Deadline for AB InBev, SABMiller Deal Extended

November 04 2015 - 4:00AM

Dow Jones News

The U.K. Takeover Panel on Wednesday agreed to extend the

deadline for Anheuser-Busch InBev NV's $104 billion takeover of

SABMiller PLC to allow the companies time to finish complex

paperwork and continue talks on the sale of SABMiller's U.S.

business.

AB InBev now has until 1700 GMT on Nov. 11 to make a formal

offer for its smaller rival. It will be the second extension the

companies have requested since announcing an agreement in principle

on Oct. 13.

AB InBev last week said it had completed financing for the deal

and conducted due diligence.

The latest extension highlights the complexity of a deal that

would create a beer giant with a 28.4% share of the global beer

market, according to industry tracker Plato Logic. It also

illustrates AB InBev's interest in announcing a deal without having

a solution to regulatory concerns in the U.S., where it has a 45%

market share and SABMiller's joint venture MillerCoors LLC has a

25% share.

AB InBev is in talks to sell SABMiller's stake in MillerCoors to

its joint-venture partner Molson Coors Brewing Co., according to

people familiar with the matter. Molson Coors currently owns 42% of

MillerCoors. As part of the joint-venture agreement, Molson Coors

has a first right of refusal to buy MillerCoors, an option to top

another offer by 5% and the right to name the company's chief

executive.

The need to sell the SABMiller's business in the U.S. has taken

on added importance as legislators raise concerns about AB InBev

controlling 70% of the U.S. market. The top two lawmakers on the

Senate Judiciary Subcommittee said on Oct. 20 that they will hold a

hearing before the end of the year to evaluate how the merger will

affect competition and U.S. consumers.

An AB InBev spokeswoman last month said the company would

resolve regulatory issues like those in the U.S. "promptly and

proactively."

The push to sell SABMiller mirrors AB InBev's approach during

its last acquisition, a $20.1 billion takeover of the Mexican

brewer Grupo Modelo. To address U.S. antitrust concerns about the

deal, AB InBev on the same day announced a sale of the U.S. rights

to Corona, Modelo Especial and other beers to Constellation Brands

Inc.

In addition to the U.S., AB InBev's deal is expected to face

antitrust scrutiny in China, where SABMiller has a 23% market share

through its joint-venture with government-backed China Resources

Enterprise Ltd., the maker of Snow, the world's biggest beer by

volume. AB InBev has a 14% market share, with Budweiser and local

brands like Harbin.

Antitrust experts and industry analysts think Chinese

authorities would be reluctant to allow a foreign company to

control more than a third of the market. They also have raised

concerns about markets like Italy and the U.K. where the brewer may

have to sell off rights to brands to reduce the market share of the

combined brewers in those countries.

The company also has faced some resistance in South Africa where

unions last month called on the government to reject the deal,

saying it would affect tax revenue and job security.

Write to Tripp Mickle at Tripp.Mickle@wsj.com, Shayndi Raice at

shayndi.raice@wsj.com and Ian Walker at ian.walker@wsj.com

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=BE0003793107

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US03524A1088

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 04, 2015 03:45 ET (08:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

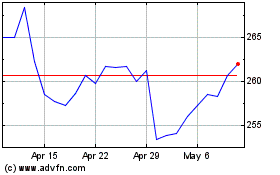

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

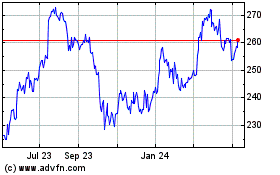

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Apr 2023 to Apr 2024