Sony Re-Commits to Roots With Return to Robotics

June 30 2016 - 1:10PM

Dow Jones News

TOKYO—Sony Corp.'s return to robotics, a step announced this

week along with a bullish profit outlook, reflects a commitment to

its roots as a consumer-electronics giant, Chief Executive Kazuo

Hirai said.

Mr. Hirai, who spent much of his early tenure streamlining the

company's troubled portfolio, said on Thursday that it was time to

start taking steps toward a more-ambitious future, and robotics

will be part of that journey.

"We need to push the envelope to really grow Sony into other

parts in all of the electronics business, where we know we could

make a difference," Mr. Hirai told The Wall Street Journal in an

interview.

Sony, which started as a hardware maker, has evolved into a

conglomerate that includes units in fields such as financial and

network services. But hardware will remain a core business because

devices will always be needed regardless of how the internet space

evolves, Mr. Hirai said.

"You can have all these great services, content, but there is a

device you need to enjoy it, or actually to feed information to the

network," he said.

Sony's re-entry into the robotics field wasn't as widely

heralded by analysts as its announcement Wednesday that it was on

track to achieve an operating profit of ¥ 500 billion ($4.86

billion) for the year ending March 2018. The 70-year-old company,

which returned to profitability only in the previous fiscal year

ended in March, has achieved that level of operating profit only

once before, in fiscal 1997.

Still, many analysts say the target is at the low end of their

expected range, despite a slowing global economy and concerns about

fallout from the U.K.'s vote to leave the European Union.

A slowdown in sales of Apple's iPhone has hit Sony by curbing

demand for its image sensors, which are used in the phone's camera.

Because of its diversified portfolio and geographic range, Sony is

one of the few companies targeting consumers directly that can keep

growing despite the headwinds, said SMBC Nikko Securities Ryosuke

Katsura.

Videogames are a bright spot. Sony's flagship PlayStation 4

console has sold more than 40 million units since its introduction

in November 2013, surpassing rivals such as Xbox One from Microsoft

Corp. and Wii U from Nintendo Co. Membership in its fee-based

subscription service, called PlayStation Plus, increased to 20.8

million in March of this year from 10.9 million in January

2015.

As of the end of trading Thursday, Sony's share had risen 10%

this week.

Sony was among the first companies to develop robots for

consumers, launching the dog-like Aibo in 1999. It left the market

in 2006 as a part of decision to restructure, and since then others

have jumped in, including SoftBank Group Corp. with Pepper. But no

one has taken robots mainstream.

Mr. Hirai said he was confident Sony can differentiate itself in

the market, just as it did more than 20 years ago with video games,

at the time ruled by Nintendo. Sony's PlayStation business has

grown to be the major growth driver for the group.

Mr. Hirai declined to outline the company's robotics strategy in

detail, but said one theme is "recurring," or designing a model

that brings customers back for periodical purchases. The strategy

has already proved successful in its PlayStation and Alpha digital

camera businesses.

Many companies already in the robotics industry have taken a

similar approach. Sharp Corp.'s Robohon, a robot that also works as

a smartphone, requires users to pay monthly fees in exchange for

software updates and add-ons. But none have had a huge hit yet,

with robots remaining expensive and less than personable.

Mr. Hirai said he is willing to nurture the business by offering

a range of products for consumers and companies, and could set up a

separate unit for each.

Atsushi Osanai, a professor at Waseda Business School and former

Sony employee, said it was too early to evaluate Sony's prospects

in robotics. But the decision to embark on the challenge indicates

Sony is charting a complete comeback because the company's strategy

is to choose only industries in which it believes it can

differentiate itself, regardless of market size.

"It is a welcoming move that Sony has made this shift," he said.

"We could see Sony with a bunch of innovative products and great

ideas once again in the near future."

(END) Dow Jones Newswires

June 30, 2016 12:55 ET (16:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

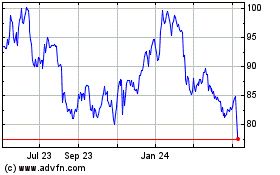

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

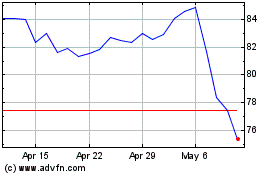

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024