UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 26, 2015

Sysco Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-06544 |

|

74-1648137 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1390 Enclave Parkway, Houston, TX 77077-2099

(Address of principal executive office) (zip code)

Registrant’s telephone number, including area code: (281) 584-1390

N/A

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 5 – CORPORATE GOVERNANCE AND MANAGEMENT

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN

OFFICERS.

Resignation of Principal Financial Officer (Item 5.02(b))

R. Chris Kreidler, Executive Vice President and Chief Financial Officer of Sysco Corporation (“Sysco” or the “Company”),

notified the Company on March 26, 2015, that he intends to resign from his service as an officer of the Company effective December 31, 2015, for personal reasons.

Appointment of Successor Principal Financial Officer (Item 5.02(c))

On March 26, 2015, the Board of Directors of the Company (the “Board”) appointed Joel T. Grade, currently Sysco’s Senior

Vice President, Finance and Chief Accounting Officer, as the Company’s Executive Vice President and Chief Financial Officer, effective September 1, 2015. Mr. Grade was promoted to Senior Vice President – Finance and Chief

Accounting Officer in February 2014, after serving as Senior Vice President, Foodservice Operations (North) since May 2012. He began his career at Sysco as a Staff Auditor in 1996. He was promoted to Assistant Manager-Operations Review in 1999. He

transferred to Sysco Austin in 2000 as Controller, was appointed Vice President-Finance and CFO of Sysco Chicago in 2002, and became Vice President-Finance and CFO of Sysco Canada in 2007. He was promoted to Vice President, Foodservice Operations of

Sysco Corporate and President of Sysco Canada in 2010 and held that position until May 2012.

The compensation that Mr. Grade will

receive in his role as Executive Vice President and Chief Financial Officer has not yet been determined by the Compensation Committee of the Board (the “Committee”), and an amendment to this Current Report on Form 8-K will be filed at a

later date to disclose such compensation when a determination has been made. There are no arrangements or understandings between Mr. Grade and any other person pursuant to which he was selected as an officer. Mr. Grade does not have any

family relationship with any director or other executive officer of Sysco or any person nominated or chosen by Sysco to become a director or executive officer, and there are no transactions in which Mr. Grade has an interest requiring

disclosure under Item 404(a) of Regulation S-K.

Letter Agreement with Principal Financial Officer (Item 5.02(e))

On March 26, 2015, in light of Mr. Kreidler’s significant contributions to Sysco, particularly with regard to the pending

acquisition of US Foods (the “Merger”), the Committee approved a waiver of the service-related recoupment provision under the incentive and cash retention award (the “Transaction Incentive Award”). The Transaction Incentive Award

entitles Mr. Kreidler to receive an incentive payment if certain conditions, including the completion of the Merger, are satisfied prior to December 31, 2015. The service-related recoupment provision would have required the Company to

recoup the payment under this Transaction Incentive

- 2 -

Award from Mr. Kreidler if his employment with the Company terminated prior to the first anniversary of the receipt of such payment. For further discussion of the Transaction Incentive

Award, please refer to the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on October 8, 2014. The Transaction Incentive Award remains subject to the other conditions thereof,

including the completion of the Merger, prior to December 31, 2015, and the Company’s waiver of the service-based recoupment provision is conditioned upon Mr. Kreidler’s execution of a customary release of claims in favor of the

Company.

In connection with Mr. Kreidler’s resignation, the Company and Mr. Kreidler entered into a letter agreement (the

“Letter Agreement”), dated April 1, 2015, which provides for the conditional waiver of the service-related recoupment provision under his Transaction Incentive Award described above and acknowledges that, through the end of calendar

year 2015, (1) his outstanding stock options and restricted stock unit awards will continue to vest according to the terms and conditions of those awards and (2) he will remain eligible to receive any payouts made with respect to his

outstanding cash performance units based upon satisfaction of the pre-established Company performance criteria applicable to such units. The Letter Agreement further provides that he will not be eligible to receive a base salary merit increase in

calendar year 2015, a fiscal year 2016 annual incentive award under the 2009 Management Incentive Plan, or any new long-term incentive plan awards during fiscal year 2016.

Press Release

The press release issued

by the Company on April 1, 2015, announcing the matters described above, is filed herewith as Exhibit 99.1, and is incorporated herein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma

Financial Information.

Not applicable.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated April 1, 2015 |

- 3 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Sysco Corporation has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Sysco Corporation |

|

|

|

|

| Date: April 1, 2015 |

|

|

|

By: |

|

/s/ Russell T. Libby |

|

|

|

|

|

|

Russell T. Libby |

|

|

|

|

|

|

Executive Vice President-Corporate Affairs, Chief Legal Officer and Corporate Secretary |

- 4 -

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated April 1, 2015 |

- 5 -

Exhibit 99.1

JOEL GRADE NAMED SYSCO CHIEF FINANCIAL OFFICER EFFECTIVE SEPT. 1, 2015

Chris Kreidler Elects to Step Down After Six Years in CFO Role

HOUSTON, April 1, 2015 – Sysco Corporation (NYSE: SYY) announced today that Joel T. Grade has been named executive vice

president and chief financial officer, effective Sept. 1, 2015, following Chris Kreidler’s decision to leave the company in order to relocate to the northeast and spend more time with his family. Kreidler will remain CFO through Aug. 31, 2015,

and work closely with Grade and Sysco’s senior executive team to ensure an orderly transition of his responsibilities. Kreidler has also agreed to stay on through the end of December as an advisor to the company.

“Chris was the first senior executive I hired upon becoming CEO in 2009, and we are indebted to him for his many contributions and

tireless efforts on behalf of Sysco,” said Bill DeLaney, Sysco’s president and chief executive officer. “His strong leadership in capital markets, long-term planning, mergers and acquisitions, and integration planning for the US Foods

merger are areas where Chris has made a significant and long-term impact on our company. We respect Chris’ thoughtful and personal decision to step down, and wish Chris and his family all the best for their future.”

Grade has served as Sysco’s senior vice president of finance and chief accounting officer since early 2014 with responsibility for field

finance, commercial finance, financial planning and analysis, financial reporting, and shared services accounting. He began his career at Sysco as a staff auditor in 1996 and has since held a variety of senior finance and commercial roles, including

chief financial officer of Sysco Chicago in 2002 followed by chief financial officer of Sysco Canada in 2007. He was later promoted to president of Sysco Canada in 2010 and then became senior vice president of foodservice operations, north region

and Canada in 2012. Grade earned an undergraduate degree in Accounting and Finance with a specialization in International Business from the University of Wisconsin-Madison in 1993 and an MBA in Finance, Strategy and Marketing from Northwestern

University’s Kellogg School of Management in 2007.

“As a veteran Sysco leader with nearly 20 years of experience in key finance and commercial

roles, Joel is uniquely suited to step into the CFO position,” DeLaney said. “His deep knowledge of our local operations and people combined with his more recent service at the corporate level give him a well-rounded view of how to better

serve our customers. We are fortunate to have a leader like Joel ready to take on this key position and I look forward to working closely with him in his new role as we move forward.”

# # #

About Sysco

Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments

and other customers who prepare meals away from home. Its family of products also includes equipment and supplies for the foodservice and hospitality industries. The company operates 194 distribution facilities serving approximately 425,000

customers. For Fiscal Year 2014 that ended June 28, 2014, the company generated sales of more than $46 billion. For more information, visit www.sysco.com or connect with Sysco on Facebook at www.facebook.com/SyscoCorporation or

Twitter at https://twitter.com/Sysco.

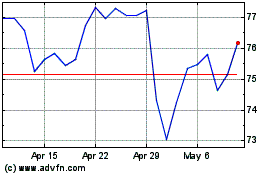

Sysco (NYSE:SYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

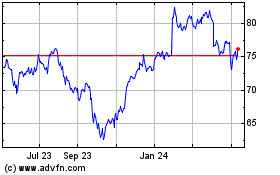

Sysco (NYSE:SYY)

Historical Stock Chart

From Apr 2023 to Apr 2024