ADR Report: Shares Lower As Euro Zone Worries Grow

May 02 2012 - 5:19PM

Dow Jones News

International companies trading in New York closed lower

Wednesday, in line with the broader market, as economic data from

the euro zone weighed on sentiment.

The Bank of New York index of ADRs slumped 0.7%, to 126.45, as

European banks fell.

The seasonally adjusted unemployment rate in the 17-nation euro

zone rose to 10.9% in March, a euro-era high, from 10.8% in

February. Meanwhile, euro-zone manufacturing activity shrank in

April at a faster pace than previously estimated.

Spain's Banco Santander (STD, SAN.MC) slumped 5.6%, to $6.03, as

the weak euro-zone data escalated concerns about the economic

crisis on the continent and particularly recession-plagued

Spain.

Other banks in the region also traded down, with Credit Agricole

SA (CRARY, ACA.FR) falling 5%, to $2.46, and BNP Paribas SA (BNPQY,

BNP.FR) losing 2.2%, to $19.94.

The European index declined 1%, to 115.94.

Daimler AG (DDAIF, DAI.XE) Chief Financial Officer Bodo Uebber

Wednesday dismissed recent media reports suggesting the German auto

maker strengthened its defense strategy against a possible takeover

and reiterated the company won't spin off its truck division in the

foreseeable future. Shares of the German car maker slipped 2.3%, to

$54.71.

Offsetting those losses, however, was Technicolor SA (TCLRY,

TCH.FR), which jumped 33%, to $2.46. French sovereign fund Fonds

Strategique d'Investissement, or FSI, together with another

investor, might buy a stake in Technicolor, a troubled cinema

production services provider and manufacturer of TV set-top boxes,

said Industry Minister Eric Besson Wednesday in a statement.

The Asian index fell 0.2%, to 126.16.

SK Telecom Co. (SKM, 017670.SE), South Korea's largest mobile

carrier by subscribers, said Wednesday its first-quarter net profit

fell, as lower phone fees and higher spending on faster network

technology hurt its bottom line. Shares dropped 0.8%, to

$13.48.

Tata Motors Ltd. (TTM, 500570.BY) shares fell 4.1%, to $28.66,

after the Indian car maker's local sales in April fell 5%.

The Latin American index dropped 0.3%, to 352.97.

Gerdau SA's (GGB, GGBR3.BR, GGBR4.BR) shares ended down 1.2%, at

$9.34, as Barclays Capital said the steelmaker is set to report

weak first-quarter results on depressing margins from its Brazilian

unit. The unit may report declining EBITDA margin, hurt by

disruptions at its iron ore business on heavy rains in January and

cost pressures, mainly in coking coal, Barclays said.

The emerging markets index inched up 0.1%, to 298.44.

Shinhan Financial Group (SHG, 055550.SE) Wednesday reported a

smaller-than-expected 10.6% on-year fall in its first-quarter net

profit as it set aside more in loan-loss provisioning. Shares rose

0.9%, to $70.34.

Offsetting those gains was Russian metals and mining company

Mechel OAO (MTL, MTLR.RS), which said late Tuesday it has failed to

file its annual report for 2011 on time as its management was busy

with talks with the company's lenders on changing loans conditions.

Shares fell 4.5%, to $8.24.

-By Corrie Driebusch, Dow Jones Newswires; 212-416-2143;

corrie.driebusch@dowjones.com

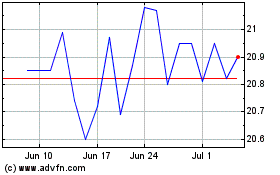

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Mar 2024 to Apr 2024

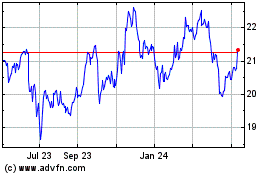

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Apr 2023 to Apr 2024