UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 10, 2015

Commission file number: 001-35653

Sunoco LP

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

30-0740483 |

| (State or other jurisdiction of

Incorporation or organization) |

|

(IRS Employer

Identification No.) |

555 East Airtex Drive

Houston, TX 77073

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (832) 234-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On April 10, 2015, Sunoco LP (the

“Partnership”) entered into a First Amendment to Credit Agreement and Increase Agreement (the “First Amendment”) with the lenders party thereto and Bank of America, N.A., in its capacity as administrative agent and collateral

agent (the “Administrative Agent”) pursuant to which the lenders thereto severally agreed to (i) provide $250 million in aggregate incremental commitments under the Partnership’s existing revolving credit facility provided

pursuant to the Credit Agreement, dated as of September 25, 2014 (as amended, supplemented and modified, the “Credit Agreement”), by and among the Partnership, the several banks and other financial institutions party thereto and the

Administrative Agent and (ii) make certain amendments to the Credit Agreement as described in the First Amendment. After giving effect to the First Amendment, the Credit Agreement permits the Partnership to borrow up to $1.5 billion on a

revolving credit basis.

The disclosure contained in this Item 1.01 does not purport to be a complete description of the First

Amendment and is qualified in its entirety by reference to the First Amendment which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

| Item 7.01. |

Regulation FD Disclosure. |

On April 10, 2015, the Partnership issued a news release

announcing entry into the Amendment. The news release also noted the availability of a presentation on its website at www.sunocolp.com. A copy of the news release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

Information on the Partnership’s website is not incorporated by reference in this Current Report. The information furnished pursuant to

this Item 7.01, including Exhibit 99.1 hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The

information in Item 7.01 of this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 10.1 |

|

First Amendment to Credit Agreement and Increase Agreement by and among Sunoco LP, Bank of America, N.A., as Administrative Agent, Collateral Agent, Swingline Lender and an LC Issuer, and the financial institutions parties thereto,

dated April 10, 2015. |

|

|

| 99.1 |

|

News Release of Sunoco LP, dated April 10, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SUNOCO LP |

|

|

|

|

|

|

|

|

By: |

|

Sunoco GP LLC, its general partner |

|

|

|

| Date: April 13, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Mary E. Sullivan |

|

|

|

|

|

|

Mary E. Sullivan |

|

|

|

|

|

|

Executive Vice President, Chief Financial Officer and Treasurer |

3

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 10.1 |

|

First Amendment to Credit Agreement and Increase Agreement by and among Sunoco LP, Bank of America, N.A., as Administrative Agent, Collateral Agent, Swingline Lender and an LC Issuer, and the financial institutions parties thereto,

dated April 10, 2015. |

|

|

| 99.1 |

|

News Release of Sunoco LP, dated April 10, 2015. |

4

Exhibit 10.1

Execution Version

FIRST AMENDMENT TO CREDIT AGREEMENT AND INCREASE AGREEMENT

This First Amendment to Credit Agreement and Increase Agreement (this “Amendment”) is entered into effective as

of the 10th day of April, 2015 (the “First Amendment Effective Date”), by and among Sunoco LP, a Delaware limited partnership, formerly known as Susser Petroleum Partners LP (“Borrower”), Bank of

America, N.A., as Administrative Agent (“Administrative Agent”), Collateral Agent, Swingline Lender and an LC Issuer, and the financial institutions parties hereto as Lenders (“Lenders”).

W I T N E S S E T H

WHEREAS, Borrower, Administrative Agent and certain Lenders (the “Existing Lenders”) are parties to that certain

Credit Agreement, dated as of September 25, 2014 (as amended, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”) (unless otherwise defined herein, all terms used herein with their

initial letter capitalized shall have the meaning given such terms in the Credit Agreement as amended by this Amendment); and

WHEREAS,

pursuant to the Credit Agreement, the Existing Lenders have made certain Loans to Borrower and provided certain other credit accommodations to Borrower;

WHEREAS, pursuant to Section 2.17 of the Credit Agreement, Borrower has requested an increase in the Aggregate Commitments from

$1,250,000,000 to $1,500,000,000;

WHEREAS, Borrower has requested that Natixis (the “New Lender”) become a Lender

under the Credit Agreement with a Commitment in the amount as shown on Schedule 1 to the Credit Agreement (as amended hereby);

WHEREAS,

Borrower has agreed to pay certain fees to the New Lender and the Increasing Lenders (as defined below) in connection with this Amendment;

WHEREAS, Borrower and the Lenders desire to make certain other amendments to the Credit Agreement; and

WHEREAS, subject to and upon the terms and conditions set forth herein, the New Lender, the Increasing Lenders and the Majority Lenders have

agreed to enter into this Amendment.

NOW THEREFORE, for and in consideration of the mutual covenants and agreements herein contained and

other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged and confessed, Borrower, Administrative Agent, the New Lender, the Increasing Lenders and the Majority Lenders hereby agree as follows:

Section 1. Amendments. In reliance on the representations, warranties, covenants and agreements contained in this

Amendment, and subject to the satisfaction of the conditions precedent set forth in Section 2 hereof, the Credit Agreement shall be amended effective as of the First Amendment Effective Date in the manner provided in this

Section 1.

1.1 Additional Definition. Section 1.01 of the Credit Agreement is

hereby amended to add thereto in alphabetical order the following definition which shall read in full as follows:

“First Amendment and Increase Agreement” means that certain First Amendment to Credit Agreement and

Increase Agreement dated as of April 10, 2015, among Borrower, Administrative Agent and the Lenders party thereto.

1.2

Amendment and Restatement of Definition. The definition “Loan Documents” contained in Section 1.01 of the Credit Agreement is hereby amended and restated to read in full as follows:

“Loan Documents” means this Agreement, the First Amendment and Increase Agreement, each Note, each

Issuer Document, each Guaranty, each Collateral Document and any agreement creating or perfecting rights in Cash Collateral pursuant to the provisions of Section 2.19 of this Agreement, the Fee Letters, and all other agreements,

certificates, documents, instruments and writings at any time delivered in connection herewith or therewith (exclusive of term sheets and commitment letters).

1.3 Amendment of Section 2.07(b). Section 2.07(b) of the Credit Agreement is hereby amended and restated to

read in full as follows:

(b) the expiration date of such Letter of Credit is either (i) prior to the Letter of

Credit Expiration Date with respect to Letters of Credit not to exceed an aggregate face amount of $75,000,000 or (ii) prior to the date which is the earlier of (A) 365 days after the issuance thereof and (B) the Letter of Credit

Expiration Date, provided that, in either case, such Letter of Credit may provide for automatic extensions of such expiration date (such Letter of Credit an “Auto-Extension Letter of Credit”) for additional periods of 365 days

thereafter unless the LC Issuer has given the beneficiary prior notice of the non-extension thereof not later than a day (the “Non-Extension Notice Date”) in each such twelve-month period to be agreed upon at the time such Letter of

Credit is issued. Unless otherwise directed by the LC Issuer, the Borrower shall not be required to make a specific request to the LC Issuer for any such extension. Once an Auto-Extension Letter of Credit has been issued, the Lenders shall

be deemed to have authorized (but may not require) the LC Issuer to permit the extension of such Letter of Credit at any time to an expiry date not later than the Letter of Credit Expiration Date; provided, however, that the LC Issuer

shall not permit any such extension if (x) the LC Issuer has determined that it would not be permitted, or would have no obligation, at such time to issue such Letter of Credit in its revised form (as extended) under the terms hereof (by reason

of the provisions of this clause (b) or Section 2.07(e) or otherwise), or (y) it has received notice (which may be by telephone or in writing) on or before the day that is seven Business

2

Days before the Non-Extension Notice Date (1) from the Administrative Agent that the Majority Lenders have elected not to permit such extension or (2) from the Administrative Agent, any

Lender or the Borrower that one or more of the applicable conditions specified in Section 4.02 is not then satisfied, and in each such case directing the LC Issuer not to permit such extension;

1.4 Replacement of Schedule 1. Schedule 1 to the Credit Agreement is hereby replaced in its entirety with Schedule

1 attached hereto, and Schedule 1 attached hereto shall be deemed to be attached as Schedule 1 to the Credit Agreement. After giving effect to this Amendment and any Borrowings made on the First Amendment Effective Date, (a) each

Lender who holds Loans in an aggregate amount less than its Applicable Percentage (after giving effect to this Amendment) of all Loans shall advance new Loans which shall be disbursed to the Administrative Agent and used to repay Loans outstanding

to each Lender who holds Loans in an aggregate amount greater than its Applicable Percentage of all Loans, (b) each Lender’s participation in each Letter of Credit, if any, shall be automatically adjusted to equal its Applicable Percentage

(after giving effect to this Amendment) and (c) such other adjustments shall be made as the Administrative Agent shall specify so that the Facility Usage applicable to each Lender equals its Applicable Percentage (after giving effect to this

Amendment) of the outstanding amount of all LC Obligations, plus the aggregate outstanding amount of the Loans, plus the outstanding amount of all Swingline Loans of all Lenders.

Section 2. Conditions Precedent. The effectiveness of the amendments to the Credit Agreement contained in

Section 1 hereof is subject to the satisfaction of each of the following conditions precedent:

2.1

Counterparts. Administrative Agent shall have received counterparts hereof duly executed by Borrower, the Guarantors, each New Lender, each Increasing Lender and the Majority Lenders.

2.2 Fees and Expenses. Borrower shall have paid to Administrative Agent all fees due and owing to Administrative Agent

pursuant to or in connection with this Amendment, including pursuant to that certain Engagement Letter, dated as of the date hereof, between the Borrower and Merrill Lynch, Pierce, Fenner & Smith Incorporated, and all reasonable

out-of-pocket expenses incurred by Administrative Agent (including the reasonable and documented fees, charges and disbursements of a single counsel for the Administrative Agent) in the preparation, execution, review and negotiation of this

Amendment and the other Loan Documents in accordance with Section 10.04(a) of the Credit Agreement.

2.3 New

Promissory Notes. Administrative Agent shall have received duly executed Notes payable to each New Lender or Increasing Lender requesting the same in a principal amount equal to its Commitment (as amended hereby) dated as of the First

Amendment Effective Date.

2.4 No Default. No Default or Event of Default shall have occurred which is continuing.

3

2.5 Certificates. The Administrative Agent shall have received:

(a) a certificate dated as of the First Amendment Effective Date, signed by a Responsible Officer of Borrower certifying that each of the

conditions to such increase set forth in Section 2.17(a) of the Credit Agreement shall have occurred and been complied with and that, before and after giving effect to such increase, (a) the representations and warranties contained in the

Credit Agreement and the other Loan Documents are true and correct in all material respects (except to the extent that such representations and warranties are qualified by materiality, in which case such representations and warranties are true and

correct in all respects) on and as of the First Amendment Effective Date after giving effect to such increase, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they were true and

correct in all material respects (except to the extent that such representations and warranties are qualified by materiality, in which case such representations and warranties were true and correct in all respects) as of such earlier date, and

(b) no Default or Event of Default exists; and

(b) certificates of resolutions or other action, incumbency certificates and/or other

certificates of Responsible Officers of the Borrower and each Guarantor evidencing the identity, authority and capacity of each Responsible Officer thereof authorized to act as a Responsible Officer in connection with this Amendment, and documents

and certifications evidencing that the Borrower and each Guarantor are validly existing and in good standing in their jurisdiction of organization.

2.6 Opinion of Counsel. Administrative Agent shall have received a favorable opinion of Latham & Watkins LLP,

New York counsel to Borrower and Guarantors, relating to this Amendment, addressed to the Administrative Agent and each Lender.

Section 3. New Lender. The New Lender hereby joins in, becomes a party to, and agrees to comply with and be bound by the

terms and conditions of the Credit Agreement (as amended by this Amendment) as a Lender thereunder and under each and every other Loan Document to which any Lender is required to be bound by the Credit Agreement, to the same extent as if such New

Lender were an original signatory thereto. The New Lender hereby appoints and authorizes the Administrative Agent to take such action as agent on its behalf and to exercise such powers and discretion under the Credit Agreement as are delegated to

the Administrative Agent by the terms thereof, together with such powers and discretion as are reasonably incidental thereto. The New Lender (a) represents and warrants that (i) it has full power and authority, and has taken all action

necessary, to execute and deliver this Amendment and to consummate the transactions contemplated hereby and to become a Lender under the Credit Agreement, (ii) it meets all the requirements to be an assignee under

Section 10.06(b)(iii) and (v) of the Credit Agreement (subject to such consents, if any, as may be required under Section 10.06(b)(iii) of the Credit Agreement), (iii) from and after the First Amendment

Effective Date, it shall be bound by the provisions of the Credit Agreement (as amended by this Amendment) as a Lender thereunder and, to the extent of the Loans and Commitments acquired by such New Lender pursuant to this Amendment (such New

Lender’s “Acquired Interest”), shall have the obligations of a Lender thereunder, (iv) it is sophisticated with respect to decisions to acquire assets of the type represented by such Acquired Interest and either it, or the

Person exercising discretion in making its decision to acquire such Acquired Interest, is experienced in

4

acquiring assets of such type, (v) it has received a copy of the Credit Agreement, and has received or has been accorded the opportunity to receive copies of the most recent financial

statements delivered pursuant to Section 4.01(a)(xi), 6.01(a) or 6.01(b) thereof, as applicable, and such other documents and information as it deems appropriate to make its own credit analysis and decision to enter into

this Amendment and to purchase such Acquired Interest, (vi) it has, independently and without reliance upon the Administrative Agent or any other Lender and based on such documents and information as it has deemed appropriate, made its own

credit analysis and decision to enter into this Amendment and to purchase such Acquired Interest, and (vii) if it is a Foreign Lender, it has delivered any documentation required to be delivered by it pursuant to the terms of the Credit

Agreement, duly completed and executed by such New Lender; and (b) agrees that (i) it will, independently and without reliance upon the Administrative Agent or any other Lender, and based on such documents and information as it shall deem

appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Loan Documents, and (ii) it will perform in accordance with their terms all of the obligations which by the terms of the Loan Documents

are required to be performed by it as a Lender.

Section 4. Commitment Increase. Pursuant to Section 2.17(a) of

the Credit Agreement, each undersigned Lender has agreed (a) in the case of Existing Lenders, to increase its Commitment under the Credit Agreement (each such Lender, an “Increasing Lender”) and (b) in the case of the New

Lender, to make a Commitment, in each case effective as of the First Amendment Effective Date so that it equals the amount set forth opposite such Lender’s name on Schedule 1 attached hereto under the caption “Commitment”. This

Amendment constitutes an Increase Agreement.

Section 5. Representations and Warranties of Borrower. To induce

Lenders and Administrative Agent to enter into this Amendment, Borrower hereby represents and warrants to Lenders and Administrative Agent as follows:

5.1 Reaffirmation of Existing Representations and Warranties. Each representation and warranty of Borrower contained in

the Credit Agreement and the other Loan Documents is true and correct in all material respects (except to the extent that such representations and warranties are qualified by materiality, in which case such representations and warranties are true

and correct in all respects) on the date hereof after giving effect to the amendments set forth in Section 1 hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they

were true and correct in all material respects (except to the extent that such representations and warranties are qualified by materiality, in which case such representations and warranties were true and correct in all respects) as of such earlier

date.

5.2 No Default or Event of Default. No Default or Event of Default has occurred which is continuing.

5.3 Acknowledgment of No Defenses. As of the First Amendment Effective Date, to the knowledge of the Borrower, Borrower

has no defense to (a) Borrower’s obligation to pay the Obligations when due, or (b) the validity, enforceability or binding effect against Borrower, Holdings or any Loan Party of the Credit Agreement or any of the other Loan Documents

(to the extent a party thereto) or any Liens intended to be created thereby.

5

Section 6. Miscellaneous.

6.1 Reaffirmation of Loan Documents. Any and all of the terms and provisions of the Credit Agreement and the Loan

Documents shall, except as amended and modified hereby, remain in full force and effect. The amendments contemplated hereby shall not limit or impair any Liens securing the Indebtedness, each of which are hereby ratified, affirmed and extended to

secure the Indebtedness as it may be increased pursuant hereto.

6.2 Parties in Interest. All of the terms and

provisions of this Amendment shall bind and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

6.3 Counterparts. This Amendment may be executed in counterparts, including, without limitation, by electronic signature,

and all parties need not execute the same counterpart. Facsimiles or other electronic transmissions (e.g. .pdfs) of such executed counterparts shall be effective as originals.

6.4 Complete Agreement. THIS AMENDMENT, THE CREDIT AGREEMENT AND THE OTHER LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT

BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN OR AMONG THE PARTIES.

6.5 Headings. The headings, captions and arrangements used in this Amendment are, unless specified otherwise, for

convenience only and shall not be deemed to limit, amplify or modify the terms of this Amendment, nor affect the meaning thereof.

6.6 Effectiveness. This Amendment shall be effective automatically and without necessity of any further action by

Borrower, Administrative Agent or Lenders when counterparts hereof have been executed by Borrower, Guarantors, each New Lender, each Increasing Lender and the Majority Lenders, and all conditions to the effectiveness hereof set forth herein have

been satisfied.

6.7 Governing Law. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS

OF THE NEW YORK.

6.8 Amendment. On and after the First Amendment Effective Date, (i) each reference in the Credit

Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import referring to the Credit Agreement shall mean and be a reference to the Credit Agreement, as amended by this Amendment, and each Increasing

Lender shall constitute a “Lender” as defined in the Credit Agreement.

6

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their

respective authorized officers on the date and year first above written.

[Signature Pages to Follow]

7

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first

above written.

|

|

|

|

|

| SUNOCO LP (F/K/A SUSSER PETROLEUM PARTNERS LP) |

|

|

|

|

By: SUNOCO GP LLC |

|

|

|

|

|

By: |

|

/s/ Mary E. Sullivan |

|

|

Name: |

|

Mary E. Sullivan |

|

|

Title: |

|

Executive Vice President, Chief Financial Officer and Treasurer |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| BANK OF AMERICA, N.A., as an LC Issuer, Swingline Lender and a Lender |

|

|

| By: |

|

/s/ Adam Fey |

|

|

| Name: |

|

Adam Fey |

| Title: |

|

Director |

|

| BANK OF AMERICA, N.A., as Administrative Agent and Collateral Agent |

|

|

| By: |

|

/s/ Denise Jones |

|

|

| Name: |

|

Denise Jones |

| Title: |

|

Assistant Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| WELLS FARGO BANK, N.A., as an LC Issuer |

| and a Lender |

|

|

| By: |

|

/s/ Larry Robinson |

|

|

| Name: |

|

Larry Robinson |

| Title: |

|

Managing Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| COMPASS BANK, |

| as a Lender |

|

|

| By: |

|

/s/ Umar Hassan |

|

|

| Name: |

|

Umar Hassan |

| Title: |

|

Senior Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., |

| as a Lender |

|

|

| By: |

|

/s/ Sherwin Brandford |

|

|

| Name: |

|

Sherwin Brandford |

| Title: |

|

Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| DNB CAPITAL LLC, |

| as a Lender |

|

|

| By: |

|

/s/ Joe Hykle |

|

|

| Name: |

|

Joe Hykle |

| Title: |

|

Senior Vice President |

|

|

| By: |

|

/s/ James Grubb |

|

|

| Name: |

|

James Grubb |

| Title: |

|

Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| BARCLAYS BANK PLC, |

| as a Lender |

|

|

| By: |

|

/s/ Marguerite Sutton |

|

|

| Name: |

|

Marguerite Sutton |

| Title: |

|

Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| CITIBANK, N.A., |

| as a Lender |

|

|

| By: |

|

/s/ Michael Zeller |

|

|

| Name: |

|

Michael Zeller |

| Title: |

|

Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH, |

| as a Lender |

|

|

| By: |

|

/s/ Nupur Kumar |

|

|

| Name: |

|

Nupur Kumar |

| Title: |

|

Authorized Signatory |

|

|

| By: |

|

/s/ Remy Riester |

|

|

| Name: |

|

Remy Riester |

| Title: |

|

Authorized Signatory |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| DEUTSCHE BANK AG – NEW YORK BRANCH, |

| as a Lender |

|

|

| By: |

|

/s/ Chris Chapman |

|

|

| Name: |

|

Chris Chapman |

| Title: |

|

Director |

|

|

| By: |

|

/s/ Vanuza Pereira-Bravo |

|

|

| Name: |

|

Vanuza Pereira-Bravo |

| Title: |

|

AVP |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| GOLDMAN SACHS BANK USA, |

| as a Lender |

|

|

| By: |

|

/s/ Rebecca Kratz |

|

|

| Name: |

|

Rebecca Kratz |

| Title: |

|

Authorized Signatory |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| JPMORGAN CHASE BANK, N.A., |

| as a Lender |

|

|

| By: |

|

/s/ Stephanie Balette |

|

|

| Name: |

|

Stephanie Balette |

| Title: |

|

Authorized Officer |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| MIZUHO BANK, LTD., as a Lender |

|

|

| By: |

|

/s/ Raymond Ventura |

|

|

| Name: |

|

Raymond Ventura |

| Title: |

|

Deputy General Manager |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| MORGAN STANLEY SENIOR FUNDING, INC., |

| as a Lender |

|

|

| By: |

|

/s/ Michael King |

|

|

| Name: |

|

Michael King |

| Title: |

|

Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| MORGAN STANLEY BANK, N.A., as a Lender |

|

|

| By: |

|

/s/ Michael King |

|

|

| Name: |

|

Michael King |

| Title: |

|

Authorized Signatory |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| PNC BANK, NATIONAL ASSOCIATION, as a Lender |

|

|

| By: |

|

/s/ Jonathan Luchansky |

|

|

| Name: |

|

Jonathan Luchansky |

| Title: |

|

Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| ROYAL BANK OF CANADA, |

| as a Lender |

|

|

| By: |

|

/s/ Mark Lumpkin, Jr. |

|

|

| Name: |

|

Mark Lumpkin, Jr. |

| Title: |

|

Authorized Signatory |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| SUMITOMO MITSUI BANKING CORPORATION, |

| as a Lender |

|

|

| By: |

|

/s/ James D. Weinstein |

|

|

| Name: |

|

James D. Weinstein |

| Title: |

|

Managing Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| SUNTRUST BANK, |

| as a Lender |

|

|

| By: |

|

/s/ Carmen Malizia |

|

|

| Name: |

|

Carmen Malizia |

| Title: |

|

Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| U.S. BANK NATIONAL ASSOCIATION, |

| as a Lender |

|

|

| By: |

|

/s/ Patrick Jeffrey |

|

|

| Name: |

|

Patrick Jeffrey |

| Title: |

|

Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| BNP PARIBAS, |

| as a Lender |

|

|

| By: |

|

/s/ Mark Renaud |

|

|

| Name: |

|

Mark Renaud |

| Title: |

|

Managing Director |

|

|

| By: |

|

/s/ Nicolas Anberree |

|

|

| Name: |

|

Nicolas Anberree |

| Title: |

|

Vice President |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| CREDIT AGRICOLE CORPORATE & INVESTMENT BANK, as a Lender |

|

|

| By: |

|

/s/ Dixon Schultz |

|

|

| Name: |

|

Dixon Schultz |

| Title: |

|

Managing Director |

|

|

| By: |

|

/s/ Michael Willis |

|

|

| Name: |

|

Michael Willis |

| Title: |

|

Managing Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| ING CAPITAL LLC, |

| as a Lender |

|

|

| By: |

|

/s/ Cheryl LaBelle |

|

|

| Name: |

|

Cheryl LaBelle |

| Title: |

|

Managing Director |

|

|

| By: |

|

/s/ Hans Beekmans |

|

|

| Name: |

|

Hans Beekmans |

| Title: |

|

Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| UBS AG, STAMFORD BRANCH, |

| as a Lender |

|

|

| By: |

|

/s/ Houssem Daly |

|

|

| Name: |

|

Houssem Daly |

| Title: |

|

Associate Director |

|

|

| By: |

|

/s/ Denise Bushee |

|

|

| Name: |

|

Denise Bushee |

| Title: |

|

Associate Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

|

|

|

| NATIXIS, NEW YORK BRANCH |

| as a Lender |

|

|

| By: |

|

/s/ Jarrett Price |

|

|

| Name: |

|

Jarrett Price |

| Title: |

|

Director |

|

|

| By: |

|

/s/ Carlos Quinteros |

|

|

| Name: |

|

Carlos Quinteros |

| Title: |

|

Managing Director |

Signature Page to First

Amendment To Credit Agreement and Increase Agreement

Sunoco LP

Each of the undersigned Guarantors (i) consents and agrees to this Amendment, and

(ii) agrees that the Loan Documents to which it is a party (including, without limitation, the Guaranty of Collection, dated as of September 25, 2014 and the Guaranty Agreement, dated as of September 25, 2014, each as amended,

modified or supplemented) shall remain in full force and effect and shall continue to be the legal, valid and binding obligation of the undersigned, enforceable against it in accordance with its terms.

|

|

|

|

|

| CONSENTED, ACKNOWLEDGED AND AGREED TO BY: |

|

| SUNOCO ENERGY SERVICES LLC |

| SUSSER PETROLEUM OPERATING COMPANY LLC |

| SUSSER PETROLEUM PROPERTY COMPANY LLC |

| SUSSER HOLDINGS CORPORATION |

|

|

| By: |

|

/s/ Mary E. Sullivan |

|

|

Name: |

|

Mary E. Sullivan |

|

|

Title: |

|

Executive Vice President, Chief Financial |

|

|

|

|

Officer, and Treasurer |

|

| MID-ATLANTIC CONVENIENCE STORES, LLC |

| SOUTHSIDE OIL, LLC |

| MACS RETAIL LLC |

|

|

| By: |

|

/s/ Clare P. McGrory |

|

|

Name: |

|

Clare P. McGrory |

|

|

Title: |

|

Treasurer |

|

| ALOHA PETROLEUM, LTD. |

|

|

| By: |

|

/s/ Mary E. Sullivan |

|

|

Name: |

|

Mary E. Sullivan |

|

|

Title: |

|

Vice President and Chief Financial Officer |

SCHEDULE 1

COMMITMENTS AND APPLICABLE PERCENTAGES

|

|

|

|

|

|

|

|

|

| Lender |

|

Commitment |

|

|

Applicable

Percentage |

|

|

|

|

| Bank of America, N.A. |

|

$ |

79,000,000.00 |

|

|

|

5.266666667 |

% |

|

|

|

| BBVA Compass |

|

$ |

79,000,000.00 |

|

|

|

5.266666667 |

% |

|

|

|

| The Bank of Tokyo-Mitsubishi UFJ, Ltd. |

|

$ |

79,000,000.00 |

|

|

|

5.266666667 |

% |

|

|

|

| DNB Capital LLC |

|

$ |

79,000,000.00 |

|

|

|

5.266666667 |

% |

|

|

|

| Mizuho |

|

$ |

79,000,000.00 |

|

|

|

5.266666667 |

% |

|

|

|

| Natixis |

|

$ |

79,000,000.00 |

|

|

|

5.266666667 |

% |

|

|

|

| The Royal Bank of Scotland plc |

|

$ |

70,000,000.00 |

|

|

|

4.666666667 |

% |

|

|

|

| Barclays |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| CitiBank |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| Credit Suisse |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| Deutsche Bank |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| Goldman Sachs Bank USA |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| JPMorgan Chase Bank, N.A. |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| Morgan Stanley Senior Funding, Inc. |

|

$ |

31,500,000.00 |

|

|

|

2.100000000 |

% |

|

|

|

| Morgan Stanley Bank, N.A. |

|

$ |

25,000,000.00 |

|

|

|

1.666666667 |

% |

|

|

|

| PNC |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| RBC |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| Sumitomo Mitsui |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| SunTrust |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| UBS AG, Stamford Branch |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| US Bank |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Wells Fargo Bank, N.A. |

|

$ |

56,500,000.00 |

|

|

|

3.766666667 |

% |

|

|

|

| BNP Paribas |

|

$ |

42,500,000.00 |

|

|

|

2.833333333 |

% |

|

|

|

| Credit Agricole |

|

$ |

42,500,000.00 |

|

|

|

2.833333333 |

% |

|

|

|

| ING Bank |

|

$ |

42,500,000.00 |

|

|

|

2.833333333 |

% |

|

|

|

| Bank of Montreal |

|

$ |

37,500,000.00 |

|

|

|

2.500000000 |

% |

|

|

|

| TOTAL: |

|

$ |

1,500,000,000 |

|

|

|

100 |

% |

Exhibit 99.1

News Release

Sunoco LP Expands Revolving Credit Facility to $1.5 Billion

Receives an additional $250 million of bank credit commitments

HOUSTON, April 10, 2015 - Sunoco LP (NYSE: SUN) announced today that it has amended its existing revolving credit facility and expanded aggregate

credit commitments from $1.25 billion to $1.5 billion. The facility with a syndicate of banks matures in September 2019.

The expansion will provide the

Partnership with additional financing flexibility and liquidity to fund future growth capital expenditures.

New Investor Presentation

The Partnership has also posted to its website a new investor presentation that will be used during upcoming investor meetings. The presentation is available

in the Investor Relations section of Sunoco LP’s website at www.SunocoLP.com under Events & Presentations.

Sunoco LP (NYSE:

SUN) is a master limited partnership (MLP) that primarily distributes motor fuel to convenience stores, independent dealers, commercial customers and distributors. SUN also operates more than 150 convenience stores and retail fuel sites. SUN

conducts its business through wholly owned subsidiaries, as well as through its 31.58 percent interest in Sunoco, LLC, in partnership with an affiliate of its parent company, Energy Transfer Partners. While primarily engaged in natural gas, natural

gas liquids, crude oil and refined products transportation, ETP also operates a retail and fuel distribution business through its interest in Sunoco, LLC, as well as wholly owned subsidiaries, Sunoco, Inc. and Stripes LLC, that operate approximately

1,100 convenience stores and retail fuel sites. For more information, visit the Sunoco LP website at www.SunocoLP.com.

Forward-Looking

Statements

This news release contains “forward-looking statements” which may describe Sunoco LP’s (“SUN”) objectives,

expected results of operations, targets, plans, strategies, costs, anticipated capital expenditures, potential acquisitions, new store openings and/or new dealer locations, management’s expectations, beliefs or goals regarding proposed

transactions between ETP and SUN, the expected timing of those transactions and the future financial and/or operating impact of those transactions, including the anticipated integration process and any related benefits, opportunities or synergies.

These statements are based on current plans, expectations and projections and involve a number of risks and uncertainties that could cause actual results and events to vary materially, including but not limited to: execution, integration,

environmental and other risks related to acquisitions (including the Sunoco, LLC drop-down, and future drop-downs) and our overall acquisition strategy; competitive pressures from convenience stores, gasoline stations, other non-traditional

retailers and other

1

wholesale fuel distributors located in SUN’s and Sunoco, LLC’s markets; dangers inherent in storing and transporting motor fuel; SUN’s or Sunoco, LLC’s ability to renew or

renegotiate long-term distribution contracts with customers; changes in the price of and demand for motor fuel; changing consumer preferences for alternative fuel sources or improvement in fuel efficiency; competition in the wholesale motor fuel

distribution industry; seasonal trends; severe or unfavorable weather conditions; increased costs; environmental laws and regulations; dangers inherent in the storage of motor fuel; reliance on suppliers to provide trade credit terms to adequately

fund ongoing operations; acts of war and terrorism; dependence on information technology systems; SUN’s and ETP’s ability to consummate any proposed transactions, or to satisfy the conditions precedent to the consummation of such

transactions; successful development and execution of integration plans; ability to realize anticipated synergies or cost-savings and the potential impact of the transactions on employee, supplier, customer and competitor relationships; and other

unforeseen factors. For a full discussion of these and other risks and uncertainties, refer to the “Risk Factors” section of SUN’s and ETP’s most recently filed annual reports on Form 10-K. These forward-looking statements are

based on and include our estimates as of the date hereof. Subsequent events and market developments could cause our estimates to change. While we may elect to update these forward-looking statements at some point in the future, we specifically

disclaim any obligation to do so, even if new information becomes available, except as may be required by applicable law.

Contacts

Scott Grischow

Director – Investor Relations and Treasury

(361) 884-2463, scott.grischow@susser.com

Dennard-Lascar Associates

Anne Pearson

(210) 408-6321, apearson@dennardlascar.com

# # #

2

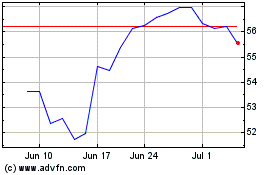

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

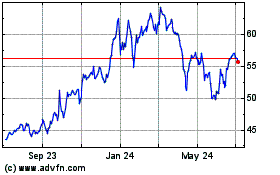

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024