Sanofi Investors Count Cost of Praluent Ruling -- Update

January 06 2017 - 2:29PM

Dow Jones News

By Denise Roland

A ruling by a U.S. judge blocking the sale of Sanofi SA's new

cholesterol-lowering drug dealt a fresh blow to the French

pharmaceuticals giant as it scrambles to make up for falling sales

of a separate, best-selling medicine.

Sanofi shares ended down more than 2% Friday afternoon, a day

after the U.S. District Court of Delaware issued an injunction

against the sale of the drug. The judge ruled Sanofi and partner

Regeneron Pharmaceuticals Inc. infringed on a patent held by rival

Amgen Inc. for its own, new cholesterol drug.

Regeneron shares were down more sharply, 7% lower in midday

trading Friday. Amgen shares were up more than 3%.

Sanofi and Regeneron have said they would appeal the ruling,

allowing them to continue selling the drug, called Praluent, for

now. The appeal process can take anywhere from a few months to more

than a year, giving Sanofi some breathing room.

The two can also settle with Amgen, a move the judge in the case

encouraged in her ruling Thursday. Such a settlement often involves

agreeing to pay royalties. That could lessen the sting for Sanofi.

Still, the legal setback remains a big disappointment for one of

its most promising new drugs.

Both Praluent and Amgen's Repatha belong to a new class of

cholesterol-lowering medicines known as PCSK9s. They were approved

within weeks of each other in 2015.

Sanofi has been leaning heavily on Praluent and a clutch of

other recently launched drugs to offset a sharp decline in sales

from its best-selling insulin medication Lantus. U.S.

pharmacy-benefit managers, who negotiate drug prices on behalf of

health insurers and employers, have succeeded in winning steep

discounts from Sanofi on Lantus. Meanwhile, a biosimilar version of

Lantus made by Eli Lilly and Co. and poised to launch in the U.S.

this year is expected to cut into sales. Biosimilars are close, but

not exact, copies of drugs manufactured using living cells.

Before the ruling, analysts expected Praluent could eventually

generate around $3 billion a year globally for the two drugmakers.

Praluent's U.S. sales alone were forecast to hit $2 billion or

higher by 2020.

Karen Linehan, Sanofi's general counsel, said the company

believed Amgen's patent claims are invalid, and that ending the

sale of Praluent in the U.S. would go against the best interest of

patients.

Amgen said it was pleased with the decision and will strive to

make a "smooth transition" for patients who choose to switch to its

drug.

The stakes are also high for Regeneron, for which Praluent was

considered a potentially large source of growth. Still, the

company's top-selling product, the eye drug Eylea, accounts for

nearly all revenue, and Regeneron is counting even more heavily on

an eczema drug, Dupixent, awaiting approval in the U.S. than on

Praluent.

"The company is looking forward to a very important year with

multiple drug launches, most importantly Dupixent," a Regeneron

spokeswoman said.

Its legal woes aside, Praluent hasn't lived up to its initial

promise. Both it and Repatha have struggled to gain momentum in the

U.S. market, in part because the PCSK9s have yet to prove that they

are more effective at reducing the risk of heart attack, stroke and

other serious cardiovascular problems than the much less costly

statins.

Sanofi is running a large clinical trial that it hopes will show

Praluent significantly lowers cardiovascular risk compared with

statins, a move aimed at driving higher demand for the drug.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

January 06, 2017 14:14 ET (19:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

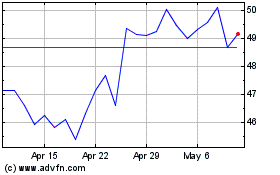

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

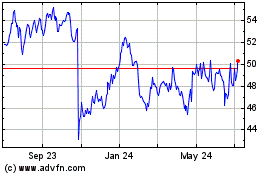

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024