Initial Statement of Beneficial Ownership (3)

April 22 2016 - 3:43PM

Edgar (US Regulatory)

|

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Laureles Saul R.

|

2. Date of Event Requiring Statement (MM/DD/YYYY)

4/20/2016

|

3. Issuer Name

and

Ticker or Trading Symbol

SCHLUMBERGER LTD /NV/ [SLB]

|

|

(Last)

(First)

(Middle)

5599 SAN FELIPE - 17TH FLOOR

|

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director

_____ 10% Owner

___

X

___ Officer (give title below)

_____ Other (specify below)

Deputy General Counsel, Corp. /

|

|

(Street)

HOUSTON, TX 77056

(City)

(State)

(Zip)

|

5. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4)

|

2. Amount of Securities Beneficially Owned

(Instr. 4)

|

3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5)

|

4. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Common Stock, $0.01 Par Value Per Share

|

1690

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4)

|

2. Date Exercisable and Expiration Date

(MM/DD/YYYY)

|

3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4)

|

4. Conversion or Exercise Price of Derivative Security

|

5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5)

|

6. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Incentive Stock Option (Right to Buy)

|

1/21/2011

(1)

|

1/21/2020

|

Common Stock, $0.01 Par Value Per Share

|

500

|

$68.505

|

D

|

|

|

Incentive Stock Option (Right to Buy)

|

10/21/2011

(2)

|

10/21/2020

|

Common Stock, $0.01 Par Value Per Share

|

1588

|

$64.225

|

D

|

|

|

Incentive Stock Option (Right to Buy)

|

1/19/2013

(3)

|

1/19/2022

|

Common Stock, $0.01 Par Value Per Share

|

1799

|

$72.11

|

D

|

|

|

Incentive Stock Option (Right to Buy)

|

1/17/2014

(4)

|

1/17/2023

|

Common Stock, $0.01 Par Value Per Share

|

2519

|

$73.25

|

D

|

|

|

Incentive Stock Option (Right to Buy)

|

4/16/2015

(5)

|

4/16/2024

|

Common Stock, $0.01 Par Value Per Share

|

800

|

$100.555

|

D

|

|

|

Incentive Stock Option (Right to Buy)

|

7/17/2015

(6)

|

7/17/2024

|

Common Stock, $0.01 Par Value Per Share

|

170

|

$114.825

|

D

|

|

|

Incentive Stock Option (Right to Buy)

|

4/16/2016

(7)

|

4/16/2025

|

Common Stock, $0.01 Par Value Per Share

|

1090

|

$91.74

|

D

|

|

|

Incentive Stock Option (Right to Buy)

|

1/21/2017

(8)

|

1/21/2026

|

Common Stock, $0.01 Par Value Per Share

|

1614

|

$61.92

|

D

|

|

|

Nq Stock Option (Right to Buy) W/ Tandem Tax W/h Right

|

10/21/2011

(2)

|

10/21/2020

|

Common Stock, $0.01 Par Value Per Share

|

12

|

$64.225

|

D

|

|

|

Nq Stock Option (Right to Buy) W/ Tandem Tax W/h Right

|

1/19/2013

(3)

|

1/19/2022

|

Common Stock, $0.01 Par Value Per Share

|

601

|

$72.11

|

D

|

|

|

Nq Stock Option (Right to Buy) W/ Tandem Tax W/h Right

|

1/17/2014

(4)

|

1/17/2023

|

Common Stock, $0.01 Par Value Per Share

|

3081

|

$73.25

|

D

|

|

|

Nq Stock Option (Right to Buy) W/ Tandem Tax W/h Right

|

4/16/2015

(5)

|

4/16/2024

|

Common Stock, $0.01 Par Value Per Share

|

3200

|

$100.555

|

D

|

|

|

Nq Stock Option (Right to Buy) W/ Tandem Tax W/h Right

|

7/17/2015

(6)

|

7/17/2024

|

Common Stock, $0.01 Par Value Per Share

|

5830

|

$114.825

|

D

|

|

|

Nq Stock Option (Right to Buy) W/ Tandem Tax W/h Right

|

4/16/2016

(7)

|

4/16/2025

|

Common Stock, $0.01 Par Value Per Share

|

6910

|

$91.74

|

D

|

|

|

Nq Stock Option (Right to Buy) W/ Tandem Tax W/h Right

|

1/21/2017

(8)

|

1/21/2026

|

Common Stock, $0.01 Par Value Per Share

|

8386

|

$61.92

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

Became exercisable in five equal annual installments beginning January 21, 2011.

|

|

(

2)

|

Became exercisable in five equal installments beginning October 21, 2011.

|

|

(

3)

|

Became exercisable in five equal installments beginning January 19, 2013.

|

|

(

4)

|

Became exercisable in five equal annual installments beginning January 17, 2014.

|

|

(

5)

|

Became exercisable in five equal installments beginning April 16, 2015.

|

|

(

6)

|

Became exercisable in five equal installments beginning July 17, 2105.

|

|

(

7)

|

Became exercisable in five equal annual installments beginning April 16, 2016.

|

|

(

8)

|

Will become exercisable in five equal annual installments beginning January 21, 2017.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Laureles Saul R.

5599 SAN FELIPE - 17TH FLOOR

HOUSTON, TX 77056

|

|

|

Deputy General Counsel, Corp.

|

|

Signatures

|

|

/s/Matthew Rinegar, attorney-in-fact for Saul R. Laureles

|

|

4/22/2016

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 5(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

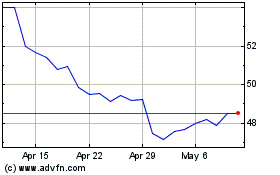

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

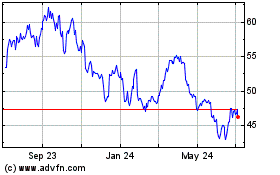

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024