Analysts See Danaher Facing Hurdles To Higher 2010 Profit

March 31 2010 - 6:50PM

Dow Jones News

Danaher Corp.'s (DHR) lack of comment on its 2010 profit

forecast when it boosted its first-quarter guidance earlier this

week caused some analysts Wednesday to conclude the diversified

industrial company is likely to encounter headwinds later this

year.

Danaher's announcement late Monday that its first-quarter profit

will be 90 cents a share or above triggered a rally Tuesday in the

multi-industry sector in anticipation that other conglomerate

companies will report better-than-expected quarterly results.

Danaher had said in January it expected to earn 77 cents a share to

82 cents a share for the quarter ending Wednesday and $3.86 to

$4.16 a share for 2010.

After Danaher's stock Tuesday rose 4.54% ,or $3.51, to $80.88,

investors took a second look at the company's revised guidance,

which included no mention of its full-year forecast, and the rally

fizzled Wednesday. Danaher's stock closed down 1.16%, or 94 cents,

at $79.94 a share. Other companies in the sector also saw their

gains trimmed from Tuesday with 3M Co. (MMM) ending down 0.84%,

Illinois Tool Works Inc. (ITW) down 0.15% and Emerson Electric Co.

(EMR) off 0.93%.

"We shouldn't take [Danaher's] first quarter and multiple it by

four," said Nicholas Heymann, an analyst with Sterne Agee &

Leach Inc.

A spokesman for Danaher declined to comment.

Danaher's primary business segments include testing and

measurement instruments; medical and dental equipment; and

industrial technologies, such as bar-code identification equipment

and factory process control systems.

Heymann predicted Danaher will have higher costs for research

and development and employees as its revenue increases on improving

business conditions and customer demand. Moreover, the recently

weakening euro against the U.S. dollar will erode Danaher's

earnings.

Danaher's 2010 earnings forecast included 7 cents from favorable

currency exchange rates. But Heymann now anticipates the

strengthening U.S. dollar will shave 2 cents or 3 cents off

Danaher's 2010 income.

Analysts say the company's decision last week to merge its hand

tools business in a joint venture with Cooper Industries PLC (CBE)

also could lower income by the third or fourth quarter. The merger

is expected to be completed in the second quarter.

Danaher and Cooper will each own 50% of the new company, which

had combined sales of about $1.2 billion in 2009, the companies

said March 26. The venture will include several well-known consumer

and industrial brands, including Cooper's Crescent wrenches, Wiss

tin snips, Lufkin tape measures and Plumb hammers, as well as

Danaher's Allen and Armstrong tool lines. Danaher also makes

Craftsman-brand tools for Sears Holdings Corp. (SHLD) and

Husky-brand wrenches for Home Depot Inc. (HD).

Danaher's contributions to the venture have higher operating

margins than Cooper's and make up about 60% of the venture's

estimated sales, according to analysts. To account for the

disparity, the new company will pay Danaher a one-time dividend of

$90 million.

"We view the deal as attractive because the combined companies

will have a stronger sales potential and earnings power than each

company has on its own," said Jeffrey Germanotta, an analyst for

William Blair & Co., in a note to investors Wednesday.

Danaher said it will retain its Matco line of professional

mechanics' tools, which are distributed through independent dealers

who sell the tools directly to auto repair shops and industrial

customers. Matco's main competitor is Wisconsin-based Snap-On Inc.

(SNA), which uses a similar distribution model.

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

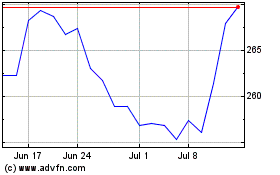

Snap on (NYSE:SNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

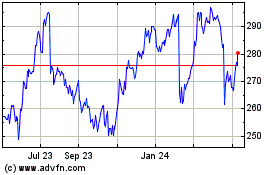

Snap on (NYSE:SNA)

Historical Stock Chart

From Apr 2023 to Apr 2024