Current Report Filing (8-k)

December 22 2016 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 22, 2016 (December 21, 2016)

SUNOCO LP

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35653

|

|

30-0740483

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

8020 Park Lane, Suite 200

Dallas, Texas 75231

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (832) 234-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Fourth Amendment to Credit Agreement and First

Amendment to Senior Secured Term Loan Agreement

On December 21, 2016, Sunoco LP (the “Partnership”) entered into

(i) an amendment (the “Credit Agreement Amendment”) to that certain Credit Agreement, dated as of September 25, 2014 (as amended to date, the “Credit Agreement”) with the lenders party thereto and Bank of America, N.A.,

in its capacity as a letter of credit issuer, as swing line lender, and as administrative agent, and (ii) an amendment (the “Term Loan Amendment”) to that certain Senior Secured Term Loan Agreement, dated as of March 31, 2016 (as

amended to date, the “Term Loan Agreement”) with the lenders party thereto and Credit Suisse AG, Cayman Islands Branch, in its capacity as administrative agent. The Credit Agreement Amendment amended the Credit Agreement and the Term Loan

Amendment amended the Term Loan Agreement to, among other matters:

|

|

•

|

|

Increase the applicable margin applicable to obligations thereunder by including two additional tranches of pricing based on the Partnership’s leverage ratio. As a result the maximum applicable margin for LIBOR

rate loans has increased from 2.500% to 3.00% and the maximum applicable margin for base rate loans has increased from 1.500% to 2.00%.

|

|

|

•

|

|

Increase in the maximum level of the ratio of funded debt to EBITDA of the Partnership permitted under each of the Credit Agreement and the Term Loan Agreement to (i) as of the last day of each fiscal quarter

through December 31, 2017, 6.75 to 1.0, (ii) as of March 31, 2018, 6.5 to 1.0, (iii) as of June 30, 2018, 6.25 to 1.0, (iv) as of September 30, 2018, 6.0 to 1.0, (v) as of December 31, 2018, 5.75 to 1.0

and (vi) thereafter, 5.5 to 1.0 (in the case of the quarter ending March 31, 2019 and thereafter, subject to increases to 6.0 to 1.0 in connection with certain future specified acquisitions).

|

|

|

•

|

|

Add new obligations to maintain, (i) for so long as the obligations under the Term Loan Agreement remain outstanding, a maximum ratio of secured funded debt to EBITDA of the Partnership of (x) as of the last

day of each fiscal quarter through December 31, 2017, 3.75 to 1.0 and (y) thereafter, 3.5 to 1.0 and (ii) until the maximum leverage permitted is reduced to 5.5 to 1.0, a minimum ratio of EBITDA to interest expense of the Partnership

of 2.25 to 1.0.

|

The discussion included herein of the Credit Agreement Amendment and the Term Loan Amendment is qualified

in its entirety by reference to Exhibit 10.1 and Exhibit 10.2, respectively, of this report on Form 8-K, which are hereby incorporated into this item.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

.

|

|

|

|

|

10.1

|

|

Fourth Amendment to Credit Agreement, dated as of December 21, 2016, by and among Sunoco LP, Bank of America, N.A. and the financial institutions parties thereto as Lenders.

|

|

|

|

|

10.2

|

|

First Amendment to Senior Secured Term Agreement, dated as of December 21, 2016, by and among Sunoco LP, Credit Suisse AG, Cayman Islands Branch, and the financial institutions parties thereto as Lenders.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SUNOCO LP

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

SUNOCO GP LLC, its General Partner

|

|

|

|

|

|

|

Date: December 22, 2016

|

|

|

|

By:

|

|

/s/ Thomas R. Miller

|

|

|

|

|

|

|

|

Name: Thomas R. Miller

|

|

|

|

|

|

|

|

Title: Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

EXHIBIT

|

|

DESCRIPTION

|

|

|

|

|

10.1

|

|

Fourth Amendment to Credit Agreement, dated as of December 21, 2016, by and among Sunoco LP, Bank of America, N.A. and the financial institutions parties thereto as Lenders.

|

|

|

|

|

10.2

|

|

First Amendment to Senior Secured Term Agreement, dated as of December 21, 2016, by and among Sunoco LP, Credit Suisse AG, Cayman Islands Branch, and the financial institutions parties thereto as Lenders.

|

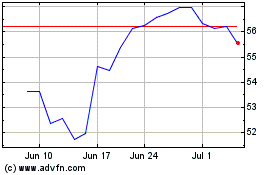

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

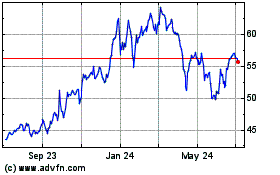

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024