Regeneron Revenue Growth Slows

November 04 2016 - 8:50AM

Dow Jones News

Regeneron Pharmaceuticals Inc. again posted double-digit revenue

growth for its key eye-disease treatment, but the company's overall

revenue grew at the slowest pace in more than four years as

concerns mount over industrywide pressures on pharmaceutical

pricing.

U.S. sales of the drug Eylea increased 16% to $854 million,

compared with $734 million in the prior-year quarter. The company

now expects Eylea to post between 23% and 25% revenue growth for

the year, raising the low end of its forecast by 3 percentage

points.

Regeneron is facing increasing pressure from health insurers

keen on keeping drug prices low.

Investors are closely watching the company's new

anti-cholesterol drug, Praluent, as it was expected to be among a

new slate of blockbusters in the giant cholesterol-control

market.

Regeneron also said it received 36% less revenue from

drug-development partner Sanofi SA, bringing in $144.4 million. It

took in less R&D cost reimbursement from Sanofi and took a

larger hit from its profit-and-loss sharing.

For the quarter ended in September, Regeneron posted a profit of

$265 million, or $2.27 on a per-share basis, up from $210 million,

or $1.82 a share a year earlier. Excluding special items, adjusted

per-share earnings were $3.13.

Revenue rose 7.3% to $1.22 billion. Analysts polled by Thomson

Reuters had expected adjusted earnings per share of $2.71 on

revenue of $1.29 billion in revenue.

In the quarter, Regeneron's research and development costs

increased 28% to $543 million.

Sales of Praluent in the latest quarter were $38 million, up

from $24 million in the previous quarter. The drug was launched in

the U.S. in the third quarter of 2015 and in certain European Union

countries in the following quarter. In July, Japan granted approval

for the drug.

Praluent, which is made by Regeneron and Sanofi, and Amgen

Inc.'s Repatha, are the only two available of a class of new

cholesterol-lowering injections blocking a protein known as PCSK9

in what Wall Street had initially thought could be as up-to-$20

billion market.

Health insurers and drug-benefit managers have steered patients

to using low-price, generic versions of statins like Lipitor, which

was once the top-selling drug in the world, instead of either of

the two drugs, which have list prices of over $14,000 a year.

Sanofi records sales of Praluent, and Regeneron shares in the

profits.

On Tuesday, Pfizer Inc. said it would halt the development of

its PCSK9 inhibitor that was in late-stage trials amid safety

concerns and mounting pricing pressures confronting the

industry.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

November 04, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

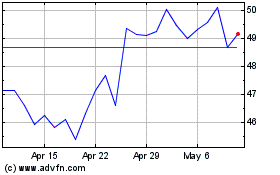

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024