Smucker Profit Rises 15%

February 23 2016 - 9:50AM

Dow Jones News

J.M. Smucker Co. on Tuesday sharply raised its earnings guidance

for the year as its profit jumped 15% in the latest quarter,

handily beating Wall Street expectations on continued momentum in

its coffee business.

The company, which produces Folgers coffee and Pillsbury baking

mixes in addition to its namesake jellies, jams and peanut butter,

now expects adjusted earnings of $5.84 to $5.94 a share in 2016,

compared with previous guidance for $5.70 to $5.80 a share.

However, Smucker lowered its revenue forecast to $7.8 billion from

$7.9 billion.

Chief Executive Richard Smucker pointed to strength in the

coffee business, specifically the launch of "on-trend products"

such as Dunkin' Donuts K-Cup pods and lower pricing on Folgers

roast and ground offerings. He also highlighted expanded

distribution for its Natural Balance brand into the largest pet

specialty retailer.

For the quarter ended Jan. 31, profit grew 15% to $185.3 million

from $160.9 million a year earlier. Per-share earnings were $1.55,

compared with $1.58 a year ago, when the company had fewer shares

outstanding.

Per-share adjusted earnings rose to $1.76 from $1.54.

Total sales grew 37% to $1.97 billion. Sales were lifted by the

recent acquisition of Big Heart Pet Brands, which makes Milk-Bone

dog treats and Meow Mix cat food. The business contributed $580.3

million to sales in the quarter. The company said excluding Big

Heart, the impact from foreign currency exchange, and the impact of

the U.S. canned milk divestiture, net sales declined $17.9 million,

or 1%.

Analysts polled by Thomson Reuters were looking for earnings of

$1.64 a share on revenue of $2.05 billion.

The company's U.S. retail coffee sales grew 1% in the quarter to

$575.5 million, driven by the U.S. retail launch of its Dunkin'

Donuts K-Cup pods and Folgers mainstream roast and ground

offerings, partially offset by Folgers K-Cup pods. The favorable

volume and mix was mostly offset by lower pricing on Folgers

mainstream roast and ground offerings.

Like other big food companies, Smucker has seen heated

competition from smaller companies positioning their products as

fresher and more natural, as Americans shy away from traditional

processed-and-packaged foods.

In its consumer foods segment, which includes Smucker's namesake

fruit spreads, its Pillsbury products, and Crisco oil, sales were

down 5% to $569.8 million, weighed down by lower prices for its Jif

brand peanut butter. The divestiture of its U.S. canned milk brands

also dented sales by $9.4 million.

Gross margin expanded to 38.7% from 36.3% a year earlier.

Shares of the company, which have risen 3.5% over the past three

months, were inactive premarket.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 23, 2016 09:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

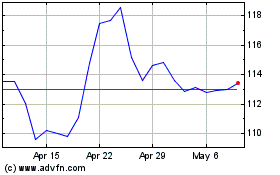

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Mar 2024 to Apr 2024

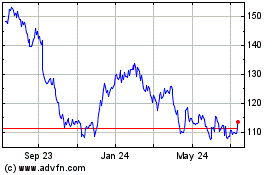

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Apr 2023 to Apr 2024