As filed with the Securities and Exchange Commission on September 21, 2016

Registration No. 333- and 333- -01

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM S-3

REGISTRATION STATEMENT

under

THE SECURITIES ACT OF 1933

______________________

|

|

|

|

|

|

|

SPIRE INC.

|

Missouri

|

74-2976504

|

|

LACLEDE GAS COMPANY

|

Missouri

|

43-0368139

|

|

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

MARK C. DARRELL

|

ELLEN L. THEROFF

|

|

Senior Vice President,

General Counsel and

Chief Compliance Officer

|

Vice President, Corporate and Shared Services Governance and Standards and

Corporate Secretary

|

|

700 Market Street

St. Louis, MO 63101

314-342-0500

|

(Names, address, including zip code, and telephone number, including area code, of agents for service

and address, including zip code, and telephone number of registrants’ principal executive offices)

______________________

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

x

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

x

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

Accelerated filer

|

Non-accelerated filer

|

Smaller reporting company

|

|

Spire Inc.

|

x

|

¨

|

¨

|

¨

|

|

Laclede Gas Company

|

¨

|

¨

|

x

|

¨

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

Title of each class of securities to be registered

|

Proposed maximum aggregate offering price (1)

|

Amount of registration fee (2)

|

|

Spire Inc.:

Senior Debt Securities

Junior Subordinated Debt Securities

Preferred Stock

Common Stock

Stock Purchase Contracts (3)

Stock Purchase Units (4)

Laclede Gas Company:

First Mortgage Bonds

Unsecured Debt Securities

Preferred Stock

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

(1)

|

An unspecified aggregate initial offering amount or number of the securities of each identified class is being registered as may from time to time be offered by Spire Inc. and Laclede Gas Company at unspecified prices, along with an indeterminate amount or number of securities that may be issued upon exercise, settlement, exchange or conversion of securities offered hereunder. Separate consideration may or may not be received for securities that are issuable upon exercise, settlement, exchange or conversion of other securities or that are issued in units.

|

|

(2)

|

In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrants are deferring payment of the registration fee relating to the securities offered hereby and will pay “pay-as-you-go registration fees.”

|

|

(3)

|

Each Stock Purchase Contract obligates Spire Inc. to sell, and obligates the holder thereof to purchase, an indeterminate amount of shares of Preferred Stock or Common Stock of Spire Inc. being registered hereby.

|

|

(4)

|

Each Stock Purchase Unit consists of a combination of a Stock Purchase Contract and Senior Debt Securities or Junior Subordinated Debt Securities of Spire Inc. or debt obligations of third parties, including United States Treasury securities.

|

EXPLANATORY NOTE

This registration statement contains the following two separate prospectuses:

|

|

|

|

(1)

|

The first prospectus relates to offerings by Spire Inc. of its senior debt securities, junior subordinated debt securities, preferred stock, common stock, stock purchase contracts and stock purchase units; and

|

|

|

|

|

(2)

|

The second prospectus relates to offerings by Laclede Gas Company of its first mortgage bonds, unsecured debt securities and preferred stock.

|

Each offering of securities made under this registration statement will be made pursuant to one of these prospectuses, with the specific terms of the securities offered thereby set forth in an accompanying prospectus supplement.

Additionally, this combined registration statement is separately filed by Spire Inc. and Laclede Gas Company. The registration statement of each of the respective registrants consists of the prospectus of such registrant (including the documents incorporated therein by reference) and the information set forth in Part II of this registration statement that is applicable to such registrant. Each registrant makes no representation as to information relating to the other registrant.

PROSPECTUS

Senior Debt Securities

Junior Subordinated Debt Securities

Preferred Stock

Common Stock

Stock Purchase Contracts

Stock Purchase Units

We may offer for sale, from time to time, either separately or together in any combination, the securities described in this prospectus. Each time we sell securities pursuant to this prospectus, we will provide a supplement to this prospectus that contains specific information about the offering and the specific terms of the securities offered. You should read this prospectus and the applicable prospectus supplement carefully before you invest. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

We may sell the offered securities through the solicitation of proposals of underwriters or dealers to purchase the offered securities, through underwriters or dealers on a negotiated basis, through agents or directly to a limited number of purchasers or to a single purchaser. The supplements to this prospectus will describe the terms of any particular plan of distribution, including any underwriting arrangements. Please see the “Plan of Distribution” section of this prospectus.

Investing in our securities involves risks that are described in the “Risk Factors” section of this prospectus as well as in our annual, quarterly, and current reports filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are incorporated by reference into this prospectus.

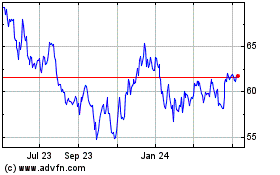

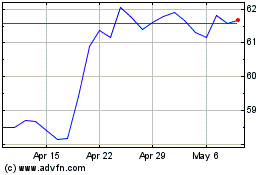

Our common stock trades on the New York Stock Exchange under the symbol “SR.”

Our address is 700 Market Street, St. Louis, Missouri 63101 and our telephone number is 314-342-0500.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

_________________

The date of this prospectus is September 21, 2016

As permitted under the rules of the Securities and Exchange Commission (“SEC”), this prospectus incorporates important information about us that is contained in documents that we file with the SEC but that is not included in or delivered with this prospectus. You may obtain copies of these documents without charge from the website maintained by the SEC at www.sec.gov as well as other sources. See “Where You Can Find More Information.” You may also obtain copies of the incorporated documents, without charge, upon written or oral request to our Corporate Secretary, Spire Inc., 700 Market Street, St. Louis, MO 63101 (314-342-0531).

We have not authorized anyone to provide you with any information other than information incorporated by reference or provided in this prospectus and any prospectus supplement. We can take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. We will not make an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or the documents incorporated by reference is accurate as of any date other than the date on the front of those documents. Our business, financial condition, result of operations, and prospects may have changed since that date.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

Page

|

|

|

About This Prospectus

|

1

|

|

|

Risk Factors

|

1

|

|

|

Where You Can Find More Information

|

1

|

|

|

Forward-Looking Statements

|

2

|

|

|

Spire

|

3

|

|

|

Use of Proceeds

|

3

|

|

|

Ratios of Earnings to Fixed Charges

|

3

|

|

|

Description of Debt Securities

|

3

|

|

|

Description of Capital Stock

|

11

|

|

|

Description of Stock Purchase Contracts and Stock Purchase Units

|

13

|

|

|

Book-Entry Securities

|

13

|

|

|

Plan of Distribution

|

15

|

|

|

Legal Matters

|

16

|

|

|

Experts

|

16

|

|

The distribution of this prospectus may be restricted by law in certain jurisdictions. This prospectus does not constitute, and may not be used in connection with an offer or solicitation by anyone in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make the offer or solicitation.

______________________

The terms “we,” “our,” “us” and “Spire” refer to Spire Inc. and its subsidiaries unless the context suggests otherwise. The term “you” refers to a prospective investor.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, we may offer and sell, from time to time, any combination of securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. The registration statement we filed with the SEC includes or incorporates by reference exhibits that provide more detail on descriptions of matters discussed in this prospectus. Each time we offer and sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering, including the specific amounts, prices and terms of the securities offered. The prospectus supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement. You should read this prospectus and the related exhibits filed with the SEC and any prospectus supplement together with additional information described under the heading “Where You Can Find More Information.”

RISK FACTORS

Investing in our securities involves risks. Before making an investment decision, you should read and carefully consider the risk factors described in our annual, quarterly and current reports filed with the SEC, which are incorporated by reference into this prospectus, as well as other information we include or incorporate by reference in this prospectus before making an investment decision. The prospectus supplement applicable to each type or series of securities we offer may contain a discussion of additional risks applicable to an investment in us and the particular types of securities we are offering under that prospectus supplement.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, and other information with the SEC. These SEC filings are available over the Internet at the SEC’s web site at “http://www.sec.gov” or on our own website at “http://www.spireenergy.com.” Information contained on our website does not constitute part of this prospectus. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on the Public Reference Room.

The SEC allows us to “incorporate by reference” into this prospectus the information we file with the SEC, which means we can disclose important information by referring you to those documents. The information we incorporate by reference is an important part of this prospectus or any prospectus supplement relating to an offering of our securities and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings made with the SEC under Sections 13(a), 13(c), 14 and 15 of the Exchange Act from the time we file the registration statement of which this prospectus is a part until we sell all of the securities. These documents contain important information about us and our finances. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not file in accordance with SEC rules.

|

|

|

|

|

|

|

SEC Filings (File No. 1-16681)

|

Period/Date

|

|

Annual Report on Form 10-K

|

Year ended September 30, 2015

|

|

Quarterly Report on Form 10-Q

|

Quarters ended December 31, 2015, March 31, 2016 and June 30, 2016

|

|

Current Reports on Form 8-K

|

November 24, 2015, January 29, 2016, February 22, 2016, May 3, 2016, May 17, 2016, June

21, 2016, August 5, 2016 and September 12, 2016

|

You may request a copy of these filings at no cost by writing or telephoning us at the following address:

Spire Inc.

Attn: Investor Relations

700 Market Street, 6

th

Floor

St. Louis, Missouri 63101

(314) 342-0878

FORWARD-LOOKING STATEMENTS

Certain matters contained in or incorporated by reference in this prospectus, excluding historical information, include forward-looking statements. Certain words, such as “may,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “seek,” and similar words and expressions identify forward-looking statements that involve uncertainties and risks. Future developments may not be in accordance with our current expectations or beliefs and the effect of future developments may not be those anticipated. Among the factors that may cause results to differ materially from those contemplated in any forward-looking statement are:

|

|

|

|

•

|

Weather conditions and catastrophic events, particularly severe weather in the natural gas producing areas of the country;

|

|

|

|

|

•

|

Volatility in gas prices, particularly sudden and sustained changes in natural gas prices, including the related impact on margin deposits associated with the use of natural gas derivative instruments;

|

|

|

|

|

•

|

The impact of changes and volatility in natural gas prices on our competitive position in relation to suppliers of alternative heating sources, such as electricity;

|

|

|

|

|

•

|

Changes in gas supply and pipeline availability, including decisions by natural gas producers to reduce production or shut in producing natural gas wells, expiration of existing supply and transportation arrangements that are not replaced with contracts with similar terms and pricing, as well as other changes that impact supply for and access to the markets in which our subsidiaries transact business;

|

|

|

|

|

•

|

Acquisitions may not achieve their intended results, including anticipated cost savings;

|

|

|

|

|

•

|

Legislative, regulatory and judicial mandates and decisions, some of which may be retroactive, including those affecting:

|

•

allowed rates of return,

•

incentive regulation,

•

industry structure,

•

purchased gas adjustment provisions,

•

rate design structure and implementation,

•

regulatory assets,

•

non-regulated and affiliate transactions,

•

taxes,

•

franchise renewals,

|

|

|

|

•

|

environmental or safety matters, including the potential impact of legislative and regulatory actions related to climate change and pipeline safety,

|

•

pension and other postretirement benefit liabilities and funding obligations, or

•

accounting standards;

|

|

|

|

•

|

The results of litigation;

|

|

|

|

|

•

|

The availability of, and access to, in general, funds to meet our debt obligations prior to or when they become due and to fund our operations and necessary capital expenditures, either through (i) cash on hand, (ii) operating cash flow, or (iii) access to the capital markets;

|

|

|

|

|

•

|

Retention of, ability to attract, ability to collect from, and conservation efforts of, customers;

|

|

|

|

|

•

|

Our ability to comply with all covenants in our indentures and credit facilities any violations of which, if not cured in a timely manner, could trigger a default of our obligation;

|

|

|

|

|

•

|

Capital and energy commodity market conditions, including the ability to obtain funds with reasonable terms for necessary capital expenditures and general operations and the terms and conditions imposed for obtaining sufficient gas supply;

|

|

|

|

|

•

|

Discovery of material weakness in internal controls; and

|

|

|

|

|

•

|

Employee workforce issues, including but not limited to labor disputes and future wage and employee benefit costs including changes in discount rates and returns on benefit plan assets.

|

Readers are urged to consider the risks, uncertainties and other factors that could affect our business as described in this prospectus and the information incorporated by reference herein. All forward-looking statements made or incorporated by reference in this prospectus rely upon the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. We do not, by including this statement, assume any obligation to review or revise any particular forward-looking statement in light of future events.

SPIRE

Spire, headquartered in St. Louis, Missouri, is a public utility holding company whose primary business is the safe and reliable delivery of natural gas service to more than 1.66 million residential, commercial and industrial customers across Missouri, Alabama and Mississippi. We have two key business segments: Gas Utility and Gas Marketing. The Gas Utility segment consists of five natural gas utilities (Utilities): Laclede Gas (serving St. Louis and eastern Missouri), Missouri Gas Energy (MGE) (serving Kansas City and western Missouri), Alabama Gas Corporation (Alagasco) (serving central and northern Alabama, including Birmingham and Montgomery), Mobile Gas Service Corporation (serving southwestern Alabama, including Mobile) and Willmut Gas and Oil Company (serving south-central Mississippi, including Hattiesburg) . Spire’s subsidiary, Laclede Gas Company (LGC), comprises the Laclede Gas and MGE utilities. Spire’s non-utility businesses include Laclede Energy Resources, Inc. (LER), which provides non-regulated natural gas services. For more information about us and our business you should refer to the additional information described under the caption “Where You Can Find More Information.”

Our principal offices are located at 700 Market Street, St. Louis, Missouri, 63101 and our telephone number is 314-342-0500.

USE OF PROCEEDS

Unless we state otherwise in any applicable prospectus supplement, we intend to use the net proceeds from any sale of the offered securities for general corporate purposes, including for working capital, repaying indebtedness, and funding capital projects and acquisitions.

We may set forth additional information on the use of net proceeds from a particular offering of securities in the prospectus supplement relating to that offering.

RATIOS OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratios of earnings to fixed charges for the respective periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended September 30,

|

9 Months Ended

|

|

|

2011

|

2012

|

2013

|

2014

|

2015

|

June 30, 2016

|

|

Ratio of earnings to fixed charges

|

4.42

|

4.35

|

3.30

|

3.41

|

3.55

|

4.92

|

For purposes of computing the ratios of earnings to fixed charges, earnings consist of income from continuing operations plus applicable income taxes and fixed charges. Fixed charges include all interest expense and the portion of rent expense deemed representative of the interest component.

DESCRIPTION OF DEBT SECURITIES

General

The description below contains summaries of selected provisions of the indentures, including supplemental indentures, under which the unsecured debt securities will be issued. These summaries are not complete. The indentures and the form of the supplemental indentures applicable to the debt securities are exhibits to the registration statement. You should read them for provisions that may be important to you.

We are not required to issue future issues of indebtedness under the indentures described in this prospectus. We are free to use other indentures or documentation, containing provisions different from those described in this prospectus, in connection with future issues of other indebtedness not under this registration statement.

The debt securities will be represented either by global senior debt securities registered in the name of The Depository Trust Company (“DTC”), as depositary, or its nominee, or by securities in certificated form issued to the registered owners, as set forth in the applicable prospectus supplement. See the information under the heading “Book-Entry Securities” in this prospectus.

Unless otherwise provided, we may reopen a series without the consent of the holders of the debt securities of that series for issuance of additional debt securities of that series. Unless otherwise described in the applicable prospectus supplement, neither indenture described above limits or will limit the aggregate amount of debt, including secured debt, we or our subsidiaries may incur.

The following briefly summarizes the material provisions of the indentures and the debt securities. You should read the more detailed provisions of the applicable indenture, including the defined terms, for provisions that may be important to you. The indentures have been filed as exhibits to the registration statement of which this prospectus is a part. Copies of the indentures may also be obtained from us or the applicable trustee.

The applicable prospectus supplement relating to any series of debt securities will describe the following terms, where applicable:

|

|

|

|

•

|

the title of the debt securities;

|

|

|

|

|

•

|

whether the debt securities will be senior or subordinated debt;

|

|

|

|

|

•

|

the total principal amount of the debt securities;

|

|

|

|

|

•

|

the percentage of the principal amount at which the debt securities will be sold and, if applicable, the method of determining the price;

|

|

|

|

|

•

|

the maturity date or dates or the method of determining the maturity date or dates;

|

|

|

|

|

•

|

the interest rate or the method of computing the interest rate;

|

|

|

|

|

•

|

the date or dates from which any interest will accrue, or how such date or dates will be determined, and the interest payment date or dates and any related record dates;

|

|

|

|

|

•

|

the location where payments on the debt securities will be made;

|

|

|

|

|

•

|

the terms and conditions on which the debt securities may be redeemed at our option;

|

|

|

|

|

•

|

any of our obligations to redeem, purchase or repay the debt securities at the option of a holder upon the happening of any event and the terms and conditions of redemption, purchase or repayment;

|

|

|

|

|

•

|

any provisions for the discharge of our obligations relating to the debt securities by deposit of funds or United States government obligations;

|

|

|

|

|

•

|

whether the debt securities are to trade in book-entry form and the terms and any conditions for exchanging the global security in whole or in part for paper certificates;

|

|

|

|

|

•

|

any material provisions of the applicable indenture described in this prospectus that do not apply to the debt securities;

|

|

|

|

|

•

|

any additional events of default; and

|

|

|

|

|

•

|

any other specific terms of the debt securities.

|

Federal income tax consequences and other special considerations applicable to any debt securities issued by us at a discount may be described in the applicable prospectus supplement.

Registration, Transfer and Exchange

. Unless otherwise indicated in the applicable prospectus supplement, each series of debt securities will initially be issued in the form of one or more global securities, in registered form, without coupons, as described under “Book-Entry Securities.” The global securities will be registered in the name of DTC, as depositary, or its nominee, and deposited with, or on behalf of, the depositary. Except in the circumstances described under “Book-Entry Securities,” owners of beneficial interests in a global security will not be entitled to have debt securities registered in their names, will not receive or be entitled to receive physical delivery of any debt securities and will not be considered the registered holders thereof under the debt indenture.

Debt securities of any series will be exchangeable for other debt securities of the same series of any authorized denominations and of a like aggregate principal amount and tenor. Subject to the terms of the applicable indenture and the limitations applicable to global securities, debt securities may be presented for exchange or registration of transfer, duly endorsed or accompanied by a duly executed instrument of transfer, at the office of any security registrar we may designate for that purpose, without service charge but upon payment of any taxes and other governmental charges as described in the applicable indenture.

Unless otherwise indicated in the applicable prospectus supplement, the security registrar will be the trustee under the applicable indenture. We may at any time designate additional security registrars or rescind the designation of any security registrar or approve a change in the office through which any security registrar acts, except that we will be required to maintain a security registrar in each place of payment for the debt securities of each series.

Payment and Paying Agents

. Principal of and interest and premium, if any, on debt securities issued in the form of global securities will be paid in the manner described under “Book-Entry Securities.”

Unless otherwise indicated in the applicable prospectus supplement, the principal of and any premium and interest on debt securities of a particular series in the form of certificated securities will be payable at the office of the trustee or at the authorized office of any paying agent or paying agents upon presentation and surrender of such debt securities. We may at any time designate additional paying agents or rescind the designation of any paying agent or approve a change in the office through which any paying agent acts, except that we will be required to maintain a paying agent in each place of payment for the debt securities of a particular series.

All monies we pay to a trustee or a paying agent for the payment of the principal of, and premium or interest, if any, on, any debt security that remain unclaimed at the end of two years after such principal, premium or interest shall have become due and payable will be repaid to us. The holder of such debt security thereafter may look only to us for payment thereof, subject to the laws of unclaimed property.

Redemption

. Any terms for the optional or mandatory redemption of the debt securities will be set forth in the applicable prospectus supplement. Unless otherwise indicated in the applicable prospectus supplement, debt securities will be redeemable by us only upon notice not less than 30 (or, in the case of junior subordinated debt securities, 20) nor more than 60 days prior to the date fixed for redemption, and, if less than all the debt securities of a series are to be redeemed, the particular debt securities to be redeemed will be selected by the method provided for that particular series, or in the absence of any such provision, by the trustee in the manner it deems fair and appropriate and, in the case of debt securities issued in the form of global securities, in accordance with the depositary’s applicable procedures.

Any notice of redemption at our option may state that redemption will be conditional upon receipt by the trustee or the paying agent or agents, on or prior to the date fixed for such redemption, of money sufficient to pay the principal of and premium, if any, and interest on, the debt securities and that if that money has not been so received, the notice will be of no force and effect and we will not be required to redeem the debt securities.

Annual Notice to Trustee

. We will provide to each trustee an annual statement by an appropriate officer as to our compliance with all conditions and covenants under the applicable indenture.

Notices

. Notices to holders of debt securities will be given by mail to the addresses of the holders as they may appear in the security register for the applicable debt securities.

Title

. We, the trustee, and any agents of us or the trustee, may treat the person in whose name debt securities are registered as the absolute owner of those debt securities, whether or not those debt securities may be overdue, for the purpose of making payments and for all other purposes irrespective of notice to the contrary.

Governing Law

. Each indenture and the debt securities will be governed by, and construed in accordance with, the laws of the State of New York.

Regarding the Trustees

. UMB Bank & Trust, n.a. is the trustee under the senior debt indenture. U.S. Bank National Association is the trustee under the subordinated debt indenture. These banks have provided in the past to us and our affiliates and may provide from time to time in the future certain commercial banking, investment banking and other services for us and our affiliates in the ordinary course of their business, for which they have received and may continue to receive customary fees and commissions. In particular, these banks or their affiliates are lenders under our and our affiliates’ credit facilities.

A trustee may resign at any time by giving written notice to us or may be removed at any time by act of the holders of a majority in principal amount of all series of debt securities then outstanding delivered to the trustee and us. No resignation or removal of a trustee and no appointment of a successor trustee will be effective until the acceptance of appointment by a successor trustee.

Each indenture provides that our obligations to compensate the trustee and reimburse the trustee for expenses, disbursements and advances will be secured by a lien prior to that of the applicable senior debt securities upon the property and funds held or collected by the trustee as such, except funds held in trust for the payment of principal of, or interest, if any, on, such securities.

Consolidation, Merger or Sale of Assets

. Each indenture provides that we will not consolidate with or merge into, or sell, lease or convey our property as an entirety or substantially as an entirety to any other person unless the successor corporation assumes our obligations under the debt securities and the indentures and is organized and existing under the laws of the United States, any state thereof or the District of Columbia.

Senior Debt Securities

General

. The senior debt securities will be unsecured and issued under the senior debt indenture between us and UMB Bank & Trust, n.a. and, unless otherwise specified in the applicable prospectus supplement, will rank equally with our other unsecured and senior indebtedness. The senior debt indenture does not limit the aggregate principal amount of senior debt securities that may be issued under the senior debt indenture. The following summaries of some important provisions of the senior debt indenture (including its supplements) are not complete and are subject to, and qualified in their entirety by, all of the provisions of the senior debt indenture, which is an exhibit to the registration statement of which this prospectus forms a part.

Ranking

. The senior debt securities will be our direct unsecured general obligations and will rank equally with all of our other unsecured and unsubordinated debt.

We are a holding company that derives substantially all of our income from our operating subsidiaries and primarily from our utility subsidiaries. As a result, our cash flows and consequent ability to service our debt, including the senior debt securities, are dependent upon the earnings of our subsidiaries and distribution of those earnings to us and other payments or distributions of funds by our subsidiaries to us, including payments of principal and interest under intercompany indebtedness. Our operating subsidiaries are separate and distinct legal entities and will have no obligation, contingent or otherwise, to pay any dividends or make any other distributions (except for payments required under the terms of intercompany indebtedness) to us or to otherwise pay amounts due with respect to the senior debt securities or to make specific funds available for such payments. Various financing arrangements, charter provisions and regulatory requirements may impose certain restrictions on the ability of our subsidiaries to transfer funds to us in the form of cash dividends, loans or advances. Furthermore, except to the extent we have a priority or equal claim against our subsidiaries as a creditor, the senior debt securities will be effectively subordinated to debt and preferred stock at the subsidiary level because, as the direct or indirect common shareholder of our subsidiaries, we will be subject to the prior claims of creditors and holders of preferred stock of our subsidiaries.

Events of Default

. Each of the following will constitute an event of default under the senior debt indenture with respect to senior debt securities of any series:

|

|

|

|

•

|

failure to pay principal of or premium, if any, on any senior debt security of that series, as the case may be, within three business days after maturity;

|

|

|

|

|

•

|

failure to pay interest on the senior debt securities of such series within 60 days after the same becomes due and payable;

|

|

|

|

|

•

|

failure to perform or breach of any of our other covenants or warranties in the senior debt indenture (other than a covenant or warranty solely for the benefit of one or more series of senior debt securities other than that series) for 90 days after written notice to us by the trustee or to us and the trustee by the holders of at least 33% in aggregate principal amount of the outstanding senior debt securities of that series;

|

|

|

|

|

•

|

certain events of bankruptcy, insolvency, reorganization, assignment or receivership; or

|

|

|

|

|

•

|

any other event of default specified in the applicable prospectus supplement with respect to senior debt securities of a particular series.

|

No event of default with respect to the senior debt securities of a particular series necessarily constitutes an event of default with respect to the senior debt securities of any other series issued under the senior debt indenture.

If an event of default with respect to any series of senior debt securities occurs and is continuing, then either the trustee for such series or the holders of at least 33% in aggregate principal amount of the outstanding senior debt securities of that series, by notice in writing, may declare the principal amount of and interest on all of the senior debt securities of that series to be due and payable immediately. However, if the event of default applies to more than one series of senior debt securities under the senior debt indenture, the trustee for that series or the holders of at least 33% in aggregate principal amount of the outstanding senior debt securities of all those series, considered as one class, and not the holders of the senior debt securities of any one of such series, may make such declaration of acceleration.

At any time after an acceleration with respect to the senior debt securities of any series has been declared, but before a judgment or decree for the payment of the money due has been obtained, the event or events of default giving rise to such acceleration will be considered waived, and the acceleration will be considered rescinded and annulled, if

|

|

|

|

•

|

we pay or deposit with the trustee for such series a sum sufficient to pay all matured installments of interest on all senior debt securities of that series, the principal of and premium, if any, on the senior debt securities of that series that have become due otherwise than by acceleration and interest, if any, thereon at the rate or rates specified in such senior debt securities, interest, if any, upon overdue installments of interest at the rate or rates specified in such senior debt securities, to the extent that payment of such interest is lawful, and all amounts due to the trustee for that series under the senior debt indenture; or

|

|

|

|

|

•

|

any other event or events of default with respect to the senior debt securities of such series have been cured or waived as provided in the senior debt indenture.

|

However, no such waiver or rescission and annulment shall extend to or shall affect any subsequent default or impair any related right.

There is no automatic acceleration, even in the event of our bankruptcy, insolvency or reorganization.

Other than its duties in case of an event of default, the trustee is not obligated to exercise any of its rights or powers under the senior debt indenture at the request, order or direction of any of the holders, unless the holders offer the trustee a reasonable indemnity. If they provide a reasonable indemnity, the holders of a majority in principal amount of any series of senior debt securities will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee, or exercising any power conferred upon the trustee. However, if the event of default relates to more than one series, only the holders of a majority in aggregate principal amount of all affected series will have the right to give this direction. The trustee is not obligated to comply with directions that conflict with law or other provisions of the senior debt indenture.

No holder of senior debt securities of any series will have any right to institute any proceeding under the senior debt indenture, or to exercise any remedy under the senior debt indenture, unless:

|

|

|

|

•

|

the holder has previously given to the trustee written notice of a continuing event of default;

|

|

|

|

|

•

|

the holders of a majority in aggregate principal amount of the outstanding senior debt securities of all series in respect of which an event of default shall have occurred and be continuing have made a written request to the trustee and have offered reasonable indemnity to the trustee to institute proceedings; and

|

|

|

|

|

•

|

the trustee has failed to institute any proceeding for 60 days after notice and has not received any direction inconsistent with the written request of holders during that period.

|

However, the limitations discussed above do not apply to a suit by a holder of a debt security for payment of the principal of, or premium, if any, or interest, if any, on, a senior debt security on or after the applicable due date.

Modification and Waiver

. We and the trustee may enter into one or more supplemental indentures without the consent of any holder of senior debt securities for any of the following purposes:

|

|

|

|

•

|

to evidence the assumption by any permitted successor of our covenants in the senior debt indenture and in the senior debt securities;

|

|

|

|

|

•

|

to add additional covenants or to surrender any of our rights or powers under the senior debt indenture;

|

|

|

|

|

•

|

to add additional events of default;

|

|

|

|

|

•

|

to change, eliminate, or add any provision to the senior debt indenture; provided, however, if the change, elimination, or addition will adversely affect the interests of the holders of senior debt securities of any series in any material respect, such change, elimination, or addition will become effective only:

|

|

|

|

|

•

|

when the consent of the holders of senior debt securities of such series has been obtained in accordance with the senior debt indenture; or

|

|

|

|

|

•

|

when no debt securities of the affected series remain outstanding under the senior debt indenture;

|

•

to provide collateral security for all but not part of the senior debt securities;

|

|

|

|

•

|

to establish the form or terms of senior debt securities of any other series as permitted by the senior debt indenture;

|

|

|

|

|

•

|

to provide for the authentication and delivery of bearer securities and coupons attached thereto;

|

|

|

|

|

•

|

to evidence and provide for the acceptance of appointment of a successor trustee;

|

|

|

|

|

•

|

to provide for the procedures required for use of a noncertificated system of registration for the senior debt securities of all or any series;

|

|

|

|

|

•

|

to change any place where principal, premium, if any, and interest shall be payable, debt securities may be surrendered for registration of transfer or exchange and notices to us may be served; or

|

|

|

|

|

•

|

to cure any ambiguity or inconsistency or to make any other provisions with respect to matters and questions arising under the senior debt indenture; provided that such action shall not adversely affect the interests of the holders of senior debt securities of any series in any material respect.

|

The holders of a majority in aggregate principal amount of the senior debt securities of all series then outstanding may waive our compliance with certain restrictive provisions of the senior debt indenture. The holders of a majority in principal amount of the outstanding senior debt securities of any series may waive any past default under the senior debt indenture with respect to that series, except a default in the payment of principal, premium, if any, or interest and certain covenants and provisions of the senior debt indenture that cannot be modified or be amended without the consent of the holder of each outstanding senior debt security of the series affected.

If the Trust Indenture Act of 1939 is amended after the date of the senior debt indenture in such a way as to require changes to the senior debt indenture, the senior debt indenture will be deemed to be amended so as to conform to the amendment of

the Trust Indenture Act of 1939. We and the trustee may, without the consent of any holders, enter into one or more supplemental indentures to evidence such an amendment.

The consent of the holders of a majority in aggregate principal amount of the senior debt securities of all series then outstanding is required for all other modifications to the senior debt indenture. However, if less than all of the series of senior debt securities outstanding are directly affected by a proposed supplemental indenture, then the consent only of the holders of a majority in aggregate principal amount of all series that are directly affected will be required. No such amendment or modification may:

|

|

|

|

•

|

change the stated maturity of the principal of, or any installment of principal of or interest on, any senior debt security, or reduce the principal amount of any senior debt security or its rate of interest or change the method of calculating such interest rate or reduce any premium payable upon redemption, or change the currency in which payments are made, or impair the right to institute suit for the enforcement of any payment on or after the stated maturity of any senior debt security, without the consent of the holder;

|

|

|

|

|

•

|

reduce the percentage in principal amount of the outstanding senior debt securities of any series whose consent is required for any supplemental indenture or any waiver of compliance with a provision of the senior debt indenture or any default thereunder and its consequences, or reduce the requirements for quorum or voting, without the consent of all the holders of the series; or

|

|

|

|

|

•

|

modify certain of the provisions of the senior debt indenture relating to supplemental indentures, waivers of certain covenants and waiver of past defaults with respect to the senior debt securities of any series, without the consent of the holder of each outstanding senior debt security affected thereby.

|

A supplemental indenture that changes the senior debt indenture solely for the benefit of one or more particular series of senior debt securities, or modifies the rights of the holders of senior debt securities of one or more series, will not affect the rights under the senior debt indenture of the holders of the senior debt securities of any other series.

The senior debt indenture provides that senior debt securities owned by us, any of our affiliates or anyone else required to make payment on the senior debt securities shall be disregarded and considered not to be outstanding in determining whether the required holders have given a request or consent.

We may fix in advance a record date to determine the required number of holders entitled to give any request, demand, authorization, direction, notice, consent, waiver or other act of the holders, but we shall have no obligation to do so. If a record date is fixed for that purpose, the request, demand, authorization, direction, notice, consent, waiver or other act of the holders may be given before or after that record date, but only the holders of record at the close of business on that record date will be considered holders for the purposes of determining whether holders of the required percentage of the outstanding senior debt securities have authorized or agreed or consented to the request, demand, authorization, direction, notice, consent, waiver or other act of the holders. For that purpose, the outstanding senior debt securities shall be computed as of the record date. Any request, demand, authorization, direction, notice, consent, election, waiver or other act of a holder shall bind every future holder of the same senior debt securities and the holder of every senior debt security issued upon the registration of transfer of or in exchange for those senior debt securities. A transferee will be bound by acts of the trustee or us taken in reliance upon an act of holders whether or not notation of that action is made upon that senior debt security.

Satisfaction and Discharge

. We will be discharged from our obligations on the senior debt securities of a particular series, or any portion of the principal amount of the senior debt securities of such series, if we irrevocably deposit with the trustee sufficient cash or government securities to pay the principal, or portion of principal, interest, any premium and any other sums when due on the senior debt securities of such series at their maturity, stated maturity date, or redemption.

The indenture will be deemed satisfied and discharged when no senior debt securities remain outstanding and when we have paid all other sums payable by us under the senior debt indenture.

Junior Subordinated Debt Securities

General

. The junior subordinated debt securities will be unsecured and issued under the junior subordinated debt indenture between us and U.S. Bank National Association and, unless otherwise specified in the applicable prospectus supplement, will rank equally with our other unsecured and subordinated indebtedness. The junior subordinated debt indenture does not limit the aggregate principal amount of junior subordinated debt securities that may be issued under the junior subordinated debt indenture. The following summaries of some important provisions of the junior subordinated debt indenture (including its supplements) are not complete and are subject to, and qualified in their entirety by, all of the provisions of the junior subordinated debt indenture, which is an exhibit to the registration statement of which this prospectus forms a part.

Subordination

. Unless otherwise specified in the applicable prospectus supplement, the junior subordinated debt securities will rank subordinated and junior in right of payment, to the extent set forth in the junior subordinated indenture, to all of our “priority indebtedness.”

“Priority Indebtedness” means the principal, premium, interest and any other payment in respect of any of the following:

|

|

|

|

•

|

all of our current and future indebtedness for borrowed or purchase money whether or not evidenced by notes, debentures, bonds or other similar written instruments;

|

|

|

|

|

•

|

our obligations under synthetic leases, finance leases and capitalized leases;

|

|

|

|

|

•

|

our obligations for reimbursement under letters of credit, surety bonds, banker’s acceptances, security purchase facilities or similar facilities issued for our account;

|

|

|

|

|

•

|

any of our other indebtedness or obligations with respect to derivative contracts, including commodity contracts, interest rate, commodity and currency swap agreements, forward contracts and other similar agreements or arrangements; and

|

|

|

|

|

•

|

all indebtedness of others of the kinds described in the preceding categories which we have assumed, endorsed or guaranteed or with respect to which we have a similar contingent obligation.

|

However, “Priority Indebtedness” will not include trade accounts payable, accrued liabilities arising in the ordinary course of business, indebtedness to our subsidiaries, and any other indebtedness that effectively by its terms, or expressly provides that it, ranks on parity with, or junior to, the junior subordinated debt securities.

If we default in the payment of principal of or interest on any priority indebtedness when it becomes due and payable after any applicable grace period, then, unless and until the default is cured or waived or ceases to exist, we cannot make a payment on account of or redeem or otherwise acquire the junior subordinated debt securities issued under the junior subordinated debt indenture. If there is any insolvency, bankruptcy, liquidation or other similar proceeding relating to us, our creditors or our property, then all priority indebtedness must be paid in full before any payment may be made to any holders of junior subordinated debt securities. Holders of junior subordinated debt securities must return and deliver any payments received by them directly to the holders of priority indebtedness until all priority indebtedness is paid in full.

The junior subordinated debt indenture does not limit the total amount of priority indebtedness that may be issued.

Events of Default

. The junior subordinated debt indenture provides that events of default regarding any series of junior subordinated debt securities include the following events that shall have occurred and be continuing:

|

|

|

|

•

|

failure to pay required interest on the series of junior subordinated debt securities for 30 days;

|

|

|

|

|

•

|

failure to pay when due principal on the series of junior subordinated debt securities;

|

|

|

|

|

•

|

failure to perform, for 90 days after notice, any other covenant in the junior subordinated indenture applicable to the series of junior subordinated debt securities; and

|

|

|

|

|

•

|

certain events of bankruptcy or insolvency, whether voluntary or not.

|

If an event of default regarding junior subordinated debt securities of any series should occur and be continuing, either the junior subordinated debt securities trustee or the holders of at least 25% in total principal amount of outstanding junior subordinated debt securities of a series may declare each junior subordinated debt security of that series immediately due and payable.

Holders of a majority in total principal amount of the outstanding junior subordinated debt securities of any series will be entitled to control certain actions of the junior subordinated debt securities trustee and to waive past defaults regarding that series. The trustee generally will not be required to take any action requested, ordered or directed by any of the holders of junior subordinated debt securities, unless one or more of those holders shall have offered to the trustee reasonable security or indemnity.

Before any holder of any series of junior subordinated debt securities may institute action for any remedy, except payment on that holder’s junior subordinated debt securities when due, the holders of not less than a majority in principal amount of the junior subordinated debt securities of that series outstanding must request the junior subordinated debt securities trustee to take action. Holders must also offer and give the junior subordinated debt securities trustee satisfactory security and indemnity against liabilities incurred by the trustee for taking that action.

We are required to annually furnish the junior subordinated debt securities trustee a statement as to our compliance with all conditions and covenants under the junior subordinated debt indenture. The junior subordinated debt securities trustee is required, within 90 days after the occurrence of a default with respect to a series of junior subordinated debt securities, to give notice of all defaults affecting that series of junior subordinated debt securities to each holder of such series. However, the junior subordinated debt indenture provides that the junior subordinated debt securities trustee may withhold notice to

the holders of the junior subordinated debt securities of any series of any default affecting such series, except payment of principal and interest on holders’ junior subordinated debt securities when due, if we, in some cases with the trustee’s input, consider withholding notice to be in the interests of the holders of the junior subordinated debt securities of that series.

Modification and Waiver

. The junior subordinated debt indenture permits us and the junior subordinated debt securities trustee to enter into supplemental indentures without the consent of the holders of the junior subordinated debt securities to:

|

|

|

|

•

|

establish the form and terms of any series of securities under the junior subordinated debt indenture;

|

|

|

|

|

•

|

secure the notes or debentures with property or assets;

|

|

|

|

|

•

|

evidence the succession of another corporation to us, and the assumption by the successor corporation of our obligations, covenants and agreements under the subordinated indenture;

|

|

|

|

|

•

|

add covenants from us for the benefit of the holders of the junior subordinated debt securities;

|

|

|

|

|

•

|

add or change any of the provisions of the junior subordinated debt indenture to permit or facilitate the issuance of junior subordinated debt securities in bearer form, registrable or not registrable as to principal, and with or without interest coupons;

|

|

|

|

|

•

|

change or eliminate any provisions of the junior subordinated debt indenture;

provided, however

, that any such change or elimination shall become effective only when there are no junior subordinated debt securities of any series outstanding created prior to the execution of such supplemental indenture which are entitled to the benefit of such provision;

|

|

|

|

|

•

|

qualify, or maintain the qualification of, the junior subordinated debt indenture under the Trust Indenture Act of 1939, as amended;

|

|

|

|

|

•

|

cure any ambiguity or correct or supplement any provision in the junior subordinated debt indenture or any supplement to the junior subordinated debt indenture, provided that the action does not adversely affect the interests of the holders of the junior subordinated debt securities in any material respect; and

|

|

|

|

|

•

|

evidence and provide for the acceptance of a successor trustee.

|

The junior subordinated debt indenture also permits us and the junior subordinated debt securities trustee, with the consent of the holders of a majority in total principal amount of the junior subordinated debt securities of all series then outstanding and affected (voting as one class), to change in any manner the provisions of the junior subordinated debt indenture or modify in any manner the rights of the holders of the junior subordinated debt securities of each such affected series. We and the trustee may not, without the consent of the holder of each of the junior subordinated debt securities affected, enter into any supplemental indenture to:

|

|

|

|

•

|

change the time of payment of the principal;

|

|

|

|

|

•

|

reduce the principal amount of the junior subordinated debt securities;

|

|

|

|

|

•

|

reduce the rate or extend the time of payment of interest on the junior subordinated debt securities;

|

|

|

|

|

•

|

reduce any amount payable upon redemption of the subordinated debt securities;

|

|

|

|

|

•

|

modify the provisions with respect to the subordination of outstanding junior subordinated debt securities of any series in a manner adverse to the holders thereof; or

|

|

|

|

|

•

|

impair the right to institute suit for the enforcement of any payment on any junior subordinated debt securities when due.

|

In addition, no modification may reduce the percentage in principal amount of the junior subordinated debt securities of the affected series, the consent of whose holders is required for that modification or for any waiver provided for in the junior subordinated debt indenture.

Before the acceleration of the maturity of any junior subordinated debt securities, the holders, voting as one class, of a majority in total principal amount of the junior subordinated debt securities with respect to which a default or event of default has occurred and is continuing, may, on behalf of the holders of all such affected junior subordinated debt securities, waive any past default or event of default and its consequences, except a default or event of default in the payment of the principal or interest or in respect of a covenant or provision of the applicable indenture or of any junior subordinated debt securities that cannot be modified or amended without the consent of the holder of each of the junior subordinated debt securities affected.

Satisfaction and Discharge

. The junior subordinated debt indenture provides that, at our option, we will be discharged from all obligations in respect of the junior subordinated debt securities of a particular series then outstanding (except for certain

obligations to register the transfer of or exchange the junior subordinated debt securities of that series, to replace stolen, lost or mutilated junior subordinated debt securities of that series, and to maintain paying agencies) if all of the securities of such series have become due and payable, or are to become due and payable within one year, and we, in each case, irrevocably deposit in trust with the relevant trustee money and/or securities backed by the full faith and credit of the United States that through the payment of the principal thereof and the interest thereon in accordance with their terms, will provide money in an amount sufficient to pay all the principal and interest on the junior subordinated debt securities of that series on the stated maturities of the junior subordinated debt securities in accordance with the terms thereof.

DESCRIPTION OF CAPITAL STOCK

General

The following descriptions of our preferred and common stock and the relevant provisions of our articles of incorporation and bylaws are summaries. These summaries are qualified by reference to (1) our articles of incorporation and bylaws that have been previously filed with the SEC and are exhibits to the registration statement of which this prospectus is a part and (2) the applicable provisions of The Missouri General and Business Corporation Law.

Under our articles of incorporation, we are authorized to issue up to 75,000,000 shares of capital stock, consisting of 70,000,000 shares of common stock, $l.00 par value per share, and 5,000,000 shares of preferred stock, $25 par value per share. At June 30, 2016, 45,636,678 shares of common stock and no shares of preferred stock were issued and outstanding.

Because we are a holding company and conduct all of our operations through our subsidiaries, our cash flow and ability to pay dividends will be dependent on the earnings and cash flows of our subsidiaries and the distribution or other payment of those earnings to us in the form of dividends, or in the form of loans to or repayments of loans from us. Some of our subsidiaries may have restrictions on their ability to pay dividends including covenants under their borrowing arrangements and mortgage indentures, and possibly also restrictions imposed by their regulators. Currently, the Mortgage and Deed of Trust of Laclede Gas Company, under which it issues its first mortgage bonds, contains a covenant that restricts its ability to pay dividends to us as its sole common stock shareholder. Under that covenant, as of June 30, 2016, $917 million was available to pay dividends. Further, the right of common shareholders to receive dividends may be subject to our prior payment of dividends on any outstanding shares of preferred stock.

Description of Preferred Stock

Our articles of incorporation authorize our board of directors to approve the issuance of preferred stock in one or more series, without shareholder action. Our board can determine the rights, preferences and limitations of each series. Before issuing a series of preferred stock, our board will adopt resolutions creating and designating the series as a series of preferred stock. Our board of directors has the authority to determine or fix the following terms with respect to shares of any series of preferred stock:

|

|

|

|

•

|

the dividend rate, the dates of payment, and the date from which dividends will accumulate, if dividends are to be cumulative;

|

|

|

|

|

•

|

whether and upon what terms the shares will be redeemable;

|

|

|

|

|

•

|

whether and upon what terms the shares will have a sinking fund;

|

|

|

|

|

•

|

whether and upon what terms the shares will be convertible or exchangeable;

|

|

|

|

|

•

|

whether the shares will have voting rights and the terms thereof;

|

|

|

|

|

•

|

any amounts payable to the holders upon liquidation or dissolution, if any; and

|

|

|

|

|

•

|

any other preferences, qualifications, limitations, restrictions and special or relative rights.

|

These terms will be described in the prospectus supplement for any series of preferred stock that we offer. In addition, you should read the prospectus supplement relating to the particular series of the preferred stock offered thereby for specific terms, including:

|

|

|

|

•

|

the title of the series of preferred stock and the number of shares offered;

|

|

|

|

|

•

|

the initial public offering price at which we will issue the preferred stock; and

|

|

|

|

|

•

|

any additional dividend, liquidation, redemption, sinking fund and other rights, preferences, privileges and limitations and restrictions.

|

When we issue the preferred stock, the shares will be fully paid and non-assessable. This means that the full purchase price for the outstanding preferred stock will have been paid and the holder of the preferred stock will not be assessed any additional monies for the preferred stock. Unless the applicable prospectus supplement specifies otherwise:

|

|

|

|

•

|

each series of preferred stock will rank senior to our common stock and equally in all respects with the outstanding shares of each other series of preferred stock; and

|

|

|

|

|

•

|

holders of the preferred stock will have no preemptive rights to subscribe for any additional securities that we may issue in the future. This means that the holder of preferred stock will have no right, as holder of preferred stock, to buy any portion of preferred or common stock that we may issue in the future.

|

Description of Common Stock

Listing

. Our outstanding shares of common stock are listed on the New York Stock Exchange under the symbol “SR.” Any additional common stock we issue will also be listed on the New York Stock Exchange.

Liquidation Rights

.

In the event of any dissolution, liquidation or winding up of our affairs voluntarily or involuntarily, the holders of our common stock will be entitled to receive the remainder, if any, of our assets after the payment of all our debts and liabilities and after the payment in full of any preferential amounts to which holders of any preferred stock may be entitled.

Voting Rights

.

Except as otherwise provided by law and subject to the voting rights of holders of our preferred stock that may be issued in the future, all voting power rests exclusively in the holders of shares of our common stock. Each holder of our common stock is entitled to one vote per share on all matters submitted to a vote at a meeting of shareholders, including the election of directors. The common stock votes together as a single class. The holders of our common stock are not entitled to cumulate votes for the election of directors. At annual and special meetings of shareholders, the holders of a majority of the outstanding shares of common stock, present in person or by proxy, constitute a quorum.

Miscellaneous

. The holders of our common stock have no preemptive or preferential rights to subscribe for or purchase any part of any new or additional issue of stock or securities convertible into stock. The outstanding shares of our common stock and the shares of common stock offered hereby will be, upon payment for them, fully paid and non-assessable. Our common stock does not contain any redemption provisions or conversion rights.

Transfer Agent and Registrar

. Computershare Trust Company, N. A. acts as transfer agent and registrar for our common stock. Its address is P. O. Box 30170, College Station, TX 77842-3170. You can reach it at 1-800-884-4225.

Certain Anti-takeover Matters

It is not the intent of our board of directors to discourage legitimate offers to enhance shareholder value. Provisions of our articles of incorporation or bylaws, however, may have the effect of discouraging unilateral tender offers or other attempts to acquire our business. These provisions include the classification of our directors with three-year staggered terms, the requirement that director nominations by shareholders be made not less than 90 nor more than 120 days prior to the date of the shareholder meeting, and the ability of the board, without further action of the holders of common stock, to issue one or more series of preferred stock from time to time, which may have terms more favorable than the common stock, including, among other things, preferential dividend, liquidation, voting and redemption rights.

These provisions might discourage a potentially interested purchaser from attempting a unilateral takeover bid for us on terms that some shareholders might favor. If these provisions discourage potential takeover bids, they might limit the opportunity for our shareholders to sell their shares at a premium.

In addition, our articles of incorporation do not provide for cumulative voting in the election of directors. Cumulative voting permits shareholders to multiply their number of votes by the total number of directors being elected and to cast their total number of votes for one or more candidates in each shareholder’s discretion.

Our bylaws also include provisions setting forth specific conditions and restrictions under which business may be transacted at meetings of shareholders. For example, no business may be transacted at a meeting unless it is:

|

|

|

|

•

|

specified in the notice of meeting;

|

|

|

|

|

•

|

otherwise brought before the meeting by or at the direction of the board of directors or a committee thereof; or

|

|

|

|

|

•

|

brought before the meeting by a shareholder of record who provided notice and other specified information in writing to the corporate secretary not less than 90 nor more than 120 days prior to the meeting.

|

These provisions may restrict the content of the issues to be discussed at a shareholders meeting.

In addition, the issuance of authorized but unissued shares of our common or preferred stock may have an anti-takeover effect. These shares might be issued by our board of directors without shareholder approval in transactions that might prevent or render more difficult or costly the completion of a takeover transaction by, for example, diluting voting or other

rights of the proposed acquirer. In this regard, our articles of incorporation grant the board of directors broad powers to establish the rights and preferences of the authorized but unissued preferred stock, one or more series of which could be issued entitling holders to vote separately as a class on any proposed merger or consolidation, to convert the stock into shares of our common stock or possibly other securities, to demand redemption at a specified price under prescribed circumstances related to a change in control or to exercise other rights designed to impede a takeover.

Missouri Shareholder Protection Statutes

We are subject to Missouri corporate statutes that restrict the voting rights of a person who acquires 20% or more of our outstanding common stock as well as that person’s ability to enter into a business combination with us.

The control share acquisition statute provides that shares acquired that would cause the acquiring person’s aggregate voting power to meet or exceed any of three thresholds (20%, 33-1/3% or a majority) have no voting rights unless such voting rights are granted by a majority vote of the holders of the shares not owned by the acquiring person or any of our officers or directors or employee-directors. The statute sets out a procedure under which the acquiring person may call a special shareholders meeting for the purpose of considering whether voting rights should be conferred. Acquisitions as part of a merger or exchange offer arising out of an agreement to which we are a party are exempt from the statute.