TAL International, Triton Container to Merge

November 09 2015 - 7:17PM

Dow Jones News

By Josh Beckerman

TAL International Group Inc. (TAL), which leases intermodal

freight containers, has agreed to merge with privately owned Triton

Container International Ltd. in a stock swap.

TAL, which trades on the New York Stock Exchange, will combine

with Triton under a newly formed holding company that is expected

to be listed on the NYSE.

Triton shareholders will own 55% of the combined company's

equity, with TAL stockholders owning 45%. Triton's owners include

private-equity firms Warburg Pincus and Vestar Capital

Partners.

The deal is projected to add about 30% to earnings per share for

TAL's existing shareholders when cost savings are fully

realized.

TAL Chief Executive Brian Sondey said in a statement that "the

new company's enhanced capabilities, larger scale and improved cost

competitiveness will better position it in the current soft

operating environment and provide valuable operating leverage when

the market recovers."

On Oct. 28, TAL said its third-quarter profit fell 31%, while

leasing revenue rose 2.6% to $154.4 million. The company said its

utilization rate was strong, but pricing was pressured by factors

including lower steel prices.

For the 12 months ended Sept. 30, TAL's leasing revenue was $608

million, while Triton's was $716 million.

In after-hours trading, TAL shares were down 1.8% to $17.03.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

November 09, 2015 19:02 ET (00:02 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

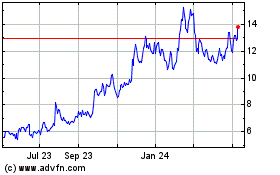

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

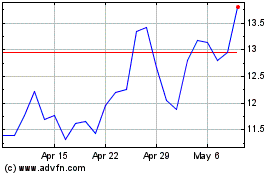

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024