Sun Life, Industrial Alliance Beat 3Q Expectations

November 03 2010 - 6:21PM

Dow Jones News

Two of Canada's top-four life insurers posted

better-than-expected third-quarter results Wednesday from rising

equity markets and managing their exposure to rock-bottom interest

rates.

Sun Life Financial Inc. (SLF, SLF.T), which owns Boston-based

MFS Investment Management, swung to a profit of C$453 million, or

79 Canadian cents a share, from a year-earlier loss of C$140

million, or 25 Canadian cents. Per-share results handily surpassed

analysts' expectations of 61 Canadian cents, according to Thomson

Reuters.

Industrial Alliance Insurance and Financial Services Inc.'s

(IAG.T) net income rose 9% to C$64.7 million, or 78 Canadian cents

a share, its strongest quarterly result since the 2008 global

financial crisis. The life insurer topped the mean estimate of 75

Canadian cents from a Thomson Reuters survey.

Both companies benefited from higher equity markets, as the

S&P/TSX and the S&P 500 rallied 9.5% and 10.7%,

respectively, in the quarter ended Sept. 30, and from their

wealth-management divisions. Both life insurers also said they took

steps to mitigate the earnings impact of low interest rates, which

had little impact on their results. Life insurers are forced to

build up their reserves to cover long-term obligations on products,

such as annuities, when equities or interest rates fall.

Manulife Financial Corp. (MFC, MFC.T), the most sensitive to

equity-market volatility and low interest rates because it sold

more long-term guaranteed products, releases its results Thursday,

while Great-West Lifeco Inc. (GWLIF, GWO.T), the least earnings

sensitive, reports next week.

For the past year, investors have been on a rollercoaster with

Manulife, as its earnings fall and rise with the markets as it

marks to market investments against its long-term obligations.

"The focus will be on Manulife. If they can straighten out, the

whole industry will have a big sigh of relief," said John Kinsey, a

portfolio manager at Toronto-based Caldwell Investment Management

Ltd., which manages assets of C$1 billion, including life-insurance

stocks.

"People are looking from them to get the feeling that the write

offs are over, and that they've done all they're going to do with

their hedging and are comfortable with where they are now rather

than the confusion that we've seen for the last year," he said.

Toronto-based Sun Life also attributed its improved performance

to changes in its actuarial assumptions. Like Manulife, Sun Life

generally reassesses its assumptions in the third quarter each

year. Concern about the U.S. commercial-mortgage market prompted

Sun Life to raise its mortgage sectoral allowance by C$57 million,

which reduced net income by C$40 million, it said in a

statement.

Sun Life said the net impact from interest rates in the third

quarter "was not material" on its third-quarter results because of

its use of interest-rate swaps.

Assets under management rose 10% to C$455 billion, primarily

from rising equity markets and the sale of more mutual and managed

funds. Total assets under management at MFS were US$204

billion.

The company's U.S. division also returned to profitability

compared to the prior quarter and the year-earlier quarter, it

said.

Quebec City-based Industrial Alliance recorded its

fourth-straight quarter of solid top-line growth, with premiums and

deposits increasing 15% to C$1.4 billion and the value of new

business jumping 44% to C$41.4 million.

The life insurer appears on track to surpass its 2007 record.

For the nine months, premiums and deposits were up 31% over 2009

and 7% over 2007, fuelled primarily by its individual

wealth-management division, which is benefiting from stock-market

gains and high net sales, it said in a statement. Assets under

management and administration grew by 7% to C$64.1 million at

quarter end.

The company, which plans to finalize changes to its actuarial

assumptions by the end of the fourth quarter, said it is "confident

at this time" that it won't have any significant impact on its

fourth-quarter results.

With investors' focused on the sector's sensitivity to

capital-market fluctuations, Industrial Alliance said it is taking

steps to reduce its sensitivity to interest rates, including a 5%

increase in the proportion of stocks backing long-term liabilities.

If these initiatives had been in place at Sept. 30, it would be

able to absorb a 15% decline in equity markets and that provisions

for future policy benefits wouldn't have to be strengthened as long

as the S&P/TSX remains above 10,500 points, it said in a

statement.

Industrial Alliance also said it implemented a hedging program

to manage the equity risk related to its guaranteed annuity

product, effective Oct. 20. The guaranteed annuity book represents

about C$1.5 billion of assets under management, including C$900

million in equities.

-By Caroline Van Hasselt, Dow Jones Newswires; 416-306-2023;

caroline.vanhasselt@dowjones.com

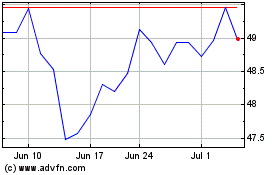

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

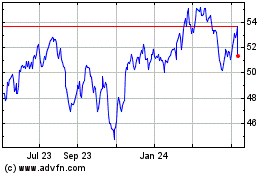

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Apr 2023 to Apr 2024