Baker Hughes Loss Widens as Pricing Pressures Continue

July 28 2016 - 8:30AM

Dow Jones News

Baker Hughes Inc. said its second-quarter loss widened as the

oil-services company's revenue slumped amid continued weak demand

and pricing pressures as the result of the prolonged commodities

downturn.

The per-share loss, excluding certain items, was wider than

analysts' feared—though revenue beat expectations.

In early May, Baker Hughes and Halliburton Co. called off their

planned merger deal, once valued at nearly $35 billion, as

regulators claimed it would hurt competition in the sector.

A day later, Baker Hughes said it planned to use the $3.5

billion breakup fee from Halliburton to help improve its balance

sheet and unveiled plans to restructure its business. The deal to

combine the second- and third-largest oil-field services businesses

after Schlumberger Ltd.—announced in November of 2014—had prevented

Baker Hughes from cutting costs and making other changes in

response to a commodities rout that reduced demand for drilling

wells and pumping oil and natural gas.

Both Halliburton and Baker Hughes have cut thousands of jobs

amid the commodities downturn.

In prepared remarks Thursday, Baker Hughes Chief Executive

Martin Craighead said that despite an extremely tough market

environment, he was encouraged to see that Baker Hughes's

second-quarter revenue declined only 10% from the first quarter

despite a 19% drop in the global rig count. Mr. Craighead said he

attributed the revenue decline mostly to the continued steep drop

in activity and to pricing pressure.

For the second half of 2016, excluding the seasonality in

Canada, Baker Hughes doesn't expect activity in North America to

meaningfully increase because customers require a more sustained

improvement in oil prices before committing to any material

increase in spending, he said.

However, activity outside North America is expected to continue

to decline in most countries, with a steeper decline in markets

with higher lifting costs, Mr. Craighead said.

Over all, Baker Hughes reported a loss of $911 million, or $2.08

a share, compared with a year-earlier loss of $188 million, or 43

cents a share. Excluding write-downs, restructuring charges, the

breakup fee and other items, the adjusted per-share loss was 90

cents, compared with a year-earlier adjusted loss of 14 cents.

Revenue slumped 39% to $2.41 billion.

Analysts polled by Thomson Reuters expected a per-share loss of

62 cents and revenue of $2.32 billion.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

July 28, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

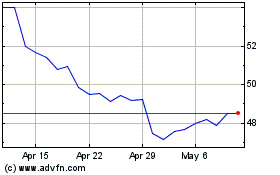

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

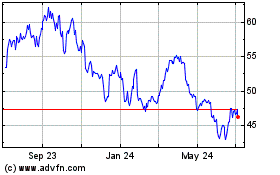

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024