Panasonic Scraps Revenue Goal

March 31 2016 - 9:10AM

Dow Jones News

TOKYO—Panasonic Corp. scrapped its ¥ 10 trillion ($89 billion)

revenue goal, citing a slowing Chinese economy and a continuing

commitment to pursue profit rather than just scale.

"The ¥ 10 trillion revenue was rather a symbolic flag to

encourage every member of Panasonic to think about how we should

achieve growth," Chief Executive Kazuhiro Tsuga said at a news

conference Thursday. But profit, he said, better reflects the

contribution to customers the company should focus on.

The goals he laid for the fiscal year ending March 2019— the

target year of the abandoned revenue goal, coinciding with the

company's 100th anniversary—are an operating profit of ¥ 500

billion and net profit of ¥ 250 billion. For the fiscal year just

ending, Panasonic expects an operating profit of ¥ 410 billion and

net profit of ¥ 180 billion, on ¥ 7.55 trillion in revenue.

When Mr. Tsuga took the top job in 2012, Panasonic was coming

off a net loss of ¥ 772 billion. He pledged to turn around the

Osaka-based electronics company by chopping off low-margin units

and nurturing profitable business-to-business enterprises. It was a

clear shift in strategy for Panasonic, which had been fighting

fiercely competitive South Korean rivals for market dominance in

consumer electronics. The company scaled back its flagship

television business and stopped selling smartphones.

That is why analysts and investors were puzzled when Mr. Tsuga

in 2014 mapped out the project to hit ¥ 10 trillion, a goal set

but not reached by some of his predecessors. It seemed like a

reversal for Mr. Tsuga, though he stressed at the time that the

added revenue should be accompanied by higher profits.

"If you want to just achieve ¥ 10 trillion goal, you could have

bought some unprofitable companies but with large revenue," said Yu

Okazaki, an analyst at Nomura Securities. The puzzlement might

partly explain why Panasonic's market cap falls short of that of

its closest rival, Sony Corp.—which was slower to fight bloat—¥ 2.5

trillion to ¥ 3.7 trillion.

"Withdrawing the stretched target should help investors look at

Panasonic's strategy more rationally," Mr. Okazaki said.

Challenges await Panasonic, but the company is on track for

growth, analysts say. The key is replicating the sort of success

enjoyed by its highly profitable U.S.-based Panasonic Avionics

unit, which sells airlines in-flight entertainment systems and

communication platforms connecting its cabin crews and ground

crews.

Among its recent initiatives, Panasonic is providing batteries

forTesla Motors Inc., joining the car maker in building a big

battery factory in the U.S., and has begun slowing expanding to

home batteries on its own. Last year it bought Hussmann Corp., a

U.S. maker of display cases and refrigeration systems for

retailers—a business in which Panasonic has a major presence in

Asia.

Panasonic is also pursuing opportunities in areas from security

cameras to advanced driver-assistance systems—perhaps too many

areas, analysts say.

"Panasonic planted many seeds of business and that's good, but

it may want to start picking up few best ones to focus on," said

Akie Iriyama, an associate professor at Waseda Business School.

In improving its business-to-business operation, Panasonic is

beefing up M&A to speed growth of promising business units such

as Avionics. Its efforts include hiring Eiichi Katayama, formerly a

top electronics analyst at Bank of America Merrill Lynch in Tokyo,

earlier this year. Mr. Katayama said in February that his job

includes advising Mr. Tsuga which business units to focus on.

Though the consumer market may not be as profitable as the

business market, Mr. Tsuga has been stressing its importance as a

source of stable profitability—a contrast to the approach of fellow

electronics giant Toshiba Corp., which gave up most of its

consumer-appliance businesses in trying to escape financial

troubles.

In Japan, Panasonic is a major provider of home appliances such

as refrigerators, rice cookers and even hair dryers. Its TV unit is

expected to turn a profit in the fiscal year ending Thursday—the

first in eight years.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

March 31, 2016 08:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

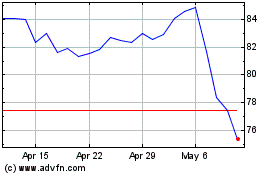

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

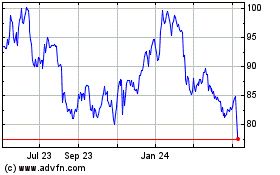

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024