Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

November 10 2015 - 3:39PM

Edgar (US Regulatory)

Filed by TAL International Group, Inc.

pursuant to Rule 425 under the U.S. Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: TAL International Group, Inc.

Commission File No. 001-32638

Date: November 10, 2015

To all TAL employees:

A few minutes ago, TAL International announced that we have entered into an agreement to merge with Triton Container. The combination of TAL and Triton will create the world’s largest and most efficient container leasing company. The combined company will also benefit from the pooled capabilities of two businesses already recognized for high quality people, operational excellence, close customer relationships and thoughtful decision-making. The new company will truly be an exceptional organization.

The enhanced capabilities, larger scale and improved cost competitiveness of the new company will provide meaningful advantages in good markets and bad, but these advantages will be particularly valuable in the current challenging environment. Our value proposition to customers will be strengthened. We will offer customers a significantly expanded container supply capacity and an enhanced customer service platform. We will provide our lenders with a larger, stronger borrower and our equity investors will benefit from improved earnings and strategic leadership. The new company will provide employees opportunities to take on new, increased responsibilities.

The combination of TAL International and Triton is structured as a merger of equals. The new company’s Board of Directors, senior management team and overall staff will include a mix of people from both organizations. I will serve as the combined company’s Chief Executive Officer, Triton’s Simon Vernon will be President and John Burns will be Chief Financial Officer. The name of the new company will be Triton International.

Organizational planning is underway and we believe we have developed an outline for the integration of TAL and Triton that will build upon the core strengths that each company brings to the merger. We will provide more details on the integration plan for the combined company over the coming weeks.

While I think this merger represents an exciting new chapter for TAL, it also necessarily creates a period of uncertainty for employees. We will work hard to quickly provide details for employees about how the integration of the two companies will impact your positions. We are also implementing enhanced employee protection plans to help mitigate some of this uncertainty. We will send details about these enhanced protection plans in a separate E-mail.

Both TAL and Triton have well-earned reputations for operational excellence and reliability with our customers, suppliers and capital providers. From the beginning of our discussions it was clear that bringing together our two companies was the ideal combination. This view recognizes all you have done to make TAL a great company, an outstanding competitor and an excellent place to work. We have a similar view of Triton.

I joined TAL over sixteen years ago as the company was still struggling with the aftermath of the Asia crisis. Many of you have been with the company much longer. We have gone through multiple corporate changes and faced a huge variety of market conditions. I look back at the things we have accomplished together with a tremendous amount of pride and more than a little amazement. I think I am most proud about the way we have always gone about our work. Over the last ten years that we have been a stand-alone public company, we have more than tripled the size of our assets and have generated almost $1.4 billion in cash income for our investors. We have done this by focusing on delivering value to customers, driving operational excellence and emphasizing clear, honest and open communication internally and with our external stakeholders. I am confident that we will continue this commitment to great results achieved the right way in the next phase of our company.

We expect the merger with Triton to close in the first half of 2016 after we have gone through regulatory reviews and received shareholder approvals for the transaction. We will use the interim period to lay the groundwork for bringing the companies together. However, it is especially critical that we also remain focused on our day-to-day business. We can’t let the preparation for our next phase interrupt our focus on our customers, operations and performance.

We will provide more information about the transaction and integration plan shortly with a goal of quickly giving each of you a clear understanding about what is happening and what it will mean for you. Also, your manager and TAL’s senior management team are also available for individual calls or drop-by visits, as always.

I am extremely excited by the opportunity to build on all that we have accomplished at TAL to create a truly unique, best-in-class leasing company together with Triton. I am looking forward to working closely with all of you to make this happen together.

Sincerely,

Brian

Forward-Looking Statements

Certain statements included in this communication are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “may”, “should”, “would”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “seem”, “seek”, “continue”, “future”, “will”, “expect”, “outlook” or other similar words, phrases or expressions. These forward-looking statements include statements regarding our industry, future events, the proposed transaction between Triton and TAL International, the estimated or anticipated future

results and benefits of Triton and TAL International following the transaction, including estimated synergies, the likelihood and ability of the parties to successfully close the proposed transaction, future opportunities for the combined company, and other statements that are not historical facts. These statements are based on the current expectations of Triton and TAL International management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding Triton’s and TAL International’s respective businesses and the transaction, and actual results may differ materially. These risks and uncertainties include, but are not limited to, changes in the business environment in which Triton and TAL International operate, including inflation and interest rates, and general financial, economic, regulatory and political conditions affecting the industry in which Triton and TAL International operate; changes in taxes, governmental laws, and regulations; competitive product and pricing activity; difficulties of managing growth profitably; the loss of one or more members of Triton’s or TAL International’s management team; the ability of the parties to successfully close the proposed transaction, including the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the transaction; failure to realize the anticipated benefits of the transaction, including as a result of a delay in completing the transaction or a delay or difficulty in integrating the businesses of Triton and TAL International; uncertainty as to the long-term value of Triton International common shares; the expected amount and timing of cost savings and operating synergies; failure to receive the approval of the stockholders of Triton and TAL International for the transaction, and those discussed in TAL International’s Annual Report on Form 10-K for the year ended December 31, 2014 under the heading “Risk Factors,” as updated from time to time by TAL International’s Quarterly Reports on Form 10-Q and other documents of TAL International on file with the Securities and Exchange Commission (“SEC”) or in the registration statement on Form S-4 that will be filed with the SEC by Triton International. There may be additional risks that neither Triton nor TAL International presently know or that Triton and TAL International currently believe are immaterial which could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements provide Triton’s and TAL International’s expectations, plans or forecasts of future events and views as of the date of this communication. Triton and TAL International anticipate that subsequent events and developments will cause Triton’s and TAL International’s assessments to change. However, while Triton and TAL International may elect to update these forward-looking statements at some point in the future, Triton and TAL International specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Triton’s and TAL International’s assessments as of any date subsequent to the date of this communication.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No

offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information

This communication is not a solicitation of a proxy from any stockholder of TAL International. In connection with the proposed transaction, Triton International will file with the SEC a registration statement on Form S-4 that will constitute a prospectus of Triton International and include a proxy statement of TAL International. TAL International will mail the proxy statement/prospectus to stockholders. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the proxy statement/prospectus, as well as other filings containing information about TAL International free of charge, at the website maintained by the SEC at www.sec.gov. Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, free of charge, by directing a request to TAL International Group, Inc., 100 Manhattanville Road, Purchase, New York 10577, Attention: Secretary.

The respective directors and executive officers of Triton, TAL International and Triton International and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding TAL International’s directors and executive officers is available in its proxy statement filed with the SEC on March 19, 2015. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and their respective interests will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

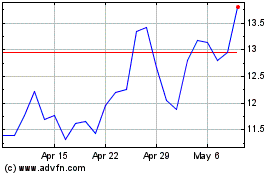

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

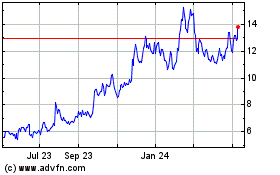

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024