Schlumberger Profit Falls Sharply

October 20 2016 - 5:52PM

Dow Jones News

By Tess Stynes

Schlumberger Ltd. said its third-quarter earnings fell 82% on

lower revenue and expenses related to the oil-field services

acquisition of Cameron International Corp. earlier this year.

Schlumberger and other companies in the oil-field services

sector have been hurt by weak demand from oil and natural-gas

producers for services such as drilling and completing oil-and-gas

wells.

Chief Executive Paal Kibsgaard said Schlumberger's business

stabilized in the third quarter, though visibility remains limited

regarding spending by oil-and-gas companies for 2017 because the

company's customers are still in their planning stages.

"We maintain that a broad-based V-shaped recovery is unlikely

given the fragile financial state of the industry, although we do

see activity upside in 2017 in North America land, the Middle East

and Russia markets, " Mr. Kibsgaard said.

Schlumberger's results come a day after rival Halliburton Co.

posted a small third-quarter profit that its executives attributed

to U.S. energy company customers starting to return to drilling

this summer as crude prices moved back toward $50 a barrel.

Still Halliburton executives sounded a note of caution that the

fourth quarter could slow due to holiday and seasonal

weather-related downtime before activity picks back up in early

2017. It was also the first quarter Halliburton was relieved of

hefty charges related to its failed tie-up with rival Baker Hughes

Inc., which is scheduled to report third-quarter results

Tuesday.

The three oil-services giants each have shed thousands of

workers in efforts to offset weaker demand from energy producers

during the downturn.

In all, Schlumberger reported a third-quarter profit of $176

million, or 13 cents a share, down from $989 million, or 78 cents a

share, a year earlier. Excluding items such as acquisition-related

charges, adjusted per-share earnings were 25 cents. Analysts polled

by Thomson Reuters expected per-share profit of 22 cents.

Revenue declined 17% to $7.02 billion, while analysts expected

$7.08 billion.

In Schlumberger's North American business, revenue dropped 25%

to $1.7 billion. Outside the U.S., Schlumberger's revenue declined

13% to $5.25 billion.

The three months ended Sept. 30, marked the second period that

Schlumberger's results include Cameron, which makes drilling

equipment and supplies maintenance equipment to pipelines,

refineries and oil-and-gas wells.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

October 20, 2016 17:37 ET (21:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

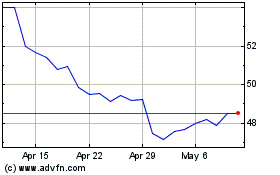

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

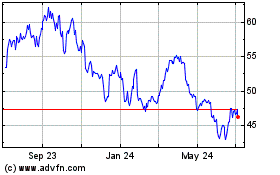

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024