SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of

1934

|

|

|

| For the month of November 2015 |

|

Commission File Number: 001-15014 |

SUN LIFE FINANCIAL INC.

(the “Company”)

(Translation of registrant’s

name into English)

150 King Street West, Toronto, Ontario, M5H 1J9

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

[Indicate be check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): 82-

N/A

|

|

|

| Exhibit |

|

|

|

|

| 99.1 |

|

Shareholders’ Report |

|

|

| 99.2 |

|

Certificates of the Chief Executive Officer and Chief Financial Officer pursuant to Canadian Multilateral Instrument 52-109 – Certification of Issuers’ Annual and Interim Filings |

|

|

| 99.3 |

|

Earnings Coverage Ratio pursuant to Canadian National Instrument 44-102- Shelf Offerings |

SIGNATURE

Pursuant to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Sun Life Financial Inc. |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: November 5, 2015 |

|

|

|

By |

|

/s/ “Eric Weinheimer” |

|

|

|

|

|

|

Eric Weinheimer, |

|

|

|

|

|

|

Vice-President and |

|

|

|

|

|

|

Associate General Counsel |

Exhibit 99.1

SHAREHOLDERS’ REPORT

SUN LIFE FINANCIAL INC.

For the period ended

September 30, 2015

sunlife.com

CANADIAN RESIDENTS PARTICIPATING IN THE SHARE ACCOUNT

Shareholders holding shares in the Canadian Share Account can sell their shares for $15 plus 5 cents per share.

Complete Form A on the front of your Share Ownership Statement, tear it off and return it by mail to Canadian Stock Transfer Company Inc.

For more information call Canadian Stock Transfer Company Inc. at 1 877 224-1760.

Sun Life Financial Reports Third Quarter 2015 Results

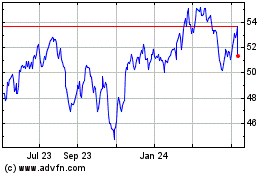

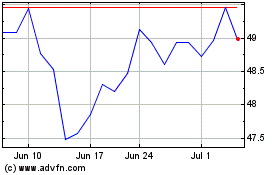

TORONTO – (November 4, 2015) – Sun Life Financial Inc. (TSX: SLF) (NYSE: SLF)

The information contained in this document concerning the third quarter of 2015 is based on the unaudited interim financial results of Sun Life Financial Inc. for the period ended September 30, 2015. Sun Life

Financial Inc., and its subsidiaries and joint ventures, are collectively referred to as “the Company”, “Sun Life Financial”, “we”, “our”, and “us”. Unless otherwise noted, all amounts are in

Canadian dollars.

Third Quarter 2015 Financial Highlights

| • |

|

Operating net income(1) of $478 million or $0.78 per share(1)(2), compared to $467 million or $0.76 per share in the third quarter of 2014. Reported net income of

$482 million or $0.79 per share, compared to $435 million or $0.71 per share in the same period last year |

| |

• |

|

Underlying net income(1) of $528 million or $0.86 per share(1)(2) in the third quarter of 2015, compared to $517 million or $0.84 per share in the third quarter of 2014 |

| • |

|

Operating return on equity(1) (“ROE”) of 10.5% and underlying ROE(1) of 11.6% in the third quarter of 2015, compared to operating ROE of 11.9% and underlying ROE of 13.1% in the same period last year |

| • |

|

Quarterly dividend declared of $0.39 per share |

| • |

|

Minimum Continuing Capital and Surplus Requirements ratio for Sun Life Assurance Company of Canada of 229% |

| • |

|

Global assets under management (“AUM”) of $846 billion |

“We reported underlying net income of $528 million in the third quarter of 2015, up slightly from the prior year in a volatile market environment. Notwithstanding the impact of capital markets on our results,

we benefited from our balanced and diversified business model, coupled with strong execution on our four-pillar strategy.” said Dean Connor, President and Chief Executive Officer, Sun Life Financial. “We announced a dividend increase of

one cent per share, bringing our quarterly common share dividend to $0.39 per share. This, together with the increase announced in the first quarter, represents a total increase of 8% in the quarterly dividend in the year.”

“We continued to deploy capital in accordance with our four-pillar business strategy through the agreement to acquire the U.S. Employee Benefits business of

Assurant, Inc.,” Connor said. “Completion of the acquisition will enhance our market position in U.S. Group Benefits with a significant boost in scale and new distribution and product capabilities.”

“During the quarter, we also completed the acquisitions of Prime Advisors and Bentall Kennedy to broaden our asset management pillar,” Connor said.

“While assets under management at MFS were impacted by volatile markets and net outflows, MFS continues to deliver strong performance for clients and achieved solid margins of 40%.”

“SLF Canada delivered strong sales growth across all lines of business. During the quarter, we announced the creation of the Digital Benefits Assistant which uses big data and advanced analytical tools to help

plan members use their benefit plans wisely.”

“SLF Asia reported strong underlying earnings, led by contributions from the Philippines and

Hong Kong,” Connor said. “Sales were strong in SLF Asia, with continuing momentum in the wealth businesses.”

Reported net income was $482

million in the third quarter of 2015, compared to reported net income of $435 million in the same period last year. The following table sets out our operating net income and underlying net income for the third quarter of 2015 and 2014.

|

|

|

|

|

|

|

|

|

| ($ millions, after-tax) |

|

Q3’15 |

|

|

Q3’14 |

|

| Operating net income |

|

|

478 |

|

|

|

467 |

|

| Market related impacts |

|

|

(82 |

) |

|

|

(54 |

) |

| Assumption changes and management actions |

|

|

32 |

|

|

|

4 |

|

| Underlying net income |

|

|

528 |

|

|

|

517 |

|

The Board of Directors of Sun Life Financial Inc. today declared a quarterly shareholder dividend of $0.39 per common share.

| (1) |

Operating net income (loss) and financial information based on operating net income (loss), such as operating earnings (loss) per share, operating ROE,

underlying net income (loss), underlying earnings (loss) per share and underlying ROE, are not based on International Financial Reporting Standards. See Use of Non-IFRS Financial Measures and Reconciliation of Non-IFRS Financial Measures.

|

| (2) |

All earnings per share (“EPS”) measures refer to fully diluted EPS, unless otherwise stated. |

|

|

|

|

|

|

|

| |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

1 |

Operational Highlights

Our strategy is focused on four key pillars of growth. We detail our continued progress against these pillars below.

Leader in financial protection and wealth solutions in our Canadian home market

Individual wealth sales increased by 16% to $1.2 billion, driven primarily by growth in mutual funds sales. Sun Life Global Investments (Canada) Inc. (“SLGI”) had strong sales growth with a 45% increase

in retail mutual fund sales over the third quarter of 2014 to $288 million. Total segregated fund sales of $152 million in the third quarter of 2015 increased by 54% from the third quarter of 2014, and included sales of $111 million of Sun Life

Guaranteed Investment Funds, our new segregated fund product launched in the second quarter of 2015.

Individual insurance sales in Canada increased by

31% to $98 million from the third quarter of 2014, driven by growth in all distribution channels, and included a number of large participating whole life insurance sales.

Group Benefits (“GB”) sales increased to $139 million from $81 million in the third quarter of 2014, including a number of large client wins. Group Retirement Services (“GRS”) sales

increased by 71% compared to the third quarter of the prior year, achieving $2.2 billion, driven by strong defined contribution plan sales. GRS assets under administration were $77 billion at the end of the third quarter of 2015.

SLF Canada achieved Platinum certification from Excellence Canada, which recognizes Canada’s best run corporations across six categories: leadership, strategy,

customer experience, people engagement, process management and partners.

Premier global asset manager, anchored by MFS

In the third quarter of 2015, we completed the acquisitions of Prime Advisors, Inc. (“Prime Advisors”) and the Bentall Kennedy group of companies

(“Bentall Kennedy”). These acquisitions, along with the acquisition of Ryan Labs Asset Management Inc. (“Ryan Labs”) in the second quarter of 2015, build on our strategy to expand our capabilities in customized fixed income

solutions and alternative asset classes in our asset management pillar. Sun Life Investment Management (“SLIM”), which consists of Bentall Kennedy, Prime Advisors, Ryan Labs, and Sun Life Investment Management Inc., had combined total

third-party AUM of $56 billion as at September 30, 2015 and gross sales for the third quarter of 2015 of $1.2 billion.

MFS’s AUM of US$404

billion at the end of September 30, 2015 declined compared to the second quarter of 2015 with market depreciation of $28 billion and net outflows of US$9 billion in the quarter. Lower sales and higher levels of redemptions by institutional

clients were the largest drivers of the outflows in the third quarter of 2015.

MFS’s long-term retail fund performance remains strong with 74%,

86%, and 97% of MFS’s mutual fund assets ranked in the top half of their Lipper categories based on three-, five-, and ten-year performance, respectively, as of the third quarter of 2015.

Bentall Kennedy was named the top North American firm and a top firm globally in the 2015 Global Real Estate Sustainability Benchmark rankings. This is the fifth year that the team at Bentall Kennedy has received

this recognition.

Leader in U.S. group benefits and International high net worth solutions

On September 9, 2015, we announced an agreement to acquire the Employee Benefits business of Assurant, Inc. (“Assurant”). The transaction will expand

our capabilities in our U.S. group benefits business, with an array of employee benefits products that include leading capabilities in the Group Life and Disability, Dental and Vision, Stop-Loss and Voluntary businesses.

This acquisition, in concert with the management of our current U.S. group business, allows us to accelerate growth in our U.S. strategic pillar, bringing value to

our clients, partners, distributors, employees and the communities we serve.

We also continued our expense, claims management and pricing actions in the

group life and disability business, driving improvement in Group Benefits operating net income. In addition, we continue to expand our offerings on private exchanges, a growing distribution platform in the U.S. market. In September 2015, we

announced a partnership with Maxwell Health, our fourth private exchange partnership agreement signed in 2015, bringing us to a total of eight private exchange platforms.

The U.S. stop-loss business continued to achieve strong results. Sales increased 63% to US$60 million compared to the third quarter of 2014, along with a 14% growth in stop-loss business in-force over the same

quarter in the prior year.

Growing Asia through distribution excellence in higher growth markets

Wealth sales in SLF Asia grew compared to the third quarter of 2014, with strong mutual fund sales in India and higher managed funds sales in Hong Kong.

Individual insurance sales in SLF Asia of $114 million reflected sales growth in the Philippines, Vietnam and Malaysia, which were more than offset by decreases in

Hong Kong, Indonesia, India and China.

Sun Life of Canada (Philippines), Inc. received the prestigious ‘Employer of the Year’ award by the

People Management Association of the Philippines. The annual award is based on leadership, business results and contributions to the community.

|

|

|

|

|

|

|

| 2 |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

|

About Sun Life Financial

Celebrating 150 years in 2015, Sun Life Financial is a leading international financial services organization providing a diverse range of protection and wealth products and services to individuals and corporate

customers. Sun Life Financial and its partners have operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore,

Vietnam, Malaysia and Bermuda. As of September 30, 2015, the Sun Life Financial group of companies had total assets under management of $846 billion. For more information please visit www.sunlife.com.

Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

|

|

|

|

|

|

|

| |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

3 |

Management’s Discussion and Analysis

For the period ended September 30, 2015

Dated November 4, 2015

How We Report Our Results

Sun Life Financial Inc. (“SLF Inc.”), and its

subsidiaries and joint ventures, are collectively referred to as “the Company”, “Sun Life Financial”, “we”, “our”, and “us”. We manage our operations and report our financial results in five business

segments: Sun Life Financial Canada (“SLF Canada”), Sun Life Financial United States (“SLF U.S.”), Sun Life Financial Asset Management (“SLF Asset Management”), Sun Life Financial Asia (“SLF Asia”), and

Corporate. SLF Asset Management consists of the operations of MFS Investment Management (“MFS”) and Sun Life Investment Management (“SLIM”). SLIM consists of the Bentall Kennedy group of companies (“Bentall Kennedy”),

Prime Advisors, Inc. (“Prime Advisors”), Ryan Labs Asset Management Inc. (“Ryan Labs”), and Sun Life Investment Management Inc. (“SLIM Inc.”). Our Corporate segment includes the operations of our United

Kingdom business unit (“SLF U.K.”) and Corporate Support operations. Our Corporate Support operations includes our Run-off reinsurance business and investment income, expenses, capital and other items not allocated to other business

segments. Information concerning these segments is included in our annual and interim consolidated financial statements and accompanying notes (“Annual Consolidated Financial Statements” and “Interim Consolidated Financial

Statements”, respectively). We prepare our unaudited Interim Consolidated Financial Statements using International Financial Reporting Standards (“IFRS”), and in accordance with the International Accounting Standard (“IAS”)

34 Interim Financial Reporting. The information contained in this document is in Canadian dollars unless otherwise noted.

SLF Asset

Management

In the third quarter of 2015, we renamed our MFS segment to SLF Asset Management to reflect our acquisitions closed in 2015. This segment

includes the operations of MFS, our premier global asset management firm, previously reported as the MFS segment, and the operations of SLIM, our third-party institutional investment management business, have been added to this segment. SLIM

consists of: (i) Bentall Kennedy, a real estate investment manager operating in Canada and the U.S.; (ii) Prime Advisors, Inc., a U.S.-based investment management firm specializing in customized fixed income portfolios primarily for U.S.

insurance companies; (iii) Ryan Labs Asset Management Inc. (previously Ryan Labs, Inc.), a New York-based asset manager specializing in fixed income and liability-driven investing; and (iv) SLIM Inc., our institutional asset manager which

provides investment expertise in alternative asset classes and liability-driven investing to pension funds and other institutional investors in Canada.

Use of Non-IFRS Financial Measures

We report certain

financial information using non-IFRS financial measures, as we believe that these measures provide information that is useful to investors in understanding our performance and facilitate a comparison of our quarterly and full year results from

period to period. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under

IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Additional information concerning these non-IFRS financial measures and reconciliations to the

closest IFRS measures are included in our annual and interim management’s discussion and analysis (“MD&A”) and the Supplementary Financial Information packages that are available on www.sunlife.com under Investors –

Financial results & reports. Reconciliations to IFRS measures are also available in this document under the heading Reconciliation of Non-IFRS Financial Measures.

Operating net income (loss) and financial measures based on operating net income (loss), consisting of operating earnings per share (“EPS”) or operating loss per share, and operating return on equity

(“ROE”), are non-IFRS financial measures. Operating net income (loss) excludes from reported net income the impact of the following amounts that are not operational or ongoing in nature to assist investors in understanding our business

performance: (i) certain hedges in SLF Canada that do not qualify for hedge accounting; (ii) fair value adjustments on share-based payment awards at MFS; (iii) the loss on the sale of our U.S. Annuity Business(1); (iv) the impact of assumption changes and management actions related to the sale of our U.S. Annuity Business(1); (v) acquisition, integration and restructuring costs (including impacts related to the sale of our U.S. Annuity Business(1) and impacts related to acquiring and integrating acquisitions, previously reported as restructuring and other related costs); (vi) goodwill and intangible asset

impairment charges; and (vii) other items that are not operational or ongoing in nature. Operating EPS also excludes the dilutive impact of convertible instruments.

Underlying net income (loss) and financial measures based on underlying net income (loss), consisting of underlying EPS or underlying loss per share, and underlying ROE, are non-IFRS financial measures. Underlying

net income (loss) removes from operating net income (loss) the impact of the following items that create volatility in our results under IFRS and when removed assist

| (1) |

Effective August 1, 2013, we completed the sale of our U.S. annuities business and certain of our U.S. life insurance businesses (collectively, our “U.S. Annuity

Business”). For information on our discontinued operations, refer to our 2014 Annual Consolidated Financial Statements and 2013 annual MD&A. |

|

|

|

|

|

|

|

| 4 |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

in explaining our results from period to period: (a) market related impacts; (b) assumption changes and management actions; and (c) other items that have not been treated as

adjustments to operating net income and when removed assist in explaining our results from period to period. Market related impacts include: (i) the impact of changes in interest rates that differ from our best estimate assumptions in the

reporting period on investment returns and the value of derivative instruments used in our hedging programs, including changes in credit and swap spreads, and any changes to the assumed fixed income reinvestment rates in determining the actuarial

liabilities; (ii) the impact of changes in equity markets, net of hedging, above or below our best estimate assumptions of approximately 2% growth per quarter in the reporting period and of basis risk inherent in our hedging program for

products that provide benefit guarantees; and (iii) the impact of changes in the fair value of real estate properties in the reporting period. Additional information regarding these adjustments is available in the footnotes to the table

included under the heading Q3 2015 vs. Q3 2014 in the Financial Summary section in this document. Assumption changes reflect the impact of revisions to the assumptions used in determining our liabilities for insurance contracts and investment

contracts. The impact on our liabilities for insurance contracts and investment contracts of actions taken by management in the current reporting period, referred to as management actions include, for example, changes in the prices of in-force

products, new or revised reinsurance on in-force business, or material changes to investment policies for asset segments supporting our liabilities. Underlying EPS also excludes the dilutive impact of convertible instruments.

Other non-IFRS financial measures that we use include adjusted revenue, administrative services only (“ASO”), premium and deposit equivalents, mutual fund

assets and sales, managed fund assets and sales, premiums and deposits, adjusted premiums and deposits, assets under management (“AUM”) and assets under administration, and effective income tax rate on an operating net income basis.

Unless indicated otherwise, all factors discussed in this document that impact our results are applicable to reported net income (loss), operating net

income (loss), and underlying net income (loss). Reported net income (loss) refers to Common shareholders’ net income (loss) determined in accordance with IFRS. Reported net income (loss), operating net income (loss) including adjustments,

underlying net income (loss) including adjustments, and net income and other comprehensive income (“OCI”) sensitivities are expressed on an after-tax basis unless otherwise noted.

All EPS measures in this document refer to fully diluted EPS, unless otherwise stated.

Additional Information

Additional information about SLF Inc. can be found in our Annual and Interim Consolidated Financial Statements, annual and interim MD&A and

Annual Information Form (“AIF”). These documents are filed with securities regulators in Canada and are available at www.sedar.com. SLF Inc.’s Annual Consolidated Financial Statements, annual MD&A and AIF are filed with the

United States Securities and Exchange Commission (“SEC”) in SLF Inc.’s annual report on Form 40-F and SLF Inc.’s interim MD&As and Interim Consolidated Financial Statements are

furnished to the SEC on Form 6-Ks and are available at www.sec.gov.

|

|

|

|

|

|

|

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

5 |

Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarterly results |

|

|

Year-to-date |

|

| ($ millions, unless otherwise noted) |

|

Q3’15 |

|

|

Q2’15 |

|

|

Q1’15 |

|

|

Q4’14 |

|

|

Q3’14 |

|

|

2015 |

|

|

2014 |

|

| Net income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating net income (loss)(1) |

|

|

478 |

|

|

|

731 |

|

|

|

446 |

|

|

|

511 |

|

|

|

467 |

|

|

|

1,655 |

|

|

|

1,409 |

|

| Reported net income (loss) |

|

|

482 |

|

|

|

726 |

|

|

|

441 |

|

|

|

502 |

|

|

|

435 |

|

|

|

1,649 |

|

|

|

1,260 |

|

| Underlying net income (loss)(1) |

|

|

528 |

|

|

|

615 |

|

|

|

516 |

|

|

|

360 |

|

|

|

517 |

|

|

|

1,659 |

|

|

|

1,456 |

|

| Diluted EPS ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating EPS (diluted)(1) |

|

|

0.78 |

|

|

|

1.19 |

|

|

|

0.73 |

|

|

|

0.83 |

|

|

|

0.76 |

|

|

|

2.70 |

|

|

|

2.30 |

|

| Reported EPS (diluted) |

|

|

0.79 |

|

|

|

1.18 |

|

|

|

0.72 |

|

|

|

0.81 |

|

|

|

0.71 |

|

|

|

2.68 |

|

|

|

2.05 |

|

| Underlying EPS (diluted)(1) |

|

|

0.86 |

|

|

|

1.00 |

|

|

|

0.84 |

|

|

|

0.59 |

|

|

|

0.84 |

|

|

|

2.71 |

|

|

|

2.38 |

|

| Reported basic EPS ($) |

|

|

0.79 |

|

|

|

1.19 |

|

|

|

0.72 |

|

|

|

0.82 |

|

|

|

0.71 |

|

|

|

2.69 |

|

|

|

2.06 |

|

| Avg. common shares outstanding (millions) |

|

|

611 |

|

|

|

612 |

|

|

|

613 |

|

|

|

613 |

|

|

|

612 |

|

|

|

612 |

|

|

|

611 |

|

| Closing common shares outstanding (millions) |

|

|

611.2 |

|

|

|

610.6 |

|

|

|

611.2 |

|

|

|

613.1 |

|

|

|

612.7 |

|

|

|

611.2 |

|

|

|

612.7 |

|

| Dividends per common share ($) |

|

|

0.38 |

|

|

|

0.38 |

|

|

|

0.36 |

|

|

|

0.36 |

|

|

|

0.36 |

|

|

|

1.12 |

|

|

|

1.08 |

|

| MCCSR

ratio(2) |

|

|

229% |

|

|

|

223% |

|

|

|

216% |

|

|

|

217% |

|

|

|

218% |

|

|

|

229% |

|

|

|

218% |

|

| Return on equity (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating ROE(1) |

|

|

10.5% |

|

|

|

16.5% |

|

|

|

10.4% |

|

|

|

12.6% |

|

|

|

11.9% |

|

|

|

12.5% |

|

|

|

12.2% |

|

| Underlying

ROE(1) |

|

|

11.6% |

|

|

|

13.9% |

|

|

|

12.1% |

|

|

|

8.8% |

|

|

|

13.1% |

|

|

|

12.5% |

|

|

|

12.6% |

|

| Premiums and deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net premium revenue |

|

|

2,114 |

|

|

|

2,523 |

|

|

|

2,207 |

|

|

|

2,701 |

|

|

|

2,695 |

|

|

|

6,844 |

|

|

|

7,295 |

|

| Segregated fund deposits |

|

|

2,626 |

|

|

|

4,487 |

|

|

|

2,411 |

|

|

|

2,155 |

|

|

|

1,907 |

|

|

|

9,524 |

|

|

|

7,094 |

|

| Mutual fund sales(1) |

|

|

16,902 |

|

|

|

19,927 |

|

|

|

22,124 |

|

|

|

17,071 |

|

|

|

14,714 |

|

|

|

58,953 |

|

|

|

49,548 |

|

| Managed fund sales(1) |

|

|

7,507 |

|

|

|

7,002 |

|

|

|

8,243 |

|

|

|

7,988 |

|

|

|

8,170 |

|

|

|

22,752 |

|

|

|

21,880 |

|

| ASO premium and deposit equivalents(1) |

|

|

1,758 |

|

|

|

1,781 |

|

|

|

1,769 |

|

|

|

1,855 |

|

|

|

1,638 |

|

|

|

5,308 |

|

|

|

4,893 |

|

| Total premiums and

deposits(1) |

|

|

30,907 |

|

|

|

35,720 |

|

|

|

36,754 |

|

|

|

31,770 |

|

|

|

29,124 |

|

|

|

103,381 |

|

|

|

90,710 |

|

| Assets under management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General fund assets |

|

|

151,654 |

|

|

|

145,472 |

|

|

|

148,725 |

|

|

|

139,419 |

|

|

|

133,623 |

|

|

|

151,654 |

|

|

|

133,623 |

|

| Segregated funds |

|

|

88,248 |

|

|

|

90,500 |

|

|

|

89,667 |

|

|

|

83,938 |

|

|

|

82,058 |

|

|

|

88,248 |

|

|

|

82,058 |

|

| Mutual funds, managed funds and other AUM(1) |

|

|

606,256 |

|

|

|

572,110 |

|

|

|

574,166 |

|

|

|

511,085 |

|

|

|

482,499 |

|

|

|

606,256 |

|

|

|

482,499 |

|

| Total

AUM(1) |

|

|

846,158 |

|

|

|

808,082 |

|

|

|

812,558 |

|

|

|

734,442 |

|

|

|

698,180 |

|

|

|

846,158 |

|

|

|

698,180 |

|

| Capital |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated debt and innovative capital

instruments(3) |

|

|

3,389 |

|

|

|

2,879 |

|

|

|

2,881 |

|

|

|

2,865 |

|

|

|

2,857 |

|

|

|

3,389 |

|

|

|

2,857 |

|

| Participating policyholders’ equity |

|

|

164 |

|

|

|

139 |

|

|

|

142 |

|

|

|

141 |

|

|

|

133 |

|

|

|

164 |

|

|

|

133 |

|

| Total shareholders’ equity |

|

|

20,609 |

|

|

|

19,997 |

|

|

|

19,761 |

|

|

|

18,731 |

|

|

|

18,156 |

|

|

|

20,609 |

|

|

|

18,156 |

|

| Total capital |

|

|

24,162 |

|

|

|

23,015 |

|

|

|

22,784 |

|

|

|

21,737 |

|

|

|

21,146 |

|

|

|

24,162 |

|

|

|

21,146 |

|

| (1) |

Represents a non-IFRS financial measure. See Use of Non-IFRS Financial Measures and Reconciliation of Non-IFRS Financial Measures. |

| (2) |

Minimum Continuing Capital and Surplus Requirements (“MCCSR”) ratio of Sun

Life Assurance Company of Canada (“Sun Life Assurance”). |

| (3) |

Innovative capital instruments consist of Sun Life ExchangEable Capital Securities and qualify as capital for Canadian regulatory purposes. However, under IFRS

they are reported as Senior debentures in our Annual and Interim Consolidated Financial Statements. For additional information see Capital and Liquidity Management – Capital in our 2014 annual MD&A. |

Unless indicated otherwise, all factors discussed in this document that impact our results are applicable to reported net income (loss), operating net income

(loss), and underlying net income (loss).

Q3 2015 vs. Q3 2014

Our reported net income was $482 million in the third quarter of 2015, compared to $435 million in the third quarter of 2014. Operating net income was $478 million for the quarter ended September 30, 2015,

compared to $467 million for the same period last year. Underlying net income was $528 million, compared to $517 million in the third quarter of 2014.

Operating ROE and underlying ROE in the third quarter of 2015 were 10.5% and 11.6%, respectively. Operating and underlying ROE in the third quarter of 2014 were

11.9% and 13.1%, respectively.

|

|

|

|

|

|

|

| 6 |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

The following table reconciles our net income measures and sets out the impact that other notable items had on our net

income in the third quarter of 2015 and 2014.

|

|

|

|

|

|

|

|

|

| |

|

Quarterly results |

|

| ($ millions, after-tax) |

|

Q3’15 |

|

|

Q3’14 |

|

| Reported net income |

|

|

482 |

|

|

|

435 |

|

| Certain hedges that do not qualify for hedge accounting in SLF Canada |

|

|

(10 |

) |

|

|

2 |

|

| Fair value adjustments on share-based payment awards at MFS |

|

|

28 |

|

|

|

(31 |

) |

| Acquisition, integration and restructuring costs(1) |

|

|

(14 |

) |

|

|

(3 |

) |

| Operating net

income(2) |

|

|

478 |

|

|

|

467 |

|

| Equity market impact |

|

|

|

|

|

|

|

|

| Impact from equity market changes |

|

|

(116 |

) |

|

|

1 |

|

| Basis risk impact |

|

|

(6 |

) |

|

|

(4 |

) |

| Equity market

impact(3) |

|

|

(122 |

) |

|

|

(3 |

) |

| Interest rate impact |

|

|

|

|

|

|

|

|

| Impact from interest rate changes |

|

|

(13 |

) |

|

|

(56 |

) |

| Impact of credit spread movements |

|

|

26 |

|

|

|

6 |

|

| Impact of swap spread movements |

|

|

31 |

|

|

|

– |

|

| Interest rate impact(4) |

|

|

44 |

|

|

|

(50 |

) |

| Increases (decreases) from changes in the fair value of real estate |

|

|

(4 |

) |

|

|

(1 |

) |

| Market related impacts |

|

|

(82 |

) |

|

|

(54 |

) |

| Assumption changes and management actions |

|

|

32 |

|

|

|

4 |

|

| Underlying net

income(2) |

|

|

528 |

|

|

|

517 |

|

| Impact of other notable items on our net income: |

|

|

|

|

|

|

|

|

| Experience related items(5) |

|

|

|

|

|

|

|

|

| Impact of investment activity on insurance contract liabilities |

|

|

33 |

|

|

|

22 |

|

| Mortality |

|

|

(18 |

) |

|

|

(4 |

) |

| Morbidity |

|

|

(26 |

) |

|

|

(10 |

) |

| Credit |

|

|

20 |

|

|

|

9 |

|

| Lapse and other policyholder behaviour |

|

|

10 |

|

|

|

(8 |

) |

| Expenses |

|

|

(7 |

) |

|

|

(17 |

) |

| Other |

|

|

(16 |

) |

|

|

9 |

|

| Other

items(6) |

|

|

– |

|

|

|

29 |

|

| (1) |

In 2015, acquisition and integration costs primarily related to our acquisitions and

integrations of Bentall Kennedy, Prime Advisors and Ryan Labs and our proposed acquisition of Assurant, Inc.’s U.S. Employee Benefits business. In 2014, restructuring costs consisted of transition costs related to the sale of our U.S. Annuity

Business. |

| (2) |

Represents a non-IFRS financial measure. See Use of Non-IFRS Financial Measures and

Reconciliation of Non-IFRS Financial Measures. |

| (3) |

Equity market impact consists primarily of the effect of changes in equity markets during the quarter, net of hedging, that differ from the best estimate

assumptions used in the determination of our insurance contract liabilities of approximately 2% growth per quarter in equity markets. Equity market impact also includes the income impact of the basis risk inherent in our hedging program, which is

the difference between the return on underlying funds of products that provide benefit guarantees and the return on the derivative assets used to hedge those benefit guarantees. |

| (4) |

Interest rate impact includes the effect of interest rate changes on investment returns that differ from best estimate assumptions, and on the value of

derivative instruments used in our hedging programs. Our exposure to interest rates varies by product type, line of business, and geography. Given the long-term nature of our business, we have a higher degree of sensitivity in respect of interest

rates at long durations. Interest rate impact also includes the income impact of changes in assumed fixed income reinvestment rates and of credit and swap spread movements. |

| (5) |

Experience related items reflect the difference between actual experience during the reporting period and best estimate assumptions used in the determination of

our insurance contract liabilities. |

| (6) |

In 2014, Other items consists of non-recurring tax benefits pertaining to SLF U.K. and MFS. |

Our reported net income for the third quarter of 2015 and 2014 included items that are not operational or ongoing in nature and are, therefore, excluded in our

calculation of operating net income. Operating net income for the third quarter of 2015 and 2014 excluded the net impact of certain hedges that do not qualify for hedge accounting in SLF Canada, fair value adjustments on share-based payment awards

at MFS, and acquisition, integration and restructuring costs. The net impact of these items increased reported net income by $4 million in the third quarter of 2015 compared to a reduction of $32 million in the third quarter of 2014. In

addition, our operating net income in the third quarter of 2015 increased by $58 million as a result of movements in currency rates relative to the average exchange rates in the third quarter of 2014.

Our underlying net income for the third quarter of 2015 and 2014 excludes market related impacts and assumption changes and management actions. The net impact of

market related impacts and assumption changes and management actions reduced operating net income by $50 million in the third quarter of 2015, compared to a decrease of $50 million in the third quarter of 2014.

|

|

|

|

|

|

|

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

7 |

Net income in the third quarter of 2015 also reflected the favourable impact of investment activity on insurance

contract liabilities, positive credit experience and policyholder behaviour, partially offset by unfavourable morbidity and mortality experience, expense experience, and other experience items.

Net income in the third quarter of 2014 also reflected gains from investment activity on insurance contract liabilities, positive credit experience, tax benefits

and business growth. These items were partially offset by unfavourable mortality and morbidity and expense experience.

Q3 2015 vs. Q3 2014

(year-to-date)

Our reported net income was $1,649 million for the first nine months of 2015, compared to $1,260 million in the first nine months of

2014. Operating net income was $1,655 million for the nine months ended September 30, 2015, compared to $1,409 million for the same period last year. Underlying net income was $1,659 million, compared to $1,456 million for the first nine months

of 2014.

Operating ROE and underlying ROE for the first nine months of 2015 were both 12.5%. Operating ROE and underlying ROE for the first nine months

of 2014 were 12.2% and 12.6%, respectively.

The following table reconciles our net income measures and sets out the impact that other notable items had

on our net income for the nine months ended September 30, 2015 and 2014.

|

|

|

|

|

|

|

|

|

| |

|

Year-to-date |

|

| ($ millions, after-tax) |

|

2015 |

|

|

2014 |

|

| Reported net income |

|

|

1,649 |

|

|

|

1,260 |

|

| Certain hedges that do not qualify for hedge accounting in SLF Canada |

|

|

11 |

|

|

|

(1 |

) |

| Fair value adjustments on share-based payment awards at MFS |

|

|

(3 |

) |

|

|

(126 |

) |

| Acquisition, integration and restructuring costs(1) |

|

|

(14 |

) |

|

|

(22 |

) |

| Operating net

income(2) |

|

|

1,655 |

|

|

|

1,409 |

|

| Net equity market impact(3) |

|

|

(124 |

) |

|

|

53 |

|

| Net interest rate impact(4) |

|

|

100 |

|

|

|

(158 |

) |

| Net increases (decreases) from changes in the fair value of real estate |

|

|

17 |

|

|

|

3 |

|

| Market related impacts |

|

|

(7 |

) |

|

|

(102 |

) |

| Assumption changes and management actions |

|

|

3 |

|

|

|

55 |

|

| Underlying net

income(2) |

|

|

1,659 |

|

|

|

1,456 |

|

| Impact of other notable items on our net income: |

|

|

|

|

|

|

|

|

| Experience related items(5) |

|

|

|

|

|

|

|

|

| Impact of investment activity on insurance contract liabilities |

|

|

91 |

|

|

|

90 |

|

| Mortality |

|

|

22 |

|

|

|

(16 |

) |

| Morbidity |

|

|

(12 |

) |

|

|

(38 |

) |

| Credit |

|

|

54 |

|

|

|

43 |

|

| Lapse and other policyholder behaviour |

|

|

(10 |

) |

|

|

(25 |

) |

| Expenses |

|

|

(42 |

) |

|

|

(42 |

) |

| Other |

|

|

(21 |

) |

|

|

22 |

|

| Other

items(6) |

|

|

– |

|

|

|

29 |

|

| (1) |

In 2015, acquisition and integration costs primarily related to our acquisitions and

integrations of Bentall Kennedy, Prime Advisors and Ryan Labs and our proposed acquisition of Assurant, Inc.’s U.S. Employee Benefits business. In 2014, restructuring costs consisted of transition costs related to the sale of our

U.S. Annuity Business. |

| (2) |

Represents a non-IFRS financial measure. See Use of Non-IFRS Financial Measures and

Reconciliation of Non-IFRS Financial Measures. |

| (3) |

Equity market impact consists primarily of the effect of changes in equity markets

during the period, net of hedging, that differ from the best estimate assumptions used in the determination of our insurance contract liabilities of approximately 2% growth per quarter in equity markets. Equity market impact also includes the income

impact of the basis risk inherent in our hedging program, which is the difference between the return on underlying funds of products that provide benefit guarantees and the return on the derivative assets used to hedge those benefit guarantees.

|

| (4) |

Interest rate impact includes the effect of interest rate changes on investment returns that differ from best estimate assumptions, and on the value of

derivative instruments used in our hedging programs. Our exposure to interest rates varies by product type, line of business and geography. Given the long-term nature of our business, we have a higher degree of sensitivity in respect of interest

rates at long durations. Interest rate impact also includes the income impact of changes in assumed fixed income reinvestment rates and of credit and swap spread movements. |

| (5) |

Experience related items reflect the difference between actual experience during the

reporting period and best estimate assumptions used in the determination of our insurance contract liabilities. |

| (6) |

In 2014, Other items consists of non-recurring tax benefits pertaining to SLF U.K. and MFS. |

Our reported net income for the first nine months of 2015 and 2014 included items that are not operational or ongoing in nature and are, therefore, excluded in our

calculation of operating net income. Operating net income for the first nine months of 2015 and 2014 excluded the net impact of certain hedges that do not qualify for hedge accounting in SLF Canada, fair value adjustments on share-based payment

awards at MFS, and acquisition, integration and restructuring costs. The net impact of these items reduced reported net income by $6 million in the first nine months of 2015 compared to a reduction of $149 million in the same period of

2014. In addition, our operating net income in the first nine months of 2015 increased by $137 million as a result of movements in currency rates in the first nine months of 2015 relative to the average exchange rates in the first nine months

of 2014.

|

|

|

|

|

|

|

| 8 |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

Our underlying net income for the first nine months of 2015 and 2014 excludes market related impacts and assumption

changes and management actions. The net impact of market related impacts and assumption changes and management actions reduced operating net income by $4 million in the first nine months of 2015, compared to a decrease of $47 million in

the first nine months of 2014.

Net income for the first nine months of 2015 also reflected the favourable impact from investment activity on insurance

contract liabilities, positive credit and mortality experience, partially offset by unfavourable expense experience including investment in growing our businesses, morbidity, lapse and other policyholder behaviour, and other experience items.

Net income for the first nine months of 2014 also reflected gains from investment activity on insurance contract liabilities, positive credit

experience, business growth and tax benefits, partially offset by unfavourable mortality and morbidity, expense, and lapse and other policyholder behaviour experience.

Assumption Changes and Management Actions

Due to the long-term nature of our business, we make certain

judgments involving assumptions and estimates to value our obligations to policyholders. The valuation of these obligations are recorded in our financial statements as insurance contract liabilities and investment contract liabilities and requires

us to make assumptions about equity market performance, interest rates, asset default, mortality and morbidity rates, lapse and other policyholder behaviour, expenses and inflation and other factors over the life of our products. We review

assumptions each year, generally in the third quarter, and revise these assumptions if appropriate.

During the third quarter of 2015 the net impact of

assumption changes and management actions resulted in an increase of $32 million to reported and operating net income compared to an increase of $4 million in the third quarter of 2014.

Assumption changes and management actions by type

The following table sets out the impact of assumption

changes and management actions on our net income in the third quarter of 2015.

|

|

|

|

|

|

|

| Q3’15 |

|

Quarterly |

| ($ millions, after-tax) |

|

Impact on net income |

|

|

Comments |

| Mortality/morbidity |

|

|

179 |

|

|

Updates to reflect mortality/morbidity experience in all jurisdictions and changes to future mortality improvement assumptions in the International insurance business in SLF

U.S. |

| Lapse and other policyholder behaviour |

|

|

(555 |

) |

|

Updates to reflect experience as discussed below. |

| Expenses |

|

|

(85 |

) |

|

Updates to reflect expense studies primarily in our International wealth business in SLF U.S. and in the individual wealth business in SLF Canada. |

| Investment returns |

|

|

237 |

|

|

Updates to various investment related assumptions. The largest items are a change to the provision for investment risk in the SLF Canada participating account and the reflection of

investment strategy changes in the SLF Canada non-participating insurance business. |

| Model enhancements and other |

|

|

256 |

|

|

Other changes, the largest of which are changes in reinsurance agreements and tax assumptions in the SLF U.S. insurance business. |

| Total impact on net

income(1) |

|

|

32 |

|

|

|

| (1) |

Assumption changes and management actions is presented as an adjustment to arrive at underlying net income described in the Q3 2015 vs. Q3 2014 heading of

this section. |

Changes in lapse and policyholder behaviour assumptions are primarily in the individual insurance businesses in SLF

Canada and SLF U.S. The largest items, which all had negative impacts, were the increase in lapse rates at renewal for term insurance in SLF Canada to reflect a stronger link between lapse rates and the size of the renewal premium increase; the

reduction in lapse rates at longer policy durations for Universal Life policies in SLF Canada to reflect emerging experience; the reduction in assumed premium payments for flexible premium insurance policies in SLF U.S. to reflect the increasing

tendency of policyholders to stop paying premiums when their policy becomes fully funded; and the reduction in lapse rates on International insurance policies, especially for no-lapse-guarantee policies.

Goodwill Impairment Testing

In the fourth quarter of 2015,

we will perform our annual goodwill impairment testing. Testing is conducted by comparing a cash generating unit’s (“CGU’s”) carrying value to its recoverable amount. We determine the recoverable amount by reference to an

appraisal value that is impacted by the economic and regulatory environment, which includes changes in interest rates, market volatility, capital requirements and other factors, and is based on estimates of future sales, income, expenses, and the

level and cost of capital over the lifetime of the business.

|

|

|

|

|

|

|

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

9 |

A listing of our CGUs as at December 31, 2014 and the goodwill allocated to them is included in Note 10 of our

2014 Annual Consolidated Financial Statements.

Goodwill is not recognized as an asset for MCCSR purposes and is deducted from available capital.

Therefore, impairment charges against goodwill do not have any impact on the MCCSR ratio.

Acquisitions

On July 31, 2015, we completed the acquisition of Prime Advisors, a U.S.-based investment management firm specializing in customized fixed income portfolios

primarily for U.S. insurance companies.

On September 1, 2015, we completed the acquisition of Bentall Kennedy, a real estate investment manager

operating in Canada and the U.S.

On September 9, 2015, we entered into an agreement with Assurant, Inc. (“Assurant”) to acquire

Assurant’s U.S. Employee Benefits business. The acquisition will be financed using a combination of cash and subordinated debt issued by SLF Inc. The transaction is expected to close by the end of the first quarter of 2016 and is subject to

regulatory approvals and customary closing conditions.

Additional information concerning the acquisitions is provided in Note 3 of our Interim

Consolidated Financial Statements.

Impact of Foreign Exchange Rates

We have operations in many markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia,

and Bermuda, and generate revenues and incur expenses in local currencies in these jurisdictions, which are translated to Canadian dollars.

Items

impacting our Consolidated Statements of Operations, such as Revenue, Benefits and expenses, and income, are translated to Canadian dollars using average exchange rates for the respective period. For items impacting our Consolidated Statements of

Financial Position, such as Assets and Liabilities, period end rates are used for currency translation purposes. The following table provides the most relevant foreign exchange rates over the past five quarters and two years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarterly |

|

|

Year-to-date |

|

| Exchange Rate |

|

Q3’15 |

|

|

Q2’15 |

|

|

Q1’15 |

|

|

Q4’14 |

|

|

Q3’14 |

|

|

2015 |

|

|

2014 |

|

| Average |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Dollar |

|

|

1.307 |

|

|

|

1.229 |

|

|

|

1.240 |

|

|

|

1.136 |

|

|

|

1.088 |

|

|

|

1.259 |

|

|

|

1.094 |

|

| U.K. Pounds |

|

|

2.025 |

|

|

|

1.882 |

|

|

|

1.878 |

|

|

|

1.797 |

|

|

|

1.817 |

|

|

|

1.929 |

|

|

|

1.825 |

|

| Period end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Dollar |

|

|

1.331 |

|

|

|

1.249 |

|

|

|

1.269 |

|

|

|

1.162 |

|

|

|

1.120 |

|

|

|

1.331 |

|

|

|

1.120 |

|

| U.K. Pounds |

|

|

2.014 |

|

|

|

1.962 |

|

|

|

1.880 |

|

|

|

1.809 |

|

|

|

1.815 |

|

|

|

2.014 |

|

|

|

1.815 |

|

In general, our net income benefits from a weakening Canadian dollar and is adversely affected by a strengthening Canadian dollar as

net income from the Company’s international operations is translated back to Canadian dollars. However, in a period of losses, the weakening of the Canadian dollar has the effect of increasing the losses. The relative impact of foreign exchange

in any given period is driven by the movement of currency rates as well as the proportion of earnings generated in our foreign operations. We generally express the impact of foreign exchange on net income on a year-over-year basis. During the third

quarter of 2015, our operating net income increased by $58 million as a result of movements in currency rates in the third quarter of 2015 relative to the average exchange rates in the third quarter of 2014. In addition, during the first nine months

of 2015, our operating net income increased by $137 million as a result of movements in currency rates in the first nine months of 2015 relative to the average exchange rates in the first nine months of 2014.

|

|

|

|

|

|

|

| 10 |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS |

Performance by Business Group

SLF Canada

SLF Canada is the Canadian market leader in a number of its businesses, providing products and services to over six million Canadians. Our distribution breadth, strong service culture, technology leadership, and

brand recognition provide an excellent platform for growth. SLF Canada has three main business units – Individual Insurance & Wealth, Group Benefits (“GB”), and Group Retirement Services (“GRS”) – which offer a

full range of protection, wealth accumulation, and income products and services to individuals in their communities and their workplaces.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarterly results |

|

|

Year-to-date |

|

| ($ millions) |

|

Q3’15 |

|

|

Q2’15 |

|

|

Q1’15 |

|

|

Q4’14 |

|

|

Q3’14 |

|

|

2015 |

|

|

2014 |

|

| Underlying net income (loss)(1) |

|

|

174 |

|

|

|

250 |

|

|

|

201 |

|

|

|

181 |

|

|

|

237 |

|

|

|

625 |

|

|

|

642 |

|

| Market related impacts |

|

|

(51 |

) |

|

|

70 |

|

|

|

(69 |

) |

|

|

(54 |

) |

|

|

(33 |

) |

|

|

(50 |

) |

|

|

(23 |

) |

| Assumption changes and management actions |

|

|

14 |

|

|

|

11 |

|

|

|

3 |

|

|

|

(4 |

) |

|

|

35 |

|

|

|

28 |

|

|

|

55 |

|

| Operating net income (loss)(1) |

|

|

137 |

|

|

|

331 |

|

|

|

135 |

|

|

|

123 |

|

|

|

239 |

|

|

|

603 |

|

|

|

674 |

|

| Hedges that do not qualify for hedge accounting |

|

|

(10 |

) |

|

|

6 |

|

|

|

15 |

|

|

|

(6 |

) |

|

|

2 |

|

|

|

11 |

|

|

|

(1 |

) |

| Reported net income (loss) |

|

|

127 |

|

|

|

337 |

|

|

|

150 |

|

|

|

117 |

|

|

|

241 |

|

|

|

614 |

|

|

|

673 |

|

| Underlying ROE (%)(1) |

|

|

9.0 |

|

|

|

12.8 |

|

|

|

10.6 |

|

|

|

9.7 |

|

|

|

12.8 |

|

|

|

10.8 |

|

|

|

11.6 |

|

| Operating ROE

(%)(1) |

|

|

7.0 |

|

|

|

17.0 |

|

|

|

7.1 |

|

|

|

6.6 |

|

|

|

12.9 |

|

|

|

10.4 |

|

|

|

12.2 |

|

| Operating net income (loss) by business

unit(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Individual Insurance & Wealth(1) |

|

|

42 |

|

|

|

178 |

|

|

|

38 |

|

|

|

80 |

|

|

|

68 |

|

|

|

258 |

|

|

|

304 |

|

| Group Benefits(1) |

|

|

71 |

|

|

|

107 |

|

|

|

54 |

|

|

|

55 |

|

|

|

124 |

|

|

|

232 |

|

|

|

235 |

|

| Group Retirement

Services(1) |

|

|

24 |

|

|

|

46 |

|

|

|

43 |

|

|

|

(12 |

) |

|

|

47 |

|

|

|

113 |

|

|

|

135 |

|

| Total operating net income

(loss)(1) |

|

|

137 |

|

|

|

331 |

|

|

|

135 |

|

|

|

123 |

|

|

|

239 |

|

|

|

603 |

|

|

|

674 |

|

| (1) |

Represents a non-IFRS financial measure. See Use of Non-IFRS Financial Measures and Reconciliation of Non-IFRS Financial Measures. |

Q3 2015 vs. Q3 2014

SLF Canada’s reported net income

was $127 million in the third quarter of 2015, compared to $241 million in the third quarter of 2014. Operating net income was $137 million, compared to $239 million in the third quarter of 2014. Operating net income for both periods in SLF Canada

excludes the impact of certain hedges that do not qualify for hedge accounting, which are set out in the table above.

Underlying net income in the third

quarter of 2015 was $174 million, compared to $237 million in the third quarter of 2014. Underlying net income in SLF Canada excludes from operating net income market related impacts and assumption changes and management actions, which are set out

in the table above. The unfavourable effect of market related impacts in the third quarter of 2015 was primarily driven by equity markets partially offset by swap spreads and credit spreads, compared to the unfavourable effect in the third quarter

of 2014 primarily driven by interest rates and equity markets.

Net income in the third quarter of 2015 also reflected lower gains from new business in

GRS, unfavourable mortality experience in the individual wealth business in Individual Insurance & Wealth and GRS, and expense experience including investment in growing our individual wealth business. In our GB line of business, the

unfavourable, though improved, impacts of high cost drug claims were offset by positive disability experience.

Net income in the third quarter of 2014

also reflected net realized gains on available-for-sale (“AFS”) assets, the favourable impact of gains from new business in GRS and the insurance business in Individual Insurance & Wealth, as well as gains from investing activity

on insurance contract liabilities.

In the third quarter of 2015, individual life and health insurance product sales increased 31% compared to the same

period last year, and included a number of large participating whole life insurance sales. Sales of Individual wealth products increased 16% over the third quarter of 2014 due to strong mutual fund sales and segregated fund sales including sales of

Sun Life Guaranteed Investment Funds. Sun Life Global Investments (Canada) Inc. (“SLGI”) retail mutual funds continued their positive momentum from 2014, with sales up 45% over the same period in 2014.

GB sales increased 72% compared to the third quarter of 2014 primarily driven by activity in the large case market segment. GRS sales increased 71% compared to the

prior year due to strong defined contribution sales and the successful retention of large case business. Pension rollover sales were $543 million, an increase of 39% from the third quarter of 2014.

Q3 2015 vs. Q3 2014 (year-to-date)

Reported net income was

$614 million for the first nine months of 2015, compared to $673 million for the nine months ended September 30, 2014. Operating net income for the first nine months of 2015 was $603 million, compared to $674 million in the same

|

|

|

|

|

|

|

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

|

Sun Life Financial Inc. |

|

Third Quarter 2015 |

|

11 |

period of 2014. Operating net income for both periods in SLF Canada excludes the impact of certain hedges that do not qualify for hedge accounting, which are set out in the table above.

Underlying net income was $625 million in the nine months ended September 30, 2015, compared to $642 million in the same period last year.

Underlying net income in SLF Canada excludes from operating net income market related impacts and assumption changes and management actions, which are set out in the table above. The unfavourable effect of market related impacts in the first nine

months of 2015 was primarily driven by equity markets partially offset by the positive impacts of swap spreads and credit spreads, compared to the unfavourable effect in the first nine months of 2014 primarily driven by interest rates partially

offset by equity markets.

Net income for the nine months ended September 30, 2015 also reflected gains from investment activity on insurance

contract liabilities offset by unfavourable policyholder behaviour, lower gains on new business, and expense experience including investment in growing our individual wealth business.

Net income for the nine months ended September 30, 2014 also reflected net realized gains on AFS assets, gains from new business in GRS and the insurance business in Individual Insurance & Wealth, as

well as gains from investing activity on insurance contract liabilities. These positive impacts were partially offset by unfavourable morbidity experience in GB.

SLF U.S.

SLF U.S. has three business units: Group Benefits, International, and In-force Management. Group Benefits provides protection solutions to employers and employees

including group life, disability, medical stop-loss, and dental insurance products, as well as a suite of voluntary benefits products. International offers individual life insurance and investment wealth products to high net worth clients in

international markets. In-force Management includes certain closed individual life insurance products, primarily universal life and participating whole life insurance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarterly results |

|

|

Year-to-date |

|

| (US$ millions) |

|

Q3’15 |

|

|

Q2’15 |

|

|

Q1’15 |

|

|

Q4’14 |

|

|

Q3’14 |

|

|

2015 |

|

|

2014 |

|

| Underlying net income (loss)(1) |

|

|

73 |

|

|

|

85 |

|

|

|

65 |

|

|

|

9 |

|

|

|

45 |

|

|

|

223 |

|

|

|

231 |

|

| Market related impacts |

|

|

(16 |

) |

|

|

23 |

|

|

|

8 |

|

|

|

16 |

|

|

|

(6 |

) |

|

|

15 |

|

|

|

(53 |

) |

| Assumption changes and management actions |

|

|

(8 |

) |

|

|

– |

|

|

|

(54 |

) |

|

|

121 |

|

|

|

(42 |

) |

|

|

(62 |

) |

|

|

(19 |

) |

| Operating net income (loss)(1) |

|

|

49 |

|

|

|

108 |

|

|

|

19 |

|

|

|

146 |

|

|

|

(3 |

) |

|

|

176 |

|

|

|

159 |

|

| Reported net income (loss) |

|

|

49 |

|

|

|

108 |

|

|

|

19 |

|

|

|

146 |

|

|

|

(3 |

) |

|

|

176 |

|

|

|

159 |

|

| Underlying ROE (%)(1) |

|

|

11.2 |

|

|

|

12.7 |

|

|

|

9.7 |

|

|

|

1.3 |

|

|

|

6.8 |

|

|

|

11.2 |

|

|

|

11.3 |

|

| Operating ROE

(%)(1) |

|

|

7.5 |

|

|

|

16.2 |

|

|

|

2.8 |

|

|

|

22.0 |

|

|

|

(0.4 |

) |

|

|

8.9 |

|

|

|

7.8 |

|

| Operating net income (loss) by business

unit(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Group Benefits(1) |

|

|

16 |

|

|

|

22 |

|

|

|

38 |

|

|

|

(64 |

) |

|

|

(11 |

) |

|

|

76 |

|

|

|

9 |

|

| International(1) |

|

|

67 |

|

|

|

(1 |

) |

|

|

2 |

|

|

|

78 |

|

|

|

33 |

|

|

|

68 |

|

|

|

83 |

|

| In-force

Management(1) |

|

|

(34 |

) |

|

|

87 |

|

|

|

(21 |

) |

|

|

132 |

|

|

|

(25 |

) |

|

|

32 |

|

|

|

67 |

|

| Total operating net income (loss)(1) |

|

|

49 |

|

|

|

108 |

|

|

|

19 |

|

|

|

146 |

|

|

|

(3 |

) |

|

|

176 |

|

|

|

159 |

|

|

|

|

|

|

|

|

|

| (C$ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Underlying net income (loss)(1) |

|

|

97 |