Canadian Insurer Manulife's Profit Misses Expectations

August 04 2016 - 8:50AM

Dow Jones News

Manulife Financial Corp. on Thursday reported a 17% increase in

second-quarter net earnings, but results fell short of analyst and

company expectations as lower interest rates and market volatility

weighed on the insurer.

Canada's largest insurance company by assets also warned that it

could book a charge this year of up to 500 million Canadian dollars

($383 million) related to its annual review of actuarial methods

and assumptions.

Toronto-based Manulife said it earned C$704 million, or 34

Canadian cents a share, in its latest quarter. That is up from a

profit of C$600 million, or 29 Canadian cents a year earlier.

It said core earnings, which exclude one-time items, fell to 40

Canadian cents a share from 44 Canadian cents a year earlier,

missing the Thomson Reuters mean estimate for earnings of 46

Canadian cents a share.

"While both core earnings and net income this quarter were

disappointing, having been impacted by the sharp decline in

interest rates and heightened market volatility, I am pleased with

how resilient our underlying businesses remained," Chief Executive

Donald Guloien said in a release.

The surprise U.K. decision to leave the European Union sent

Canadian and U.S. government bond yields lower, creating headwinds

for life insurance companies which are sensitive to interest-rate

shifts as a result of investing customers' premiums in bonds.

Manulife said its minimum continuing capital and surplus

requirements ratio, a key measure of capital strength, was 236% at

the end of June.

The company said it is in the early stages of completing its

annual third-quarter assumptions review and said preliminary

indications suggest it could results in an after-tax charge of up

to C$500 million.

Canadian insurers Manulife and smaller rival Sun Life Financial

Inc. generally offer assumption-review guidance alongside

second-quarter results, according to Desjardins Capital Markets.

Ahead of the latest results, Desjardins had guided for a smaller

C$200 million charge for Manulife.

Sun Life, Canada's third-largest insurance company by assets, is

due to report second-quarter results on Aug. 10.

Write to Judy McKinnon at judy.mckinnon@wsj.com

(END) Dow Jones Newswires

August 04, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

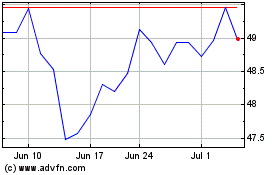

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

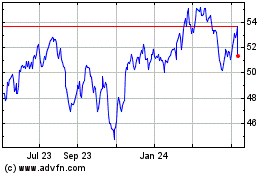

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Apr 2023 to Apr 2024