levels now as far as the factories are concerned, we believe.

As far as — as far as the suppliers are concerned, when we start to see demand coming back into the market which most people expect to happen at some stage next year — perhaps after Chinese New Year — and we start to see normalized levels of demand again, that’s when we think (that) there’ll be more stability in container prices.

And certainly, as far as we’re concerned and have been led to believe, the factories will be very keen to start pushing pricing upwards and starting to bring back some kind of reasonable profit margin as far as — as far as they’re concerned. And they’ve got a fair degree of catching up to do, too.

Jim Delisle: Thank you very much for your candor.

Male: OK.

Operator: That concludes today’s...

Male: Go ahead.

Operator: That concludes today’s teleconference. Thank you for your participation. You may now disconnect at this time.

END

Forward-Looking Statements

Certain statements included in this communication are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “may”, “should”, “would”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “seem”, “seek”, “continue”, “future”, “will”, “expect”, “outlook” or other similar words, phrases or expressions. These forward-looking statements include statements regarding our industry, future events, the proposed transaction between Triton and TAL International, the estimated or anticipated future results and benefits of Triton and TAL International following the transaction, including estimated synergies, the likelihood and ability of the parties to successfully close the proposed transaction, future opportunities for the combined company, and other statements that are not historical facts. These statements are based on the current expectations of Triton and TAL International management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding Triton’s and TAL International’s respective businesses and the transaction, and actual results may differ materially. These risks and uncertainties include, but are not limited to, changes in the business environment in which Triton and TAL International operate, including inflation and interest rates, and general financial, economic, regulatory and political conditions affecting the industry in which Triton and TAL International operate; changes in taxes, governmental laws, and regulations; competitive product and pricing activity; difficulties of managing growth profitably; the loss of one or more members of Triton’s or TAL International’s management team; the ability of the parties to successfully close the proposed transaction, including the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the transaction; failure to realize the anticipated benefits of the transaction, including as a result of a delay in completing the transaction or a delay or difficulty in integrating the businesses of Triton and TAL International; uncertainty as to the long-term value of Triton International common shares; the expected amount and timing of cost savings and operating synergies; failure to receive the approval of the stockholders of Triton and TAL International for the transaction, and those discussed in TAL International’s Annual Report on Form 10-K for the

year ended December 31, 2014 under the heading “Risk Factors,” as updated from time to time by TAL International’s Quarterly Reports on Form 10-Q and other documents of TAL International on file with the Securities and Exchange Commission (“SEC”) or in the registration statement on Form S-4 that will be filed with the SEC by Triton International. There may be additional risks that neither Triton nor TAL International presently know or that Triton and TAL International currently believe are immaterial which could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements provide Triton’s and TAL International’s expectations, plans or forecasts of future events and views as of the date of this communication. Triton and TAL International anticipate that subsequent events and developments will cause Triton’s and TAL International’s assessments to change. However, while Triton and TAL International may elect to update these forward-looking statements at some point in the future, Triton and TAL International specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Triton’s and TAL International’s assessments as of any date subsequent to the date of this communication.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information

This communication is not a solicitation of a proxy from any stockholder of TAL International. In connection with the proposed transaction, Triton International will file with the SEC a registration statement on Form S-4 that will constitute a prospectus of Triton International and include a proxy statement of TAL International. TAL International will mail the proxy statement/prospectus to stockholders. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the proxy statement/prospectus, as well as other filings containing information about TAL International free of charge, at the website maintained by the SEC at www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, free of charge, by directing a request to TAL International Group, Inc., 100 Manhattanville Road, Purchase, New York 10577, Attention: Secretary.

The respective directors and executive officers of Triton, TAL International and Triton International and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding TAL International’s directors and executive officers is available in its proxy statement filed with the SEC on March 19, 2015. These documents can be obtained free of charge from the sources indicated above. Other

information regarding the participants in the proxy solicitation and their respective interests will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

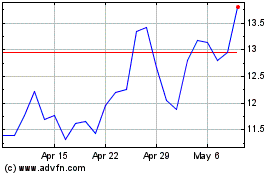

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024