UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

Date of Report (Date of earliest event reported) | November 17, 2015 |

|

| | |

Commission File Number | Registrant, State of Incorporation, Address and Telephone Number | I.R.S. Employer Identification No. |

| | |

1-3526 | The Southern Company (A Delaware Corporation) 30 Ivan Allen Jr. Boulevard, N.W. Atlanta, Georgia 30308 (404) 506-5000 | 58-0690070 |

| | |

001-11229 | Mississippi Power Company (A Mississippi Corporation) 2992 West Beach Gulfport, Mississippi 39501 (228) 864-1211 | 64-0205820 |

The names and addresses of the registrants have not changed since the last report.

This combined Form 8-K is filed separately by two registrants: The Southern Company and Mississippi Power Company. Information contained herein relating to each registrant is filed by each registrant solely on its own behalf. Each registrant makes no representation as to information relating to the other registrant.

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

|

| |

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

See MANAGEMENT’S DISCUSSION AND ANALYSIS - FUTURE EARNINGS POTENTIAL - “Integrated Coal Gasification Combined Cycle - Rate Recovery of Kemper IGCC Costs” in Item 7 of Mississippi Power Company’s (“Mississippi Power”) Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “Form 10-K”) and in Mississippi Power’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015 (the “Form 10-Q”). See also Note 3 to the financial statements of The Southern Company (“Southern Company”) and of Mississippi Power under “Integrated Coal Gasification Combined Cycle - Rate Recovery of Kemper IGCC Costs” in Item 8 of each company’s Form 10-K for additional information regarding rate recovery for costs associated with the integrated coal gasification combined cycle facility under construction in Kemper County, Mississippi (the “Kemper IGCC”). See also Note (B) to the Condensed Financial Statements of Southern Company and Mississippi Power under “Integrated Coal Gasification Combined Cycle - Rate Recovery of Kemper IGCC Costs” in each company’s Form 10-Q for information regarding: (1) Mississippi Power’s filing of three alternative rate proposals on May 15, 2015; (2) Mississippi Power’s supplemental filing on July 10, 2015 including a request for interim rates (the “Interim Rate Request”) and an additional alternative rate proposal (the “In-Service Asset Proposal”), which were designed to collect approximately $159 million annually; and (3) the Mississippi Public Service Commission’s (“PSC”) approval, on August 13, 2015, of the Interim Rate Request beginning with the first billing cycle of September 2015 (on August 19), subject to refund and certain other conditions (the “Interim Rates”), which approval provided for a final order with respect to permanent rates under the In-Service Asset Proposal on or before December 8, 2015.

On November 17, 2015, Mississippi Power and the Mississippi Public Utilities Staff entered into a stipulation (the “Stipulation”) regarding the implementation of the In-Service Asset Proposal in rates on a permanent basis. The Stipulation provides for retail rate recovery of an annual revenue requirement of approximately $126 million, based on Mississippi Power’s actual average capital structure, with a maximum common equity percentage of 49.733%, a 9.225% return on common equity, and actual embedded interest costs during the test period. The Stipulation also provides for a prudence finding of all costs included in this revenue requirement calculation for the in-service assets. Upon implementation of permanent rates under the In-Service Asset Proposal in compliance with the terms of the Stipulation, the Interim Rates will be terminated and Mississippi Power will credit customer bills for the difference between the Interim Rates collected and the permanent rates within 90 days.

Mississippi Power will be required to file a subsequent rate request within 18 months of the Mississippi PSC’s order approving the In-Service Asset Proposal. Mississippi Power will continue to defer for regulatory purposes all of the costs excluded, reduced, or compromised in the revenue requirement calculation resulting from the Stipulation as regulatory assets to be addressed in the final prudency hearing or in a rate case expected to be filed following commercial operation of the entire Kemper IGCC.

The Stipulation is subject to approval by the Mississippi PSC. Mississippi Power expects the Mississippi PSC to reach a decision on the Stipulation and the In-Service Asset Proposal on or before December 8, 2015. Mississippi Power can provide no assurance that the Mississippi PSC will approve the Stipulation in the agreed form or at all. The ultimate outcome of this matter cannot be determined at this time.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this Current Report on Form 8-K is forward-looking information based on current expectations and plans that involve risks and uncertainties. Forward-looking information includes, among other things, statements concerning the approval and implementation of the Stipulation. Southern Company and Mississippi Power caution that there are certain factors that could cause actual results to differ materially from the forward-looking information that has been provided. The reader is cautioned not to put undue reliance on this forward-looking information, which is not a guarantee of future performance and is subject to a number of uncertainties and other factors, many of which are outside the control of Southern Company and Mississippi Power; accordingly, there can be no assurance that such suggested results will be realized. The following factors, in addition to those discussed in each of Southern Company’s and Mississippi Power’s Form 10-K, and subsequent securities filings, could cause actual results to differ materially from management expectations as suggested by such forward-looking information: state and federal rate regulations and the impact of pending and future rate cases and negotiations, including the Mississippi PSC’s review and approval of the Stipulation; the impact of recent and future federal and state regulatory changes, including legislative and regulatory initiatives regarding deregulation and restructuring of the electric utility industry, environmental laws including regulation of water, coal combustion residuals, and emissions of sulfur, nitrogen, carbon dioxide, soot, particulate matter, hazardous air pollutants, including mercury, and other substances, and also changes in tax and other laws and regulations to which Mississippi Power is subject as well as changes in application of existing laws and regulations; current and future litigation, regulatory investigations, proceedings, or inquiries, Federal Energy Regulatory Commission matters, and Internal Revenue Service and state tax audits; the effects, extent, and timing of the entry of additional competition in the markets in which Mississippi Power operates; variations in demand for electricity, including those relating to weather, the general economy and recovery from the last recession, population and business growth (and declines), the effects of energy conservation and efficiency measures, including from the development and deployment of alternative energy sources such as self-generation and distributed generation technologies, and any potential economic impacts resulting from federal fiscal decisions; available sources and costs of fuels; effects of inflation; the ability to control costs and avoid cost overruns during the development and construction of facilities, which include the development and construction of generating facilities with designs that have not been finalized or previously constructed, including changes in labor costs and productivity, adverse weather conditions, shortages and inconsistent quality of equipment, materials, and labor, contractor or supplier delay, non-performance under construction or other agreements, operational readiness, including specialized operator training and required site safety programs, unforeseen engineering or design problems, start-up activities (including major equipment failure and system integration), and/or operational performance (including additional costs to satisfy any operational parameters ultimately adopted by the Mississippi PSC); the ability to construct facilities in accordance with the requirements of permits and licenses, to satisfy any environmental performance standards and the requirements of tax credits and other incentives, and to integrate facilities into the Southern Company system upon completion of construction; advances in technology; actions related to cost recovery for the Kemper IGCC, including the ultimate impact of the 2015 decision of the Mississippi Supreme Court, the

Mississippi PSC’s August 2015 interim rate order, and related legal or regulatory proceedings, Mississippi PSC review of the prudence of Kemper IGCC costs and approval of permanent rate recovery plans, actions relating to proposed securitization, the ability to utilize bonus depreciation, which currently requires that assets be placed in service in 2015, satisfaction of requirements to utilize investment tax credits and grants, and the ultimate impact of the termination of the proposed sale of an interest in the Kemper IGCC to South Mississippi Electric Power Association; the ability of counterparties of Mississippi Power to make payments as and when due and to perform as required; the ability to obtain new short- and long-term contracts with wholesale customers; the direct or indirect effect on Mississippi Power’s business resulting from cyber intrusion or terrorist incidents and the threat of terrorist incidents; interest rate fluctuations and financial market conditions and the results of financing efforts; changes in Mississippi Power’s credit ratings, including impacts on interest rates, access to capital markets, and collateral requirements; the impacts of any sovereign financial issues, including impacts on interest rates, access to capital markets, impacts on currency exchange rates, counterparty performance, and the economy in general; the ability to obtain additional generating capacity at competitive prices; catastrophic events such as fires, earthquakes, explosions, floods, hurricanes and other storms, droughts, pandemic health events such as influenzas, or other similar occurrences; the direct or indirect effects on Mississippi Power’s business resulting from incidents affecting the U.S. electric grid or operation of generating resources; and the effect of accounting pronouncements issued periodically by standard setting bodies. Southern Company and Mississippi Power expressly disclaim any obligation to update any forward-looking information.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

Date: November 18, 2015 | | THE SOUTHERN COMPANY

|

| By | /s/Melissa K. Caen |

| | Melissa K. Caen Corporate Secretary

|

| | MISSISSIPPI POWER COMPANY

|

| By | /s/Melissa K. Caen |

| | Melissa K. Caen Assistant Secretary |

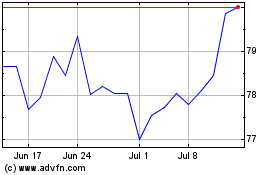

Southern (NYSE:SO)

Historical Stock Chart

From Mar 2024 to Apr 2024

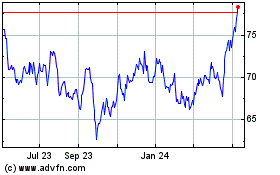

Southern (NYSE:SO)

Historical Stock Chart

From Apr 2023 to Apr 2024