Schlumberger to Buy Cameron International for $12.7 Billion -- Update

August 26 2015 - 7:20AM

Dow Jones News

By Lisa Beilfuss

Schlumberger Ltd. on Wednesday said it agreed to buy Cameron

International Corp. for about $12.74 billion in cash and stock, the

latest move by the world's biggest oil-field services company as

the industry struggles with lower prices and rising supply.

The price tag values Houston-based Cameron at $66.36 a share, a

56.3% premium to Tuesday's closing price. Amid the downturn in the

energy sector, Cameron shares have fallen 42% over the past 12

months.

Cameron shareholders will receive $14.44 in cash and 0.716

Schlumberger shares for each share of Cameron. After completion,

Cameron holders will own about 10% of the combined company.

With oil prices now at lower levels, Schlumberger Chief

Executive Paal Kibsgaard said, "this agreement with Cameron opens

new and broader opportunities for Schlumberger."

The Cameron transaction follows Halliburton's $35 billion deal

unveiled late last year to acquire smaller oil-field services rival

Baker Hughes Inc. and Royal Dutch Shell PLC's nearly $70 billion

offer for Britain's BG Group PLC in April.

Paris-based Schlumberger said it anticipates pretax synergies of

about $300 million in the first year and $600 million in the second

year after the deal closes. The transaction will add to per-share

profit by the end of the first year, Schlumberger said.

The deal, subject to approval by Cameron shareholders as well as

regulatory clearance, is expected to be completed in the first

quarter of 2016. On a pro forma basis, the combined company had

2014 revenue of $59 billion.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 26, 2015 07:05 ET (11:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

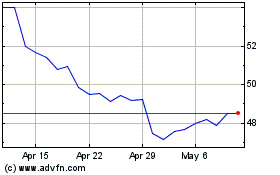

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

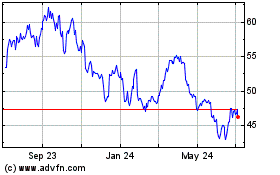

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024