Sanofi Moves to Replace Medivation Board -- Update

May 25 2016 - 11:53AM

Dow Jones News

By Noemie Bisserbe

PARIS--French drugmaker Sanofi SA said Wednesday it is moving to

call a shareholder vote on whether to remove the entire board of

Medivation Inc. after the U.S. biotech firm declined to engage in

takeover talks.

Sanofi said it had filed the necessary documents with the U.S.

Securities and Exchange Commission and proposed eight candidates to

replace Medivation's board of directors. The solicitation aims to

pave the way for shareholders to cast votes through written

consent.

Medivation swiftly urged its stockholders to reject Sanofi's

maneuver, calling it "a tactic for the French firm to facilitate

its substantially inadequate and opportunistically timed proposal

to acquire Medivation." The company said it expected to "promptly"

file its own consent revocation materials with the SEC.

The acquisition of Medivation could help Sanofi expand its new

products portfolio and build a competitive position in a hotly

tipped market where it is still a small player. Sanofi said late

last month it has made an unsolicited offer worth $9.3 billion for

Medivation, which the San Francisco-based firm promptly rejected,

claiming Sanofi's proposal undervalued the cancer-treatment

company.

The attempt to oust the Medivation directors could increase the

pressure on them to engage with Sanofi, or move on to find other

bidders.

A provision of Delaware law, where Medivation is registered,

allows shareholders to remove the board by written consent instead

of calling a vote at the general assembly meeting. Sanofi has

bought some Medivation shares, according to a person familiar with

the matter.

"Despite multiple attempts, both before and following the public

disclosure of Sanofi's proposal, Medivation has thus far refused to

engage with us regarding the merits of a value-creating

transaction," said Sanofi chief executive Olivier Brandicourt.

"Unfortunately, this has left us with no choice but to commence

a process to elect directors who are more open to supporting the

best interests of Medivation shareholders regarding a potential

transaction," he added.

Mr. Brandicourt has told the Medivation board it would raise its

offer "if you engage and provide information."

Sanofi's offer is in line with the company's stated strategy to

refocus on fewer businesses, while broadening its reach. Last

November, the Paris-based company said it would consider

acquisitions in several sectors, including oncology.

Medivation, a Nasdaq-listed company that focuses on

hard-to-treat cancers, markets one prostate cancer therapy, called

Xtandi, and has two additional oncology assets in clinical

development.

Xtandi, which the company sells in partnership with Japan's

Astellas Pharma, posted sales of $1.9 billion in 2015. According to

analysts, this number could go much higher if the treatment is

extended to patients in early stage prostate cancer--it is today

mostly used by late-stage cancer patients.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

May 25, 2016 11:38 ET (15:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

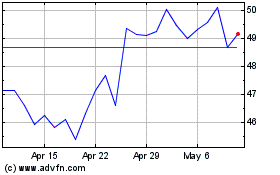

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024