XPO Courts Big Shippers With Trucking Appointment

November 04 2015 - 7:08PM

Dow Jones News

By Robbie Whelan

XPO Logistics Inc. on Wednesday appointed Tony Brooks, a veteran

transportation executive with some of the country's largest

shippers, to run its recently acquired trucking fleet, a move that

analysts said signaled the company's intent to land bigger

customers.

The company also reported a net loss of $35.4 million in the

third quarter, or $0.94 a share, after markets closed, its 16th

straight quarterly loss. Gross revenues more than doubled from a

year earlier to $2.4 billion.

XPO acquired Con-way Inc. last month for $3 billion, giving the

logistics provider one of the largest less-than-truckload fleets in

the U.S. So-called LTL fleets pack loads from multiple customers

into a single truck.

XPO Chief Executive Bradley Jacobs has said Con-Way, as well as

a French trucking company acquired earlier in the year, would help

XPO court large shippers. Mr. Brooks comes from that world, joining

XPO from food distribution giant Sysco Corp. He has also run the

transportation networks at Dean Foods, Sears Holdings Corp., and

PepsiCo/Frito-Lay.

"He has very, very good relationships with some of the biggest

shippers in North America," Mr. Jacobs said in an interview. "He

brings a lot to the table on that front."

XPO, which has been on a debt-fueled acquisition spree over the

last two years, has been punished recently by investors for its

failure to turn a profit. XPO's stock is down more than 40% since

hitting a record in May.

Investors are closely observing how XPO, which in the past owned

few physical assets, will handle the acquisition of Con-way and its

large fleet of trucks.

In a press release, the company said its net loss included $25.3

million in transaction and integration costs.

The company said profitability in the company's logistics

segment is improving, with operating income last quarter of $36

million, compared with $4.5 million a year earlier.

XPO's recent acquisitions have gained the company a foothold in

a wide array of logistics and transportation services. Mr. Jacobs,

who previously "rolled up" companies in the equipment rental and

garbage disposal industries, has said he seeks to create a one-stop

shop for logistics services so he can reel in large global shipping

customers.

On Friday, the company closed on its $3 billion deal to buy

Con-way. Earlier this year, XPO spent more than $3 billion buying

French transportation company Norbert Dentressangle SA. Last year,

XPO spent nearly $1 billion on acquisitions.

This summer, Mr. Jacobs announced that the company would focus

for the time being on integrating past acquisitions rather than

making major new ones. On Friday, XPO laid off 250 Con-way

employees.

The fact that Mr. Jacobs appointed a new head for the business

segment so soon after closing the deal should please investors,

said Kevin Sterling, an analyst with BB&T Capital Markets.

"If they take some time to digest these acquisitions, they're

going to wake up one day and start printing money," Mr. Sterling

said. "It's just hard to pinpoint when."

The company released quarterly results after the market closed.

XPO shares ended down 2.1% at $27.95 Wednesday, but rose 5.5% in

after-hours trading.

Write to Robbie Whelan at robbie.whelan@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 04, 2015 18:53 ET (23:53 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

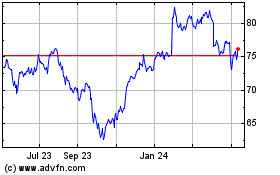

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024