Report of Foreign Issuer (6-k)

November 04 2015 - 6:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF NOVEMBER 2015

Commission File Number: 333-04906

SK Telecom

Co., Ltd.

(Translation of registrant’s name into English)

Euljiro65(Euljiro2-ga), Jung-gu

Seoul 100-999, Korea

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): ¨

Decision on Acquisition of Shares of CJ HelloVision

On November 2, 2015, the Board of Directors of SK Telecom Co., Ltd. (the “Company”) resolved to acquire shares of CJ HelloVision Co., Ltd.

(“CJ HelloVision”) to secure its position as the next generation media platform provider.

|

|

|

|

|

|

|

|

|

| 1. Details of CJ HelloVision |

|

Company Name |

|

CJ HelloVision Co., Ltd. |

| |

Location |

|

Korea |

|

Representative Director |

|

Jin-Suk Kim |

| |

Share Capital (KRW) |

|

193,617,162,500 |

|

Relationship to Company |

|

- |

| |

Number of Shares Issued |

|

77,446,865 |

|

Principal Business |

|

Fixed-line broadcast services |

|

|

|

| 2. Details of Share Acquisition |

|

Number of Shares to be Acquired |

|

23,234,060 |

| |

Acquisition Amount (KRW) |

|

500,000,000,000 |

| |

Ratio of Acquisition Amount to the Company’s Share Capital as of December 31, 2014 |

|

3.28% |

|

|

|

| 3. Number of Shares to be Held and Shareholding Ratio after Share Acquisition |

|

Number of Shares to be Held |

|

23,234,060 |

| |

Shareholding Ratio(%) |

|

30.00% |

|

|

| 4. Acquisition Method |

|

Cash |

|

|

| 5. Purpose of Acquisition |

|

By acquiring the shares of CJ HelloVision, which will subsequently be merged with the Company’s subsidiary, SK Broadband Co., Ltd. (“SK Broadband”), the Company plans to secure its position as the next

generation media platform provider and achieve growth through new business models of the new-media market, including Over the Top (OTT). |

|

|

| 6. Scheduled Acquisition Date |

|

April 4, 2016

(Subject to change depending on when the closing conditions are met, including obtaining approval from the relevant institutions) |

|

|

| 7. Submission of Key Matter Report Regarding Asset Transfer |

|

Not required |

| - Total Assets of the Company at December 31, 2014 (KRW) |

|

27,941,233,180,410 |

| - Percentage of Acquisition Amount to Total Assets |

|

1.79% |

|

|

| 8. Date of the resolution by the Board of Directors |

|

November 2, 2015 |

| — Attendance of Outside Directors |

|

Present |

|

4 |

| |

Absent |

|

0 |

| — Attendance of members of Audit Committee who are not outside directors |

|

0 |

|

|

| 9. Related Put or Call Agreements |

|

(a) Upon the closing of the share acquisition transaction (the “Closing”), CJ O Shopping will have a put option and

the Company will have a call option with respect to the CJ HelloVision shares that are owned by CJ O Shopping Co., Ltd. (“CJ O Shopping”) at the time of exercise of such option.

Price of put option (KRW):

26,994 |

2

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercise period: For a period of two years from the third anniversary of the Closing

Price of call option (KRW): 26,994

Exercise period: For a period of five years from the Closing

(b) In addition, if a third party offers to purchase CJ HelloVision shares from CJ O Shopping, the Company has a right of first refusal to purchase such shares

at the same purchase price. |

|

|

| 10. Other Matters Relating to an Investment Decision |

|

On November 2, 2015, the board of directors of SK Broadband approved the merger with CJ HelloVision. Please refer to the Form 6-K filed on November 3, 2015 entitled “Decision on Merger of SK Broadband” for

related information. |

[Summary Financial Information of CJ HelloVision (Unit: in millions of KRW)]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of and for the year ended December 31, |

|

Assets |

|

|

Liabilities |

|

|

Total

Shareholder’s

Equity |

|

|

Share Capital |

|

|

Revenue |

|

|

Net income |

|

| 2014 |

|

|

2,170,450 |

|

|

|

1,266,873 |

|

|

|

903,577 |

|

|

|

193,617 |

|

|

|

1,270,376 |

|

|

|

25,655 |

|

| 2013 |

|

|

2,080,518 |

|

|

|

1,195,974 |

|

|

|

884,543 |

|

|

|

193,617 |

|

|

|

1,160,227 |

|

|

|

76,955 |

|

| 2012 |

|

|

1,555,958 |

|

|

|

831,197 |

|

|

|

724,761 |

|

|

|

173,157 |

|

|

|

890,993 |

|

|

|

104,361 |

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| SK TELECOM CO., LTD. |

| (Registrant) |

|

| By: /s/ Yong Hwan Lee |

| (Signature) |

| Name: |

|

Yong Hwan Lee |

| Title: |

|

Senior Vice President |

Date: November 3, 2015

4

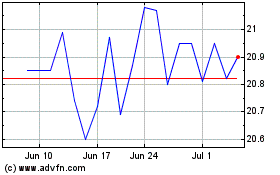

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Mar 2024 to Apr 2024

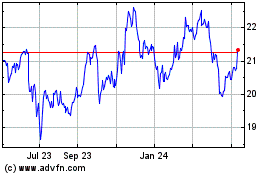

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Apr 2023 to Apr 2024