Sysco Profit Climbs, Helped by Higher Volume

May 02 2016 - 9:40AM

Dow Jones News

By Anne Steele

Sysco Corp. said profit shot up 23% in its latest quarter as

volume improved in the U.S. and the food giant makes moves to

manage expenses.

Results easily beat expectations, and shares added 0.9%

premarket to $46.50.

Sysco, the No. 1 distributor of food and supplies to

restaurants, hospitals and other venues in the U.S., has lately

faced rising competition from smaller, specialty distributors and

wholesale stores. In its fiscal third quarter, Sysco's domestic

case volume grew 3.6%. Sales volume rose 3.4% among smaller, local

restaurants -- a promising sign as Sysco has been struggling in

that area, and those customers are more profitable than national

chains.

Chief Executive Bill DeLaney said local growth and expense

management helped drive operating profit, "and we are committed to

sustaining this momentum in our fourth quarter and into fiscal

2017."

Sysco said in February it is eliminating 1,200 jobs -- about 2%

of its workforce -- and abandoning a yearslong technology overhaul

in an effort to accelerate profit growth. Mr. DeLaney has said the

moves would help boost operating income by at least $500 million by

the end of 2018.

In all for the quarter, Sysco earned $217.1 million, or 38 cents

a share, up from $177 million, or 30 cents a share, a year earlier.

Excluding certain items, adjusted earnings rose to 46 cents a share

from 40 cents.

Revenue rose 2.2% to $12 billion.

Analysts had projected 42 cents in adjusted earnings per share

on $11.87 billion in revenue, according to Thomson Reuters.

Gross margin improved 34 basis points to 17.9%.

Sysco posted $586,000 in acquisition-related costs, none related

to its abandoned merger with rival US Foods Inc., which Sysco

walked away from in June of last year. A year earlier, Sysco had

booked $46.6 million in the quarter related to that deal.

The failed merger cost Sysco hundreds of millions of dollars --

and it opened the door for activist investor Nelson Peltz of Trian

Fund Management LP. In August, the fund disclosed a 7% stake in

Sysco, which Mr. Peltz said wasn't living up to its potential. Less

than a week later, Sysco named Mr. Peltz and another Trian

representative to its board.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 02, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

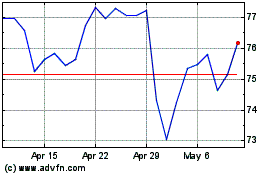

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

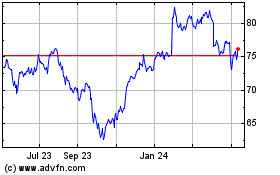

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024