Constellation Brands Profits Double

October 07 2015 - 9:20AM

Dow Jones News

Constellation Brands Inc. on Wednesday said profits more than

doubled in its latest quarter and raised its earnings outlook for

the current year as the liquor company continues to benefit from

strong beer sales.

Shares of Constellation, up 54% over the past 12 months through

Tuesday, rose 3.8% to $136.25 in premarket trading.

Constellation, the third-largest beer company by volume in the

U.S., has benefited in recent quarters from becoming the full

distributor of Corona and Modelo in the U.S.

The number of drinking-age Hispanics in the U.S. is expected to

grow by more than one million annually in the coming years,

outpacing other demographic groups, and many of those drinkers have

been choosing to buy Mexican beers such as Corona and Modelo

Especial, according to the National Beer Wholesalers

Association.

Constellation's net beer sales climbed 14%, propelled partly by

demand for new Corona cans. The wine and spirits segment, which has

struggled to deliver much growth in recent quarters, had sales

increase 3%.

Results from Constellation Brands come amid a consolidation push

in the beer industry. Earlier Wednesday, Anheuser-Busch InBev NV

went public with an offer valued at about $104 billion to buy

SABMiller PLC, in a bid to combine the world's top two brewers.

Meanwhile, Diageo PLC and Heineken NV announced an exchange of

emerging-market brewing assets.

For the quarter ended in August, its second of the fiscal year,

Constellation reported a profit of $302 million, or $1.49 a share,

up from a year-earlier profit of $195.8 million, or 98 cents a

share. Excluding certain items, per-share profit rose to $1.56 from

$1.11 a year earlier.

Revenue grew 8% to $1.73 billion from $1.6 billion.

Analysts anticipated $1.32 in earnings per share and $1.73

billion in sales.

In the wake of the better-than-expected profit, the company said

it now expects per-share earnings for the year ending in February

between $5 and $5.20 on an adjusted basis, up from a previous range

of $4.80 to $5.00.

Analysts, on average, were expecting $4.98 a share.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=BE0003793107

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US03524A1088

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 09:05 ET (13:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

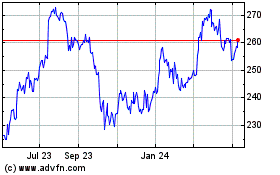

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

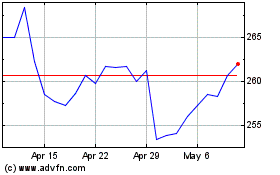

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Apr 2023 to Apr 2024