As filed with the Securities and Exchange Commission on . Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AT&T INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

|

43-1301883

|

|

(State or other jurisdiction of

|

|

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

|

| |

|

|

|

|

208 S. Akard Street, Dallas, Texas

|

|

|

75202

|

|

(Address of Principal Executive Offices)

|

|

|

(Zip Code)

|

DIRECTV 2010 Stock Plan

DIRECTV 401(k) Savings Plan

and

Liberty Entertainment, Inc. Transitional Stock Adjustment Plan

(Full title of the plans)

|

Name, address and telephone number of agent for service:

|

|

|

Please send copies of all communications to:

|

|

Stacey Maris

|

|

|

Wayne Wirtz

|

|

Senior Vice President and Secretary

|

|

|

Associate General Counsel

|

|

AT&T Inc.

|

|

|

AT&T Inc.

|

|

208 S. Akard, 32nd Floor

|

|

|

208 S. Akard, 30th Floor

|

|

Dallas, Texas 75202

|

|

|

Dallas, Texas 75202

|

|

(210) 821-4105

|

|

|

(210) 821-4105

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer X Accelerated filer Non-accelerated filer Smaller Reporting Company ___

CALCULATION OF REGISTRATION FEE

|

Title of securities to

be registered

|

Amount to

be registered

|

Proposed maximum offering price

per share

|

Proposed maximum aggregate offering

price

|

Amount of registration fee

|

|

Common Stock, par value $1.00 per share (1)

|

38,000,000

(1)

|

$34.10

(2)

|

$1,206,207,029

(2)

|

$77,788

(3)

|

|

(1)

|

The number of shares being registered represents the number of shares of Common Stock which may be sold pursuant to the DIRECTV 2010 Stock Plan, DIRECTV 401(k) Savings Plan, and the Liberty Entertainment, Inc. Transitional Stock Adjustment Plan.

|

|

(2)

|

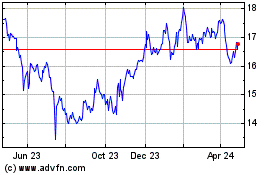

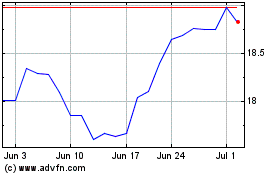

The price per share was calculated in accordance with Rule 457(c) and (h) of the Securities Act of 1933 for purposes of calculating the registration fee. For shares to be issued pursuant to an employee benefit plan, the maximum aggregate offering price was computed by multiplying 32,889,647 shares by the average of the high and low price of the stock on July 23, 2015 ($34.10 per share). For shares to be issued pursuant to an employee stock option plan, the maximum aggregate offering price was computed by multiplying 5,110,353 shares by the price at which the options may be exercised.

|

|

(3)

|

Pursuant to Rule 457(p) under the Securities Act of 1933, the amount of the registration fee payable hereunder has been partially offset by previously paid filing fees as follows:

|

| |

(a) On July 1, 2014, the Registrant filed a Registration Statement on Form S-4, File Number 333-197144, and paid a filing fee of $3,688,084.75. The offering was completed on September 25, 2014; upon completion of the offering, there were unsold shares remaining for which a filing fee of $62,373 had been paid that may be used as an offset against future filings. |

| |

(b) In connection with the filing of this Registration Statement, the total filing fee of $140,161 is hereby offset by $62,373, which represents the unused portion of the filing fees paid in (a) above. |

| |

|

|

Pursuant to Rule 416(a) under the Securities Act of 1933, this registration statement also covers such indeterminate number of additional shares of Common Stock as is necessary to eliminate any dilutive effect of any future stock split or stock dividend. No additional registration fee is required. In addition, pursuant to Rule 416(c) of the Securities Act of 1933, this Registration Statement also covers an indeterminate amount of interests to be offered or sold pursuant to the DIRECTV 401(k) Savings Plan.

|

PART I. INFORMATION REQUIRED IN PROSPECTUS

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act of 1933 and the Note to Part I of Form S-8.

PART II. INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents have been filed by AT&T Inc. (“AT&T”) with the Securities and Exchange Commission (the “SEC”) (File No. 1-08610) and are incorporated herein by reference: Annual Report on Form 10-K for the year ended December 31, 2014; Quarterly Report on Form 10-Q for the quarter ended March 31, 2015; the description of AT&T’s shares of common stock, contained in its Registration Statement on Form 10, dated November 15, 1983; and AT&T’s Current Reports on Form 8-K, filed on January 16, 2015, January 22, 2015, January 27, 2015, January 28, 2015, January 30, 2015, February 12, 2015, March 4, 2015, March 9, 2015, March 10, 2015, April 22, 2015, April 23, 2015, April 28, 2015, May 4, 2015, May 15, 2015, June 26, 2015, June 29, 2015, July 23, 2015, and July 24, 2015.

The following additional document has been filed by DIRECTV with the SEC (File No. 1-34554) and is hereby incorporated herein by reference: the Annual Report on Form 11-K for the year ended December 31, 2014 for the DIRECTV 401(k) Savings Plan.

All documents filed by AT&T or any of the plans listed on the cover page of this Registration Statement pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”) subsequent to the filing of this registration statement, and prior to the filing of a post-effective amendment that indicates that all securities offered hereby have been sold or which deregisters all securities remaining unsold, shall be deemed to be incorporated by reference in this registration statement and to be part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item 4. Description of Securities

The Registrant is registering common shares which are registered pursuant to Section 12 of the Exchange Act, as amended.

Item 5. Interests of Named Experts and Counsel

As of July 24, 2015, Wayne Watts owned less than 1% of the outstanding shares of AT&T.

Item 6. Indemnification of Directors and Officers

The laws of the State of Delaware provide for indemnification of any person (the “Indemnitee”), under certain circumstances, against reasonable expenses, including attorneys’ fees, incurred in connection with the defense of a civil, criminal, administrative or investigative proceeding (other than an action by or in the right of AT&T) to which such person has been made, or threatened to have been made, a party by reason of the fact that he or she is or was serving as a director, officer, employee or agent of AT&T or by reason of the fact that he or she is or was serving at the request of AT&T as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise. Pursuant to the statute, indemnity may be provided for if the Indemnitee acted in good faith (and with respect to a criminal action or proceeding, had no reason to believe his or her conduct was unlawful) and in a manner reasonably believed to be in or not opposed to the best interests of AT&T. With respect to any threatened, pending or completed action or suit by or in the right of AT&T, the statute provides that AT&T may indemnify against expenses (including attorneys’ fees) actually and reasonably incurred in connection with the defense or settlement if the Indemnitee acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of AT&T, except that no indemnification may be made if the Indemnitee shall have been adjudged to be liable to AT&T unless specific court approval is obtained. The statute further provides that the indemnification provided pursuant to it shall not be deemed exclusive of any rights to which those seeking indemnification may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise. The bylaws of AT&T provide that AT&T shall indemnify, and advance expenses to, any director, officer, employee or agent of AT&T or any person serving as a director or officer of any other entity at the request of AT&T to the fullest extent permitted by law.

Under the statute, AT&T may, and does, maintain insurance policies covering AT&T, any director or officer of AT&T and any person serving at the request of AT&T as a director or officer of any other entity. These insurance policies generally cover liabilities arising out of such service, including liabilities for which any such person may not be indemnified by AT&T.

In recognition of the directors’ and officers’ need for substantial protection against personal liability in order to assure their continued service to AT&T in an effective manner, their reliance on the bylaws and to provide them with specific contractual assurances that the protection promised by such bylaws will be available to them, AT&T has entered into indemnity agreements with each of its directors and officers.

Each agreement specifies that AT&T will indemnify the director or officer to the fullest extent permitted by law, as soon as practicable after written demand is presented, against any and all expenses and losses arising out of any action, suit or proceeding, inquiry or investigation related to the fact that the director or officer is or was a director, officer or employee, agent or fiduciary of AT&T or was serving another corporation, partnership or joint venture in such a capacity at the request of AT&T. Each agreement also provides that AT&T will promptly advance any expenses if requested to do so. Each director and officer undertakes in the agreement to repay such advancements if it is ultimately determined that he or she was not entitled to indemnification. The right of any director or officer to indemnification in any case will be determined by either the Board of Directors (provided that a majority of directors are not parties to the claim), by a person or body selected by the Board of Directors or, if there has been a change in control, defined in the agreement generally to mean an acquisition by any person of 20 percent or more of AT&T’s stock or a change in the identity of a majority of the Board of Directors over a two-year period, by a special, independent counsel.

In each agreement, AT&T commits to maintaining its insurance coverage of directors and officers both in scope and amount at least as favorable as the policies maintained as of the effective date of the agreement. In the event that such insurance is not reasonably available or if it is determined in good faith that the cost of the insurance is not reasonably justified by the coverage thereunder or that the coverage thereunder is inadequate, AT&T may discontinue any one or more of such policies or coverages. In such event, AT&T agrees to hold harmless and indemnify directors and officers to the full extent of the coverage which would otherwise have been provided if the insurance in effect on the effective date of the agreements had been maintained. Each agreement will remain effective so long as the director or officer is subject to liability for an indemnifiable event (the “indemnification period”). Each agreement also provides that if during the indemnification period the then existing directors and officers have more favorable indemnification rights than those provided for in the agreement, each director or officer shall be entitled to such more favorable rights. The foregoing summary is subject to the detailed provisions of the Delaware General Corporation Law, AT&T’s bylaws, and the agreements between AT&T and each of its directors and officers.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

|

Exhibit Number

|

Description of Exhibits

|

| |

|

|

5

|

Validity opinion of Wayne Watts, Esq.

|

|

10-a

|

DIRECTV 2010 Stock Plan

|

|

10-b

|

Liberty Entertainment, Inc. Transitional Stock Adjustment Plan

|

|

23-a

|

Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm

|

|

23-b

|

Consent of Crowe Horwath LLP, Independent Registered Public Accounting Firm

|

| 23-c |

Consent of Deloitte & Touche LLP, Independent Registered Public Accounting Firm |

|

23-d

|

Consent of Wayne Watts, Esq. (contained in opinion filed as Exhibit 5)

|

|

24

|

Powers of Attorney of Officers and Directors

|

Item 9. Undertakings

(a) The undersigned Registrant hereby undertakes:

| |

(1)

|

to file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

| |

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

| |

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

|

| |

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the registration statement is on Form S-8 (Section 239.16b of this chapter), and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78o(d)) that are incorporated by reference in the registration statement; and

| |

(2)

|

that, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

| |

(3)

|

to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

(b)

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Dallas, State of Texas, on this 24th day of July 2015.

| |

AT&T INC. |

| |

|

| |

|

| |

By: /s/ John J. Stephens |

| |

John J. Stephens |

| |

Senior Executive Vice President |

| |

and Chief Financial Officer |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the date indicated:

|

Principal Executive Officer:

|

Randall L. Stephenson *

Chairman of the Board, Chief Executive Officer

and President

|

|

Principal Financial and

Accounting Officer:

|

John J. Stephens

Senior Executive Vice President and

Chief Financial Officer

|

| |

By: /s/ John J. Stephens |

| |

John J. Stephens, as attorney-in-fact for Mr. Stephenson, |

| |

the Directors, and on his own behalf as |

| |

Principal Financial and Accounting Officer |

| |

|

| |

July 24, 2015 |

DIRECTORS:

|

Scott T. Ford *

|

Beth E. Mooney *

|

|

Glenn H. Hutchins *

|

Joyce M. Roché *

|

|

William E. Kennard *

|

Matthew K. Rose *

|

|

Jon C. Madonna *

|

Cynthia B. Taylor *

|

|

Michael B. McCallister *

|

Laura D’Andrea Tyson *

|

|

John B. McCoy *

|

|

* By power of attorney

The Plan. Pursuant to the requirements of the Securities Act of 1933, the Administrative Committee responsible for the administration of the DIRECTV 401(k) Savings Plan has duly caused this Registration Statement to be signed on behalf of the DIRECTV 401(k) Savings Plan by the undersigned, thereunto duly authorized in the City of El Segundo, State of California, on this 24th day of July, 2015.

| |

DIRECTV 401(k) Savings Plan |

| |

|

| |

By: DIRECTV 401(k) Savings Plan, Administrative Committee |

| |

|

| |

By: /s/ Irene McKenna |

| |

Irene McKenna |

| |

Member of the Administrative Committee |

| |

of the DIRECTV 401(k) Savings Plan |

INDEX TO EXHIBITS

|

Exhibit Number

|

Description of Exhibits

|

| |

|

|

5

|

Validity opinion of Wayne Watts, Esq.

|

|

10-a

|

DIRECTV 2010 Stock Plan

|

|

10-b

|

Liberty Entertainment, Inc. Transitional Stock Adjustment Plan

|

|

23-a

|

Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm

|

|

23-b

|

Consent of Crowe Horwath LLP, Independent Registered Public Accounting Firm

|

| 23-c |

Consent of Deloitte & Touche LLP, Independent Registered Public Accounting Firm |

|

23-d

|

Consent of Wayne Watts, Esq. (contained in opinion filed as Exhibit 5)

|

|

24

|

Powers of Attorney of Officers and Directors

|

Exhibit 5

[AT&T Inc. Letterhead]

July 24, 2015

AT&T Inc.

208 S. Akard Street

Dallas, TX 75202

Dear Sirs:

In connection with the registration under the Securities Act of 1933 (the “Act”) of shares of Common Stock, par value $1.00 per share (the “Shares”) of AT&T Inc., a Delaware corporation (“AT&T”), I am of the opinion that:

(1) Thirty eight Million (38,000,000) Shares, which may be purchased pursuant to the terms of the DIRECTV 2010 Stock Plan, DIRECTV 401(k) Savings Plan, and the Liberty Entertainment, Inc. Transitional Stock Adjustment Plan (the “Plans”), have been duly authorized, and, when the registration statement on Form S-8 relating to the Shares to be issued pursuant to the Plan (the “Registration Statement”) has become effective under the Act, upon issuance of such Shares and upon payment therefore, in accordance with the Plan, the Shares will be legally and validly issued, fully paid and nonassessable;

(2) The provisions of the DIRECTV 401(k) Savings Plan are in compliance with the requirements of the Employee Retirement Income Security Act of 1974 pertaining to such provisions; and

(3) AT&T has been duly incorporated and is validly existing as a corporation in good standing under the laws of the State of Delaware.

The foregoing opinion is limited to the federal laws of the United States and the General Corporation Law of the State of Delaware, and I am expressing no opinion as to the effect of the laws of any other jurisdiction.

I have relied as to certain matters on information obtained from public officials, officers of AT&T and other sources believed by me to be responsible.

I hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, I do not thereby admit that I am in the category of persons whose consent is required under Section 7 of the Act.

| |

Very truly yours, |

| |

|

| |

/s/ Wayne Watts |

| |

Wayne Watts |

Exhibit 10-a

DIRECTV

2010 STOCK PLAN

(effective June 3, 2010, as amended December 19, 2013)

|

1.

|

Purposes. The purposes of the DIRECTV 2010 Stock Plan are to promote the success of DIRECTV, a Delaware corporation and its Subsidiaries, and to increase stockholder value by providing an additional means through the grant of awards to attract, motivate, retain and reward selected employees and other eligible persons.

|

|

2.

|

Definitions. As used in this Plan, the following terms shall have the meanings set forth below:

|

"Affiliates" means Subsidiaries of the Company and entities over which the Company, directly or indirectly, has the power to direct or cause the direction of the management and policies.

"Award" means, individually or in the aggregate, an award granted under this Plan in the form of Stock Options, Stock Appreciation Rights, Restricted Stock, Stock Units (restricted or unrestricted), Stock Bonuses, shares of Common Stock or any combination of the foregoing, including Dividend Equivalent Rights at the discretion of the Committee.

"Award Terms and Conditions" or "Terms and Conditions" mean Award specifications set for each Award or group of Awards.

"Beneficiary" means the person, persons, trust or trusts designated by a Participant or, in the absence of a designation, entitled by will or the laws of descent and distribution, to receive the benefits specified in the Award Terms and Conditions and under this Plan in the event of a Participant's death.

"Board" means the Board of Directors of DIRECTV.

"Code" means the Internal Revenue Code of 1986, as amended from time to time.

"Committee" means the Compensation Committee of the Board.

"Common Stock" means share(s) of Class A common stock, $.01 par value, of DIRECTV and such other securities or property as may become the subject of Awards under this Plan, or may become subject to such Awards, pursuant to an adjustment made under Section 14.

"Company" means DIRECTV and its Subsidiaries.

"DIRECTV" means DIRECTV, a Delaware corporation, and any successor entity which shall have assumed the rights and obligations of this Plan by operation of law or otherwise.

"Dividend Equivalent Right" or "DER" means a right authorized by Section 11 of this Plan.

"Eligible Person" means any person who is (i) an Officer or Employee, (ii) a director of DIRECTV, or (iii) an individual consultant or advisor who renders or has rendered bona fide services (other than services in connection with the offering or sale of securities of DIRECTV or one of its Subsidiaries in a capital-raising transaction or as a market maker or promoter of securities of DIRECTV or one of its Subsidiaries) to the Company; provided, however, that a person who is otherwise an Eligible Person under clause (iii) above may participate in this Plan only if such participation would not adversely affect either (x) DIRECTV's eligibility to use Form S-8 to register under the Securities Act the offering and sale of shares of Common Stock issuable under this Plan by DIRECTV, or (y) DIRECTV's or any Subsidiary's compliance with any other laws applicable to transactions or determinations under this Plan.

"Employee" means any person who is employed by the Company.

"Exchange Act" means the Securities Exchange Act of 1934, as amended from time to time.

"Fair Market Value" on any date shall mean the closing price of the Common Stock as reported in the NASDAQ Stock Market Composite Transactions quotations, as quoted in the Bloomberg News Service (or other comparable system, as approved by the Committee) for such date. If the Common Stock shall cease to be listed on the NASDAQ, the Committee shall designate an alternative method of determining the Fair Market Value of the Common Stock. Notwithstanding the foregoing, to the extent necessary or, in the opinion of the Committee, appropriate, to secure benefits or obtain qualification of this Plan or particular Awards under this Plan in other countries, the Committee may establish alternative methods for determining Fair Market Value at the date of grant (or any other applicable date as to which such determination may be required), consistent with the laws of those countries.

"ISO" or "Incentive Stock Option" means a Stock Option that is designated as, and complies with the rules applicable to, an incentive stock option within the meaning of Section 422.

"NQSO" or "Non-Qualified Stock Option" means a Stock Option that is not an ISO.

"Officer" means any person elected by the Board as an executive officer of DIRECTV.

"Participant" means an Eligible Person who receives an Award under this Plan.

"Performance Share Award" means an Award of a right to receive shares of Common Stock or other compensation (including cash) under Section 10, the issuance or payment of which is contingent upon, among other conditions, the attainment of performance objectives established by the Committee.

"Personal Representative" means the person or persons who, upon the disability or incompetence of a Participant, shall have acquired on behalf of the Participant, by legal proceeding or otherwise, the power to exercise the rights or receive benefits under this Plan and who shall have become the legal representative of the Participant.

"Plan" means the DIRECTV 2010 Stock Plan, as amended from time to time.

"Prior Plan" means all of or any one of, depending on the context, the Hughes Electronics Corporation Incentive Plan effective December 31, 1985 and last amended on December 22, 2003, The DIRECTV Group 2004 Stock Plan, effective June 3, 2004 and last amended on June 5, 2007, and the Liberty Entertainment, Inc. Transitional Stock Adjustment Plan effective November 19, 2009.

"Restricted Stock" means shares of Common Stock awarded under this Plan subject to such conditions on vesting and transfer and other restrictions as are established pursuant to this Plan and the related Award Terms and Conditions for so long as such shares remain unvested under the terms of the applicable Award Terms and Conditions.

"Restricted Stock Unit" or "RSU" means a Stock Unit subject to such conditions on vesting and payout as established pursuant to this Plan and the related Award Terms and Conditions.

"Rule 16b-3" means Rule 16b-3 promulgated under the Exchange Act, as amended from time to time.

"Section 162(m)," "Section 280G," "Section 409A," "Section 422," "Section 424" and "Section 4999" mean respectively, Section 162(m) of the Code, Section 280G of the Code, Section 409A of the Code, Section 422 of the Code, Section 424 of the Code and Section 4999 of the Code and the regulations promulgated thereunder, all as amended from time to time.

"Securities Act" means the Securities Act of 1933, as amended from time to time.

"Stock Appreciation Right" or "SAR" means the right to receive a payment in cash and/or Common Stock in an amount equal to the excess of the Fair Market Value of a specified number of shares of Common Stock on the date the Stock Appreciation Right is exercised over an amount that is not less than the Fair Market Value of that number of shares of Common Stock on the grant date.

"Stock Bonus" means an Award of shares of Common Stock granted under this Plan for no consideration other than services performed and without restriction other than such transfer or other restrictions as may be established pursuant to this Plan to assure compliance with law.

"Stock Option" or "Option" means a right to purchase a specified number of shares of Common Stock at a specified price during a specified period of time as determined in accordance with this Plan.

"Stock Unit" means a bookkeeping entry that serves as a unit of measurement relative to a share of Common Stock for purposes of determining the payment, in Common Stock or cash, of an Award. Stock Units are not outstanding shares of Common Stock and do not entitle a Participant to any dividend, voting or other rights in respect of any Common Stock.

"Subsidiary" means (i) in the case of an ISO, a "subsidiary corporation" of DIRECTV, whether now or hereafter existing, as defined in Section 424(f) of the Code, (ii) in the case of any Award other than an ISO, a corporation, partnership, limited liability company or other entity in which DIRECTV owns, directly or indirectly, capital stock or other interests having ordinary voting power to elect a majority of the board of directors or other governing body and (iii) any other entity that the Committee determines qualifies as a "subsidiary" of DIRECTV for purposes of the use of Form S-8 to register the offering and sale of securities under this Plan.

|

(a)

|

Committee. This Plan shall be administered by the Committee, which shall be comprised solely of not less than three members who shall be (i) "Non-Employee Directors" within the meaning of Rule 16b-3(b)(3) promulgated under the Exchange Act, (ii) "outside directors" within the meaning of Treasury Regulation Section 1.162-27(e)(3) promulgated under Section 162(m) and (iii) to the extent required by any applicable listing agency, independent directors (within the meaning of the applicable listing agency's rules).

|

|

(b)

|

Authority of Committee. Subject to the provisions of this Plan, including the limitations in Section 16, the Committee shall have the authority to do all things necessary or desirable in connection with the authorization of Awards and the administration of this Plan, including the authority to:

|

|

(i)

|

determine the individuals who are Eligible Persons and each particular Eligible Person who will receive an Award;

|

|

(ii)

|

grant Awards to Eligible Persons, determine the price at which securities will be offered or awarded and the amount of securities to be offered or awarded to any of such persons, and determine the other specific terms and conditions of such Awards consistent with the express limits of this Plan, and establish the installments (if any) in which such Awards shall become exercisable or shall vest and establish the events of vesting, termination or reversion of such Awards;

|

|

(iii)

|

approve the forms of Award Terms and Conditions;

|

|

(iv)

|

construe, interpret and implement this Plan, grant terms and grant notices, and all Awards and Award certificates, further define the terms used in this Plan, and prescribe, amend and rescind rules and regulations relating to the administration of this Plan or the Awards granted under this Plan;

|

|

(v)

|

cancel, modify, or waive DIRECTV's rights with respect to, or modify, discontinue, suspend or terminate any or all outstanding Awards and make any adjustments to Awards or authorize the termination, substitution or conversion of Awards upon the occurrence of an event described in Section 14;

|

|

(vi)

|

accelerate or extend the vesting or exercisability or extend the term of any or all such outstanding Awards (in the case of Stock Options or Stock Appreciation Rights, within the maximum ten-year (or, if applicable, five-year) term of such Awards) in such circumstances as the Committee may deem appropriate (including, without limitation, in connection with a termination of employment or services or other events of a personal nature);

|

|

(vii)

|

adjust the number of shares of Common Stock subject to any Award, adjust the price of any or all outstanding Awards or otherwise change previously imposed Terms and Conditions, in such circumstances as the Committee may deem appropriate, and provided that in no case (except due to an adjustment contemplated by Section 14 or any repricing that may be approved by stockholders) shall such an adjustment constitute a repricing (by amendment, cancellation and regrant, exchange or other means) of the per share grant or base price of any Stock Option or Stock Appreciation Right to a price that is less than the Fair Market Value of a share of Common Stock (as adjusted pursuant to Section 14) on the date of the grant of the initial Award; and to make all other determinations and take such other actions as contemplated by this Plan or as may be necessary or advisable for the administration of this Plan and the effectuation of its purposes.

|

|

(c)

|

Foreign Countries. The Committee shall have the authority to adopt such modifications, procedures and subplans as may be necessary or desirable to comply with the provisions of the laws of foreign countries in which the Company may operate to assure the viability of the benefits from Awards granted to Participants performing services in such countries and to meet the purposes of this Plan.

|

|

(d)

|

Binding Determinations. Any action taken by, or inaction of, DIRECTV, any Subsidiary or the Committee relating or pursuant to this Plan and within its authority hereunder or under applicable law shall be within the absolute discretion of that entity or body and shall be conclusive and binding upon all persons. Neither the Board nor the Committee, nor any member thereof or person acting at the direction thereof, shall be liable for any act, omission, interpretation, construction or determination made in good faith in connection with this Plan (or any Award made under this Plan).

|

|

(e)

|

Reliance on Experts. In making any determination or in taking or not taking any action under this Plan, the Board or the Committee, as the case may be, may obtain and may rely upon the advice of experts, including employees and professional advisors to DIRECTV. No director, officer or agent of DIRECTV or any of its Subsidiaries shall be liable for any such action or determination taken or made or omitted in good faith.

|

|

(f)

|

Delegation of Authority. The Committee may by resolution delegate different levels of authority to make grants of Awards to Eligible Persons other than Officers (or any person who is expected to become a "covered employee" within the meaning of Section 162(m)) under this Plan to different committees, provided that each committee consists solely of one or more members of the Board. The Committee may delegate ministerial, non-discretionary functions to individuals who are Officers or Employees.

|

|

(g)

|

Indemnification. No member of the Board or the Committee or any employee of the Company or any of its Affiliates (each such person an "Affected Person") shall have any liability to any person (including without limitation, any Participant), for any action taken or omitted to be taken or any determination made in good faith with respect to the Plan or any Award. Each Affected Person shall be indemnified and held harmless by DIRECTV against and from any loss, cost, liability or expense (including attorneys' fees) that may be imposed upon or incurred by such Affected Person in connection with or resulting from any action, suit or proceeding to which such Affected Person may be a party or in which such Affected Person may be involved by reason of any action taken or omitted to be taken under the Plan and against and from any and all amounts paid by such Affected Person, with the Company's approval, in settlement thereof, or paid by such Affected Person in satisfaction of any judgment in any such action, suit or proceeding against such Affected Person: provided that, the Company shall have the right, at its own expense, to assume and defend any such action, suit or proceeding and, once the Company gives notice of its intent to assume the defense, the Company shall have sole control over such defense with counsel of the Company's choice. The foregoing right of indemnification shall not be available to an Affected Person to the extent that a court of competent jurisdiction in a final judgment or other final adjudication, in either case, not subject to further appeal, determines that the acts or omissions of such Affected Person giving rise to the indemnification claim resulted from such Affected Person's bad faith, fraud or willful wrongful act or omission. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which Affected Persons may be entitled under the Company's Certificate of Incorporation or by-laws, as a matter of law, or otherwise, or any other power that the Company may have to indemnify such person or hold them harmless.

|

|

4.

|

Eligibility. The Committee may grant Awards under the Plan only to those persons that the Committee determines to be Eligible Persons.

|

|

(a)

|

Aggregate Shares Available. Subject to any adjustments made in accordance with this Plan, the maximum number of shares of Common Stock that may be subject to Awards and delivered to Participants under this Plan shall not exceed the sum of (i) 40,000,000 plus (ii) the number of shares of Common Stock that are subject to available and outstanding Awards as of December 19, 2013 (“Outstanding Award Shares”) plus (iii) the number of shares of Common Stock constituting Outstanding Award Shares but which, after December 19, 2013, are forfeited, expire, are cancelled without delivery of shares of Common Stock, or otherwise result in the return of such shares of Common Stock to DIRECTV. The following limits also apply with respect to Awards granted under this Plan:

|

|

(i)

|

The maximum number of shares of Common Stock subject to Awards that may be granted to each non-Employee director of DIRECTV during any calendar year shall be the greater of (i) 15,000 or (ii) the number of shares determined by dividing $400,000 by the Fair Market Value of the Common Stock, on the date of grant as specified by the Committee, rounded up to the next higher ten shares.

|

|

(ii)

|

The maximum number of shares of Common Stock subject to Stock Options and Stock Appreciation Rights that may be granted to any individual under this Plan during any calendar year is 4,000,000 shares of Common Stock.

|

|

(iii)

|

The maximum number of shares of Common Stock subject to Restricted Stock, Stock Units or Other Stock-Based Awards that may be granted to any individual under this Plan during any calendar year is 4,000,000 shares of Common Stock.

|

|

(b)

|

Calculation of Available Shares and Replenishment. To the extent that an Award is settled in cash or a form other than shares of Common Stock, the shares that would have been delivered had there been no such cash or other settlement shall not be counted against the shares available for issuance under this Plan. In the event that shares are delivered in respect to a Dividend Equivalent Right, Stock Appreciation Right or other Award, only the actual number of shares delivered with respect to the Award shall be counted against the share limits of this Plan. Shares that are subject to or underlie Awards that expire or for any reason are cancelled or terminated, are forfeited, fail to vest, or for any other reason are not paid or delivered under this Plan shall again be available for subsequent Awards under this Plan. The foregoing adjustments to the share limits of this Plan are subject to any applicable limitations under Section 162(m) and Section 422 with respect to Awards intended as performance-based compensation thereunder and thus are not applicable to increase the limits set forth in Section 5(a)(ii) and (iii).

|

|

(c)

|

Source of Shares. The Board or the Committee will decide the source of the shares of Common Stock that DIRECTV will deliver under an Award. The two available sources are authorized but previously unissued shares of Common Stock or shares of Common Stock that DIRECTV reacquires (treasury shares).

|

|

6.

|

Grant of Awards. Subject to the express provisions of this Plan, the Committee shall determine the number of shares of Common Stock subject to each Award, the price (if any) to be paid for the shares or the Award and, in the case of Performance Share Awards, applicable objectives, goals and performance criteria. Each Award shall be evidenced by an Award Terms and Conditions delivered to the Participant (either in hard copy or electronically). The Award Terms and Conditions shall set forth the material terms and conditions of the Award established by the Committee consistent with the specific provisions of this Plan. Unless the Committee otherwise expressly provides or as provided in Section 14, no Award shall be exercisable or shall vest until at least six months after the initial Award Date and, once exercisable, an Award shall remain exercisable until the expiration or early termination of the Award. The Committee may require, as a condition to vesting or exercise of a Stock Option or SAR, or vesting or payment of a Restricted Stock Award or RSU, that a Participant enter into agreements which the Committee considers appropriate and in the best interests of DIRECTV.

|

|

7.

|

Stock Options. The Committee is authorized to grant NQSOs and/or ISOs to Eligible Persons subject to the following provisions:

|

|

(a)

|

Grant Price. The grant price is the purchase price of the shares of Common Stock under each Stock Option and shall not be less than 100% of the Fair Market Value of such shares of Common Stock on the date the Stock Option is granted; provided, however, that if an ISO is granted to a Participant who owns more than ten percent (10%) of the total combined voting power of all classes of stock of DIRECTV or its parent or subsidiary corporations (within the meaning of Sections 424(e) and (f), respectively), at the time an ISO is granted to such Participant (taking into account the attribution rules of Section 424(a)) (any such Participant is referred to in this Plan as a "10% Holder"), the grant price for the ISO shall be 110 percent (110%) of the Fair Market Value of such shares of Common Stock at the time the Stock Option is granted.

|

|

(b)

|

Term. The Committee will determine the expiration date of each Stock Option at the time of grant, provided that each Stock Option must expire not later than the tenth anniversary of the date the Stock Option is granted (or, in the case of an ISO granted to a 10% Holder, the fifth anniversary of the date of grant).

|

|

(c)

|

Exercise. At the time of grant, the Committee will determine, and set forth in the applicable Award Terms and Conditions, the time at which the Stock Option shall vest and become exercisable, in accordance with the terms and conditions of this Plan.

|

|

(d)

|

Incentive Stock Option Limitation. ISOs may only be granted to Participants who are employees of DIRECTV or a Subsidiary (within the meaning of Section 424(f)) of DIRECTV at the date of grant. The aggregate Fair Market Value (determined as of the date of the Stock Option grant) of the Common Stock with respect to which ISOs first become exercisable during any calendar year under this Plan and all other plans of DIRECTV (and any Subsidiary or any parent corporation within the meaning of Section 424, or any successor provision) shall not exceed $100,000 (except that such amount may be adjusted by the Committee as appropriate to reflect any amendment of Section 422). Each ISO that would otherwise exceed this limit in a calendar year shall be automatically converted to a NQSO without any action required by the Committee or the Participant. In reducing the number of Options treated as incentive stock options to meet the $100,000 limit, the most recently granted Options shall be reduced first. To the extent a reduction of simultaneously granted Options is necessary to meet the $100,000 limit, the Committee may, in the manner and to the extent permitted by law, designate which shares of Common Stock are to be treated as shares acquired pursuant to the exercise of an ISO. The Terms and Conditions of any ISO granted hereunder must state that the Option is intended to be an ISO and comply in all respects with the provisions of Section 422, or any successor provision, and any regulations thereunder.

|

|

(e)

|

Payment of Grant Price. A holder of a Stock Option must pay the grant price in full for all shares of Common Stock purchased upon exercise of any Stock Option at the time of exercise. Such holder must make such payment in cash, through delivery of shares of Common Stock valued at the Fair Market Value on the date of exercise, or a combination of cash and Common Stock. Such holder must have held any shares of Common Stock which he or she acquired from DIRECTV for at least six months before using those shares of Common Stock to pay the grant price for a Stock Option exercise. To the extent the Committee authorizes and as permitted under applicable law, a holder of a Stock Option may exercise a Stock Option in accordance with any cashless exercise or net exercise program in effect at the time of the exercise.

|

|

8.

|

Stock Appreciation Rights. The Committee is authorized to grant Stock Appreciation Rights (SARs) to any Eligible Person either concurrently with the grant of another Award or independently of any other Award. Any SAR granted in connection with an ISO shall contain such terms as may be required to comply with the provisions of Section 422 and the regulations promulgated thereunder. Any SAR granted under this Plan shall be subject to the following provisions:

|

|

(a)

|

Base Price. The base price of each SAR shall be not less than 100% of the Fair Market Value of the shares of Common Stock subject to the SAR on the date the SAR is granted (except to the extent required to be 110% in the case of a grant to a 10% Holder in tandem with an ISO).

|

|

(b)

|

Terms. The Committee will determine the expiration date of each SAR at the time of grant, provided that each SAR must expire not later than the tenth anniversary of the date the SAR is granted (except to the extent required to be not later than the fifth anniversary in the case of a grant to a 10% Holder in tandem with an ISO).

|

|

(c)

|

Exercise. At the time of grant, the Committee will determine, and set forth in the applicable Award Terms and Conditions, the time at which the SAR shall vest and become exercisable in accordance with the terms and conditions of the Plan.

|

|

(d)

|

Payment. Upon the exercise of a SAR, the number of shares subject to the SAR, and if the SAR was granted in tandem with a Stock Option, the number of shares subject to the related Stock Option, shall be reduced by the number of shares as to which the SAR is exercised. The Participant shall be entitled to receive payment of an amount determined by multiplying (i) the excess (if any) of the Fair Market Value of a share of Common Stock over the base price of the SAR on the date of exercise by (ii) the number of shares of Common Stock with respect to which the SAR is exercised. The Committee, in its sole discretion, shall determine the form in which payment shall be made of the amount determined in the preceding sentence, either solely in cash, solely in shares of Common Stock (valued at Fair Market Value on the date of exercise of the SAR), or partly in such shares and partly in cash, provided that the Committee shall have determined that such exercise and payment are consistent with applicable law. If the Committee permits the Participant to elect to receive cash or shares of Common Stock (or a combination thereof) on such exercise, any such election shall be subject to such conditions as the Committee may impose.

|

|

9.

|

Restricted Stock Awards and Stock Unit Awards. The Committee is authorized to grant Restricted Stock Awards and/or Stock Unit Awards to Eligible Persons under this Plan, subject to the following provisions:

|

|

(a)

|

Restricted Stock. Subject to Section 9(d), the Terms and Conditions for each Restricted Stock Award shall specify the number of shares of Common Stock to be issued to the Participant, the date of such issuance, the consideration for such shares (but not less than the minimum lawful consideration under applicable law) to be paid by the Participant, (which may be in the form of services rendered or to be rendered by the Participant), the extent (if any) to which and the time (if ever) at which the Participant shall be entitled to dividends, voting and other rights in respect of the shares prior to vesting, and the restrictions (which may be based on performance criteria, passage of time or other factors or any combination thereof) imposed on such shares and the conditions of release or lapse of such restrictions. Stock certificates or book entries evidencing shares of Restricted Stock pending the lapse of the restrictions ("Restricted Shares") shall bear a legend or notation making appropriate reference to the restrictions imposed hereunder and (if in certificate form) shall be held by DIRECTV or by a third party designated by the Committee until the restrictions on such shares shall have lapsed and the shares shall have vested.

|

|

(b)

|

Stock Units. The Committee may, in its discretion, authorize and grant to any Eligible Person a Stock Unit Award or the crediting of Stock Units for services rendered or to be rendered or in lieu of other compensation, consistent with other applicable terms of this Plan, may permit an Eligible Person to irrevocably elect to defer by means of Stock Units or receive in Stock Units all or a portion of any Award hereunder, or may grant Stock Units in lieu of, in exchange for, in respect of, or in addition to any other compensation or Award under this Plan. The specific terms, conditions and provisions relating to each Stock Unit grant or election, including the applicable vesting and payout provisions of the Stock Units and the form of payment to be made at or following the vesting thereof, shall be set forth in or pursuant to the applicable Award Terms and Conditions and any relevant Company bonus, performance or other service or deferred compensation plan, in a form substantially as approved by the Committee.

|

|

(c)

|

Pre-Vesting Restraints. Except as provided in Section 9(a), (i) Restricted Shares comprising any Restricted Stock Award may not be sold, assigned, transferred, pledged or otherwise disposed of or encumbered, either voluntarily or involuntarily, until the restrictions on such Restricted Shares have lapsed, and (ii) rights in respect of Stock Unit Awards may not be sold, assigned, transferred, pledged or otherwise disposed of or encumbered, either voluntarily or involuntarily, until the shares of Common Stock issuable pursuant to the Stock Unit Award have been issued. Except as provided in Section 14(c), the Committee may, in its discretion, at any time accelerate the date or dates on which Restricted Shares vest. The Committee may, in its sole discretion, but subject to Section 14(c), remove any and all restrictions on such Restricted Shares whenever it may determine that, by reason of changes in applicable law, the rules of any stock exchange on which the Common Stock is listed or other changes in circumstances arising after the date of grant, such action is appropriate.

|

|

(d)

|

Dividend and Voting Rights. A Participant receiving a Restricted Stock Award shall not be entitled to cash dividend or voting rights for all Restricted Shares issued until such time as they are vested, and if provided, the accrued dividend rights shall terminate immediately as to any Restricted Shares that cease to be eligible for vesting. Restricted Stock Awards (to the extent not also entitled to receive cash dividends) and Stock Unit Awards may include Dividend Equivalent Rights to the extent authorized by the Committee, as provided in Section 11.

|

|

(e)

|

Cash Payments. If the Participant shall have paid or received cash (including any payments in respect of dividends) in connection with the Restricted Stock Award or Stock Unit Award, the Award Terms and Conditions shall specify the extent (if any) to which such amounts shall be returned (with or without an earnings factor) as to any Restricted Shares or Stock Unit Awards that cease to be eligible for vesting.

|

|

(f)

|

Return to the Corporation. Restricted Shares or Stock Units that remain subject to conditions to vesting upon restrictions at the time of termination of employment or service or are subject to other conditions to vesting that have not been satisfied by the time specified in the applicable Award Terms and Conditions shall not vest and shall be returned to DIRECTV or cancelled, as the case may be, unless the Committee otherwise provides in or by amendment to the applicable Award Terms and Conditions.

|

|

10.

|

Performance Share Awards and Other Stock Awards.

|

|

(a)

|

Grants of Performance Share Awards. Subject to Section 18, the Committee may, in its discretion, grant Performance Share Awards to Eligible Persons based upon such objective or subjective factors as the Committee shall determine. An Award Terms and Conditions shall specify the maximum number of shares of Common Stock (if any) subject to the Performance Share Award, the consideration (but not less than the minimum lawful consideration and subject to any limitations under applicable law, resolutions of the Board, and other generally applicable terms and conditions of this Plan) to be paid for any such shares as may be issuable to the Participant, the duration of the Award and the conditions upon which delivery of any shares, cash or other property to the Participant shall be based. The amount of cash or shares or other property that may be deliverable pursuant to such Award shall be based upon the degree of attainment over a specified period of not less than a quarter of a calendar year and of not more than five years (a "performance cycle") as may be established by the Committee, of such measure(s) of the performance of the Company (or any part thereof) or the Participant as may be established by the Committee. The Committee may provide for full or partial credit, prior to completion of such performance cycle or the attainment of the performance achievement specified in the Award, in the event of the Participant's death, retirement or disability, or in such other circumstances as the Committee may determine.

|

|

(b)

|

Special Performance-Based Awards.

|

|

(i)

|

General Provisions. Without limiting the generality of the foregoing, and in addition to qualifying Awards granted under other provisions of this Plan (i.e. Stock Options or SARs granted with a grant price or base price not less than Fair Market Value at the applicable date of grant for Section 162(m) purposes to Eligible Persons ("Qualifying Awards")), the Committee may grant to any Eligible Person other stock-related "performance-based awards" within the meaning of Section 162(m) ("Performance-Based Awards"), in the form of shares of Common Stock, Stock Options, Restricted Stock, Stock Appreciation Rights, Stock Units, Other Stock-Based Awards (as defined below) or Dividend Equivalent Rights, payable in cash, shares of Common Stock or a combination thereof. The vesting or payment of any Performance-Based Award (other than a Qualifying Award) shall depend on the performance of the Company on a consolidated, Subsidiary, business unit, segment, division, acquired business, minority investment, partnership or joint venture, region or property basis with reference to performance goals relative to one or more of the following business criteria: subscribers, subscriber service and subscriber satisfaction; employees and employment activities; revenues, expenses and earnings; cash and cash flow; margins, returns and ratios; stock price and other performance measures, as listed in Exhibit A. The business criteria, determined on a quantitative basis, in the Committee's sole discretion may be:

|

|

(a)

|

determined relative to any product or service provided by the Company,

|

|

(b)

|

combined in any manner to define other performance-based business criteria,

|

|

(c)

|

determined either before or after any capital costs, interest, taxes, depreciation or amortization,

|

|

(d)

|

determined either including or excluding non-cash, extraordinary, special or non-recurring items,

|

|

(e)

|

determined on a per share (basic or diluted), per subscriber or per unit basis,

|

|

(f)

|

determined on an incremental, cumulative or average basis, on an absolute, percentage or percentage point basis, and/or

|

|

(g)

|

determined relative to any internal or external business criteria or relative to the performance of other companies.

|

Such determinations in (a) through (g) above shall be made by the Committee at the time it establishes the business criteria, performance targets and how performance will be calculated and shall be set forth in the Award. The business criteria shall be GAAP-based unless the Committee decides otherwise at that time.

The Committee may establish performance cycles that are not based on Plan Years, but such performance cycles may not exceed five years and shall be set forth in the Award.

|

(ii)

|

Form of Payment. Grants or Awards under this Section 10(b) may be paid in cash or Common Stock or any combination thereof.

|

|

(iii)

|

Committee Certification. Except as otherwise permitted to qualify as performance-based compensation under Section 162(m), before any Performance-Based Award under this Section 10(b) is paid, the Committee must certify that the performance standard, target(s), and the other material terms of the Performance-Based Award were in fact satisfied.

|

|

(iv)

|

Terms and Conditions of Awards. The Committee will have discretion to determine the restrictions or other limitations of the individual Awards under this Section 10(b), including the authority to reduce Awards, to determine payout schedules and the extent of vesting or to pay no Awards, in its sole discretion, if the Committee preserves such authority at the time of grant by language to this effect in its authorizing resolutions or otherwise. The Committee may provide that in the event a Participant terminates employment or service for any one or more reasons during a performance cycle, the Participant shall forfeit or retain any portion of or all, rights to any Award for that performance cycle.

|

|

(v)

|

Adjustments. To preserve the intended incentives and benefits of an Award granted under this Section 10(b), the Committee shall (A) adjust performance targets or other features of an Award to reflect any material change in corporate capitalization, any material corporate transaction (such as a reorganization, combination, separation, merger, acquisition, or any combination of the foregoing), or any complete or partial liquidation of the Company (or material portion of the Company), (B) calculate performance targets without regard to any change in accounting policies or practices affecting the Company and/or the business criteria or the performance targets and (C) adjust business criteria and performance targets or other features of an Award to reflect the effects of any special charges to the Company's earnings, in each case only to the extent consistent with the requirements of Section 162(m) to qualify such Award as performance-based compensation. By express provision in an Award, the Committee may (X) provide that one or more of the adjustments in (A), (B) or (C) above will not be made with respect to the Award, and/or (Y) establish such other events or circumstances, consistent with Section 162(m), with respect to which the Committee will make appropriate adjustments to the Award.

|

|

(c)

|

Grants of Stock Bonuses and Other Awards. Subject to Section 18, the Committee may grant a Stock Bonus to any Eligible Person to reward services, contributions or achievements, or in connection with the deferral of compensation, the value of which shall be determined by the Committee, in the manner and on such terms and conditions (including restrictions on such shares, if any) as determined from time to time by the Committee. The number of shares so awarded shall be determined by the Committee. The Award may be granted independently or in lieu of a cash bonus. The Committee shall have authority to grant to Participants an Other Stock-Based Award, (as defined below), which shall consist of any right which is (i) not an Award described in Sections 7 through 10 above and (ii) an Award of shares or an Award denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to, shares (including, without limitation, securities convertible into shares), as deemed by the Committee to be consistent with the purpose of the Plan; provided that any such rights must comply, to the extent deemed desirable by the Committee, with Rule 16b-3 and applicable law. Subject to the terms of the Plan and any applicable Award Terms and Conditions, the Committee shall determine the terms and conditions of any such Other Stock-Based Award, including the price, if any, at which securities may be purchased pursuant to any Other Stock-Based Award granted under this Plan.

|

|

(d)

|

Deferred Payments. The Committee may authorize for the benefit of any Eligible Person the deferral of any payment of cash or shares of Common Stock or other property that may become due or payable under this Plan, and provide for accretions to benefits thereon based upon such deferment (including an allowance for interest, dividend equivalents or appreciation rights) at the election or at the request of such Participant or as a mandatory basis as a condition of the Award, subject to the other terms of this Plan. Such deferral shall be subject to such further conditions, restrictions or requirements as the Committee may impose, subject to any then vested rights of Participants.

|

|

11.

|

Dividend Equivalent Rights. In its discretion, the Committee may grant Dividend Equivalent Rights or DERs to any Eligible Person, concurrently with or after the grant of any Stock Option, Restricted Stock, Stock Unit or Other Stock-Based Award, on such terms as are set forth by the Committee in the Award Terms and Conditions applicable to such Dividend Equivalent Rights. DERs shall be based on all or part of the amount of dividends declared on shares of Common Stock and shall be credited as of dividend payment dates, during the period between the date of grant (or such later date as the Committee may set) and the date the stock-based Award is exercised, is paid or expires (or such earlier date as the Committee may set), as determined by the Committee. DERs shall be payable in cash or shares of Common Stock, or (to the extent permitted by law) may be subject to such conditions, not inconsistent with Section 162(m) (in the case of Stock Options or SARs, or other Awards intended to satisfy its conditions with respect to deductibility), as may be determined by the Committee.

|

|

12.

|

Withholding. Upon any exercise, vesting, or payment of any Award or upon the disposition of shares of Common Stock acquired pursuant to the exercise of an ISO prior to satisfaction of the holding period requirements of Section 422, the Company shall have the right at its option to (a) require the Participant (or Personal Representative or Beneficiary, as the case may be) to pay or provide for payment of at least the minimum amount of any taxes which the Company may be required to withhold with respect to such Award event or payment, (b) deduct from any amount payable in cash at least the minimum amount of any taxes which the Company may be required to withhold with respect to such cash payment or (c) if the Award is payable in shares of Common Stock, allow the Participant to elect, pursuant to such rules and subject to such conditions as the Committee may establish, to have DIRECTV reduce the number of shares to be delivered by (or otherwise reacquire) the appropriate number of shares, valued in a consistent manner at their Fair Market Value or at the sales price in accordance with authorized procedures for cashless exercises or net exercises, necessary to satisfy the minimum applicable withholding obligation on exercise, vesting or payment. Shares in no event shall be withheld in excess of the minimum number required for tax withholding under applicable law.

|

|

13.

|

Termination of Awards.

|

|

(a)

|

Breach of Terms and Conditions. If a Participant breaches the applicable Terms and Conditions of any Award (as determined by the Committee) such Award shall immediately terminate and, in the case of Stock Options or SARs, cease to be exercisable. The Committee may include in any Terms and Conditions for Awards a provision requiring the Participant to return gains (as defined by the Committee) realized on Awards made under the Plan in the event the Committee determines that a material breach of specified obligations under one or more written agreements between a Participant and the Company has occurred during the one-year period after termination of the Participant's employment or service with the Company or an Affiliate.

|

|

(b)

|

Termination of Employment.

|

|

(i)

|

General. The Committee shall establish, and set forth in the applicable Terms and Conditions for Awards (which need not be the same for each Participant), the effect of a termination of employment or service on the rights and benefits under each Award under this Plan and in so doing may make distinctions based upon, among other things, the cause of termination and type of Award. If the Participant is not an Employee and provides other services to the Company, the Committee shall be the sole judge for purposes of this Plan (unless a contract or the Award otherwise provides) of whether the Participant continues to render services to the Company and the date, if any, upon which such services shall be deemed to have terminated.

|

|

(ii)

|

Events Not Deemed Terminations of Service. Unless the express policy of DIRECTV or one of its Subsidiaries, or the Committee, otherwise provides, the employment relationship shall not be considered terminated in the case of (a) sick leave, (b) military leave, or (c) any other leave of absence authorized by DIRECTV or one of its Subsidiaries, or the Committee; provided that unless reemployment upon the expiration of such leave is guaranteed by contract or law, such leave is for a period of not more than 90 days. If any Employee of DIRECTV or one of its Subsidiaries is on an approved leave of absence, continued vesting of the Award while on leave from the employ of DIRECTV or one of its Subsidiaries may be suspended until the Employee returns to service, unless the Committee otherwise provides or applicable law otherwise requires. In no event shall an Award be exercised after the expiration of the term set forth in the Award Terms and Conditions.

|

|

(c)

|

Sale or Disposition of Subsidiaries. For purposes of this Plan and any Award, if an entity ceases to be a Subsidiary, an involuntary termination of employment or service shall be deemed to have occurred with respect to each Eligible Person in respect of such former Subsidiary who does not continue as an Eligible Person in respect of another entity within the Company after giving effect to the Subsidiary's change of status.

|

|

14.

|

Adjustments; Acceleration; Termination of Awards.

|

|

(a)

|

Adjustments. Upon or in contemplation of any reclassification, recapitalization, stock split (including a stock split in the form of a stock dividend) or reverse stock split ("stock split"); any merger, combination, consolidation, or other reorganization; any spin-off, split-up, or similar extraordinary dividend distribution in respect of the Common Stock (whether in the form of cash, securities or other property); any exchange of Common Stock or other securities of DIRECTV, or any similar, unusual or extraordinary corporate transaction in respect of the Common Stock; or a sale of all or substantially all the assets of DIRECTV, as an entirety; then the Committee shall, in such manner, to such extent (if any) and at such time as it deems appropriate and equitable in the circumstances:

|

|

(i)

|

proportionately adjust any or all of (A) the number and type of shares of Common Stock (or other securities) that thereafter may be made the subject of Awards (including the specific share limits, maximums and numbers of shares set forth elsewhere in this Plan), (B) the number, amount and type of shares of Common Stock (or other securities or property) subject to any or all outstanding Awards, (C) the grant, purchase or exercise price (which term includes the base price in the case of SARs or similar rights) of any or all outstanding Awards, (D) the securities, cash or other property deliverable upon exercise of any or all outstanding Awards, or (E) (subject to limitations under Section 19) the performance standards appropriate to any or all outstanding Awards, or

|

|

(ii)

|

make provision for a cash payment or for the assumption, substitution or exchange of any or all outstanding share-based Awards or the cash, securities or property deliverable to the holder of any or all outstanding share-based Awards, based upon the distribution or consideration payable to holders of the outstanding Common Stock upon or in respect of such event.

|

The Committee may adopt such valuation methodologies for outstanding Awards as it deems reasonable in the event of a cash or property settlement and, in the case of Stock Options, SARs or similar rights, but without limitation on other methodologies, may base such settlement solely upon the excess if any of the per share amount payable upon or in respect of such event over the grant price of the Award, unless otherwise provided in, or by authorized amendment to, the Award Terms and Conditions or provided in another applicable agreement with the Participant. With respect to any Award of an Incentive Stock Option, in the discretion of the Committee, the adjustment may be made in a manner that would cause the Option to cease to qualify as an Incentive Stock Option.

In any of such events, the Committee may take such action prior to such event to the extent that the Committee deems the action necessary to permit the Participant to realize the benefits intended to be conveyed with respect to the underlying shares in the same manner as is or will be available to stockholders generally. In the case of any stock split, if no action is taken by the Committee, the proportionate adjustments contemplated by clause (a)(i) above shall nevertheless be made.

|

(b)

|

Automatic Acceleration of Awards. Upon a dissolution of DIRECTV or other event described in Section 14(a) that DIRECTV does not survive (or does not survive as a public corporation or a subsidiary of a public corporation), then each then outstanding Stock Option and SAR shall become fully vested, all shares of Restricted Stock then outstanding shall fully vest free of restrictions, and each other Award granted under this Plan that is then outstanding shall become payable to the holder of such Award; provided that such acceleration provision shall not apply, unless otherwise expressly provided by the Committee, with respect to any Award to the extent that the Committee has made a provision for the substitution, assumption, exchange or other continuation or settlement of the Award, or the Award would otherwise continue in accordance with its terms, in the circumstances.

|

|

(c)

|

Early Termination of Awards. Any Award that has been accelerated as required or contemplated by Section 14(b) (or would have been so accelerated but for Section 14(d) or 14(f)) shall terminate upon the related event referred to in Section 14(b), as applicable, subject to any provision that has been expressly made by the Committee, through a plan of reorganization or otherwise, for the survival, substitution, assumption, exchange or other continuation or settlement of such Award and provided that, in the case of Stock Options and SARs that will not survive, be substituted for, assumed, exchanged, or otherwise continued or settled in the transaction, the holder of such Award shall be given reasonable advance notice of the impending termination and a reasonable opportunity to exercise his or her outstanding Stock Options and SARs in accordance with their terms before the termination of such Awards (except that in no case shall more than ten days' notice of accelerated vesting and the impending termination be required).

|

|

(d)

|