Sanofi Pressures Biotech Company On Bid -- WSJ

May 06 2016 - 3:03AM

Dow Jones News

By Anne Steele

Sanofi SA on Thursday said it sent a letter to Medivation Inc.

saying it would try to remove and replace members of the U.S.

biotech firm's board if it didn't engage in takeover talks.

The Paris-based drugmaker, which has a record of hostile

takeovers in the biotech sector, said in the letter that it has had

"extensive conversations" with Medivation's shareholders and that

it believes there is "overwhelming support" for a deal.

"If you are not prepared to engage with us, we have no choice

but to go directly to your shareholders," the company said.

Medivation on Thursday reiterated its rejection of Sanofi's

"substantially inadequate proposal."

"Sanofi's letter simply restates an inadequate proposal that the

Medivation board of directors has already determined substantially

undervalues the company, its leading oncology franchise, and

innovative late-stage pipeline," the company said in a

statement.

Sanofi last week said it was ready to approach Medivation

shareholders after the board rejected its $9.3 billion offer,

opening the way for a protracted takeover battle. Sanofi's offer of

$52.50 a share represented a 50% premium to Medivation's average

share price for the two months before takeover speculation emerged.

However, it is now below Medivation's share price, which closed

Thursday at $59.22, up 16 cents.

In the letter, Sanofi said it could increase its offer if the

Medivation board engages in good faith discussions.

Medivation, a Nasdaq-listed company that focuses on

hard-to-treat cancers, markets one prostate-cancer therapy, Xtandi,

and has two other oncology assets in clinical development.

A takeover of Medivation would allow Sanofi to significantly

expand its drugs portfolio while it is under pressure to launch

innovative medicines to make up for declining sales of its

blockbuster Lantus insulin.

"We remain enthusiastic about a potential combination with

Medivation. We and our advisers stand ready to meet at any time so

we can work to quickly consummate a mutually beneficial

transaction," Sanofi said in the letter.

Later Thursday, Medivation said it swung to a profit in the

first quarter and reaffirmed 2016 earnings and sales guidance.

The company earned $4.8 million, or 3 cents a share, compared

with a loss of $3.1 million, or 2 cents a share, a year earlier.

Collaboration revenue rose to $182.5 million from $129.2

million.

Earnings excluding items were 11 cents a share.

Analysts polled by Thomson Reuters had projected earnings

excluding items of 23 cents a share on revenue of $196.6

million.

Josh Beckerman contributed to this article.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 06, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

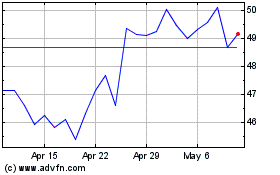

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024