Amgen Profit Rises 39%; 2016 Outlook Raised

January 28 2016 - 4:40PM

Dow Jones News

Amgen Inc. said its fourth-quarter earnings rose 39% as revenue

benefited from higher prices and strong sales of Enbrel, Kyprolis

and the biotechnology company's osteoporosis drugs.

Per-share earnings, excluding certain one-time items, and

revenue beat expectations.

The Thousand Oaks, Calif., company also raised its 2016 outlook

and now expects per-share earnings of $10.60 to $11 and revenue of

$22 billion to $22.5 billion. The company previously expected

per-share profit of $10.35 to $10.75 and revenue of $21.7 billion

to $22.3 billion.

Last year "was an exceptional year for Amgen with six innovative

new launches, strong financial performance, continued pipeline

advances and improved operating margins driven by our

transformation efforts," said Chairman and Chief Executive Robert

A. Bradway in prepared remarks. "We remain on track to meet or

exceed our 2018 commitments."

Like other big drugmakers, Amgen is counting on introductions of

new therapies and its drug-development pipeline to help offset

competition that is looming for some of its aging biotech

drugs.

The company's anticholesterol drug Repatha was approved by the

U.S. Food and Drug Administration in August. Amgen didn't break out

sales figures for the drug in its earnings release for the December

quarter, but analysts are likely to be listening for details on the

progress of Repatha's U.S. rollout on the conference call.

Repatha belongs to a powerful new drug class that promises help

for patients who have struggled to control their cholesterol using

older statin medicines and is competing with Praluent, from Sanofi

SA and Regeneron Pharmaceuticals Inc.

Overall, Amgen reported a profit of $1.8 billion, or $2.37 a

share, up from $1.29 billion, or $1.68 a share, a year earlier.

Excluding acquisition- and restructuring-related impacts and other

items, per-share earnings rose to $2.61 from $2.16. Revenue

increased 3.8% to $5.54 billion.

Analysts polled by Thomson Reuters expected per-share profit of

$2.29 and revenue of $5.53 billion.

Sales declined for Neulasta and Neupogen, both of which are used

to prevent infections in patients receiving chemotherapy. Neulasta

sales decreased 2% to $1.16 billion as lower demand and unfavorable

currency rates offset higher prices. Neupogen sales declined 4% to

$263 million amid currency impacts and increased competition in the

U.S. with the introduction of Novartis AG's Zarxio.

Sales of rheumatoid arthritis and psoriasis drug Enbrel rose

7.8% to $1.44 billion, driven by higher prices.

Amgen's osteoporosis drugs continued to see strong demand, with

Xgeva sales increasing 9.5% to $356 million and Prolia sales

improving 21% to $380 million.

Sales of Sensipar—a treatment for secondary

hyperparathyroidism—rose 21% to $384 million.

Multiple myeloma drug Kyprolis's revenue climbed 63% to $148

million, thanks to increased demand. Amgen gained the drug with its

$10.4 billion acquisition of Onyx Pharmaceuticals Inc. in 2013.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

January 28, 2016 16:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

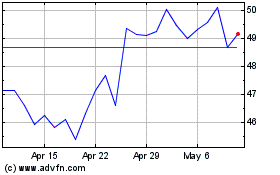

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024