By Peter Loftus and Anna Wilde Mathews

Health insurer Cigna Corp. will get extra price discounts from

drugmakers if new cholesterol medications don't help patients as

much as expected, a significant step in a broader push to tie the

cost of drugs to how well they work.

Such "value-based" deals are becoming more common as rising

costs spur customers to demand assurances they are getting what

they pay for. U.S. prescription spending rose 12% to nearly $425

billion in 2015, following a 13% increase in 2014, according to

research firm IMS Health.

Cigna is set to announce on Wednesday that it is the first

insurer to reach value-based contracts for an entire new class of

cholesterol drugs: Praluent, which is co-marketed by Sanofi SA and

Regeneron Pharmaceuticals Inc., and Amgen Inc.'s Repatha are the

only two cholesterol-lowering drugs known as PCSK9 inhibitors

currently on the U.S. market.

Both drugs were introduced last year to reduce levels of LDL

cholesterol, or "bad" cholesterol, beyond what can be achieved by

an older class of drugs known as statins. Reducing LDL can lower

risk of heart attacks and strokes, though Praluent and Repatha

haven't yet been proven to reduce cardiovascular risk in

trials.

Both drugs cost at least $14,000 a year, and Cigna negotiated an

undisclosed discount off the list prices.

If Cigna-insured patients who take the drugs aren't able to

reduce LDL cholesterol at least as well as what was shown in

clinical trials, the manufacturers will further discount the costs

of the drugs -- and not just for patients who didn't meet the

cholesterol goals. If the drugs meet or exceed expectations, the

original negotiated price stays, according to Cigna.

Health insurers and pharmacy-benefit managers have signed at

least a dozen such deals with drugmakers since 2014, including

Cigna, Harvard Pilgrim Health Care and Express Scripts Holding Co.,

targeting high-cost drugs in categories including cancer and

hepatitis C.

While the number of value-based deals has increased, they remain

somewhat limited in scope, and may not put a huge dent in drug

spending in the near-term, experts say. Insurers and manufacturers

say the complexity of tracking patients' health -- which falls on

the insurer -- can be a barrier, and most supply contracts still

tie payments to volume of prescriptions.

"There is a general increase in interest in exploring these

kinds of contracts, but a fair amount of caution as well, largely

because the administrative aspects tend to be quite daunting in the

short term," said Steven Pearson, president of the Institute for

Clinical and Economic Review, a Boston nonprofit that promotes

value-based drug prices.

Chris Bradbury, senior vice president for Cigna's

pharmacy-benefits business, said the deals "are protecting our

clients and customers if something doesn't work as

expected...especially for many of these medicines now that cost

thousands or tens of thousands of dollars a year."

Cigna has access to patients' cholesterol levels and will track

them over "a period of time, months and quarters," Mr. Bradbury

said, to determine whether they are meeting the targets. Cigna also

plans to track whether these patients have heart attacks and other

cardiovascular events over the long-term, but that information

doesn't determine reimbursement levels in the current contracts.

The drugs aren't currently approved to reduce the risk of

cardiovascular events.

A Cigna spokeswoman said the company can monitor patients'

adherence to prescriptions, side effects and drug interactions. The

company also can review lab results and work with customers'

doctors as needed, she said.

Joshua Ofman, senior vice president of global value and access

at Amgen, said the company has agreed to such contracts with

insurers to "address their short-term budget concerns and

real-world performance regarding Repatha." Amgen hopes the

agreement will enable patients to get access to the drug.

Sanofi and Regeneron said in a joint statement they have pursued

value-based contracts for Praluent to address insurers' "complex

needs and facilitate access for appropriate patients who require

additional treatment options to lower their bad cholesterol."

Drugmaker AstraZeneca PLC signed a deal last year with Express

Scripts to reimburse costs of the lung-cancer drug Iressa if a

patient stops treatment before the third prescription fill. And Eli

Lilly & Co. has a deal with insurer Humana Inc. that ties the

level of reimbursement for the heart drug Effient to the rate of

hospitalizations among patients who take it.

"More and more in the U.S., people are making choices between a

bag of groceries and a medicine, a copay," Paul Hudson, president

of AstraZeneca's U.S. unit, said in an interview. "The long-term

sustainability of the industry and our ability to deliver

breakthrough medicines requires us to demonstrate value."

AstraZeneca has been among the more active drugmakers pursuing

alternative payment arrangements. In addition to the Iressa

contract, AstraZeneca has a deal with University of Pittsburgh

Medical Center's regional health plan to cover a portion of the

costs of treating patients who have additional heart attacks after

taking the heart drug Brilinta, if the rate of heart attacks

exceeds a threshold. Brilinta has been shown in clinical trials to

reduce the rate of heart attacks in patients. A UPMC spokesman

declined to comment.

CVS Health Corp., the second-biggest U.S. pharmacy-benefit

manager, has also made deals that tie payment to patient

outcomes.

Alan Lotvin, executive vice president for specialty pharmacy at

CVS, said the setups can be difficult to execute because many

achievements -- such as a reduction in heart attacks and deaths for

cholesterol drugs -- can take years to become clear, while patients

may be impossible to track over time as they change insurers and

jobs.

Also, he said, drug manufacturers may have advantages in

negotiating favorable terms because they have the best data on

their products. "What we want to be sure is that we're not letting

the manufacturer use the outcomes-based arrangements to avoid the

best price on day one," Dr. Lotvin said.

Colin Wight, CEO of GalbraithWight, which advises drugmakers on

pricing strategies, says many of the value-based contracts amount

to a "fancy way of rebating." He thinks drugmakers should go

further and consider payment models used in other industries, like

software licenses. In that model, an insurer could pay a set

monthly fee to a drugmaker for as long as a patient benefits from

it, he said.

Write to Peter Loftus at peter.loftus@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

May 11, 2016 00:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

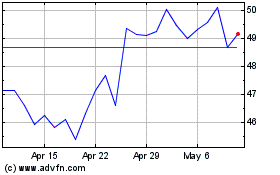

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024