TAL International Group, Inc. (NYSE:TAL), one of the

world’s largest lessors of intermodal freight containers and

chassis, today reported results for the second quarter ended

June 30, 2015.

Highlights:

- TAL reported Adjusted pre-tax income

per fully diluted common share of $1.24 for the second quarter of

2015, an increase of 0.8% from the first quarter of 2015. TAL’s

Adjusted pre-tax income per fully diluted common share decreased

14.5% from the second quarter of 2014.

- TAL reported leasing revenues of $150.8

million for the second quarter of 2015, an increase of 1.2% from

the first quarter of 2015, and an increase of 4.2% from the second

quarter of 2014.

- TAL continues to achieve strong

operational performance. Utilization averaged 97.1% for the second

quarter of 2015, and through July 29, 2015, we have invested

over $420 million in new and sale-leaseback containers for delivery

in 2015.

- TAL announced a quarterly dividend of

$0.72 per share payable on September 23, 2015 to shareholders

of record as of September 2, 2015.

Financial Results

The following table depicts TAL’s selected key financial

information for the three and six months ended June 30, 2015

and 2014 (dollars in millions, except per share data):

Three Months Ended

June 30, Six Months Ended June 30,

2015 2014

% Change 2015

2014 % Change

Adjusted pre-tax income(1) $40.9 $48.9 (16.4%) $81.4 $96.4

(15.6%)

Adjusted pre-tax income(1) per share $1.24 $1.45

(14.5%) $2.47 $2.85 (13.3%)

Leasing revenues $150.8 $144.7

4.2% $299.8 $289.5 3.6%

Adjusted EBITDA(1) $141.3 $142.1

(0.6%) $279.9 $283.1 (1.1%)

Adjusted net income(1) $26.4

$32.2 (18.0%) $52.7 $63.2 (16.6%)

Adjusted net income(1) per

share $0.80 $0.95 (15.8%) $1.60 $1.87 (14.4%)

Net income

$26.7 $29.4 (9.2%) $52.4 $59.4 (11.8%)

Net income per share

$0.81 $0.87 (6.9%) $1.59 $1.76

(9.7%) Note: All per share data is per fully diluted common share.

The Company focuses on adjusted pre-tax results since it

considers gains and losses on interest rate swaps and the write-off

of deferred financing costs to be unrelated to operating

performance and since it does not expect to pay any significant

income taxes for a number of years due to the availability of

accelerated tax depreciation on its existing container fleet and

anticipated future equipment purchases.

Operating Performance

“TAL achieved solid results in the second quarter of 2015,”

commented Brian M. Sondey, President and CEO of TAL International.

“We generated $40.9 million of Adjusted pre-tax income,

representing $1.24 of Adjusted pre-tax income per share. We grew

our leasing revenues 4.2% from the second quarter of 2014, and we

continued to generate an attractive level of returns. In the second

quarter of 2015, our annualized Adjusted pre-tax return on tangible

equity(1) was 15.8%.”

“TAL’s solid results in the second quarter were achieved in a

difficult market environment. TAL has been experiencing lease

pricing pressure and decreasing disposal gains for several years

due to falling steel and new container prices, widely available

low-cost financing and aggressive competition. However, we have

generally benefited from strong leasing demand driven by solid

trade growth and a market share shift from owned to leased

containers. In 2015, we are facing even heavier pricing pressures

due to a 35% drop in steel prices since December of last year, and

we are also facing unusually low demand this year. Our pick-up

volumes usually ramp-up as we approach the summer peak season for

shipping, but we did not see an increase in pick-up volumes in the

second quarter this year. Trade volumes on the critical Asia to

Europe trade lane have been weak in 2015, and overall global

containerized trade growth now seems likely to fall below

expectations.”

“Our utilization remains at a high level and continues to drive

our solid profitability despite the difficult market conditions.

Our utilization averaged 97.1% in the second quarter of 2015, and

finished the quarter at 96.6%. Our utilization currently stands at

96.1%. The resiliency of our utilization reflects the underlying

strength of our lease portfolio. As of June 30, 2015, 74.7% of our

containers on-hire were covered by long-term or finance leases, and

these leases have an average remaining duration of 41 months

assuming no leases are renewed. Our lease portfolio is also

protected by our lease structuring discipline, especially in

ensuring the vast majority of our containers on lease must be

returned to strong export locations.”

“We have purchased over $420 million of new and sale-leaseback

containers for delivery this year. Most of this investment was

placed early in the year and is supported by customer lease

commitments. This solid level of investment in a challenging year

reflects TAL’s strong supply capability and close customer

relationships. Container pick-ups, however, on most of our

committed leases are proceeding slower than expected, and we

accordingly plan to slow the pace of investments in the second half

of the year.”

Outlook

Mr. Sondey continued, “We typically expect our operating and

financial performance to improve as we move into the traditional

summer peak season for shipping. However, we have not seen leasing

demand improve seasonally this year, and our average lease rates

will continue to fall due to the large difference between the rates

on our existing leases and lease rates available in the current

market. Still, our pick-up volumes will be supported by the large

number of containers covered by committed leases, and we expect our

utilization to remain at a high level due to the strength of our

lease portfolio. Overall, we expect our Adjusted pre-tax income to

decrease slightly from the second quarter to the third quarter of

2015.”

Dividend

TAL’s Board of Directors has approved and declared a $0.72 per

share quarterly cash dividend on its issued and outstanding common

stock, payable on September 23, 2015 to shareholders of record

at the close of business on September 2, 2015. Based on the

information available today, we believe this distribution will

qualify as a return of capital rather than a taxable dividend for

U.S. tax purposes. Investors should consult with a tax adviser to

determine the proper tax treatment of this distribution.

Investors’ Webcast

TAL will hold a Webcast at 9 a.m. (New York time) on Thursday,

July 30, 2015 to discuss its second quarter results. An

archive of the Webcast will be available one hour after the live

call through Friday, September 11, 2015. To access the live

Webcast or archive, please visit the Company’s website at

http://www.talinternational.com.

About TAL International Group, Inc.

TAL is one of the world’s largest lessors of intermodal freight

containers and chassis with 17 offices in 11 countries and

approximately 230 third-party container depot facilities in 40

countries. The Company’s global operations include the acquisition,

leasing, re-leasing and subsequent sale of multiple types of

intermodal containers and chassis. TAL’s fleet consists of

approximately 1,468,000 containers and related equipment

representing approximately 2,419,000 twenty-foot equivalent units

(TEUs). This places TAL among the world’s largest independent

lessors of intermodal containers and chassis as measured by fleet

size.

Important Cautionary Information Regarding Forward-Looking

Statements

Statements in this press release regarding TAL International

Group, Inc.'s business that are not historical facts are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Readers are cautioned

that these statements involve risks and uncertainties, are only

predictions and may differ materially from actual future events or

results. For a discussion of such risks and uncertainties, see

"Risk Factors" in the Company's Annual Report on Form 10-K filed

with the Securities and Exchange Commission on February 19,

2015.

The Company’s views, estimates, plans and outlook as described

within this document may change subsequent to the release of this

statement. The Company is under no obligation to modify or update

any or all of the statements it has made herein despite any

subsequent changes the Company may make in its views, estimates,

plans or outlook for the future.

(1) Adjusted pre-tax income, Adjusted EBITDA, Adjusted net

income, and Adjusted pre-tax return on tangible equity are non-GAAP

measurements we believe are useful in evaluating our operating

performance. The Company’s definition and calculation of Adjusted

pre-tax income, Adjusted EBITDA, Adjusted net income, and Adjusted

pre-tax return on tangible equity are outlined in the attached

schedules.

Please see below for a detailed reconciliation

of these financial measurements.-Financial Tables Follow-

TAL INTERNATIONAL

GROUP, INC.

Consolidated Balance Sheets

(Dollars in thousands, except share

data)

(Unaudited)

June 30, December 31,

2015 2014 ASSETS: Leasing equipment,

net of accumulated depreciation and allowances of $1,137,930 and

$1,055,864 $ 3,855,705 $ 3,674,031 Net investment in finance

leases, net of allowances of $846 and $1,056 205,525 219,872

Equipment held for sale 59,589 59,861

Revenue earning assets 4,120,819 3,953,764 Unrestricted cash

and cash equivalents 72,161 79,132 Restricted cash 34,490 35,649

Accounts receivable, net of allowances of $1,003 and $978 85,269

85,681 Goodwill 74,523 74,523 Deferred financing costs 29,713

32,937 Other assets 12,852 11,400 Fair value of derivative

instruments 3,209 1,898

Total assets $

4,433,036 $ 4,274,984

LIABILITIES AND

STOCKHOLDERS' EQUITY: Equipment purchases payable $ 34,760 $

88,336 Fair value of derivative instruments 6,781 10,394 Accounts

payable and other accrued expenses 50,381 57,877 Net deferred

income tax liability 441,898 411,007 Debt 3,223,630

3,040,842

Total liabilities 3,757,450 3,608,456

Stockholders' equity: Preferred stock, $0.001 par value,

500,000 shares authorized, none issued

-

-

Common stock, $0.001 par value, 100,000,000 shares authorized,

37,167,134 and 37,006,283 shares issued respectively 37 37 Treasury

stock, at cost, 3,911,843 and 3,829,928 shares (75,310 ) (71,917 )

Additional paid-in capital 508,378 504,891 Accumulated earnings

251,307 246,766 Accumulated other comprehensive (loss) (8,826 )

(13,249 )

Total stockholders' equity 675,586

666,528

Total liabilities and stockholders'

equity $ 4,433,036 $ 4,274,984

TAL INTERNATIONAL

GROUP, INC.

Consolidated Statements of

Income

(Dollars and shares in thousands,

except earnings per share)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2015 2014 2015 2014

Leasing revenues: Operating leases $ 146,569 $ 139,489 $ 291,137 $

278,819 Finance leases 3,887 4,724 7,911 9,677 Other revenues 382

510 765 994

Total leasing

revenues 150,838 144,723 299,813 289,490

Equipment trading revenues 16,478 18,794 33,323

31,281 Equipment trading expenses (14,957 ) (16,579 ) (30,388 )

(27,418 )

Trading margin 1,521 2,215 2,935

3,863 Net (loss) gain on sale of leasing

equipment (660 ) 2,461 (2,109 ) 5,557

Operating

expenses: Depreciation and amortization 60,021 54,237 118,405

108,040 Direct operating expenses 10,011 8,267 18,833 16,949

Administrative expenses 11,367 11,128 23,349 22,960 (Reversal)

provision for doubtful accounts (165 ) 5 (188 ) 36

Total operating expenses 81,234 73,637 160,399

147,985 Operating income 70,465 75,762 140,240 150,925

Other expenses: Interest and debt expense 29,602 26,888

58,845 54,507 Write-off of deferred financing costs

-

3,729

-

4,899 Net (gain) loss on interest rate swaps (364 ) 582 352

955

Total other expenses 29,238 31,199

59,197 60,361 Income before income taxes

41,227 44,563 81,043 90,564 Income tax expense 14,557 15,201

28,616 31,191

Net income $ 26,670

$ 29,362 $ 52,427 $ 59,373

Net income per common share-Basic

$ 0.81 $ 0.87 $ 1.60 $ 1.77

Net income per common share-Diluted

$ 0.81 $ 0.87 $ 1.59 $ 1.76 Cash

dividends paid per common share $ 0.72 $ 0.72 $ 1.44 $ 1.44

Weighted average number of common shares

outstanding-Basic

32,857 33,619 32,859 33,614 Dilutive stock options and restricted

stock 151 178 149 168

Weighted average number of common shares

outstanding-Diluted

33,008 33,797 33,008 33,782

TAL INTERNATIONAL

GROUP, INC.

Consolidated Statements of Cash

Flows

(Dollars in thousands)

(Unaudited)

Six Months Ended

June 30,

2015 2014 Cash flows from operating

activities: Net income $ 52,427 $ 59,373 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 118,405 108,040 Amortization of

deferred financing costs 3,941 3,861 Amortization of net loss on

terminated derivative instruments designated as cash flow hedges

1,355 1,463 Amortization of lease premiums 1,047

-

Net loss (gain) on sale of leasing equipment 2,109 (5,557 ) Net

loss on interest rate swaps 352 955 Write-off of deferred financing

costs

-

4,899 Deferred income taxes 28,616 31,191 Stock compensation charge

3,449 3,419 Changes in operating assets and liabilities: Net

equipment purchased for resale activity (4,809 ) (4,627 ) Net

realized gain (loss) on interest rate swaps terminated prior to

their contractual maturities

-

(1,700 ) Other changes in operating assets and liabilities (3,759 )

(23,109 )

Net cash provided by operating activities 203,133

178,208

Cash flows from investing activities:

Purchases of leasing equipment and investments in finance leases

(428,963 ) (289,766 ) Proceeds from sale of equipment, net of

selling costs 66,026 83,503 Cash collections on finance lease

receivables, net of income earned 21,289 24,100 Other 74 97

Net cash (used in) investing activities (341,574 )

(182,066 )

Cash flows from financing activities: Purchases

of treasury stock (4,446 )

-

Stock options exercised and stock related activity 38 (234 )

Financing fees paid under debt facilities (717 ) (8,246 )

Borrowings under debt facilities 365,000 912,935 Payments under

debt facilities and capital lease obligations (182,251 ) (862,871 )

Decrease (increase) in restricted cash 1,159 (390 ) Common stock

dividends paid (47,313 ) (48,409 )

Net cash provided by (used

in) financing activities 131,470 (7,215 )

Net

(decrease) in unrestricted cash and cash equivalents $ (6,971 )

$ (11,073 ) Unrestricted cash and cash equivalents, beginning of

period 79,132 68,875

Unrestricted cash and cash

equivalents, end of period $ 72,161 $ 57,802

Supplemental non-cash investing activities: Equipment

purchases payable $ 34,760 $ 61,579

The following table sets forth TAL’s equipment fleet

utilization(2) as of and for the quarter ended June 30,

2015:

Average and Ending Utilization for

the

Quarter Ended June 30, 2015

Average Utilization Ending Utilization 97.1 %

96.6 %

(2) Utilization is computed by dividing TAL’s total units on

lease (in cost equivalent units, or "CEUs") by the total units in

TAL’s fleet (in CEUs) excluding new units not yet leased and

off-hire units designated for sale.

The following table provides the composition of TAL’s equipment

fleet as of June 30, 2015 (in units, TEUs and CEUs):

June 30, 2015 Equipment Fleet in Units

Equipment Fleet in TEUs Owned

Managed Total Owned

Managed Total Dry 1,273,097

14,706 1,287,803 2,072,780 25,649

2,098,429

Refrigerated 66,051 29 66,080 125,428 46 125,474

Special 55,517 698 56,215 101,406 1,232 102,638

Tank

9,852

-

9,852 9,852

-

9,852

Chassis 20,293

-

20,293 36,325

-

36,325

Equipment leasing fleet

1,424,810 15,433 1,440,243 2,345,791 26,927 2,372,718

Equipment

trading fleet 28,256

-

28,256 46,614

-

46,614

Total 1,453,066

15,433 1,468,499 2,392,405

26,927 2,419,332

Percentage 98.9

% 1.1 % 100.0 % 98.9 % 1.1 %

100.0 %

June 30, 2015 Equipment Fleet in CEUs

Owned Managed Total Operating leases

2,625,942 23,022 2,648,964

Finance leases 195,005 794

195,799

Equipment trading fleet 119,226

-

119,226

Total 2,940,173

23,816 2,963,989

Percentage 99.2 %

0.8 % 100.0 %

Non-GAAP Financial Measures

We use the terms "EBITDA", “Adjusted EBITDA”, "Adjusted pre-tax

income", "Adjusted net income", and "Adjusted pre-tax return on

tangible equity" throughout this press release.

EBITDA is defined as net income before interest and debt

expense, income tax expense, depreciation and amortization, and the

write-off of deferred financing costs. Adjusted EBITDA is defined

as EBITDA excluding gains and losses on interest rate swaps, plus

principal payments on finance leases.

Adjusted pre-tax income is defined as income before income taxes

as further adjusted for certain items which are described in more

detail below, which management believes are not representative of

our operating performance. Adjusted pre-tax income excludes gains

and losses on interest rate swaps and the write-off of deferred

financing costs. Adjusted net income is defined as net income

further adjusted for the items discussed above, net of income

tax.

Adjusted pre-tax return on tangible equity is defined as the

current quarter's Annualized adjusted pre-tax income divided by the

average adjusted tangible equity. Adjusted tangible equity is

defined as total stockholders' equity plus net deferred income tax

liability and the net fair value of derivative instruments less

goodwill.

EBITDA, Adjusted EBITDA, Adjusted pre-tax income, Adjusted net

income, and Adjusted pre-tax return on tangible equity are not

presentations made in accordance with U.S. GAAP. EBITDA, Adjusted

EBITDA, Adjusted pre-tax income, Adjusted net income, and Adjusted

pre-tax return on tangible equity should not be considered as

alternatives to, or more meaningful than, amounts determined in

accordance with U.S. GAAP, including net income, or net cash from

operating activities.

We believe that EBITDA, Adjusted EBITDA, Adjusted pre-tax

income, Adjusted net income, and Adjusted pre-tax return on

tangible equity are useful to an investor in evaluating our

operating performance because:

-- these measures are widely used by securities analysts and

investors to measure a company's operating performance without

regard to items such as interest and debt expense, income tax

expense, depreciation and amortization, and gains and losses on

interest rate swaps, which can vary substantially from company to

company depending upon accounting methods and the book value of

assets, capital structure and the method by which assets were

acquired;

-- these measures help investors to more meaningfully evaluate

and compare the results of our operations from period to period by

removing the impact of our capital structure, our asset base and

certain non-routine events which we do not expect to occur in the

future; and

-- these measures are used by our management for various

purposes, including as measures of operating performance to assist

in comparing performance from period to period on a consistent

basis, in presentations to our board of directors concerning our

financial performance and as a basis for strategic planning and

forecasting.

We have provided reconciliations of net income, the most

directly comparable U.S. GAAP measure, to EBITDA and Adjusted

EBITDA in the tables below for the three and six months ended

June 30, 2015 and 2014. We have provided reconciliations of

income before income taxes and net income, the most directly

comparable U.S. GAAP measures, to Adjusted pre-tax income and

Adjusted net income in the tables below for the three and six

months ended June 30, 2015 and 2014.

We have also provided a reconciliation of Adjusted pre-tax

return on tangible equity in the tables below for the current

quarter.

TAL INTERNATIONAL GROUP, INC.

Non-GAAP Reconciliations of EBITDA and

Adjusted EBITDA(Dollars in Thousands)

Three Months Ended June 30,

Six Months Ended June 30, 2015

2014 2015 2014 Net income $

26,670 $ 29,362 $ 52,427 $ 59,373 Add: Depreciation

and amortization 60,021 54,237 118,405 108,040 Interest and debt

expense 29,602 26,888 58,845 54,507 Write-off of deferred financing

costs

-

3,729

-

4,899 Income tax expense 14,557 15,201

28,616 31,191 EBITDA 130,850 129,417 258,293 258,010

Add: Net (gain) loss on interest rate swaps (364 ) 582 352 955

Principal payments on finance lease 10,815 12,096

21,289 24,100 Adjusted EBITDA $ 141,301

$ 142,095 $ 279,934 $

283,065

TAL INTERNATIONAL GROUP, INC.

Non-GAAP Reconciliations of Adjusted

Pre-tax Income and Adjusted Net Income(Dollars and Shares in

Thousands, Except Per Share Data)

Three Months Ended June 30, Six

Months Ended June 30, 2015 2014

2015 2014 Income before income taxes $

41,227 $ 44,563 $ 81,043 $ 90,564 Add: Write-off of deferred

financing costs

-

3,729

-

4,899 Net (gain) loss on interest rate swaps (364 ) 582

352 955 Adjusted pre-tax income $

40,863 $ 48,874 $ 81,395

$ 96,418 Adjusted pre-tax income per fully diluted common share

$1.24 $1.45 $2.47 $2.85

Weighted average number of common shares

outstanding-Diluted

33,008 33,797 33,008 33,782

Three Months Ended

June 30, Six Months Ended June 30,

2015 2014 2015

2014 Net income $ 26,670 $ 29,362 $ 52,427 $ 59,373 Add:

Write-off of deferred financing costs, net of tax(a)

-

2,450

-

3,212 Net (gain) loss on interest rate swaps, net of tax(a) (235 )

382 228 626 Adjusted net

income(a) $ 26,435 $ 32,194 $ 52,655

$ 63,211 Adjusted net income per fully diluted common

share $0.80 $0.95 $1.60

$1.87

Weighted average number of common shares

outstanding-Diluted

33,008 33,797 33,008 33,782 (a) The differences between

Adjusted net income and reported net income in the three and six

months ended June 30, 2015 and 2014 were due to net gains and

losses on interest rate swaps and the write-off of deferred

financing costs. TAL uses interest rate swaps to synthetically fix

the interest rates for most of its floating rate debt so that the

duration of the fixed interest rates more closely matches the

expected duration of TAL’s lease portfolio.

TAL INTERNATIONAL

GROUP, INC.Non-GAAP Reconciliations of Adjusted Pre-tax

Return on Tangible Equity (Dollars in Thousands)

Balance as of June 30, 2015 Balance

as of March 31, 2015 Total stockholders' equity $ 675,586

$ 654,554 Net deferred income tax liability 441,898 418,298

Net fair value of derivative instruments liability 3,572 28,781

Goodwill (74,523 ) (74,523 ) Total adjusted tangible equity

$ 1,046,533 $ 1,027,110 Average adjusted

tangible equity(a) $ 1,036,822

Adjusted pre-tax income (for the current three months ended) $

40,863 Annualized adjusted pre-tax income (Adjusted pre-tax income

* 4) $ 163,452 Adjusted pre-tax return on tangible equity 15.8 %

(a) Calculated by taking the average of the current

quarter's and the prior quarter's ending total adjusted tangible

equity.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150729006751/en/

TAL International Group, Inc.John Burns, (914) 697-2900Senior

Vice President and Chief Financial OfficerInvestor Relations

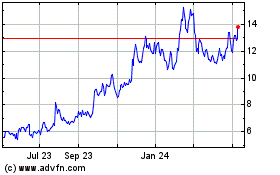

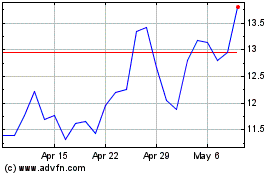

Tal Education (NYSE:TAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tal Education (NYSE:TAL)

Historical Stock Chart

From Apr 2023 to Apr 2024