Filed

by Triton Container International Limited

pursuant

to Rule 425 under the U.S. Securities Act of 1933, as amended,

and

deemed filed pursuant to Rule 14a-12

under

the Securities Exchange Act of 1934, as amended

Subject

Company: TAL International Group, Inc.

Commission

File No. 001-32638

Date:

November 9, 2015

From: Ed Schneider for the Executive Management

Committee

Dear Tritonites,

I want to share some important news about

the future of our Company. A few minutes ago, we announced that we have reached an agreement to combine with TAL International

in a merger of equals (a copy of the press release is attached).

Let me take a moment to give you my perspective on this merger.

This is a transformative step for both companies,

creating the world’s largest intermodal container lessor. TAL International is the ideal partner for us – we

have complementary operations and share similar cultures. Together, we will have deep industry knowledge, enhanced operating

and systems capabilities and the industry’s largest fleet size – all backed by world-class customer service.

I am confident that joining forces with TAL International is a next logical step for Triton, ensuring that we will be a stronger

competitor today and well into the future.

As we look ahead to our next chapter, it’s

important to remember where we came from and how we have grown. Our new company will be built upon those foundations.

Over the last 35 years, we’ve built

a company we can all be proud of. From a start-up with the collective talent, will and enthusiasm of a handful of Triton

pioneers, the extraordinary long-time support of the Pritzker family – and more recently Warburg Pincus and Vestar Capital

Partners – as well as loyal friends in shipping, banking and the law, we’ve become an industry leader with over $6

Billion in assets, well over $1 Billion in retained earnings and subsidiary locations around the world accommodating our complement

of nearly 200 Tritonites. We’re proud of Triton’s spirit and style. We’ve created a culture of respect,

diligence, trust and teamwork that defines us and has allowed us to thrive and to anticipate – and adapt to – a

world of constant and accelerating change. We’ve developed an industry-wide reputation for competence and reliability.

We’ve done this privately, organically and quietly.

But the world relentlessly changes, and

we must continue to adapt. We all understand that our industry is cyclical and that in recent years the global economy

has not recovered from the recession nearly as fully as we and others had expected. Present world-wide economic conditions

have resulted in lower levels of containerized trade growth, deflation in steel and new container prices, the availability of abundant

low-cost debt capital for new investment, fierce competition among lessors, and a continuing commoditization of our service.

That said, we’ve always maintained a long-term perspective about our business – and remain optimistic about the future.

We’ve been in difficult global economic markets before. We continue to believe that the world’s economies will

recover, that trade will rebound and that we will continue to enjoy the fruits of our labor – now as a larger, stronger company.

The combined company will be named Triton

International Limited, and its shares will be traded on the New York Stock Exchange. We will maintain significant subsidiary

operations world-wide. TAL International’s President and Chief Executive Officer Brian Sondey will serve as Chief Executive

Officer, Triton’s President and Chief Executive Officer Simon Vernon will serve as President, and TAL International’s

Chief Financial Officer John Burns will serve as Chief Financial Officer. Other senior officers will be appointed shortly.

As you know, I have decided that I will

retire from Triton following the close of the transaction, which is expected to take place in the first half of 2016. Until

then I will remain Chairman, continuing to work closely with Simon and our management team to complete the merger. Triton

and TAL International will remain separate companies until the transaction is completed, and we must stay focused on our day-to-day

Triton responsibilities throughout.

An integration planning team, led for Triton

by Dean Bonomo, has been assembled to ensure that the companies are brought together successfully and that the new combined company

will be well positioned and prepared to lead the industry. This team, consisting of Dean Bonomo, Simon Vernon, John O'Callaghan

and Edward Thomas, will provide regular communication on the progress of the integration planning.

This merger will result in changes to our

global infrastructure, leadership and staffing. We will draw upon both companies’ populations in defining the staffing

of Triton International Limited. We will do everything we can to see to it that these changes will be undertaken with great

care and in a manner consistent with past Triton practice. As we navigate through the planning for this integration, we should

continue to practice the professionalism, integrity, and respect for our colleagues and our Company that have defined us for so

long. We will be building a new, combined company. It won’t be Triton. It won’t be TAL. It

will be different. It will be better than either company standing alone. It will be what we make of it.

I know many of you will have questions about

today’s announcement. We will be holding an employee meeting in San Francisco on the second floor this afternoon at

3:30pm PST. We will be joined by our other NAM colleagues by teleconference. We will also hold a teleconference

for our Triton colleagues in Asia and Australia at 5:00pm PST today. Our colleagues in Europe and elsewhere will hear from

John O’Callaghan on Tuesday morning.

Thank you for your continuing dedication

and diligence on behalf of Triton.

Best,

Ed

*********************************************************************************

Forward-Looking Statements

Certain statements included in this communication are not historical facts but are forward-looking statements for purposes of the

safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied

by words such as “may”, “should”, “would”, “plan”, “intend”, “anticipate”,

“believe”, “estimate”, “predict”, “potential”, “seem”, “seek”,

“continue”, “future”, “will”, “expect”, “outlook” or other similar

words, phrases or expressions. These forward-looking statements include statements regarding our industry, future events,

the proposed transaction between Triton and TAL International, the estimated or anticipated future results and benefits of Triton

and TAL International following the transaction, including estimated synergies, the likelihood and ability of the parties to successfully

close the proposed transaction, future opportunities for the combined company, and other statements that are not historical facts.

These statements are based on the current expectations of Triton and TAL International management and are not predictions of actual

performance. These statements are subject to a number of risks and uncertainties regarding Triton’s and TAL International’s

respective businesses and the transaction, and actual results may differ materially. These risks and uncertainties include, but

are not limited to, changes in the business environment in which Triton and TAL International operate, including inflation and

interest rates, and general financial, economic, regulatory and political conditions affecting the industry in which Triton and

TAL International operate; changes in taxes, governmental laws, and regulations; competitive product and pricing activity; difficulties

of managing growth profitably; the loss of one or more members of Triton’s or TAL International’s management team;

the ability of the parties to successfully close the proposed transaction, including the risk that the required regulatory approvals

are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the

expected benefits of the transaction; failure to realize the anticipated benefits of the transaction, including as a result of

a delay in completing the transaction or a delay or difficulty in integrating the businesses of Triton and TAL International; uncertainty

as to the long-term value of Triton International common shares; the expected amount and timing of cost savings and operating

synergies; failure to receive the approval of the stockholders of Triton and TAL International for the transaction, and those discussed

in TAL International’s Annual Report on Form 10-K for the year ended December 31, 2014 under the heading “Risk Factors,”

as updated from time to time by TAL International’s Quarterly Reports on Form 10-Q and other documents of TAL International

on file with the Securities and Exchange Commission (“SEC”) or in the registration statement on Form S-4 that will

be filed with the SEC by Triton International. There may be additional risks that neither Triton nor TAL International presently

know or that Triton and TAL International currently believe are immaterial which could also cause actual results to differ from

those contained in the forward-looking statements. In addition, forward-looking statements provide Triton’s and TAL International’s

expectations, plans or forecasts of future events and views as of the date of this communication. Triton and TAL International

anticipate that subsequent events and developments will cause Triton’s and TAL International’s assessments to change.

However, while Triton and TAL International may elect to update these forward-looking statements at some point in the future, Triton

and TAL International specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon

as representing Triton’s and TAL International’s assessments as of any date subsequent to the date of this communication.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer

to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information

This communication is not a solicitation of a proxy from any stockholder of TAL International. In connection with the proposed

transaction, Triton International will file with the SEC a registration statement on Form S-4 that will constitute a prospectus

of Triton International and include a proxy statement of TAL International. TAL International will mail the proxy statement/prospectus

to stockholders. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION. You will be able to obtain the proxy statement/prospectus, as well as other filings containing information

about TAL International free of charge, at the website maintained by the SEC at www.sec.gov.

Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus

can also be obtained, free of charge, by directing a request to TAL International Group, Inc., 100 Manhattanville Road, Purchase,

New York 10577, Attention: Secretary.

The respective directors and executive officers

of Triton, TAL International and Triton International and other persons may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information regarding TAL International’s directors and executive officers

is available in its proxy statement filed with the SEC on March 19, 2015. These documents can be obtained free of charge from the

sources indicated above. Other information regarding the participants in the proxy solicitation and their respective interests

will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

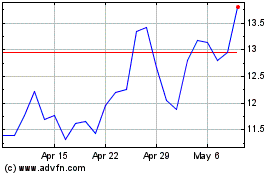

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

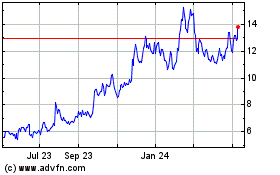

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024