By Erin Ailworth

U.S. oil producers, optimistic that higher crude prices are here

to stay, have issued 2017 budgets that call for dramatically

greater spending to tap new wells.

Preliminary capital-spending plans released in recent weeks by

more than a dozen American shale drillers, including Hess Corp. and

Noble Energy Inc., show an average 60% budget increase for the

group.

The trend comes after two years of austere budget cuts and

layoffs at shale companies to help them cope with a protracted oil

bust. The price of U.S. crude started to collapse in 2014 from over

$100 a barrel to below $30 in early 2016, prompting drillers to

idle rigs and lay off more than 150,000 workers in the U.S.

Many more energy firms will announce capital budgets in the

coming weeks, and early indications are that they expect to spend

more, as well as pump more oil and natural gas this year.

Praveen Narra, an energy analyst with Raymond James &

Associates, predicts a surge in shale spending based on an improved

outlook for the sector. Raymond James is forecasting that crude

prices will average $70 a barrel this year, up from a $43 average

in 2016. U.S. oil prices closed at $51.37 a barrel Thursday.

"That willingness to spend is certainly there," Mr. Narra said.

"People are just optimistic that we have put the worst behind

us."

Paal Kibsgaard, chief executive of oil-field-services provider

Schlumberger Ltd., said Friday that oil prices and production are

poised to rebound this year, led by U.S. shale drillers that pump

in the Permian Basin of West Texas. Globally, the energy-sector

pickup could take longer to materialize, in part, because many

operators are not as well funded or nimble as American

producers.

"The pace and scope of the recovery from here is uncertain," he

added.

Wall Street darling RSP Permian Inc., which drills exclusively

in West Texas, is boosting this year's budget by 97% to $600

million. RSP's stock price has more than doubled in the last year

to a recent $42.41 per share.

Last week, Hess, one of the biggest drillers in North Dakota,

unveiled a $2.25 billion budget for 2017, an 18% increase over the

$1.9 billion it spent last year. The company will spend a

significant amount putting more rigs back to work in the Bakken

formation, and production is expected to rise by about 10% this

year, according to Greg Hill, president of Hess.

Noble has said it would spend up to $2.5 billion this year, a

potential 67% jump over last year's $1.5 billion budget, as it

doubles its rig activity from Texas to Colorado. Earlier this week,

the company said it would buy Clayton Williams Energy Inc., based

in West Texas, for $2.7 billion, giving it another 2,400

prospective wells to tap.

The oil price stabilized over $50 a barrel in the fall thanks,

in part, to an agreement to curb output by members of the

Organization of the Petroleum Exporting Countries, such as Saudi

Arabia, as well as other major producers such as Russia.

Several U.S. oil producers, including Pioneer Natural Resources

Co. and EOG Resources Inc., have said that advanced technology and

efficiency gains implemented during the oil-price downturn will

allow them to not just survive but thrive at $55 a barrel.

Spending by oil and gas producers world-wide is expected to jump

7% in 2017, according to Barclays PLC, a British bank which

recently surveyed 215 energy companies about their plans.

U.S. onshore oil and gas producers will lead the way,

particularly as larger shale drillers ramp back up, said J. David

Anderson, a Barclays analyst. He estimates that spending among

American exploration and production companies will rise more than

50%, setting off a wave of activity that may surprise OPEC and

other foreign competitors. "They're about to find out how efficient

the U.S. producers have become," Mr. Anderson said.

There are already signs of increased U.S. oil activity. The

number of oil and gas rigs drilling from Colorado to Oklahoma has

been on the rise, reaching 670 working onshore as of Friday, up

from a low of 380 in May. The past week's gain of 36 marked is the

biggest one-week surge in land rigs since 2011. Earlier this month,

U.S. oil production surpassed 8.9 million barrels a day, its

highest level in nine months, and has stayed roughly at that level,

according to the latest weekly federal data.

One of the most pronounced increases in planned spending was

announced by Denver-based Extraction Oil & Gas Inc. The company

was the first initial public offering of a U.S. oil and gas

producer in two years when it made its debut on the Nasdaq Stock

Market in October.

Extraction said it would spend about $865 million in 2017, up

137% from the $365 million it budgeted for 2016. The company

expects to boost output this year by nearly 76% to 51,000 barrels

of oil equivalent a day.

Mark Erickson, Extraction's chief executive, said $45 oil has

proven to be a sweet spot for the company, and any improvement in

price just means stronger returns and more activity are on the

way.

"We're looking at this just being a very high-growth year," he

said.

--Christopher M. Matthews contributed to this article.

(END) Dow Jones Newswires

January 20, 2017 14:58 ET (19:58 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

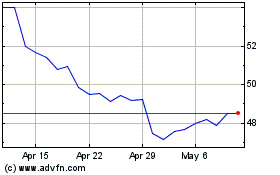

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

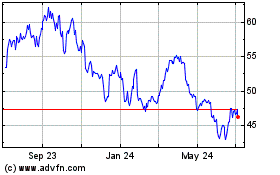

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024