Helicopter Operator in Oil-Field Squeeze

November 05 2015 - 12:10AM

Dow Jones News

The slump in oil-field services business could push one of the

sector's largest helicopter operators to cancel or defer almost

three-quarters of its existing order book, including deals with

units of soon-to-be-sold Sikorsky Aircraft and the AgustaWestland

arm of Italy's Finmeccanica SpA.

Era Group Inc. said Wednesday that it had amended existing

contracts with manufacturers last month allowing it to defer

deliveries of helicopters used to transfer workers and cargo to and

from offshore platforms, delay deposits or even cancel deals

altogether.

The warning from Houston-based Era as it reported an 85% side in

third- quarter profit highlights the spread of the energy

industry's downturn beyond traditional oil-field services companies

such as Schlumberger Ltd. and General Electric Co. to include

suppliers more closely tied with production rather than

exploration.

Era is more exposed to work in the Gulf of Mexico, where

production and rig counts have held up better than in regions such

as the North Sea where relatively higher costs have stunted

exploration and started to limit output.

Helicopter operators such as Era, Bristow Group Inc.—which

reports quarterly earnings on Friday—and CHC Group Ltd. have

previously said they'd been in talks with rotorcraft makers about

cancellations or deferrals, but didn't provide any details. Though

executives don't expect any industry recovery before 2017, most had

previously insisted they were relatively protected by sustained oil

and gas production rates, which kept revenues stable because of

fixed-price contracts.

Era has outstanding orders for 17 helicopters, including 14 from

Finmeccanica and three from Sikorsky, a unit of United Technologies

Corp. that plans to close the $9 billion sale of the business to

defense company Lockheed Martin Corp. on Friday.

Era said it may terminate deals worth around $127 million of its

existing $175 million in capital commitments. Most of the

helicopters are due to be delivered between the end of this year

and 2018, and Era has options on another 13 rotorcraft.

"We remain in dialogue with our long-term partners at the

helicopter manufacturers and expect that those commercial

conversations will result in additional contract modifications that

will further reduce our near-term capital commitments by deferring

additional helicopter delivery dates," Era said in a statement.

The slide in energy business comes as big helicopter makers,

which also include units of Airbus Group SE and Textron Inc., roll

out new faster and larger models designed to serve fields in deeper

waters farther from shore. GE also paid $1.8 billion in January for

Milestone Aviation, the largest helicopter leasing company by

sales.

Lockheed has said it plans to retain the commercial arm of

Sikorsky, the world's largest military helicopter maker by revenue,

aiming to develop its services business.

Era shares have fallen about 22% since the turn of the year,

less than the 44% decline at Bristow and CHC's precipitous fall of

more than 90% that has left the stock clinging on to its New York

Stock Exchange listing by a thread after a prolonged period below

$1 a share.

Write to Doug Cameron at doug.cameron@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 04, 2015 23:55 ET (04:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

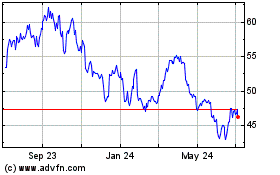

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

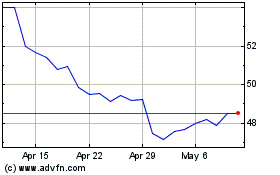

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024