UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Act of 1934

Date of Report (Date of Earliest Event Reported):

August 5, 2015

Commission file number: 001-35653

SUNOCO LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

30-0740483 |

|

(State or other jurisdiction of

incorporation or organization) |

(IRS Employer

Identification No.) |

|

555 East Airtex Drive

Houston, Texas 77073

(Address of principal executive offices, including zip codes) |

Registrant’s telephone number, including area code: (832) 234-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On August 5, 2015, Sunoco LP (the “Partnership”) issued a news release announcing its financial results for the second fiscal quarter ended June 30, 2015, approval of a cash distribution, and providing access information for an investor conference call to discuss those financial results. A copy of the news release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference into this Item 2.02.

The information set forth herein is furnished under Item 2.02, “Results of Operations and Financial Condition.” This information, including the information contained in Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are filed herewith:

|

|

|

|

|

|

|

|

Exhibit Number |

|

Exhibit Description |

|

|

99.1 |

|

News Release of Sunoco LP, dated August 5, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SUNOCO LP |

|

|

By |

Sunoco GP LLC, its general partner |

|

Date: August 6, 2015 |

By: |

/s/ Clare McGrory |

|

|

|

Clare McGrory |

|

|

|

Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit Index

|

|

|

|

|

|

|

|

Exhibit Number |

|

Exhibit Description |

|

|

99.1 |

|

News Release of Sunoco LP, dated August 5, 2015 |

Exhibit 99.1

Sunoco LP Announces 2Q 2015 Financial and Operating Results and

9th Consecutive Distribution Increase

|

• |

Distribution increased 7.5% versus 1Q 2015, 33.4% versus 2Q 2014 levels |

|

• |

Acquisition of Susser Holdings in 3Q to increase Partnership’s exposure to high-growth retail markets |

Conference Call Scheduled for 9 a.m. CT (10:00 a.m. ET) on Thursday, August 6

HOUSTON, August 5, 2015 - Sunoco LP (NYSE: SUN) today announced financial and operating results for the three months ended June 30, 2015 and provided an update on recent developments.

Adjusted EBITDA(1) attributable to partners totaled $55.5 million, compared with adjusted EBITDA attributable to partners of $15.6 million in the second quarter of 2014. Adjusted EBITDA attributable to partners excluding transaction related expenses totaled $58.2 million. Distributable cash flow attributable to partners, as adjusted(1) was $39.3 million, compared to $13.7 million a year earlier and distributable cash flow per common unit was $0.9506. The favorable year-over-year comparisons primarily reflect the contributions from the dropdown acquisitions of a 31.58 percent interest in the wholesale fuel distribution business of Sunoco, LLC in April 2015 and the MACS convenience stores in October 2014 from SUN’s parent, Energy Transfer Partners, L.P. (NYSE: ETP), along with the purchase of Aloha Petroleum in December 2014.

Revenue was $4.2 billion, up 205.7 percent compared to $1.4 billion in second quarter of 2014. The increase was the result of the contribution of wholesale fuel distribution sales from Aloha Petroleum and SUN’s interest in Sunoco, LLC on a consolidated basis(2), merchandise and retail fuel sales from the MACS and Aloha convenience stores, higher rental income, partly offset by the impact of lower selling prices for motor fuel.

Total gross profit was $236.8 million, compared to $22.2 million in the second quarter of 2014. Key drivers of the increase were the contribution from the previously mentioned wholesale and retail businesses and an increase in the weighted average margin per gallon of gasoline -- which is the result of higher-margin retail fuel gallons being added to the overall sales mix.

Net income attributable to partners was $34.9 million, or $0.87 per diluted unit, versus $9.6 million, or $0.43 per diluted unit, in the second quarter of last year.

On a weighted average basis, excluding noncontrolling interest, fuel margin for all gallons sold increased to 7.6 cents per gallon, compared to 3.7 cents per gallon a year ago. Sales of higher margin retail gallons by MACS and Aloha -- along with a change in the wholesale fuel customer mix related to the Sunoco, LLC, MACS and Aloha acquisitions -- drove most of the margin increase.

Excluding the noncontrolling interest, total wholesale gallons sold in the second quarter were 967.9 million, compared with 461.8 million in the second quarter of last year, an increase of 109.6%. This includes gallons sold to affiliate operated convenience stores, consignment stores and third-party customers, including independent dealers, fuel distributors and commercial customers.

Motor fuel gallons sold to affiliates, increased 39.2% from a year ago to 408.1 million gallons during the second quarter of 2015, excluding the noncontrolling interest. Affiliate customers included 679 Stripes ® and Sac-N-Pac ™ convenience stores operated by ETP as well as sales of motor fuel to ETP subsidiaries for resale under consignment arrangements at approximately 85 independently operated convenience stores. Additionally, effective with the acquisition of Sunoco, LLC, affiliates also included Sunoco retail fuel and convenience store sites operated by a subsidiary of ETP, which contributed 86.8 million gallons in the quarter. Organic growth in sales through Stripes sites from new builds and same store sales growth also contributed to the increase. The Partnership realized 3.3 cent per gallon gross profit on these gallons on a weighted average basis.

Other wholesale gallons, increased from a year ago by 232.1 percent to 559.8 million gallons related to the acquisitions of 31.58% of Sunoco, LLC, MACs and Aloha. Gross profit on these gallons was 8.2 cents per gallon, compared to 4.9 cents per gallon a year earlier driven by a change in customer mix related to the acquisitions.

Retail gallons sold by MACS and Aloha locations during the second quarter totaled 71.1 million gallons. Gross profit on these gallons was $20.9 million, or 27.4 cents per gallon. Merchandise sales from these locations totaled $57.0 million and contributed $14.8 million of gross profit. On a same store sales basis, the retail business achieved 1.3% growth in fuel gallons and 7.8% on merchandise for the quarter. As of June 30, SUN operated 155 retail convenience stores and fuel outlets in Virginia, Hawaii, Tennessee, Maryland and Georgia

On August 4, the Board of Directors of SUN’s general partner declared a distribution for the second quarter of 2015 of $0.6934 per unit, which corresponds to $2.7736 per unit on an annualized basis. This represents a 7.5 percent increase compared to the distribution for the first quarter of 2015 and a 33.4 percent increase compared with the second quarter of 2014. This is the Partnership’s ninth consecutive quarterly increase. The distribution will be paid on August 28 to unitholders of record on August 18. SUN achieved a 1.2 times distribution coverage ratio for the second quarter.

On July 31 the Partnership completed the acquisition of Susser Holdings Corporation from an affiliate of ETP in a transaction valued at approximately $1.93 billion. SUN paid $966.9 million in cash and issued to ETP’s subsidiaries approximately 21.98 million Class B SUN Units valued at $966.9 million. This drop down is expected to be accretive to SUN with respect to distributable cash flow and accelerates SUN’s exposure to the fast growing retail business with its strong backlog of organic growth opportunities and EBITDA performance.

The Partnership expects to complete next week the acquisition of 28 Aziz Quick Stop convenience stores in South Texas for $41.6 million using amounts available on its revolving credit facility. SUN plans to rebrand most of the stores to the Stripes convenience store brand.

As previously reported, on April 1, the Partnership completed the acquisition of a 31.58 percent equity interest in Sunoco, LLC, from an affiliate of ETP in a transaction valued at approximately $816 million. A full quarter’s contribution from the Partnership’s stake in Sunoco, LLC, is included in SUN’s second quarter results.

On April 1, SUN issued $800 million of 6.375% Senior Notes due 2023 through a private offering that raised net proceeds of $786.5 million. The majority of the proceeds were used to fund the purchase of the Partnership’s interest in Sunoco, LLC and a small portion was used to repay outstanding borrowings under its senior secured revolving credit facility.

The Partnership issued $600 million of 5.5% senior notes due 2020 on July 20 through an upsized private offering that raised net proceeds of $592.5 million. The proceeds were used to fund a portion of the purchase of Susser Holdings Corporation (“Susser”) from ETP.

Also in connection with the Susser transaction, the Partnership issued 5.5 million new common units in a public offering at a price of $40.10 per unit. The offering was completed on July 21 and raised net proceeds of $212.9 million. The Partnership also granted to the underwriters a 30-day option to purchase up to an additional 825,000 units at the same price.

As of June 30, SUN had borrowings against its $1.5 billion revolving credit facility of $724.7 million and $11.1 million in standby letters of credit, leaving unused availability of $764.2 million.

SUN’s gross capital expenditures for the second quarter excluding acquisitions totaled $48.4 million, which includes $7.0 million in maintenance capital. Of the $41.4 million in growth capital, $31.8 million was for purchase and leaseback transactions for 6 Stripes stores, and approximately $10.0 million was for growth in the 3rd party wholesale business, including new dealer and distributor supply contracts.

The Partnership currently expects capital spending for the full year 2015, excluding future acquisitions but including the additional capital spending related to our 31.58% equity interest in Sunoco LLC, to be within the following ranges (in millions)

|

|

|

|

|

|

|

Growth |

|

|

Maintenance |

|

Low |

High |

|

|

Low |

High |

|

$220 |

$270 |

|

|

$40 |

$50 |

Included in the above growth capital spending estimate are 35 to 40 new convenience stores that Stripes plans to build in 2015.

______________

|

1) |

Adjusted EBITDA and distributable cash flow are non-GAAP financial measures of performance that have limitations and should not be considered as a substitute for net income. Please refer to the discussion and tables under "Reconciliations of Non-GAAP Measures" later in this news release for a discussion of our use of Adjusted EBITDA and distributable cash flow, and a reconciliation to net income for the periods presented. |

|

2) |

On April 1, 2015 SUN acquired a 31.58% membership interest in Sunoco, LLC (“Sunoco LLC”). Because SUN has a controlling financial interest in Sunoco LLC as a result of its 50.1% voting interest, SUN’s consolidated financial statements include 100% of Sunoco LLC. |

Second Quarter 2015 Earnings Conference Call

Sunoco LP management will hold a conference call on Thursday, August 6, at 9:00 a.m. CT (10:00 a.m. ET) to discuss second quarter results and recent developments. To participate, dial 412-902-0003 approximately 10 minutes early and ask for the Sunoco LP conference call. The call will also be accessible live and for later replay via webcast in the Investor Relations section of Sunoco’s website at www.SunocoLP.com under Events and Presentations. A telephone replay will be available through August 13 by calling 201-612-7415 and using the access code 13613135#.

About Sunoco LP

Sunoco LP (NYSE: SUN) is a master limited partnership (MLP) that operates more than 830 convenience stores and retail fuel sites and also distributes motor fuel to convenience stores, independent dealers, commercial customers and distributors. SUN conducts its business through wholly owned subsidiaries, as well as through its 31.58 percent interest in Sunoco, LLC, in partnership with an affiliate of its parent company, Energy Transfer Partners. While primarily engaged in natural gas, natural gas liquids, crude oil and refined products transportation, ETP also operates a retail and fuel distribution business through its interest in Sunoco, LLC, as well as wholly owned subsidiary, Sunoco, Inc., which operate approximately 440 convenience stores and retail fuel sites. For more information, visit the Sunoco LP website at www.SunocoLP.com.

Forward-Looking Statements

This news release contains "forward-looking statements" which may describe Sunoco LP’s ("SUN") objectives, expected results of operations, targets, plans, strategies, costs, anticipated capital expenditures, potential acquisitions, new store openings and/or new dealer locations, management's expectations, beliefs or goals regarding proposed transactions between ETP and SUN, the expected timing of those transactions and the future financial and/or operating impact of those transactions, including the anticipated integration process and any related benefits, opportunities or synergies. These statements are based on current plans, expectations and projections and involve a number of risks and uncertainties that could cause actual results and events to vary materially, including but not limited to: execution, integration, environmental and other risks related to acquisitions (including drop-downs) and our overall acquisition strategy; competitive pressures from convenience stores, gasoline stations, other non-traditional retailers and other wholesale fuel distributors located in SUN's markets; dangers inherent in storing and transporting motor fuel; SUN's ability to renew or renegotiate long-term distribution contracts with customers; changes in the price of and demand for motor fuel; changing consumer preferences for alternative fuel sources or improvement in fuel efficiency; competition in the wholesale motor fuel distribution industry; seasonal trends; severe or unfavorable weather conditions; increased costs; SUN's ability to make and integrate acquisitions; environmental laws and regulations; dangers inherent in the storage of motor fuel; reliance on suppliers to provide trade credit terms to adequately fund ongoing operations; acts of war and terrorism; dependence on information technology systems; SUN's and ETP's ability to consummate any proposed transactions, or to satisfy the conditions precedent to the consummation of such transactions; successful development and execution of integration plans; ability to realize anticipated synergies or cost-savings and the potential impact of the transactions on employee, supplier, customer and competitor relationships; and other unforeseen factors. For a full discussion of these and other risks and uncertainties, refer to the "Risk Factors" section of SUN's and ETP's most recently

filed annual reports on Form 10-K. These forward-looking statements are based on and include our estimates as of the date hereof. Subsequent events and market developments could cause our estimates to change. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if new information becomes available, except as may be required by applicable law.

Qualified Notice

This release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). Brokers and nominees should treat 100 percent of Sunoco LP's distributions to non-U.S. investors as being attributable to income that is effectively connected with a United States trade or business. Accordingly, Sunoco LP's distributions to non-U.S. investors are subject to federal income tax withholding at the highest applicable effective tax rate.

Contacts

Investors:

Scott Grischow, Director of Investor Relations and Treasury

(361) 884-2463, scott.grischow@sunoco.com

Anne Pearson

Dennard-Lascar Associates

(210) 408-6321, apearson@dennardlascar.com

Media:

Jeff Shields, Communications Manager

(215) 977-6056, jpshields@sunocoinc.com

Jessica Davila-Burnett, Public Relations Director

(361) 654-4882, jessica.davila-burnett@susser.com

- Financial Schedules Follow -

SUNOCO LP

CONSOLIDATED BALANCE SHEETS

(in thousands, except units)

(unaudited)

|

|

December 31,

2014 |

|

|

June 30,

2015 |

|

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

67,190 |

|

|

$ |

62,771 |

|

|

Advances to affiliates |

|

396,376 |

|

|

|

198,646 |

|

|

Accounts receivable, net |

|

193,680 |

|

|

|

226,984 |

|

|

Receivables from affiliates (MACS: $3,484 at December 31, 2014 and $4,862 at June 30, 2015) |

|

24,741 |

|

|

|

33,138 |

|

|

Inventories, net |

|

325,054 |

|

|

|

362,469 |

|

|

Other current assets |

|

49,281 |

|

|

|

21,641 |

|

|

Total current assets |

|

1,056,322 |

|

|

|

905,649 |

|

|

Property and equipment, net (MACS: $45,340 at December 31, 2014 and $44,554 at June 30, 2015) |

|

1,300,280 |

|

|

|

1,376,489 |

|

|

Other assets: |

|

|

|

|

|

|

|

|

Goodwill |

|

863,458 |

|

|

|

814,819 |

|

|

Intangible assets, net |

|

357,904 |

|

|

|

451,589 |

|

|

Deferred income taxes |

|

14,893 |

|

|

|

2,509 |

|

|

Other noncurrent assets (MACS: $3,665 at December 31, 2014 and June 30, 2015) |

|

18,133 |

|

|

|

27,288 |

|

|

Total assets |

$ |

3,610,990 |

|

|

$ |

3,578,343 |

|

|

Liabilities and equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable (MACS: $6 at December 31, 2014 and June 30, 2015) |

|

293,141 |

|

|

|

382,050 |

|

|

Accounts payable to affiliates |

|

77,721 |

|

|

|

15,138 |

|

|

Accrued expenses and other current liabilities (MACS: $484 at December 31, 2014 and June 30, 2015) |

|

234,899 |

|

|

|

193,796 |

|

|

Current maturities of long-term debt (MACS: $8,422 at December 31, 2014 and $8,380 at June 30, 2015) |

|

13,757 |

|

|

|

13,704 |

|

|

Total current liabilities |

|

619,518 |

|

|

|

604,688 |

|

|

Revolving line of credit |

|

683,378 |

|

|

|

724,689 |

|

|

Long-term debt (MACS: $48,029 at December 31, 2014 and $46,971 at June 30, 2015) |

|

173,383 |

|

|

|

969,732 |

|

|

Other noncurrent liabilities (MACS: $1,190 at December 31, 2014 and June 30, 2015) |

|

51,062 |

|

|

|

52,817 |

|

|

Total liabilities |

|

1,527,341 |

|

|

|

2,351,926 |

|

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

|

|

|

Partners' capital: |

|

|

|

|

|

|

|

|

Limited partner interest: |

|

|

|

|

|

|

|

|

Common unitholders - public (20,036,329 units issued and outstanding at December 31, 2014 and June 30, 2015) |

|

874,688 |

|

|

|

880,698 |

|

|

Common unitholders - affiliated (4,062,848 units issued and outstanding at December 31, 2014 and 4,858,330 June 30, 2015) |

|

31,378 |

|

|

|

49,930 |

|

|

Subordinated unitholders - affiliated (10,939,436 units issued and outstanding at December 31, 2014 and June 30, 2015) |

|

236,310 |

|

|

|

239,503 |

|

|

Total partners' capital |

|

1,142,376 |

|

|

|

1,170,131 |

|

|

Predecessor equity |

|

946,917 |

|

|

|

— |

|

|

Noncontrolling interest |

|

(5,644) |

|

|

|

56,286 |

|

|

Total equity |

|

2,083,649 |

|

|

|

1,226,417 |

|

|

Total liabilities and equity |

$ |

3,610,990 |

|

|

$ |

3,578,343 |

|

Parenthetical amounts represent assets and liabilities attributable to consolidated variable interest entities of Mid-Atlantic Convenience Stores, LLC (MACS) as of December 31, 2014 and June 30, 2015.

SUNOCO LP

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(in thousands, except unit and per unit amounts)

(unaudited)

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30,

2014 |

|

|

June 30,

2015 |

|

|

June 30,

2014 |

|

|

June 30,

2015 |

|

|

|

|

Predecessor |

|

|

Successor |

|

|

Predecessor |

|

|

Successor |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail motor fuel sales |

|

$ |

— |

|

|

$ |

189,894 |

|

|

$ |

— |

|

|

$ |

350,655 |

|

|

Wholesale motor fuel sales to third

parties |

|

|

507,575 |

|

|

|

2,770,695 |

|

|

|

952,141 |

|

|

|

5,219,550 |

|

|

Wholesale motor fuel sales to affiliates |

|

|

862,549 |

|

|

|

1,156,763 |

|

|

|

1,628,639 |

|

|

|

1,993,448 |

|

|

Merchandise sales |

|

|

— |

|

|

|

56,973 |

|

|

|

— |

|

|

|

104,492 |

|

|

Rental income |

|

|

4,343 |

|

|

|

23,868 |

|

|

|

8,266 |

|

|

|

46,691 |

|

|

Other income |

|

|

1,558 |

|

|

|

7,792 |

|

|

|

3,566 |

|

|

|

15,060 |

|

|

Total revenues |

|

|

1,376,025 |

|

|

|

4,205,985 |

|

|

|

2,592,612 |

|

|

|

7,729,896 |

|

|

Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail motor fuel cost of sales |

|

|

— |

|

|

|

169,014 |

|

|

|

— |

|

|

|

308,578 |

|

|

Wholesale motor fuel cost of sales |

|

|

1,353,057 |

|

|

|

3,757,475 |

|

|

|

2,546,503 |

|

|

|

6,943,692 |

|

|

Merchandise cost of sales |

|

|

— |

|

|

|

42,213 |

|

|

|

— |

|

|

|

77,038 |

|

|

Other |

|

|

765 |

|

|

|

510 |

|

|

|

1,786 |

|

|

|

1,750 |

|

|

Total cost of sales |

|

|

1,353,822 |

|

|

|

3,969,212 |

|

|

|

2,548,289 |

|

|

|

7,331,058 |

|

|

Gross profit |

|

|

22,203 |

|

|

|

236,773 |

|

|

|

44,323 |

|

|

|

398,838 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

5,372 |

|

|

|

27,646 |

|

|

|

10,242 |

|

|

|

52,403 |

|

|

Other operating |

|

|

1,761 |

|

|

|

48,759 |

|

|

|

3,795 |

|

|

|

95,052 |

|

|

Rent |

|

|

284 |

|

|

|

11,375 |

|

|

|

533 |

|

|

|

21,885 |

|

|

Gain on disposal of assets |

|

|

(36 |

) |

|

|

(30 |

) |

|

|

(36 |

) |

|

|

(156 |

) |

|

Depreciation, amortization and

accretion |

|

|

3,333 |

|

|

|

33,230 |

|

|

|

6,659 |

|

|

|

63,466 |

|

|

Total operating expenses |

|

|

10,714 |

|

|

|

120,980 |

|

|

|

21,193 |

|

|

|

232,650 |

|

|

Income from operations |

|

|

11,489 |

|

|

|

115,793 |

|

|

|

23,130 |

|

|

|

166,188 |

|

|

Interest expense, net |

|

|

(1,774 |

) |

|

|

(20,322 |

) |

|

|

(3,276 |

) |

|

|

(27,453 |

) |

|

Income before income taxes |

|

|

9,715 |

|

|

|

95,471 |

|

|

|

19,854 |

|

|

|

138,735 |

|

|

Income tax (expense) benefit |

|

|

(120 |

) |

|

|

480 |

|

|

|

(127 |

) |

|

|

(350 |

) |

|

Net income and comprehensive

income |

|

|

9,595 |

|

|

|

95,951 |

|

|

|

19,727 |

|

|

|

138,385 |

|

|

Less: Net income and comprehensive income attributable to noncontrolling interest |

|

|

— |

|

|

|

61,084 |

|

|

|

— |

|

|

|

61,930 |

|

|

Less: Preacquisition income from Sunoco LLC allocated to general partner |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

24,516 |

|

|

Net income and comprehensive income attributable to partners |

|

$ |

9,595 |

|

|

$ |

34,867 |

|

|

$ |

19,727 |

|

|

$ |

51,939 |

|

|

Net income per limited partner unit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common (basic and diluted) |

|

$ |

0.43 |

|

|

$ |

0.87 |

|

|

$ |

0.90 |

|

|

$ |

1.31 |

|

|

Common - diluted |

|

$ |

0.43 |

|

|

$ |

0.87 |

|

|

$ |

0.89 |

|

|

$ |

1.31 |

|

|

Subordinated (basic and diluted) |

|

$ |

0.43 |

|

|

$ |

0.87 |

|

|

$ |

0.90 |

|

|

$ |

1.31 |

|

|

Weighted average limited partner units

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common units - public |

|

|

10,966,981 |

|

|

|

20,036,329 |

|

|

|

10,965,066 |

|

|

|

20,036,329 |

|

|

Common units - affiliated |

|

|

79,308 |

|

|

|

4,858,330 |

|

|

|

79,308 |

|

|

|

4,460,589 |

|

|

Subordinated units - affiliated |

|

|

10,939,436 |

|

|

|

10,939,436 |

|

|

|

10,939,436 |

|

|

|

10,939,436 |

|

|

Cash distribution per unit |

|

$ |

0.5197 |

|

|

$ |

0.6934 |

|

|

$ |

1.0218 |

|

|

$ |

1.3384 |

|

Key Operating Metrics

The following information is intended to provide investors with a reasonable basis for assessing our historical operations but should not serve as the only criteria for predicting our future performance.

Beginning in late 2014, with the acquisition of MACS, we began operating our business in two primary operating segments, wholesale and retail, both of which are included as reportable segments. As a result, the Predecessor periods operated as one segment, wholesale, and the Successor period operated with our wholesale and retail segments.

On April 1, 2015 we acquired a 31.58% membership interest in Sunoco LLC. Because we have a controlling financial interest in Sunoco LLC as a result of our 50.1% voting interest our consolidated financial statements include 100% of Sunoco LLC. The 68.42% membership interest in Sunoco LLC that we do not own is presented as noncontrolling interest in our consolidated financial statements.

The following table sets forth, for the periods indicated, information concerning key measures we rely on to gauge our operating performance by segment (in thousands, except for selling price and gross profit per gallon):

|

|

|

Three Months Ended |

|

|

|

|

June 30, |

|

|

|

|

2014 |

|

|

2015 |

|

|

|

|

Predecessor |

|

|

Successor |

|

|

|

|

|

|

|

|

Wholesale |

|

|

Retail |

|

|

Total |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail motor fuel sales (1) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

189,894 |

|

|

$ |

189,894 |

|

|

Wholesale motor fuel sales to

third parties |

|

|

507,575 |

|

|

|

2,770,695 |

|

|

|

— |

|

|

|

2,770,695 |

|

|

Wholesale motor fuel sales to

affiliates |

|

|

862,549 |

|

|

|

1,156,763 |

|

|

|

— |

|

|

|

1,156,763 |

|

|

Merchandise sales |

|

|

— |

|

|

|

— |

|

|

|

56,973 |

|

|

|

56,973 |

|

|

Rental income |

|

|

4,343 |

|

|

|

17,403 |

|

|

|

6,465 |

|

|

|

23,868 |

|

|

Other income |

|

|

1,558 |

|

|

|

5,349 |

|

|

|

2,443 |

|

|

|

7,792 |

|

|

Total revenue |

|

|

1,376,025 |

|

|

|

3,950,210 |

|

|

|

255,775 |

|

|

|

4,205,985 |

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail motor fuel |

|

|

— |

|

|

|

— |

|

|

|

20,880 |

|

|

|

20,880 |

|

|

Wholesale motor fuel |

|

|

17,067 |

|

|

|

169,983 |

|

|

|

— |

|

|

|

169,983 |

|

|

Merchandise |

|

|

— |

|

|

|

— |

|

|

|

14,760 |

|

|

|

14,760 |

|

|

Rental and other |

|

|

5,136 |

|

|

|

22,241 |

|

|

|

8,909 |

|

|

|

31,150 |

|

|

Total gross profit |

|

$ |

22,203 |

|

|

$ |

192,224 |

|

|

$ |

44,549 |

|

|

$ |

236,773 |

|

|

Net income and comprehensive income attributable to partners (4) |

|

$ |

9,595 |

|

|

$ |

35,830 |

|

|

$ |

(963) |

|

|

$ |

34,867 |

|

|

Adjusted EBITDA attributable to

partners (4) (5) |

|

$ |

15,563 |

|

|

$ |

40,080 |

|

|

$ |

15,416 |

|

|

$ |

55,496 |

|

|

Distributable cash flow attributable

to partners, as adjusted (4) (5) |

|

$ |

13,653 |

|

|

|

|

|

|

|

|

|

|

$ |

39,293 |

|

|

Operating Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total motor fuel gallons sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail |

|

|

|

|

|

|

|

|

|

|

71,079 |

|

|

|

71,079 |

|

|

Wholesale (2) |

|

|

168,574 |

|

|

|

1,254,751 |

|

|

|

|

|

|

|

1,254,751 |

|

|

Wholesale contract affiliated (3) |

|

|

293,217 |

|

|

|

595,923 |

|

|

|

|

|

|

|

595,923 |

|

|

Motor fuel gross profit (cents per

gallon): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail |

|

|

|

|

|

|

|

|

|

|

27.4 |

¢ |

|

|

|

|

|

Wholesale (2) |

|

|

4.9 |

¢ |

|

|

8.0 |

¢ |

|

|

|

|

|

|

|

|

|

Wholesale contract affiliated (3) |

|

|

3.0 |

¢ |

|

|

3.5 |

¢ |

|

|

|

|

|

|

|

|

|

Volume-weighted average for all

gallons |

|

|

3.7 |

¢ |

|

|

|

|

|

|

|

|

|

|

7.3 |

¢ |

|

Retail merchandise margin |

|

|

|

|

|

|

|

|

|

|

25.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Retail motor fuel sales include sales of motor fuel at company operated convenience stores beginning September 1, 2014. |

|

(2) |

Reflects all other wholesale transactions excluding those pursuant to the Susser and Sunoco, Inc. Distribution Contracts. |

|

(3) |

Reflects transactions pursuant to the Susser and Sunoco, Inc. Distribution Contracts at set margins as dictated by agreements. |

|

(4) |

Excludes the noncontrolling interest results of operations related to our consolidated VIE and Sunoco LLC. |

|

(5) |

We define EBITDA as net income before net interest expense, income tax expense and depreciation, amortization and accretion expense. Adjusted EBITDA further adjusts EBITDA to reflect certain other non-recurring and non-cash items. Effective September 1, 2014, as a result of the ETP Merger and in an effort to conform the method by which we measure our business to that of ETP’s operations, we now define Adjusted EBITDA to also include adjustments |

|

for unrealized gains and losses on commodity derivatives and inventory fair value adjustments. We define distributable cash flow as Adjusted EBITDA less cash interest expense including the accrual of interest expense related to our 2020 and 2023 Notes which is paid on a semi-annual basis, current income tax expense, maintenance capital expenditures, and other non-cash adjustments. Further adjustments are made to distributable cash flow for certain transaction-related and non-recurring expenses that are included in net income are excluded. |

Pro Forma Results of Operations

We have provided below certain supplemental pro forma information for the three and six months ended June 30, 2015. The pro forma information gives effect to the 68.42% noncontrolling interest in Sunoco LLC. Pursuant to our 31.58% ownership interest in Sunoco LLC, the Sunoco LP pro forma information reflects only that equity interest in Sunoco LLC.

Management believes the pro forma presentation is useful to investors because it provides investors comparable operating data to support our Adjusted EBITDA and distributable cash flow attributable to partners.

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, 2015 |

|

June 30, 2015 |

|

|

|

Pro Forma |

|

|

|

(unaudited) |

|

|

|

(in thousands except gross profit per gallon) |

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

Retail gross profit |

$ |

20,880 |

|

|

$ |

42,077 |

|

|

Wholesale gross profit |

|

77,761 |

|

|

|

132,598 |

|

|

Total fuel gross profit |

$ |

98,641 |

|

|

$ |

174,675 |

|

|

|

|

|

|

|

|

|

|

|

Operating data |

|

|

|

|

|

|

|

|

Motor fuel gallons sold: |

|

|

|

|

|

|

|

|

Retail |

|

71,079 |

|

|

|

138,913 |

|

|

Wholesale |

|

559,787 |

|

|

|

1,120,581 |

|

|

Wholesale contract affiliated |

|

408,072 |

|

|

|

797,651 |

|

|

Total fuel gallons |

|

1,038,938 |

|

|

|

2,057,145 |

|

|

|

|

|

|

|

|

|

|

|

Motor fuel gross profit (cents per

gallon): |

|

|

|

|

|

|

|

|

Retail |

|

27.4 |

¢ |

|

|

29.6 |

¢ |

|

Wholesale |

|

8.2 |

¢ |

|

|

7.6 |

¢ |

|

Wholesale contract affiliated |

|

3.3 |

¢ |

|

|

3.2 |

¢ |

|

|

|

|

|

|

|

|

|

|

Volume-weighted average for all

gallons |

|

7.6 |

¢ |

|

|

7.4¢ |

|

We believe EBITDA, Adjusted EBITDA and distributable cash flow are useful to investors in evaluating our operating performance because:

|

• |

Adjusted EBITDA is used as a performance measure under our revolving credit facility; |

|

• |

securities analysts and other interested parties use such metrics as measures of financial performance, ability to make distributions to our unitholders and debt service capabilities; |

|

• |

they are used by our management for internal planning purposes, including aspects of our consolidated operating budget, and capital expenditures; and |

|

• |

distributable cash flow provides useful information to investors as it is a widely accepted financial indicator used by investors to compare partnership performance, as it provides investors an enhanced perspective of the operating performance of our assets and the cash our business is generating. |

EBITDA, Adjusted EBITDA and distributable cash flow are not recognized terms under GAAP and do not purport to be alternatives to net income (loss) as measures of operating performance or to cash flows from operating activities as a measure of liquidity. EBITDA, Adjusted EBITDA and distributable cash flow have limitations as analytical tools,

and one should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Some of these limitations include:

|

• |

they do not reflect our total cash expenditures, or future requirements for capital expenditures or contractual commitments; |

|

• |

they do not reflect changes in, or cash requirements for, working capital; |

|

• |

they do not reflect interest expense, or the cash requirements necessary to service interest or principal payments on our revolving credit facility or term loan; |

|

• |

although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect cash requirements for such replacements; and |

|

• |

because not all companies use identical calculations, our presentation of EBITDA, Adjusted EBITDA and distributable cash flow may not be comparable to similarly titled measures of other companies. |

The following table presents a reconciliation of net income to EBITDA, Adjusted EBITDA and distributable cash flow by segment for the three months ended June 30, 2014 and 2015 (in thousands):

|

|

|

Three Months Ended |

|

|

|

|

June 30, |

|

|

|

|

2014 |

|

|

2015 |

|

|

|

|

Predecessor |

|

|

Successor |

|

|

|

|

|

|

|

|

Wholesale |

|

|

Retail |

|

|

Total |

|

|

Net income and comprehensive income |

|

$ |

9,595 |

|

|

$ |

96,067 |

|

|

$ |

(116 |

) |

|

$ |

95,951 |

|

|

Depreciation, amortization and accretion |

|

|

3,333 |

|

|

|

22,074 |

|

|

|

11,156 |

|

|

|

33,230 |

|

|

Interest expense, net |

|

|

1,774 |

|

|

|

10,405 |

|

|

|

9,917 |

|

|

|

20,322 |

|

|

Income tax expense (benefit) |

|

|

120 |

|

|

|

(246 |

) |

|

|

(234 |

) |

|

|

(480 |

) |

|

EBITDA |

|

|

14,822 |

|

|

|

128,300 |

|

|

|

20,723 |

|

|

|

149,023 |

|

|

Non-cash stock based compensation |

|

|

777 |

|

|

|

430 |

|

|

|

49 |

|

|

|

479 |

|

|

(Gain) loss on disposal of assets |

|

|

(36 |

) |

|

|

(33 |

) |

|

|

3 |

|

|

|

(30 |

) |

|

Unrealized loss on commodity derivatives |

|

|

— |

|

|

|

785 |

|

|

|

— |

|

|

|

785 |

|

|

Inventory fair value adjustments (7) |

|

|

— |

|

|

|

(49,319 |

) |

|

|

(1,410 |

) |

|

|

(50,729 |

) |

|

Adjusted EBITDA |

|

$ |

15,563 |

|

|

$ |

80,163 |

|

|

$ |

19,365 |

|

|

$ |

99,528 |

|

|

Adjusted EBITDA attributable to noncontrolling

interest |

|

|

— |

|

|

|

40,083 |

|

|

|

3,949 |

|

|

|

44,032 |

|

|

Adjusted EBITDA attributable to partners |

|

|

15,563 |

|

|

|

40,080 |

|

|

|

15,416 |

|

|

|

55,496 |

|

|

Cash interest expense (6) |

|

|

1,644 |

|

|

|

|

|

|

|

|

|

|

|

15,088 |

|

|

Current income tax expense (benefit) |

|

|

105 |

|

|

|

|

|

|

|

|

|

|

|

(259 |

) |

|

Maintenance capital expenditures |

|

|

161 |

|

|

|

|

|

|

|

|

|

|

|

4,074 |

|

|

Distributable cash flow attributable to partners |

|

$ |

13,653 |

|

|

|

|

|

|

|

|

|

|

$ |

36,593 |

|

|

Transaction-related expenses |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

2,700 |

|

|

Distributable cash flow attributable to partners,

as adjusted |

|

$ |

13,653 |

|

|

|

|

|

|

|

|

|

|

$ |

39,293 |

|

|

(6) |

Reflects the partnership’s cash interest paid less the cash interest paid on our VIE debt of $4.0 million. |

|

(7) |

Due to the change in fuel prices, we recorded a $50.7 million write-up of the LIFO value of fuel inventory during the three months ended June 30, 2015. |

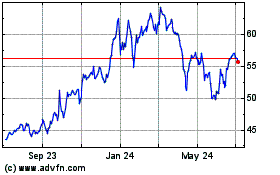

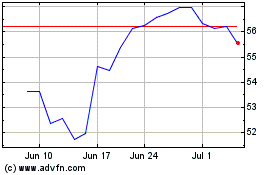

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024