Schlumberger Looks Towards Growth After Posting Another Quarterly Loss -- Update

January 20 2017 - 12:12PM

Dow Jones News

By Christopher M. Matthews and Austen Hufford

The chief executive of Schlumberger Ltd. expressed cautious

optimism Friday that a two-year downturn that ravaged the

world-wide energy industry has reached its bottom and recovery is

on the way.

The world's largest oil-field services company posted a

fourth-quarter loss of $204 million Friday, markedly lower than the

loss of $1 billion it reported for the period a year earlier.

Chief Executive Paal Kibsgaard said energy prices and production

were both poised to increase in 2017, led by shale drillers in

North America. But he warned that a ramp-up in offshore projects

and international production could take longer to materialize.

"It should be up from here in basically all markets...but the

pace and scope of the recovery from here is uncertain," Mr.

Kibsgaard said during the company's earnings call.

Schlumberger and other companies in the oil-field-services

sector have been hurt by weak demand from oil and natural gas

producers for services such as drilling and completing oil-and-gas

wells due to a two-year decline in energy prices. Analysts often

look to energy service companies as a barometer for the overall

health of the industry.

During 2016, energy prices rose and then stabilized. Though a

recovery remains tenuous, after oil prices plunged from over $100 a

barrel in the summer of 2014 to less than $30 a year ago, they are

now hovering around $55 a barrel.

Mr. Kibsgaard said that as 2017 begins, increased revenues and

cash flow will be driven by North American land production,

particularly in the oil-rich Permian shale basin in West Texas.

Shale companies have put more than 90 additional rigs back into the

field in recent weeks, after a November agreement by Russia and the

Organization of the Petroleum Exporting Countries to curb global

output boosted oil prices.

Some shale producers have found a way to eke out profits during

the downturn, often at the expense of service companies who were

forced to swallow pricing concessions. Mr. Kibsgaard said that the

company had begun renegotiating prices with clients. Revenue on

land in the U.S.increased 4% to $1.76 billion, driven both on

volume and on a modest pricing recovery in the fourth quarter on

land projects, the company said in its earnings statement. North

American offshore drilling posted a loss, the company said.

"The direction [service companies] all need to go is that we

need to recover some of the pricing concessions that we've given,"

Mr. Kibsgaard said.

In the international markets, Mr. Kibsgaard referred to the

company's capabilities as a "tightly coiled spring." He said he

expected recovery in markets outside the U.S., but warned that over

the last two years, production had largely come from the completion

of existing wells and global supplies are dwindling. The only way

to reverse that trend will be capital expenditure from

international oil producers, he said.

Mr. Kibsgaard said that company has limited spare capacity for

many of its assets, particularly offshore resources. He said the

company would redeploy those assets to projects that are

financially viable and where they are guaranteed to receive

payment.

"We aren't going to incur the cost unless there is an adequate

financial return," he said.

In all, Schlumberger reported a fourth-quarter loss of $204

million, or 15 cents a share, compared with a loss of $1.02

billion, or 81 cents a share, a year earlier.

Schlumberger said Friday that it took a $536 million

restructuring charge, largely related to workforce reduction and

facility closure, but added that it didn't anticipate any

significant cost-cutting measures in 2017.

The company also took $139 million in charges relating to its

$12.7 billion purchase of rival Cameron International Corp. and a

currency devaluation in Egypt. For the year, Schlumberger expects

$2.2 billion in capital expenditures, compared with $2.1 billion

last year.

Excluding items such as acquisition-related charges,

Schlumberger's adjusted per-share earnings were 27 cents. Revenue

declined 8.2% to $7.11 billion. Analysts polled by Thomson Reuters

had expected adjusted per-share profit of 27 cents and revenue of

$7.07 billion.

In its production unit, its largest, revenue fell 17% to $2.18

billion. In its reservoir-characterization unit, revenue fell 23%

to $1.7 billion, and in its drilling unit revenue fell 32% to $2.01

billion

The company's stock fell slightly Friday morning to $86.51 from

an open of $87.12.

Write to Christopher M. Matthews at christopher.matthews@wsj.com

and Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 20, 2017 11:57 ET (16:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

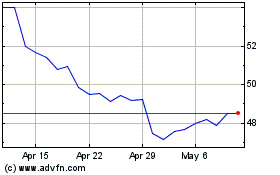

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

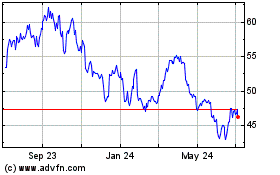

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024