Halliburton Delays Release of Full First-Quarter Financial Data

April 22 2016 - 9:03PM

Dow Jones News

By Ezequiel Minaya

Halliburton Co. is delaying the release of its full

first-quarter financial results until next month, amid a looming

April 30 deadline for its merger with Baker Hughes Inc. that has

faced stiff regulatory opposition.

Halliburton said Friday that it would release its latest data

May 3. But the oil-field-services company, nonetheless, disclosed

that it cut some 6,000 jobs in the quarter ended March 31, more

than the 5,000 jobs originally estimated for elimination in

February.

The company's head count has fallen by roughly a third or about

28,600 workers since the oil downturn began in 2014. On its

website, Halliburton says it has more than 55,000 employees.

The prolonged collapse in oil prices has resulted in a decrease

in investment, leaving the oil-field-services industry with

battered top lines.

The company also reported first-quarter revenue of $4.2 billion,

down 40% from a year earlier but more than the average estimate of

$4.16 billion by analysts surveyed by Thomson Reuters.

Halliburton Chief Executive Dave Lesar said that production

declines were expected through 2016, with clients slow to ramp up

even if there is a turnaround in the market as they first try to

repair their balance sheets.

"What we are experiencing today is far beyond headwinds; it is

unsustainable," he said, addressing market conditions in North

America. "My definition of an unsustainable market is one where all

service companies are losing money in North America, which is where

we are now."

He added that last year's 40% decline in industry spending in

North America will be followed by an estimated 50% fall this

year.

Halliburton and Baker Hughes set the April 30 deadline for

obtaining all regulatory approvals for the merger, after which

either company could terminate the deal, though they could also

choose to stay the course.

Halliburton would have to pay a steep $3.5 billion breakup fee

if the deal falls apart. But some analysts have said that Baker

Hughes might struggle to regain its footing as an independent

company.

The $35 billion deal was struck in November 2014, during better

times for the energy sector and would combine the world's second-

and third-largest oil-field services firms after Schlumberger

Ltd.

Since the deal was struck, the oil-field services industry has

faced severe setbacks, as persistently low oil prices have slashed

demand for the business of drilling wells and pumping oil and

natural gas.

The proposed merger also has faced antitrust resistance around

the globe. Earlier this month, the Justice Department filed an

antitrust suit challenging the deal, alleging the merger would

threaten higher prices and reduce innovation in the sector.

The lawsuit, filed in a Delaware federal court, asserted that

the transaction would eliminate important head-to-head competition

in markets for 23 products and services used for U.S. oil

exploration and production, from drill bits to offshore cementing

services.

Halliburton and Baker Hughes have been trying to ease those

concerns by offering to sell off assets worth billions of

dollars.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

April 22, 2016 20:48 ET (00:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

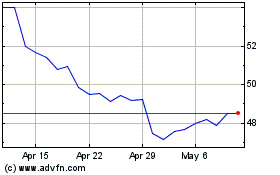

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

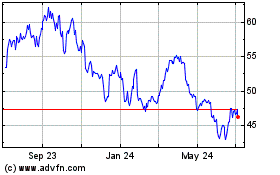

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024