Regeneron's Revenue Jumps on Sales of Eye Treatment Eylea

August 04 2016 - 2:30PM

Dow Jones News

Regeneron Pharmaceuticals Inc. posted another double-digit

revenue surge as sales for its key eye-disease treatment grew, but

higher expenses weighed on the company's profit growth.

U.S. sales of the drug, Eylea, increased 27% to $831 million,

compared with $655 million in the prior-year quarter.

But Regeneron, which had been one of the best-performing biotech

stocks in previous years, is facing increasing pressure from health

insurers that poses new challenges for the company as it aims to

maintain the growth that is made it attractive to investors.

Increased costs related to helping patients pay for Eylea, and

securing reimbursement from health insurers, negatively impacted

the drug's profit margins in the second quarter, Robert Terifay,

Regeneron's sales chief, said on a conference call with analysts on

Thursday.

Mr. Terifay also warned that Medicare's proposal to change the

way it pays for certain drugs in a new pilot program could lead

doctors to use competing drugs made by Roche Holding Ltd., instead

of Eylea. Medicare officials say the pilot program is intended to

encourage doctors to use less-expensive drugs when it is medically

appropriate.

"The impact of any changes is difficult to predict, though we

are monitoring the situation very closely," Mr. Terifay said.

Regeneron said its sales, general and administrative expenses

rose 67% to $292 million, up from $175 million in the second

quarter of last year. Regeneron now expects to spend in a range of

$980 million to $1.02 billion on sales, general and administrative

expenses this year, up from its previous guidance of $925 million

to $1 billion.

Separately, Regeneron said in a financial statement that its

expenses for distribution fees, sales-related deductions and

rebates, which are paid to health insurers in exchange for

reimbursement coverage, rose 52.2% to $70.3 million in the second

quarter, up from $46.2 million last year.

Meanwhile, sales of the company's new anti-cholesterol drug,

Praluent, continued to be sluggish, with only 25% of the

prescriptions written by doctors dispensed to patients due to

insurance hurdles. Mr. Terifay blamed the drug's sales performance

on "strict utilization management criteria," which health insurers

use to restrict who can receive certain medicines.

Some insurers require doctors to answer as many as 40 questions

before they'll approve reimbursement for Praluent, which can be

"very tedious for the physician," Mr. Terifay said on the call.

Sales of Praluent in the latest quarter were $24 million. The

drug was launched in the U.S. in the third quarter of 2015 and in

certain European Union countries in the following quarter. In July,

Japan granted approval for the drug.

Regeneron shares fell 3.7% to $424.92 in midday trading on

Thursday; shares have fallen 21.8% so far this year.

For the quarter ended in June, Regeneron posted a profit of

$196.2 million, up 0.8% from $194.6 in the same period last year.

Revenue grew 21% to $1.21 billion, up from $999 million a year

earlier. Analysts had projected revenue of $1.24 billion.

Research and development costs increased 44% to $559.9 million.

Regeneron also received lower reimbursement of its R&D costs

from its partner Sanofi S.A., which helped develop Praluent.

Regeneron said it expects to have less of its R&D costs

reimbursed by Sanofi than it had previously because of decreased

activity on the companies' joint drug development programs.

Last year, U.S. and European regulators approved Praluent, the

first of a powerful new class of cholesterol-lowering medicines.

Sanofi records sales of the product, and Regeneron shares in the

profits.

On a per share basis, Regeneron posted a profit of $1.69 a share

in the second quarter, flat from the prior year. Excluding special

items, per-share earnings were $2.82 a share; analysts polled by

Thomson Reuters had forecast adjusted per-share earnings of

$2.65.

Write to Joseph Walker at joseph.walker@wsj.com and Austen

Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 04, 2016 14:15 ET (18:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

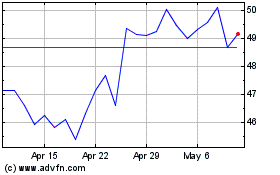

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024