UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Form 10-K/A

Amendment No. 1 |

| | |

(Mark One) | | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2014 |

Or |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 001-33160

Spirit AeroSystems Holdings, Inc.

(Exact name of registrant as specified in its charter) |

| | |

Delaware | | 20-2436320 |

(State of Incorporation) | | (I.R.S. Employer Identification Number) |

3801 South Oliver Wichita, Kansas 67210 (Address of principal executive offices and zip code) |

Registrant's telephone number, including area code: (316) 526-9000 |

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class | | Name of Each Exchange on Which Registered |

Class A Common Stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer þ | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant, based on the closing price of the class A common stock on July 3, 2014, as reported on the New York Stock Exchange was approximately $4,527,055,947.

As of February 4, 2015, the registrant had outstanding 141,089,005 shares of class A common stock, $0.01 par value per share, and 121 shares of class B common stock, $0.01 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the 2015 Annual Meeting of Stockholders to be filed not later than 120 day after the end of the fiscal year covered by this Report are incorporated herein by reference in Part III of this Annual Report on Form 10-K.

Spirit AeroSystems Holdings, Inc.

Explanatory Note

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to the Annual Report on Form 10-K of Spirit AeroSystems Holdings, Inc. (the “Company”) for the fiscal year ended December 31, 2014, initially filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 13, 2015 (the “Original Filing”), is being filed solely to correct typographical errors contained in our predecessor independent auditor’s (i) Report of Independent Registered Public Accounting Firm appearing on page 67 of the Original Filing and (ii) consent appearing on Exhibit 23.1 Consent of PricewaterhouseCoopers LLP in the Original Filing. The dates of each of the aforementioned Report of Independent Registered Public Accounting Firm and consent were incorrect in the Original Filing.

Except for the foregoing amended information, this Form 10-K/A does not amend or update any other information contained in the Original Filing or reflect any events that have occurred since the date of the Original Filing.

TABLE OF CONTENTS

Part II

Item 8. Financial Statements and Supplementary Data

SPIRIT AEROSYSTEMS HOLDINGS, INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

| |

| Page |

Consolidated Financial Statements of Spirit AeroSystems Holdings, Inc. for the periods ended December 31, 2014, December 31, 2013 and December 31, 2012 | |

| |

| |

| |

| |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of Spirit AeroSystems Holdings, Inc.

We have audited the accompanying consolidated balance sheet of Spirit AeroSystems Holdings, Inc. as of December 31, 2014, and the related consolidated statements of operations, comprehensive income (loss), shareholders' equity and cash flows for the year ended December 31, 2014. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Spirit AeroSystems Holdings, Inc. at December 31, 2014 and the consolidated results of its operations and its cash flows for the year ended December 31, 2014, in conformity with U.S. generally accepted accounting principles.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Spirit AeroSystems Holdings, Inc.'s internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated February 13, 2015 expressed an unqualified opinion thereon.

/s/ Ernst & Young LLP

Wichita, Kansas

February 13, 2015

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of Spirit AeroSystems Holdings, Inc.

In our opinion, the consolidated balance sheet as of December 31, 2013 and the related consolidated statements of operations, of comprehensive income, of shareholders’ equity and of cash flows for each of the two years in the period ended December 31, 2013 present fairly, in all material respects, the financial position of Spirit AeroSystems Holdings, Inc. and its subsidiaries at December 31, 2013, and the results of their operations and their cash flows for each of the two years in the period ended December 31, 2013, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Kansas City, Missouri

February 19, 2014

Spirit AeroSystems Holdings, Inc.

Consolidated Statements of Operations

|

| | | | | | | | | | | |

| For the Twelve Months Ended |

| December 31,

2014 | | December 31,

2013 | | December 31,

2012 |

| ($ in millions, except per share data) |

Net Revenues | $ | 6,799.2 |

| | $ | 5,961.0 |

| | $ | 5,397.7 |

|

Operating costs and expenses | | | | | |

Cost of sales | 5,711.0 |

| | 6,059.5 |

| | 5,245.3 |

|

Selling, general and administrative | 233.8 |

| | 200.8 |

| | 172.2 |

|

Impact from severe weather event | — |

| | 30.3 |

| | (146.2 | ) |

Research and development | 29.3 |

| | 34.7 |

| | 34.1 |

|

Loss on divestiture of programs (see Note 28) | 471.1 |

| | — |

| | — |

|

Total operating costs and expenses | 6,445.2 |

| | 6,325.3 |

| | 5,305.4 |

|

Operating income (loss) | 354.0 |

| | (364.3 | ) | | 92.3 |

|

Interest expense and financing fee amortization | (88.1 | ) | | (70.1 | ) | | (82.9 | ) |

Interest income | 0.6 |

| | 0.3 |

| | 0.2 |

|

Other (expense) income, net | (4.1 | ) | | 3.3 |

| | 1.8 |

|

Income (loss) before income taxes and equity in net income (loss) of affiliates | 262.4 |

| | (430.8 | ) | | 11.4 |

|

Income tax benefit (provision) | 95.9 |

| | (191.1 | ) | | 24.1 |

|

Income (loss) before equity in net income (loss) of affiliates | 358.3 |

| | (621.9 | ) | | 35.5 |

|

Equity in net income (loss) of affiliates | 0.5 |

| | 0.5 |

| | (0.7 | ) |

Net income (loss) | $ | 358.8 |

| | $ | (621.4 | ) | | $ | 34.8 |

|

Earnings (loss) per share | | | | | |

Basic | $ | 2.55 |

| | $ | (4.40 | ) | | $ | 0.24 |

|

Diluted | $ | 2.53 |

| | $ | (4.40 | ) | | $ | 0.24 |

|

See notes to consolidated financial statements

Spirit AeroSystems Holdings, Inc.

Consolidated Statements of Comprehensive Income (Loss)

|

| | | | | | | | | | | |

| For the Twelve Months Ended |

| December 31,

2014 | | December 31,

2013 | | December 31,

2012 |

| ($ in millions) |

Net income (loss) | $ | 358.8 |

| | $ | (621.4 | ) | | $ | 34.8 |

|

Other comprehensive (loss) income, net of tax: | | | | | |

Unrealized (loss) on interest rate swaps, net of tax effect of zero for all respective periods | (1.1 | ) | | — |

| | — |

|

Less: reclassification adjustment for loss realized in net income, net of tax effect of zero, zero, $1.7, respectively | — |

| | — |

| | 2.9 |

|

Net (loss) gain on interest rate swaps | (1.1 | ) | | — |

| | 2.9 |

|

Less: reclassification adjustment for loss realized in net income, net of tax effect of zero for all respective periods | — |

| | — |

| | 0.1 |

|

Net gain on foreign currency hedge contracts | — |

| | — |

| | 0.1 |

|

Pension, SERP, and Retiree medical adjustments, net of tax effect of $1.3, ($51.5), $19.5, respectively | (78.0 | ) | | 84.8 |

| | (30.5 | ) |

Unrealized foreign exchange (loss) gain on intercompany loan, net of tax effect of $1.0, $0.4, $0.8, respectively | (3.5 | ) | | 1.2 |

| | 2.2 |

|

Foreign currency translation adjustments | (16.6 | ) | | 4.6 |

| | 6.3 |

|

Total other comprehensive (loss) income | (99.2 | ) | | 90.6 |

| | (19.0 | ) |

Total comprehensive income (loss) | $ | 259.6 |

| | $ | (530.8 | ) | | $ | 15.8 |

|

See notes to consolidated financial statements

Spirit AeroSystems Holdings, Inc.

Consolidated Balance Sheets

|

| | | | | | | |

| December 31,

2014 | | December 31,

2013 |

| ($ in millions) |

Current assets | | | |

Cash and cash equivalents | $ | 377.9 |

| | $ | 420.7 |

|

Accounts receivable, net | 605.6 |

| | 550.8 |

|

Inventory, net | 1,753.0 |

| | 1,842.6 |

|

Deferred tax asset-current | 53.2 |

| | 26.9 |

|

Other current assets | 262.4 |

| | 103.2 |

|

Total current assets | 3,052.1 |

| | 2,944.2 |

|

Property, plant and equipment, net | 1,783.6 |

| | 1,803.3 |

|

Pension assets | 203.4 |

| | 252.6 |

|

Other assets | 123.6 |

| | 107.1 |

|

Total assets | $ | 5,162.7 |

| | $ | 5,107.2 |

|

Current liabilities | | | |

Accounts payable | $ | 611.2 |

| | $ | 753.7 |

|

Accrued expenses | 329.1 |

| | 220.6 |

|

Profit sharing | 111.8 |

| | 38.4 |

|

Current portion of long-term debt | 9.4 |

| | 16.8 |

|

Advance payments, short-term | 118.6 |

| | 133.5 |

|

Deferred revenue, short-term | 23.4 |

| | 19.8 |

|

Deferred grant income liability — current | 10.2 |

| | 8.6 |

|

Other current liabilities | 45.1 |

| | 144.2 |

|

Total current liabilities | 1,258.8 |

| | 1,335.6 |

|

Long-term debt | 1,144.1 |

| | 1,150.5 |

|

Advance payments, long-term | 680.4 |

| | 728.9 |

|

Pension/OPEB obligation | 73.0 |

| | 69.8 |

|

Deferred grant income liability — non-current | 96.1 |

| | 108.2 |

|

Deferred revenue and other deferred credits | 27.5 |

| | 30.9 |

|

Other liabilities | 260.8 |

| | 202.3 |

|

Equity | | | |

Preferred stock, par value $0.01, 10,000,000 shares authorized, no shares issued | — |

| | — |

|

Common stock, Class A par value $0.01, 200,000,000 shares authorized, 141,084,378 and 120,946,429 shares issued, respectively | 1.4 |

| | 1.2 |

|

Common stock, Class B par value $0.01, 150,000,000 shares authorized, 4,745 and 23,851,694 shares issued, respectively | — |

| | 0.2 |

|

Additional paid-in capital | 1,035.6 |

| | 1,025.0 |

|

Accumulated other comprehensive loss | (153.8 | ) | | (54.6 | ) |

Retained earnings | 867.5 |

| | 508.7 |

|

Treasury stock, at cost (4,000,000 and zero shares, respectively) | (129.2 | ) | | — |

|

Total shareholders' equity | 1,621.5 |

| | 1,480.5 |

|

Noncontrolling interest | 0.5 |

| | 0.5 |

|

Total equity | 1,622.0 |

| | 1,481.0 |

|

Total liabilities and equity | $ | 5,162.7 |

| | $ | 5,107.2 |

|

See notes to consolidated financial statements

Spirit AeroSystems Holdings, Inc.

Consolidated Statements of Changes in Shareholders' Equity

|

| | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings/ Accumulated Deficit | | |

| | |

| Shares | | Amount | | Total |

| ($ in millions, except share data) |

Balance — December 31, 2011 | 142,865,643 |

| | $ | 1.4 |

| | $ | 995.9 |

| | $ | (126.2 | ) | | $ | 1,093.1 |

| | $ | 1,964.2 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 34.8 |

| | 34.8 |

|

Employee equity awards | 905,438 |

| | — |

| | 15.3 |

| | — |

| | — |

| | 15.3 |

|

Stock forfeitures | (123,439 | ) | | — |

| | — |

| | — |

| | — |

| | — |

|

Excess tax benefits from share-based payment arrangements | — |

| | — |

| | 1.1 |

| | — |

| | — |

| | 1.1 |

|

SERP shares issued | 49,536 |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Other comprehensive loss | — |

| | — |

| | — |

| | (19.0 | ) | | — |

| | (19.0 | ) |

Balance — December 31, 2012 | 143,697,178 |

| | 1.4 |

| | 1,012.3 |

| | (145.2 | ) | | 1,127.9 |

| | 1,996.4 |

|

Net loss | — |

| | — |

| | — |

| | — |

| | (621.4 | ) | | (621.4 | ) |

Equity in joint venture | — |

| | — |

| | — |

| | — |

| | 2.2 |

| | 2.2 |

|

Employee equity awards | 1,979,066 |

| | — |

| | 12.6 |

| | — |

| | — |

| | 12.6 |

|

Stock forfeitures | (668,263 | ) | | — |

| | — |

| | — |

| | — |

| | — |

|

Net shares settled | (240,359 | ) | | — |

| | — |

| | — |

| | — |

| | |

Excess tax benefits from share-based payment arrangements | — |

| | — |

| | 0.1 |

| | — |

| | — |

| | 0.1 |

|

SERP shares issued | 30,501 |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Other comprehensive income | — |

| | — |

| | — |

| | 90.6 |

| | — |

| | 90.6 |

|

Balance — December 31, 2013 | 144,798,123 |

| | 1.4 |

| | 1,025.0 |

| | (54.6 | ) | | 508.7 |

| | 1,480.5 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 358.8 |

| | 358.8 |

|

Employee equity awards | 719,214 |

| | — |

| | 8.2 |

| | — |

| | — |

| | 8.2 |

|

Stock forfeitures | (249,444 | ) | | — |

| | — |

| | — |

| | — |

| | — |

|

Net shares settled | (256,332 | ) | | — |

| | — |

| | — |

| | — |

| | — |

|

Excess tax benefits from share-based payment arrangements | 77,562 |

| | — |

| | 2.4 |

| | — |

| | — |

| | 2.4 |

|

Treasury shares | (4,000,000 | ) | | — |

| | — |

| | — |

| | — |

| | (129.2 | ) |

Other comprehensive loss | — |

| | — |

| | — |

| | (99.2 | ) | | — |

| | (99.2 | ) |

Balance — December 31, 2014 | 141,089,123 |

| | $ | 1.4 |

| | $ | 1,035.6 |

| | $ | (153.8 | ) | | $ | 867.5 |

| | $ | 1,621.5 |

|

See notes to consolidated financial statements

Spirit AeroSystems Holdings, Inc.

Consolidated Statements of Cash Flows |

| | | | | | | | | | | |

| For the Twelve Months Ended |

| December 31,

2014 | | December 31,

2013 | | December 31,

2012 |

| ($ in millions) |

Operating activities | | | | | |

Net income (loss) | $ | 358.8 |

| | $ | (621.4 | ) | | $ | 34.8 |

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities | | | | | |

Depreciation expense | 170.2 |

| | 158.2 |

| | 151.1 |

|

Amortization expense | 5.8 |

| | 3.1 |

| | 5.1 |

|

Amortization of deferred financing fees | 23.3 |

| | 6.7 |

| | 14.6 |

|

Accretion of customer supply agreement | 1.1 |

| | 0.6 |

| | 0.2 |

|

Employee stock compensation expense | 16.4 |

| | 19.6 |

| | 15.3 |

|

Excess tax benefit of share-based payment arrangements | (2.6 | ) | | (0.6 | ) | | (1.2 | ) |

Loss from interest rate swaps | 0.5 |

| | — |

| | 5.2 |

|

Gain from hedge contracts | (1.4 | ) | | (2.6 | ) | | (1.5 | ) |

Loss (gain) from foreign currency transactions | 10.5 |

| | (2.6 | ) | | (5.6 | ) |

Loss on divestiture of programs | 471.1 |

| | — |

| | — |

|

Loss on disposition of assets | 13.7 |

| | 0.1 |

| | 14.1 |

|

Deferred taxes | (8.4 | ) | | 202.8 |

| | (120.1 | ) |

Long-term tax (benefit) provision | (1.2 | ) | | (2.5 | ) | | 3.6 |

|

Pension and other post retirement benefits, net | (24.0 | ) | | (32.0 | ) | | (8.9 | ) |

Grant income | (8.6 | ) | | (7.3 | ) | | (5.8 | ) |

Equity in net (income) loss of affiliates | (0.5 | ) | | (0.5 | ) | | 0.7 |

|

Changes in assets and liabilities | | | | | |

Accounts receivable | (64.7 | ) | | (128.5 | ) | | (151.1 | ) |

Inventory, net | (332.2 | ) | | 666.0 |

| | 228.3 |

|

Accounts payable and accrued liabilities | (22.1 | ) | | 94.2 |

| | 109.8 |

|

Profit sharing/deferred compensation | 73.8 |

| | 10.0 |

| | 4.7 |

|

Advance payments | (52.9 | ) | | (41.9 | ) | | 239.6 |

|

Income taxes receivable/payable | (177.9 | ) | | (82.2 | ) | | (4.3 | ) |

Deferred revenue and other deferred credits | 2.2 |

| | (0.2 | ) | | (12.4 | ) |

Cash transferred on divestiture of programs | (160.0 | ) | | — |

| | — |

|

Other | 70.7 |

| | 21.6 |

| | 28.2 |

|

Net cash provided by operating activities | 361.6 |

| | 260.6 |

| | 544.4 |

|

Investing activities | | | | | |

Purchase of property, plant and equipment | (220.2 | ) | | (234.2 | ) | | (236.1 | ) |

Purchase of property, plant and equipment — severe weather event (see Note 4) | — |

| | (38.4 | ) | | (12.9 | ) |

Proceeds from sale of assets | 0.5 |

| | 0.7 |

| | 1.6 |

|

Change in Restricted Cash | (19.9 | ) | | — |

| | — |

|

Other | — |

| | 3.7 |

| | (1.4 | ) |

Net cash used in investing activities | (239.6 | ) | | (268.2 | ) | | (248.8 | ) |

Financing activities | | | | | |

Proceeds from revolving credit facility | — |

| | — |

| | 170.0 |

|

Payments on revolving credit facility | — |

| | — |

| | (170.0 | ) |

Proceeds from issuance of debt | — |

| | — |

| | 547.6 |

|

Principal payments of debt | (16.8 | ) | | (10.4 | ) | | (571.0 | ) |

Proceeds from issuance of bonds | 300.0 |

| | — |

| | — |

|

Payments on bonds | (300.0 | ) | | — |

| | — |

|

Excess tax benefit of share-based payment arrangements | 2.6 |

| | 0.6 |

| | 1.2 |

|

Debt issuance and financing costs | (20.8 | ) | | (4.1 | ) | | (12.4 | ) |

Purchase of treasury stock | (129.2 | ) | | — |

| | — |

|

Net cash used in financing activities | (164.2 | ) | | (13.9 | ) | | (34.6 | ) |

Effect of exchange rate changes on cash and cash equivalents | (0.6 | ) | | 1.5 |

| | 1.9 |

|

Net (decrease) increase in cash and cash equivalents for the period | (42.8 | ) | | (20.0 | ) | | 262.9 |

|

Cash and cash equivalents, beginning of period | 420.7 |

| | 440.7 |

| | 177.8 |

|

Cash and cash equivalents, end of period | $ | 377.9 |

| | $ | 420.7 |

| | $ | 440.7 |

|

See notes to consolidated financial statements

Spirit AeroSystems Holdings, Inc.

Consolidated Statements of Cash Flows - continued

|

| | | | | | | | | | | |

| For the Twelve Months Ended |

| December 31,

2014 | | December 31,

2013 | | December 31,

2012 |

| ($ in millions) |

Supplemental information | | | | | |

Interest paid | $ | 69.2 |

| | $ | 68.0 |

| | $ | 69.7 |

|

Income taxes paid | $ | 91.1 |

| | $ | 69.4 |

| | $ | 96.7 |

|

Non-cash investing and financing activities | | | | | |

Property acquired through capital leases | $ | — |

| | $ | 0.4 |

| | $ | 2.6 |

|

See notes to consolidated financial statements

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements

($, €, and RM in millions other than per share amounts)

1. Nature of Business

Spirit Holdings was incorporated in the state of Delaware on February 7, 2005, and commenced operations on June 17, 2005 through the acquisition of Boeing's operations in Wichita, Kansas; Tulsa, Oklahoma and McAlester, Oklahoma (the "Boeing Acquisition") by an investor group led by Onex Partners LP and Onex Corporation (together with its affiliates, "Onex"). Holdings provides manufacturing and design expertise in a wide range of fuselage, propulsion and wing products and services for aircraft original equipment manufacturers and operators through its subsidiary, Spirit AeroSystems, Inc. ("Spirit"). The Company has its headquarters in Wichita, Kansas, with manufacturing facilities in Tulsa and McAlester, Oklahoma; Prestwick, Scotland; Wichita, Kansas; Kinston, North Carolina and Subang, Malaysia. The Company has assembly facilities in Saint-Nazaire, France, and Chanute, Kansas.

The Company is the majority participant in the Kansas Industrial Energy Supply Company ("KIESC"), a tenancy-in-common with other Wichita companies established to purchase natural gas.

The Company participates in a joint venture, Taikoo Spirit AeroSystems Composite Co. Ltd. ("TSACCL"), of which Spirit's ownership interest is 31.5%. TSACCL was formed to develop and implement a state-of-the-art composite and metal bond component repair station in the Asia-Pacific region.

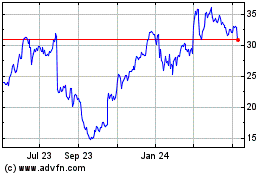

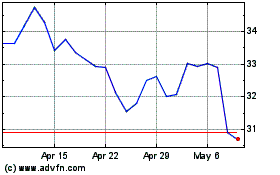

In March, June and August 2014, certain selling stockholders sold 22,915,300 shares of our class A common stock at prices to the public ranging from $28.62 to $35.90 per share in secondary offerings of our class A common stock. Following the August offering, Onex no longer held any investment in the Company.

On December 8, 2014, Spirit entered into an Asset Purchase Agreement with Triumph Aerostructures - Tulsa, LLC, a wholly-owned subsidiary of Triumph Group Inc. (“Triumph”), to sell Spirit’s G280 and G650 programs (“Gulfstream programs”), consisting of the design, manufacture and support of structural components for the Gulfstream G280 and G650 aircraft in Spirit’s facilities in Tulsa, Oklahoma to Triumph (the “Gulfstream Transaction”). The transaction closed on December 30, 2014.

The accompanying consolidated financial statements include the Company’s financial statements and the financial statements of its majority owned or controlled subsidiaries and have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and Regulation S-X. All intercompany balances and transactions have been eliminated in consolidation. Certain reclassifications have been made to the prior year financial statements and notes to conform to the 2014 presentation.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements include the Company's financial statements and the financial statements of its majority-owned subsidiaries and have been prepared in accordance with GAAP. Investments in business entities in which the Company does not have control, but has the ability to exercise influence over operating and financial policies, including TSACCL, are accounted for under the equity method. KIESC is fully consolidated as the Company owns 77.8% of the entity's equity. All intercompany balances and transactions have been eliminated in consolidation. The Company's U.K. subsidiary uses local currency, the British pound, as its functional currency; the Malaysian subsidiary uses the British pound and the Singapore subsidiary uses the Singapore dollar. All other foreign subsidiaries and branches use the U.S. dollar as their functional currency.

As part of the monthly consolidation process, the functional currencies of the Company's international subsidiaries are translated to U.S. dollars using the end-of-month translation rate for balance sheet accounts and average period currency translation rates for revenue and income accounts.

Use of Estimates

The preparation of the Company's financial statements in conformity with GAAP requires management to use estimates and assumptions that affect the reported amounts of assets and liabilities including the impacts of contingent assets and liabilities, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates and assumptions. See Note 3, "Changes in Estimates," for details on current changes in estimates.

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

Revenues and Profit Recognition

A significant portion of the Company's revenues are recognized under long-term, volume-based pricing contracts, requiring delivery of products over several years. The Company recognizes revenue under the contract method of accounting and records sales and profits on each contract in accordance with the percentage-of-completion method of accounting, primarily using the units-of-delivery method. Under the units-of-delivery method revenue is recognized based upon the number of units delivered during a period and the contract price and expenditures are recognized as the cost allocable to the delivered units. Costs allocable to undelivered units are reported in the balance sheet as inventory. The method is used in circumstances in which an entity produces units of a basic product under production-type contracts in a continuous or sequential production process to buyers' specifications. Recurring long-term production contracts are usually divided into contract blocks for this purpose, with each block treated as a separate contract for "units-of-delivery" production-type contract accounting purposes.

The total quantity of production units to be delivered under a contract may be set as a single contract accounting block, or it can be split into multiple blocks. Unless the life of the contract is so long that it prevents reliable estimates, the entire contract will typically be set as the contract accounting block quantity. "Life-of-program" or "requirements-based" contracts often lead to continuing sales of more than twenty years. Since this is much longer than can be reliably estimated, Spirit uses parameters based on the contract facts and circumstances to determine the length of the contract block. This analysis includes: considering the customer's firm orders, internal assessment of the market, reliability of cost estimates, potential segmentation of non-recurring elements of the contract, and other factors. Contract block sizes may also be determined based on certain contractual terms such as pricing renegotiation dates, such that certain contract blocks may use an approximate date instead of a defined unit quantity in order to increase the ability to estimate accurately given that the renegotiated pricing is unknown for the planning block. Shorter contract blocks for mature, ongoing programs are common due to the presence of recent cost history and probable forecast accuracy. Mature program contract blocks tend to be approximately two years in length. Initial contract blocks often require a longer time period and a greater number of units in order to take into account the higher cost of early units due to a steeper experience curve and pre-production design costs. Initial contract blocks on new programs can extend up to ten years or longer. As these programs mature, costs stabilize and efficiencies are realized, subsequent contract block length shortens to take into account the steady state of the continuing production.

Revenues from non-recurring design work are recognized based on substantive milestones or use of the cost-to-cost method, that are indicative of the Company's progress toward completion depending on facts and circumstances. The Company follows the requirements of Financial Accounting Standards Board ("FASB") authoritative guidance on accounting for the performance of construction-type and certain production-type contracts (the contract method of accounting), and use the cumulative catch-up method in accounting for revisions in estimates. Under the cumulative catch-up method, the impacts of revisions in estimates are recognized immediately when changes in estimated contract profitability become known.

A profit rate is estimated based on the difference between total revenues and total costs over a contract block. Total revenues at any given time include actual historical revenues up to that time plus future estimated revenues. Total costs at any given time include actual historical costs up to that time plus future estimated costs. Estimated revenues include negotiated or expected values for units delivered, estimates of probable recoveries asserted against the customer for changes in specifications, price adjustments for contract and volume changes, escalation and assumed but currently unnegotiated price increases for derivative models. Costs include the estimated cost of certain pre-production efforts (including non-recurring engineering and planning subsequent to completion of final design) plus the estimated cost of manufacturing a specified number of production units. Estimates take into account assumptions related to future labor performance and rates, and projections related to material and overhead costs including expected "learning curve" cost reductions over the term of the contract. Estimated revenues and costs also take into account the expected impact of specific contingencies that the Company believes are probable.

Estimated revenue for the A350 XWB program includes an estimate for probable recoveries asserted against the Company's customer for changes in specifications. Although the Company continues to project margins on the A350 XWB fuselage and wing contracts to be near or at break-even, there is still a substantial amount of risk similar to what the Company has experienced on other development programs. Specifically, the Company's ability to successfully negotiate favorable pricing and other terms with Airbus and the Company's suppliers, to manage supplier performance, execute cost reduction strategies, hire and retain skilled production and management personnel, execute quality and manufacturing processes, manage program schedule delays and adjust to higher rate schedules, among other risks, will determine the ultimate performance of this program and these contracts. There continues to be risk of additional forward loss associated with the fuselage recurring contract as the Company works through production, supply chain and customer issues.

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

Estimates of revenues and costs for the Company's contract blocks span a period of multiple years and are based on a substantial number of underlying assumptions. The Company believes that the underlying assumptions are sufficiently reliable to provide a reasonable estimate of the profit to be generated. However, due to the significant length of time over which revenue streams will be generated, the variability of the revenue and cost streams can be significant if the assumptions change. Estimates of profit margins for contract accounting blocks are typically reviewed on a quarterly basis. Assuming the initial estimates of sales and costs under the contract block are accurate, the percentage-of-completion method results in the profit margin being recorded evenly as revenue is recognized under the contract block. Changes in these underlying estimates due to revisions in sales and cost estimates may result in profit margins being recognized unevenly over a contract block as such changes are accounted for on a cumulative basis in the period estimates are revised, which the Company refers to as cumulative catch-up adjustments. The Company's Estimate at Completion estimating process is not solely an accounting process, but is instead an integrated part of the management of the Company's business, involving numerous personnel in the Company's planning, production control, contracts, cost management, supply chain and program and business management functions.

For revenues not recognized under the contract method of accounting, the Company recognizes revenues from the sale of products at the point of passage of title, which is generally at the time of shipment. Shipping and handling costs are included in cost of sales. Revenues earned from providing maintenance services, including any contracted research and development, are recognized when the service is complete or other contractual milestones are attained. Revenues from non-recurring design work are recognized based on substantive milestones that are indicative of the Company's progress toward completion. Non-recurring revenues, which are derived primarily from engineering and design efforts, were $305.5, $255.6 and $239.4 for each of the periods ended December 31, 2014, 2013 and 2012, respectively.

As required by FASB authoritative guidance related to accounting for consideration given by a vendor to a customer, under an agreement with Airbus, certain payments are amortized as a reduction to revenues on units delivered. Additionally, in 2012 the Company began making certain payments related to the Gulfstream G280 and G650 programs. The Company recognized $111.8, $28.6, and $51.1 as a reduction to net revenues for each of the periods ended December 31, 2014, 2013 and 2012, respectively.

Developments on New and Maturing Programs

A significant portion of the Company's future revenues is expected to be derived from new and maturing programs, most notably the B787, A350 XWB and BR725 on which the Company may be contracted to provide design and engineering services, recurring production, or both. There are several risks inherent to such new and maturing programs. In the design and engineering phase, the Company may incur costs in excess of the Company's forecasts due to several factors, including cost overruns, customer-directed change orders and delays in the overall program. The Company may also incur higher than expected recurring production costs, which may be caused by a variety of factors, including the future impact of engineering changes (or other change orders) or the Company's inability to secure contracts with its suppliers at projected cost levels. The Company's ability to recover these excess costs from the customer will depend on several factors, including the Company's rights under its contracts for the new and maturing programs. In determining the Company's profits and losses in accordance with the percentage-of-completion method of contract accounting, the Company is required to make significant assumptions regarding its future costs and revenues, as well as the estimated number of units to be manufactured under the contract and other variables. The Company continually review and update the Company's assumptions based on market trends and its most recent experience. If the Company makes material changes to its assumptions, such as a reduction in the estimated number of units to be produced under the contract (which could be caused by emerging market trends or other factors), an increase in future production costs or a change in the recoverability of increased design or production costs, the Company may experience negative cumulative catch-up adjustments related to revenues previously recognized. In some cases, the Company may recognize forward loss amounts.

Research and Development

Research and development includes costs incurred for experimentation, design and testing and are expensed as incurred as required under FASB authoritative guidance pertaining to accounting for research and development costs.

Joint Venture

The value of the Company's 31.5% ownership interest in Taikoo Spirit AeroSystems Composite Co. Ltd. totaled $0.5 at December 31, 2014 and is accounted for under the equity method of accounting.

Cash and Cash Equivalents

Cash and cash equivalents represent all highly liquid investments with original maturities of three months or less.

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

Accounts Receivable

Accounts receivable are recorded at the invoiced amount and do not bear interest. Consistent with industry practice, the Company classifies unbilled receivables related to contracts accounted for under the long-term contract method of accounting, as current. The Company determines an allowance for doubtful accounts based on a review of outstanding receivables. Account balances are charged off against the allowance after the potential for recovery is considered remote. The Company's allowance for doubtful accounts was approximately $0.5 and $0.2 at December 31, 2014 and December 31, 2013, respectively. Also included in accounts receivable are amounts held in retainage which, as of December 31, 2014 and December 31, 2013, are all related to Gulfstream and represent amounts due on G650 deliveries from 2010 through the third quarter of 2013. The Company settled this matter with Gulfstream on February 13, 2015. See Note 21, "Commitments, Contingencies and Guarantees," for further discussion regarding the settlement.

Accounts receivable, net includes unbilled receivables on long-term aerospace contracts, comprised principally of revenue recognized on contracts for which amounts were earned but not contractually billable as of the balance sheet date, or amounts earned in which the recovery will occur over the term of the contract, which could exceed one year.

Inventory

Raw materials are stated at lower of cost (principally on an actual or average cost basis) or market. Inventoried costs attributed to units delivered under long-term contracts are based on the estimated average cost of all units expected to be produced and are determined under the learning curve concept which anticipates a predictable decrease in unit costs. Lower unit costs are achieved as tasks and production techniques become more efficient through repetition, supply chain costs are reduced as contracts are negotiated and design changes result in lower cost. This cost averaging usually results in an increase in inventory (referred to as "excess-over-average" or "deferred production costs") during the early years of a contract. These costs are deferred only to the extent the amount of actual or expected excess-over-average is reasonably expected to be fully offset by lower-than-average costs in future periods of a contract. If in-process inventory plus estimated costs to complete a specific contract exceed the actual plus anticipated remaining sales value of such contract, such excess is charged to cost of sales in the period the loss becomes known, thus reducing inventory to estimated realizable value. Costs in inventory include amounts relating to contracts with long production cycles, some of which are not expected to be realized within one year.

The Company reviews its general stock materials and spare parts inventory each quarter to identify impaired inventory, including excess or obsolete inventory, based on historical sales trends and expected production usage. Impaired inventories are written off to work-in-process in the period identified.

Property, Plant and Equipment

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is applied using a straight-line method over the useful lives of the respective assets as described in the following table:

|

| |

| Estimated Useful Life |

Land improvements | 20 years |

Buildings | 45 years |

Machinery and equipment | 3-20 years |

Tooling — Airplane program — B787, Rolls-Royce | 5-20 years |

Tooling — Airplane program — all others | 2-10 years |

Capitalized software | 3-7 years |

The Company capitalizes certain costs, such as software coding, installation and testing, that are incurred to purchase or to create and implement internal-use computer software in accordance with FASB authoritative guidance pertaining to capitalization of cost for internal-use software. The Company's capitalization policy includes specifications that the software must have a service life greater than one year, is legally and substantially owned by Spirit, and has an acquisition cost of greater than $0.1.

Intangible Assets

Intangible assets are initially recorded at estimated fair value and are comprised of patents, favorable leasehold interests, and customer relationships that are amortized on a straight-line basis over their estimated useful lives, ranging from 6 to 16 years

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

for patents, 14 to 24 years for favorable leasehold interests, and 8 years for customer relationships. As of December 31, 2014, the customer relationships intangible asset was fully amortized.

Impairment or Disposal of Long-Lived Assets and Goodwill

Spirit reviews capital and amortizing intangible assets (long-lived assets) for impairment on an annual basis or whenever events or changes in circumstances indicate that the recorded amount may not be recoverable in accordance with FASB authoritative guidance on accounting for the impairment or disposal of long-lived assets. Under the standard, assets must be classified as either held-for-use or available-for-sale. An impairment loss is recognized when the recorded amount of an asset that is held for use exceeds the projected undiscounted future net cash flows expected from its use and disposal, and is measured as the amount by which the recorded amount of the asset exceeds its fair value, which is measured by discounted cash flows when quoted market prices are not available. For assets available-for-sale, an impairment loss is recognized when the recorded amount exceeds the fair value less cost to sell. The Company performs an annual impairment test for goodwill in the fourth quarter of each year, or more frequently, if an event occurs or circumstances change that would more likely than not reduce fair value below current value.

Deferred Financing Costs

Costs relating to long-term debt are deferred and included in other long-term assets. These costs are amortized over the term of the related debt or debt facilities and are included as a component of interest expense.

Derivative Instruments and Hedging Activity

The Company uses derivative financial instruments to manage the economic impact of fluctuations in currency exchange rates and interest rates. Derivative financial instruments are recognized on the consolidated balance sheets as either assets or liabilities and are measured at fair value. Changes in fair value of derivatives are recorded each period in earnings or accumulated other comprehensive income, depending on whether a derivative is effective as part of a hedge transaction, and if it is, the type of hedge transaction. Gains and losses on derivative instruments reported in other comprehensive income are subsequently included in earnings in the periods in which earnings are affected by the hedged item or when the hedge is no longer effective. Cash flows associated with the Company's derivatives are presented as a component of the operating section of the statement of cash flows. The use of derivatives has generally been limited to interest rate swaps and foreign currency forward contracts. The Company enters into foreign currency forward contracts to reduce the risks associated with the changes in foreign exchange rates on sales and cost of sales denominated in currencies other than the entities' functional currency.

Fair Value of Financial Instruments

Financial instruments are measured in accordance with FASB authoritative guidance related to fair value measurements. This guidance clarifies the definition of fair value, prescribes methods for measuring fair value, establishes a fair value hierarchy based on the inputs used to measure fair value, and expands disclosures about fair value measurements. See Note 12, "Fair Value Measurements."

Income Taxes

Income taxes are accounted for in accordance with FASB authoritative guidance on accounting for income taxes. Deferred income tax assets and liabilities are recognized for the future income tax consequences attributable to differences between the financial statement carrying amounts for existing assets and liabilities and their respective tax bases. Tax rate changes impacting these assets and liabilities are recognized in the period during which the rate change occurs.

At December 31, 2014 the valuation allowance for the Company's U.S. entities’ net deferred tax asset was $256.8. All available evidence, both positive and negative, has been considered to determine whether, based on the weight of that evidence, a valuation allowance for those net assets is needed.

The primary sources of negative evidence the Company considered were: 1) cumulative U.S. pre-tax losses during the last three years; 2) a history of recording material forward loss charges in the U.S. on the Company's new and maturing programs within the same period; and 3) the ongoing operational and financial risks posed by certain of its newer to maturing programs.

The primary sources of positive evidence the Company considered were: 1) significant order backlog ($46.6 billion at December 31, 2014); 2) transfer of the Gulfstream loss programs to a third party at December 30, 2014; and 3) forecasts of future taxable income (exclusive of reversals of temporary differences and carryforwards).

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

The weight given to the positive and negative evidence is commensurate with the extent the evidence may be objectively verified. As such, the Company assigned the lowest weighting to the positive evidence regarding future taxable income (exclusive of reversing taxable temporary differences), increased weighting to the Gulfstream transfer and significant order backlog, and the highest weighting to the negative evidence of cumulative recent pre-tax losses and forward loss charges, combined with the risks inherent in certain new and maturing programs mentioned above.

Continued profitable operations are required before the Company would change its judgment regarding the need for a full valuation allowance against its net deferred tax assets. Accordingly, although the Company was profitable in 2014, inclusive of the impact of the loss on sale related to the Gulfstream G280 and Gulfstream G650 programs, the Company continues to record a full valuation allowance against the net deferred tax assets in the U.S.

The Company will continue to evaluate all available positive and negative evidence for all future reporting periods and continued improvement in its operating results could lead to reversal of nearly all remaining valuation allowance. In the quarter in which the valuation allowance is released, the Copmany would record an abnormally large tax benefit reflecting the release, which would result in higher earnings per share from net income attributable to the Company.

During 2014, the Company released $167.2 of deferred tax valuation allowance into earnings. This release consists of two primary components: net utilization of underlying deferred tax assets consumed within the normal operations of the company ($49.1), and the realization of remaining deferred tax assets related to the Gulfstream G650 and G280 programs ($118.1). The utilization of these underlying deferred tax assets represent reductions to the Company's 2014 taxable income and will offset current taxes and will be carried back to prior years to offset taxable income in the available carry back period.

Additionally, the Company maintains a $16.2 valuation allowance against separate company state income tax credits and other U.S. issues and $0.6 for other foreign issues which is an increase of $1.3 from the prior year.

The Company records an income tax expense or benefit based on the net income earned or net loss incurred in each tax jurisdiction and the tax rate applicable to that income or loss. In the ordinary course of business, there are transactions for which the ultimate tax outcome is uncertain. These uncertainties are accounted for in accordance with FASB authoritative guidance on accounting for the uncertainty in income taxes. The final tax outcome for these matters may be different than management's original estimates made in determining the income tax provision. A change to these estimates could impact the effective tax rate and net income or loss in subsequent periods. The Company uses the flow-through accounting method for tax credits. Under this method, tax credits reduce income tax expense.

Stock-Based Compensation and Other Share-Based Payments

Many of the Company's employees are participants in various stock compensation plans. The expense attributable to the Company's employees is recognized over the period the amounts are earned and vested, as described in Note 17 "Stock Compensation."

Service and Product Warranties and Extraordinary Rework

Provisions for estimated expenses related to service and product warranties and certain extraordinary rework are made at the time products are sold. These costs are accrued at the time of the sale and are recorded to unallocated cost of goods sold. These estimates are established using historical information on the nature, frequency and average cost of warranty claims, including the experience of industry peers. In the case of new development products or new customers, Spirit considers other factors including the experience of other entities in the same business and management judgment, among others. See Note 21, "Commitments, Contingencies and Guarantees," for the rollfoward of the warranty and extraordinary rework provision as of December 31, 2014, 2013 and 2012.

New Accounting Pronouncements

In June 2014, the FASB issued Accounting Standards Update No. 2014-12, Compensation - Stock Compensation: Accounting for Share-Based Payments When the Terms of an Award Provide that a Performance Target Could be Achieved after the Requisite Service Period (FASB ASU 2014-12). This update requires that a performance target that affects vesting, and that could be achieved after the requisite service period, be treated as a performance condition. As such, the performance target should not be reflected in estimating the grant date fair value of the award. This update further clarifies that compensation cost should be recognized in the period in which it becomes probable that the performance target will be achieved and should represent the compensation cost attributable to the period(s) for which the requisite service has already been rendered. The provisions of FASB ASU 2014-12 are

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

effective in annual periods beginning on or after December 15, 2014 and interim periods within those annual periods. The adoption of FASB ASU 2014-12 is not expected to have a material impact on the Company's consolidated financial statements.

In May 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers, which supersedes the revenue recognition requirements in ASC 605, Revenue Recognition (FASB ASU 2014-09). This update is based on the principle that revenue is recognized to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. FASB ASU 2014-09 is effective in annual periods beginning after December 15, 2016 and for interim and annual reporting periods thereafter. Early application is not permitted for public entities. The Company is currently evaluating the new guidance to determine the impact it may have to its consolidated financial statements.

In April 2014, the FASB issued Accounting Standards Update No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity (FASB ASU 2014-08). This update changes the criteria for determining which disposals can be presented as discontinued operations and modifies related disclosure requirements. The provisions of FASB ASU 2014-08 are effective in annual periods beginning on or after December 15, 2014 and interim periods within those annual periods. The Company has elected, as permitted by the standard, to early adopt ASU 2014-08 effective for components disposed of or held for sale on or after October 3, 2014, including the divestiture of Gulfstream programs.

3. Changes in Estimates

The Company has a Company-wide quarterly Estimate at Completion (EAC) process in which management assesses the progress and performance of its contracts. This process requires management to review each program’s progress towards completion by evaluating the program schedule, changes to identified risks and opportunities, changes to estimated contract revenues and estimated contract costs over the current contract block, and any outstanding contract matters. Risks and opportunities include management's judgment about the cost associated with a program’s ability to achieve the schedule, technical requirements (e.g., a newly-developed product versus a mature product), and any other contract requirements. The majority of its fixed priced contracts are life of aircraft program contracts. Due to the span of years it may take to complete a contract block and the scope and nature of the work required to be performed on those contracts, the estimation of total revenue and costs at completion is complicated and subject to many variables and, accordingly, is subject to change. When adjustments in estimated total contract block revenue or estimated total costs are required, any changes from prior estimates for delivered units are recognized in the current period for the inception-to-date effect of such changes. When estimates of total costs to be incurred on a contract block exceed estimates of total revenue to be earned, a provision for the entire loss on the contract block is recorded in the period in which the loss is determined. Changes in estimates are summarized below:

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

|

| | | | | | |

Changes in Estimates | December 31, 2014 | December 31, 2013 | December 31, 2012 |

Favorable (Unfavorable) Cumulative Catch-up Adjustment by Segment | | | |

Fuselage | 14.8 |

| 60.1 |

| (2.4 | ) |

Propulsion | 18.8 |

| 30.0 |

| 7.3 |

|

Wing | 26.8 |

| 5.4 |

| 9.8 |

|

Total Favorable Cumulative Catch-up Adjustment | 60.4 |

| 95.5 |

| 14.7 |

|

| | | |

Reversal of Forward Loss (Forward loss) by Segment and Program | | | |

Fuselage | | | |

B747 | 6.7 |

| (41.1 | ) | (6.4 | ) |

B787 | — |

| (333.1 | ) | — |

|

B767 | 4.1 |

| (4.1 | ) | — |

|

Airbus A350 XWB non-recurring | — |

| (32.7 | ) | — |

|

Airbus A350 XWB recurring | — |

| (78.6 | ) | — |

|

Bell V280 helicopter | (0.9 | ) | — |

| — |

|

Total Fuselage Reversal of Forward Loss (Forward Loss) | 9.9 |

| (489.6 | ) | (6.4 | ) |

Propulsion | | | |

B787 | — |

| (30.6 | ) | — |

|

B767 | 1.1 |

| (12.3 | ) | (8.0 | ) |

Rolls-Royce BR725 | 15.4 |

| (13.3 | ) | (151.0 | ) |

Total Propulsion Reversal of Forward Loss (Forward Loss) | 16.5 |

| (56.2 | ) | (159.0 | ) |

Wing | | | |

B747 | — |

| — |

| (5.1 | ) |

B787 | — |

| (58.3 | ) | (184.0 | ) |

Airbus A350 XWB non-recurring | — |

| — |

| (8.9 | ) |

G280 | (0.3 | ) | (240.9 | ) | (118.8 | ) |

G650 | — |

| (288.3 | ) | (162.5 | ) |

Total Wing Forward Loss | (0.3 | ) | (587.5 | ) | (479.3 | ) |

Total Reversal of Forward Loss (Forward Loss) | 26.1 |

| (1,133.3 | ) | (644.7 | ) |

| | | |

Total Change in Estimates | 86.5 |

| (1,037.8 | ) | (630.0 | ) |

EPS Impact (diluted per share based on statutory rates) | 0.38 |

| (4.61 | ) | (2.77 | ) |

The Company is currently working on several new and maturing programs which are in various stages of development, including the B787, A350 XWB and BR725 programs. These programs carry risks associated with design responsibility, development of production tooling, production inefficiencies during the initial phases of production, hiring and training of qualified personnel, increased capital and funding commitments, supplier performance, delivery schedules and unique customer requirements. The Company has previously recorded forward loss charges on these programs. If the risks related to these programs are not mitigated, then the Company could record additional forward loss charges.

2014 Changes in Estimates

Favorable cumulative catch-up adjustments for the periods prior to 2014 and reversals of forward loss were primarily driven by productivity and efficiency improvements, favorable cost performance, mitigation of risk, benefits from increased production rates related to the absorption of fixed costs, increased statement of work on mature programs and favorable pricing negotiations on a maturing program.

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

2013 Changes in Estimates

The $422.0 forward loss recorded on the B787 program was primarily due to revised cost estimates to reflect the Company's evaluation of near-term achievable cost reductions and continued deterioration in labor performance at the Tulsa facility related to the transition to the B787-9 derivative. The $240.9 forward loss recorded on the G280 wing program was primarily due to continued deterioration in labor performance at the Tulsa facility and underperformance with respect to supply chain cost reduction. The $288.3 forward loss recorded on the G650 program was primarily due to continued deterioration in labor performance at the Tulsa facility, underperformance with respect to supply chain cost reduction, and settlement of contractual items. The $78.6 forward loss recorded on the A350 XWB fuselage recurring program was due to production inefficiencies mostly driven by early development discovery and engineering change to the aircraft design, as well as higher than expected test and transportation costs. The $32.7 forward loss recorded on the A350 XWB nonrecurring contract was due to the execution of an agreement with Airbus in 2013 regarding the work scope for the design and tooling related to the -1000 derivative. The Company recorded $95.5 of favorable cumulative catch-up adjustments related to periods prior to 2013 primarily driven by productivity and efficiency improvements and favorable cost performance on mature programs.

2012 Changes in Estimates

The $184.0 forward loss recorded on the B787 wing program was primarily due to the estimated impact of a customer-mandated recovery plan, including the cost of hiring added workforce, additional costs related to activities to improve quality measures and the delay of the ramp up to full rate production of the fixed leading edge, as well as higher material costs. The $118.8 forward loss recorded on the G280 wing program was primarily due to deterioration in labor performance related to the ramp up in production, reduction in opportunity to redesign for cost, underperformance with respect to supply chain cost reduction, and settlement of contractual items. The $162.5 forward loss recorded on the G650 wing program was primarily due to deterioration in labor performance related to the ramp up in production, reduction in opportunity to redesign for cost and underperformance with respect to supply chain cost reduction and changes in estimates related to abandonment of a plan to move production to a lower cost jurisdiction outside the United States. The $151.0 forward loss recorded on the BR725 engine nacelle program was primarily due to deterioration in labor performance related to the ramp up in production, reduction in opportunity to redesign for cost and delay in work location transfers. In addition, the Company recorded forward losses of $8.9 on the Airbus A350 XWB non-recurring wing, $11.5 on the Boeing 747-8 program and $8.0 on the B767 program. The Company recorded $14.7 of favorable cumulative catch-up adjustments related to periods prior to 2012 primarily driven by productivity and efficiency improvements and favorable cost performance on mature programs.

4. Impact from Severe Weather Event

On April 14, 2012, during a severe weather event, the Company’s Wichita, Kansas facility, which includes its headquarters and manufacturing facilities for all Boeing models as well as operations for maintenance, repair and overhaul support and services (MRO), was hit by a tornado which caused significant damage to many buildings, disrupted utilities and resulted in a short suspension of production. Over the last two years, the Company used proceeds from a global insurance settlement to restore, clean-up and repair damages to its Wichita facility. Expenditures associated with Impact from Severe Weather Event concluded in 2013.

During the twelve months ended December 31, 2013, the Company recorded expenses of $30.3 due to the severe weather event, which represents continued incremental freight, warehousing and other costs which are recorded as incurred.

During the twelve months ended December 31, 2012, the Company recorded a net gain of $146.2 under severe weather event, which represents the settlement amount of $234.9 less cumulative charges of $88.7, which primarily relate to repair, clean-up, asset impairment and incremental freight, labor and warehousing costs to restore normal operations. The Company also recorded a $0.2 impairment charge in this period for certain assets that were destroyed during the severe weather event.

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

5. Accounts Receivable, net

Accounts receivable, net consists of the following:

|

| | | | | | | |

| December 31,

2014 | | December 31,

2013 |

Trade receivables(1)(2)(3) | $ | 598.4 |

| | $ | 544.2 |

|

Other | 7.7 |

| | 6.8 |

|

Less: allowance for doubtful accounts | (0.5 | ) | | (0.2 | ) |

Accounts receivable, net | $ | 605.6 |

| | $ | 550.8 |

|

_______________________________________

| |

(1) | Includes unbilled receivables of $26.0 and $33.5 at December 31, 2014 and December 31, 2013, respectively. |

| |

(2) | Includes $135.1 held in retainage at December 31, 2014 and December 31, 2013, respectively. |

| |

(3) | Includes zero and $24.6 of withheld payments by a customer pending completion of retrofit work at December 31, 2014 and December 31, 2013, respectively. |

Accounts receivable, net includes unbilled receivables on long-term aerospace contracts, comprised principally of revenue recognized on contracts for which amounts were earned but not contractually billable as of the balance sheet date, or amounts earned in which the recovery will occur over the term of the contract, which could exceed one year.

Also included in accounts receivable are amounts held in retainage which, as of December 31, 2014, are all related to Gulfstream and represent amounts due on G650 deliveries from 2010 through the third quarter of 2013. The Company settled this matter with Gulfstream on February 13, 2015. See Note 21, "Commitments, Contingencies and Guarantees," for further discussion regarding the settlement.

6. Inventory

Inventories are summarized as follows:

|

| | | | | | | |

| December 31, 2014 | | December 31, 2013 |

Raw materials | $ | 254.5 |

| | $ | 240.2 |

|

Work-in-process | 885.7 |

| | 1,057.8 |

|

Finished goods | 46.7 |

| | 43.7 |

|

Product inventory | 1,186.9 |

| | 1,341.7 |

|

Capitalized pre-production (1) | 223.4 |

| | 486.2 |

|

Deferred production (2) | 1,244.3 |

| | 1,661.2 |

|

Forward loss provision | (901.6 | ) | | (1,646.5 | ) |

Total inventory, net | $ | 1,753.0 |

| | $ | 1,842.6 |

|

_______________________________________

| |

(1) | For December 31, 2013, $17.9 of work-in-process was reclassified to capitalized pre-production. |

| |

(2) | For December 31, 2014, $11.8 of deferred production was reclassified to work-in-process. |

Capitalized pre-production costs include certain contract costs, including applicable overhead, incurred before a product is manufactured on a recurring basis. Significant statement of work changes considered not reimbursable by the customer can also cause pre-production costs to be incurred. These costs are typically recovered over a certain number of shipset deliveries.

Deferred production includes costs for the excess of production costs over the estimated average cost per shipset, and credit balances for favorable variances on contracts between actual costs incurred and the estimated average cost per shipset for units delivered under the current production blocks. Recovery of excess-over-average deferred production costs is dependent on the number of shipsets ultimately sold and the ultimate selling prices and lower production costs associated with future production

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

under these contract blocks. The Company believes these amounts will be fully recovered. Sales significantly under estimates or costs significantly over estimates could result in losses on these contracts in future periods.

Provisions for anticipated losses on contract blocks are recorded in the period in which they become evident (“forward losses”) and included in inventory with any remaining amount reflected in accrued contract liabilities.

Non-recurring production costs include design and engineering costs and test articles.

On December 8, 2014, Spirit entered into an Asset Purchase Agreement with Triumph, to sell Spirit’s Gulfstream programs. The transaction closed on December 30, 2014. The impact of the Gulfstream divestiture resulted in a $287.0 reduction in inventory for the period ended December 31, 2014.

Inventories are summarized by platform and costs below:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2014 |

| Product Inventory |

|

|

|

|

|

|

|

|

| Inventory |

| Non-Recurring |

| Capitalized Pre-Production |

| Deferred Production |

| Forward Loss Provision(1)(2) |

| Total Inventory, net December 31, 2014 |

B787 | 227.9 |

| | — |

| | 102.7 |

| | 551.6 |

| | (606.0 | ) |

| 276.2 |

|

Boeing — All other platforms(3)(4) | 497.4 |

| | 7.7 |

| | 7.4 |

| | (8.9 | ) | | (38.8 | ) |

| 464.8 |

|

A350 XWB(5) | 148.7 |

| | 35.6 |

| | 76.4 |

| | 607.6 |

| | (120.1 | ) |

| 748.2 |

|

Airbus — All other platforms | 82.1 |

| | — |

| | — |

| | 5.6 |

| | — |

|

| 87.7 |

|

Rolls-Royce(7) | 17.5 |

| | — |

| | 35.4 |

| | 83.8 |

| | (136.7 | ) |

| — |

|

Sikorsky | — |

| | 8.8 |

| | — |

| | — |

| | — |

|

| 8.8 |

|

Bombardier C-Series | 3.8 |

| | — |

| | — |

| | 4.6 |

| | — |

|

| 8.4 |

|

Aftermarket | 45.2 |

| | 0.2 |

| | — |

| | — |

| | — |

|

| 45.4 |

|

Other platforms | 109.7 |

| | 2.3 |

| | 1.5 |

| | — |

| | — |

|

| 113.5 |

|

Total | $ | 1,132.3 |

|

| $ | 54.6 |

| | $ | 223.4 |

|

| $ | 1,244.3 |

|

| $ | (901.6 | ) |

| $ | 1,753.0 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2013 |

| Product Inventory | | | | | | | | |

| Inventory | | Non-Recurring | | Capitalized

Pre-Production | | Deferred

Production | | Forward Loss

Provision(1)(2) | | Total Inventory, net December 31, 2013 |

B787 | 263.9 |

| | 14.7 |

| | 158.2 |

| | 597.3 |

| | (606.0 | ) | | 428.1 |

|

Boeing — All other platforms(3)(4) | 517.8 |

| | 11.6 |

| | 11.4 |

| | (20.7 | ) | | (55.8 | ) | | 464.3 |

|

A350 XWB(5) | 166.7 |

| | 42.5 |

| | 76.5 |

| | 388.8 |

| | (120.8 | ) | | 553.7 |

|

Airbus — All other platforms | 83.2 |

| | — |

| | — |

| | 18.8 |

| | — |

| | 102.0 |

|

G280(6) | 46.9 |

| | — |

| | 4.9 |

| | 233.7 |

| | (285.5 | ) | | — |

|

G650 | 59.2 |

| | — |

| | 192.7 |

| | 373.3 |

| | (450.8 | ) | | 174.4 |

|

Rolls-Royce(7) | 15.8 |

| | — |

| | 42.5 |

| | 69.3 |

| | (127.6 | ) | | — |

|

Sikorsky | — |

| | 5.4 |

| | — |

| | — |

| | — |

| | 5.4 |

|

Bombardier C-Series | 9.1 |

| | — |

| | — |

| | 0.7 |

| | — |

| | 9.8 |

|

Aftermarket | 37.0 |

| | — |

| | — |

| | — |

| | — |

| | 37.0 |

|

Other platforms | 67.1 |

| | 0.8 |

| | — |

| | — |

| | — |

| | 67.9 |

|

Total | $ | 1,266.7 |

| | $ | 75.0 |

| | $ | 486.2 |

| | $ | 1,661.2 |

| | $ | (1,646.5 | ) | | $ | 1,842.6 |

|

_______________________________________

Spirit AeroSystems Holdings, Inc.

Notes to the Consolidated Financial Statements — (Continued)

($, €, and RM in millions other than per share amounts)

| |

(1) | Forward loss charges, net of forward loss charge reversals, taken since January 1, 2012 on blocks that have not closed. |

| |

(2) | Forward loss charges taken through December 31, 2011 were reflected within capitalized pre-production, non-recurring and inventory for the respective programs and are therefore not reflected as part of the Forward Loss Provision presented. The cumulative forward loss charges, net of contract liabilities, reflected within capitalized pre-production, non-recurring and inventory were $3.0, $177.6 and $29.0 for the A350 XWB, G280 and Sikorsky programs, respectively. |

| |

(3) | Forward loss charges recorded in prior periods on the fuselage portion of the B747 program exceeded the total inventory balance for the fuselage portion of the program. The excess of charge over program inventory is classified as a contract liability and reported in other current liabilities. The total contract liability was zero and $3.9 as of December 31, 2014 and December 31, 2013, respectively. |

| |

(4) | Forward loss charges recorded in prior periods on the propulsion portion of the B767 program exceeded the inventory balance for the propulsion portion of the program. The excess of charge over program inventory is classified as a contract liability and reported in other current liabilities. The total contract liability was $2.1 and $5.8 as of December 31, 2014 and December 31, 2013, respectively. |

| |

(5) | In the fourth quarter of 2014, deferred production in the amount of $11.8 was reclassified to non-recurring inventory. In 2013, non-recurring inventory in the amount of $17.9 was reclassified to capitalized pre-production. |

| |

(6) | Forward loss charges recorded in prior periods on the G280 program exceeded the total inventory balance. The excess of charge over program inventory is classified as a contract liability and reported in other current liabilities. The total contract liability was $74.2 as of December 31, 2013. |

| |

(7) | Forward loss charges recorded in prior periods on the Rolls-Royce BR725 program exceeded the total inventory balance. The excess of the charge over program inventory is classified as a contract liability and reported in other current liabilities. The total contract liability was $12.2 and $36.7 as of December 31, 2014 and December 31, 2013, respectively. |

The following is a roll forward of the capitalized pre-production costs included in the inventory balance at December 31, 2014 and December 31, 2013:

|

| | | | | | | |

| 2014 (1) | | 2013 |

Balance, January 1 | $ | 486.2 |

| | $ | 524.6 |

|

Charges to costs and expenses | (265.3 | ) | | (64.8 | ) |

Capitalized costs | 2.5 |

| | 26.4 |

|

Balance, December 31 | $ | 223.4 |

| | $ | 486.2 |

|