Kinder Morgan, Southern Set Pipeline Venture

July 10 2016 - 9:20PM

Dow Jones News

Kinder Morgan Inc. on Sunday said it is selling a stake in a

7,600-mile natural-gas pipeline system to utility Southern Co. for

$1.47 billion.

The Southern Natural Gas pipeline system connects natural-gas

fields in Texas, Louisiana, Mississippi, Alabama, and the Gulf of

Mexico to markets in the Southeast. Southern is one of the pipeline

system's customers.

The deal comes as Kinder Morgan seeks to reduce its debt load.

The sale of the 50% stake will help bring the company's ratio of

debt to earnings before interest, taxes, depreciation and

amortization below the level it has targeted for the year.

The two companies will also try to work together on additional

projects expanding the pipeline system.

Kinder Morgan said the deal has been in the works for a year.

Since those discussions began, pipeline companies like Kinder

Morgan have taken a hit from the prolonged period of languishing

oil and natural-gas prices amid investor concerns that these

companies, once seen as havens from volatile commodities prices

because of the stable fees they take in, wouldn't be immune to the

pain affecting the energy industry.

As Wall Street soured on pumping new debt and equity into

pipeline companies, Kinder Morgan reduced its dividend by 75% late

last year as it faced a choice between using its cash for growth

and funding the payout. The deal announced Sunday will help the

company in its efforts to restore its dividend.

"The transaction significantly advances our effort to strengthen

our balance sheet and move us closer to returning value to

shareholders in the form of an increased dividend or stock

repurchases," Kinder Morgan Chief Executive Steve Kean said in a

statement.

Southern Chairman and CEO Thomas Fanning said the pipeline stake

will position the company "for future growth opportunities and

enhanced access to natural gas, which are expected to benefit

customers and investors alike."

Kinder Morgan shares have rallied this year, along with oil and

natural-gas prices. Kinder Morgan shares closed at $18.54 on

Friday, up nearly 25% since the beginning of the year but still

down more than 50% from this time last year.

The company has pledged to tighten its belt to bring its balance

sheet in order, cutting spending plans and looking to bring in

joint-venture partners for some of the projects it has in the

works.

Last month, Kinder Morgan announced that it sold a 50% stake in

its Utopia ethane pipeline to private-equity firm Riverstone

Investment Group. The 215-mile pipeline in Ohio will connect to

existing pipes to bring natural-gas liquids from the Utica shale

formation to petrochemical producers in Ontario, Canada. Kinder

Morgan expects the project to cost $500 million.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

July 10, 2016 21:05 ET (01:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

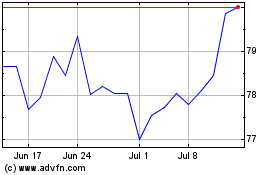

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

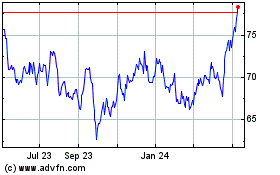

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024