Current Report Filing (8-k)

February 08 2017 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 6, 2017

Sysco Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-06544

|

|

74-1648137

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1390 Enclave Parkway, Houston, TX 77077-2099

(Address of principal executive office) (zip code)

Registrant’s telephone number, including area code: (281) 584-1390

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SECTION 2 – FINANCIAL INFORMATION

|

Item 2.02

|

Results of Operations and Financial Condition.

|

During its second quarter 2017 earnings call and webcast

at 10:00 a.m. Eastern time on February 6, 2017, Sysco Corporation (“Sysco,” or the “Company”) identified technical problems with our third party service provider that were preventing some listeners from accessing the webcast

audio feed. Participants accessing the webcast were able to access the accompanying presentation slides that were posted in advance of the call. Following management’s prepared remarks and before the planned question-and-answer period, the

Company announced that management would restart the call in its entirety, including the prepared remarks, at 11:30 a.m. Eastern time. The Company then issued instructions for participating in the rescheduled call through a press release, the

Investor Relations section of the Company’s Internet webpage and the SyscoIR App.

Sysco hereby furnishes as Exhibit 99.1 to this Current Report on

Form 8-K (this “Form 8-K”) the full transcript of the earnings call (the “Transcript”) in order to ensure complete access to all of management’s remarks. The Transcript contains certain non-GAAP financial measures, with the

corresponding, most directly comparable GAAP measures, which are set forth below:

Second Quarter Fiscal 2017

:

|

|

•

|

|

Operating income grew 13.8% to $492 million; adjusted operating income (including the Brakes Group) grew 27.7% to $558 million; adjusted operating income (excluding the Brakes Group) grew 13%;

|

|

|

•

|

|

Gross profit grew 19.2%; gross profit (excluding the Brakes Group) grew 3%;

|

|

|

•

|

|

Net earnings grew 1.0%; adjusted net earnings (including the Brakes Group) grew 15.8%;

|

|

|

•

|

|

Earnings per share (“EPS”) grew 4.2% to $0.50; adjusted EPS (including the accretion of approx. $0.07 from the Brakes Group on an adjusted basis) grew 20.8% to $0.58;

|

|

|

•

|

|

Operating expenses increased 20.6%; adjusted operating expenses (including the Brakes Group) increased 17.1%; adjusted operating expenses (excluding the Brakes Group) increased 0.4%;

|

|

|

•

|

|

Operating expenses for U.S. Foodservice Operations, on a GAAP basis and on an adjusted, non-GAAP basis, grew 0.7%;

|

|

|

•

|

|

Cost per case for U.S. Broadline decreased $0.02; cost per case on a fuel neutral basis for U.S. Broadline was flat;

|

|

|

•

|

|

Operating income for International Foodservice Operations increased $43 million; adjusted operating income (including the Brakes Group) for International Foodservice Operations increased $68 million;

|

First Half Fiscal 2017

:

|

|

•

|

|

Operating income grew 14.4% to $1.1 billion; adjusted operating income (including the Brakes Group) grew 26% to $1.2 billion; adjusted operating income (excluding the Brakes Group) grew 14%;

|

|

|

•

|

|

Gross profit grew 19.8% to $5.3 billion; gross profit (excluding the Brakes Group) grew 4.0%;

|

|

|

•

|

|

Operating expenses grew 21.2%; adjusted operating expenses (excluding the Brakes Group) grew 1%;

|

|

|

•

|

|

EPS grew 22.7% to $1.08; adjusted EPS (including the accretion of approx. $0.11 from the Brakes Group on an adjusted basis) grew 25.0% to $1.25;

|

|

|

•

|

|

Net cash provided by operating activities increased $136 million to $605 million; free cash flow increased $99 million to $331 million;

|

Three-Year Strategic Plan

:

|

|

•

|

|

Operating income grew $754 million during the 18 month period ended December 31, 2016; adjusted operating income (excluding the Brakes Group) grew $350 million during the 18 month period ended December 31,

2016.

|

Reconciliations of these non-GAAP measures (other than adjusted return on invested capital (“Adjusted ROIC”)) and

discussions of their usefulness, are contained in the accompanying presentation slides (the “Presentation Slides”) furnished as Exhibit 99.2 pursuant to Item 7.01 of this Form 8-K. Sysco management considers Adjusted ROIC to be a

measure that provides useful information to management and investors in evaluating the efficiency and effectiveness of the Company’s long-term capital investments. In addition, Sysco has targets and expectations that are based on adjusted

results including an Adjusted ROIC target of 15%, Sysco management cannot predict with certainty when the Company will achieve these results or whether the calculation of Sysco’s ROIC in such future period will be on an adjusted basis due to

the effect of certain items, which would be excluded from such calculation. Due to these uncertainties, to the extent the Company’s future calculation of ROIC is on an adjusted basis excluding certain items, Sysco cannot provide a quantitative

reconciliation of this non-GAAP measure to the most directly comparable GAAP measure without unreasonable effort. However, Sysco management would expect to calculate adjusted ROIC, if applicable, in the same manner as the Company has calculated this

historically. All components of Sysco’s Adjusted ROIC calculation would be impacted by certain items. Sysco calculates Adjusted ROIC as adjusted net earnings divided by (i) stockholders’ equity, computed as the average of adjusted

stockholders’ equity at the beginning of the year and at the end of each fiscal quarter during the year; and (ii) long-term debt, computed as the average of the long-term debt at the beginning of the year and at the end of each fiscal

quarter during the year.

Except for the historical information contained in this Form 8-K, the statements made by Sysco are forward looking statements

that involve risks and uncertainties. All such statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Sysco’s future financial performance could differ significantly from the expectations of

management and from results expressed or implied in the Transcript. Forward-looking statements in the Transcript are subject to certain risks and uncertainties described in the Transcript and the Presentation Slides. For further information on other

risk factors, please refer to the risks discussed on the “Forward-Looking Statements” slide contained in the Presentation Slides and in the “Risk Factors” contained in Sysco’s Annual Report on Form 10-K for the fiscal year

ended July 2, 2016.

The information in this Item 2.02 is being furnished, not filed, pursuant to Item 2.02 of Form 8-K.

Accordingly, the information in Item 2.02 of this report, including the Transcript attached hereto as Exhibit 99.1, will not be incorporated by reference into any registration statement filed by Sysco under the Securities Act of 1933, as

amended, unless specifically identified therein as being incorporated therein by reference.

SECTION 7 – REGULATION FD

|

Item 7.01

|

Regulation FD Disclosure.

|

The Company hereby furnishes as Exhibit 99.2 to this Form 8-K the

Presentation Slides accompanying Sysco’s second quarter 2017 earnings call and webcast on February 6, 2017. The Presentation Slides contain certain non-GAAP financial measures, and the reconciliations of such measures to the most directly

comparable GAAP measure are set forth at the end of the Presentation Slides.

Except for the historical information contained in this Form 8-K, the

statements made by Sysco are forward looking statements that involve risks and uncertainties. All such statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Sysco’s future financial

performance could differ significantly from the expectations of management and from results expressed or implied in the Press Release. Forward-looking statements in the Presentation Slides are subject to certain risks and uncertainties described in

the “Forward-Looking Statements” slide of the Presentation Slides. For further information on other risk factors, please refer to the “Risk Factors” contained in Sysco’s Annual Report on Form 10-K for the fiscal year ended

July 2, 2016.

The information in this Item 7.01 is being furnished, not filed, pursuant to Item 7.01 of Form 8-K. Accordingly, the

information in Item 7.01 of this report, including the Presentation Slides attached hereto as Exhibit 99.2, will not be incorporated by reference into any registration statement filed by Sysco under the Securities Act of 1933, as amended,

unless specifically identified therein as being incorporated therein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

|

|

(a)

|

Financial Statements of Businesses Acquired.

|

Not applicable.

|

|

(b)

|

Pro Forma Financial Information.

|

Not applicable.

|

|

(c)

|

Shell Company Transactions.

|

Not applicable.

(d) Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

99.1

|

|

Transcript of the second quarter 2017 earnings conference call held on February 6, 2017, furnished herewith

|

|

|

|

|

99.2

|

|

Slide presentation from second quarter 2017 earnings conference call held on February 6, 2017, furnished herewith

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Sysco Corporation has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sysco Corporation

|

|

|

|

|

|

|

Date: February 8, 2017

|

|

|

|

By:

|

|

/s/ Russell T. Libby

|

|

|

|

|

|

|

|

|

|

Russell T. Libby

Executive Vice

President,

Administration and Corporate Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

99.1

|

|

Transcript of the second quarter 2017 earnings conference call held on February 6, 2017, furnished herewith

|

|

|

|

|

99.2

|

|

Slide presentation from second quarter 2017 earnings conference call held on February 6, 2017, furnished herewith

|

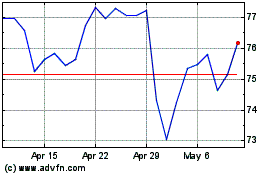

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

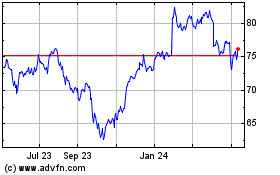

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024