Filed pursuant to Rule 424(b)(7)

Registration No. 333-197428

PROSPECTUS SUPPLEMENT

(To prospectus dated

July 15, 2014)

8,277,495 Shares

THE J. M. SMUCKER COMPANY

Common Shares

The selling

shareholder, Blue Holdings I, L.P. (“Blue Holdings” or the “Selling Shareholder”) is offering to sell 8,277,495 common shares to the underwriter named below. We will not receive any proceeds from the sale of our common shares by

the Selling Shareholder.

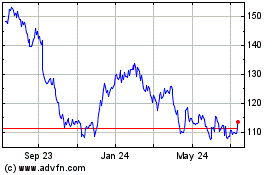

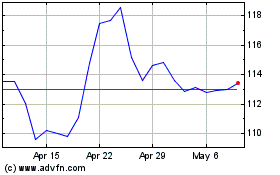

Our common shares are listed on the New York Stock Exchange under the symbol “SJM.” The last reported

closing sale price of our common shares on the New York Stock Exchange on September 21, 2015 was $117.05 per share.

Investing in

our securities involves risk. See “Risk Factors” beginning on page S-7 of this prospectus supplement.

|

|

|

|

|

|

|

|

|

| |

|

Per Share |

|

|

Total |

|

| Public offering price |

|

$ |

114.00 |

|

|

$ |

943,634,430.00 |

|

| Underwriting discounts and commissions |

|

$ |

0.69 |

|

|

$ |

5,711,471.55 |

|

| Proceeds to Selling Shareholder, before expenses |

|

$ |

113.31 |

|

|

$ |

937,922,958.45 |

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or

disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about September 25, 2015.

Morgan Stanley

The

date of this prospectus supplement is September 21, 2015.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is the prospectus supplement, which describes the specific terms of the offering. The

second part is the prospectus, which describes more general information, some of which may not apply to the offering. You should read both this prospectus supplement and the accompanying prospectus, together with additional information described

under the heading “Where You Can Find More Information and Incorporation by Reference” in this prospectus supplement and the accompanying prospectus. If the description of the offering varies between this prospectus supplement and the

accompanying prospectus, you should rely on the information contained in or incorporated by reference into this prospectus supplement.

References in this prospectus supplement or the accompanying prospectus to the “Company,” “we,” “us” and

“our” are to The J. M. Smucker Company and its consolidated subsidiaries unless otherwise specified or the context requires otherwise.

Neither we, the Selling Shareholder nor the underwriter have authorized anyone to provide you with information different from that

contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by us or on our behalf. Neither we, the Selling Shareholder nor the underwriter takes any responsibility for,

or can provide any assurance as to the reliability of, any information other than the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by us or on

our behalf. The Selling Shareholder and the underwriter are not offering to sell, nor seeking offers to buy, shares of our common stock in any jurisdiction where an offer or sale is not permitted.

You should not assume that the information appearing in this prospectus supplement and the accompanying prospectus or any document

incorporated by reference is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that date. Neither this prospectus supplement nor the

accompanying prospectus constitutes an offer, or an invitation on our behalf or on behalf of the Selling Shareholder or the underwriter or any agents, to subscribe for and purchase any of the securities and may not be used for or in connection with

an offer or solicitation by anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

S-1

WHERE YOU CAN FIND MORE INFORMATION

AND INCORPORATION BY REFERENCE

This prospectus supplement is a part of the registration statement on Form S-3, which we filed with the Securities and Exchange Commission

(the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”). The registration statement, including the attached exhibits and schedules, contains additional relevant information about us and the securities

described in this prospectus supplement. The SEC’s rules and regulations allow us to omit certain information included in the registration statement from this prospectus supplement. The registration statement may be inspected by anyone without

charge at the office of the SEC at 100 F Street, N.E., Washington, D.C. 20549 and as described below. Because we are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy

any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

The SEC allows us to incorporate by reference into this prospectus supplement the information we file with them, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus supplement, and information that we file later with the SEC will automatically update and

supersede this information. We incorporate by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, other than any portion of such documents that by statute,

designation in such documents or otherwise are deemed to be furnished, rather than filed, under the applicable SEC rules or are not required to be incorporated herein by reference. We incorporate by reference the following information or documents

that we have filed with the SEC (other than any portion of such documents that are deemed to be furnished rather than filed):

| |

• |

|

our Annual Report on Form 10-K for the fiscal year ended April 30, 2015, filed with the SEC on June 25, 2015 (including information specifically incorporated by reference therein from our definitive Proxy

Statement on Schedule 14A filed with the SEC on July 1, 2015); |

| |

• |

|

our Quarterly Report on Form 10-Q for the fiscal quarter ended July 31, 2015, filed with the SEC on September 2, 2015; |

| |

• |

|

our Current Reports on Form 8-K filed with the SEC on February 4, 2015, March 23, 2015 (other than Exhibit 99.4), as amended on August 19, 2015, June 30, 2015, July 9,

2015, July 15, 2015, August 13, 2015, and September 21, 2015; |

| |

• |

|

the description of our common shares contained in our Registration Statement on Form 8-A filed with the SEC on May 23, 2002, and all amendments and reports filed for the purpose of updating that description; and

|

| |

• |

|

the description of our rights to purchase preferred shares contained in our Registration Statement on Form 8-A filed with the SEC on May 21, 2009, and all amendments and reports filed for the purpose of updating

that description. |

The information relating to us contained in this prospectus supplement and the accompanying prospectus

should be read together with the information in the documents incorporated by reference.

You may request a copy of these filings, at no

cost, by writing or telephoning us at our principal executive offices at the following address:

The J. M. Smucker Company

Attention: Corporate Secretary

One

Strawberry Lane

Orrville, Ohio 44667

(330) 682-3000

Any statement

contained in a document incorporated by reference, or deemed to be incorporated by reference, in this prospectus supplement and the accompanying prospectus shall be deemed to be modified or superseded for purposes of this prospectus supplement and

the accompanying prospectus to the extent that a statement contained in this prospectus supplement and the accompanying prospectus or in any other subsequently filed document which also is incorporated by reference in this prospectus supplement and

the accompanying prospectus modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement and the accompanying

prospectus.

Statements contained in this prospectus supplement or the accompanying prospectus or the documents incorporated by reference

herein or therein as to the contents of any contract or other document referred to herein or therein do not purport to be complete, and where reference is made to the particular provisions of such contract or other document, such provisions are

qualified in all respects by reference to all of the provisions of such contract or other document. We will provide without charge to each person to whom a copy of this prospectus supplement and the accompanying prospectus has been delivered, on the

written or oral request of such person, a copy of any or all of the documents which have been or may be incorporated in this prospectus supplement or the accompanying prospectus by reference (other than exhibits to such documents unless such

exhibits are specifically incorporated by reference in any such documents) and a copy of any or all other contracts or documents which are referred to in this prospectus supplement or the accompanying prospectus. You may request a copy of these

filings at the address and telephone number set forth above.

S-2

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein contain forward-looking

statements within the meaning of the federal securities laws. The forward-looking statements may include statements concerning our current expectations, estimates, assumptions, and beliefs concerning future events, conditions, plans and strategies

that are not historical fact. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expect,” “anticipate,” “believe,”

“intend,” “will,” “plan,” and similar phrases. Federal securities laws provide a safe harbor for forward-looking statements to encourage companies to provide prospective information. We are providing this cautionary

statement in connection with the safe harbor provisions. Readers are cautioned not to place undue reliance on any forward-looking statements, as such statements are by nature subject to risks, uncertainties, and other factors, many of which are

outside of our control and could cause actual results to differ materially from such statements and from our historical results and experience. These risks and uncertainties include, but are not limited to, those set forth under the heading

“Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended April 30, 2015, as well as the following:

| |

• |

|

our ability to successfully integrate acquired and merged businesses in a timely and cost-effective manner and retain key suppliers, customers, and employees; |

| |

• |

|

our ability to achieve synergies and cost savings related to the Big Heart Pet Brands acquisition in the amounts and within the time frames currently anticipated; |

| |

• |

|

our ability to generate sufficient cash flow to meet our deleveraging objectives within the time frames currently anticipated; |

| |

• |

|

a change in outlook or downgrade in our public credit ratings by a rating agency below investment grade; |

| |

• |

|

our ability to obtain any required financing on a timely basis and on acceptable terms; |

| |

• |

|

volatility of commodity markets from which our raw materials are procured and the related impact on costs; |

| |

• |

|

risks associated with derivative and purchasing strategies we employ to manage commodity pricing risks, including the risk that such strategies could result in significant losses and adversely impact our liquidity;

|

| |

• |

|

crude oil price trends and their impact on transportation, energy, and packaging costs; |

| |

• |

|

the availability of reliable transportation on acceptable terms; |

| |

• |

|

our ability to successfully implement and realize the full benefit of price changes that are intended to ultimately fully recover cost, including the competitive, retailer, and consumer response, and the impact of the

timing of the price changes to profits and cash flow in a particular period; |

| |

• |

|

the success and cost of marketing and sales programs and strategies intended to promote growth in our businesses, including the introduction of new products; |

| |

• |

|

general competitive activity in the market, including competitors’ pricing practices and promotional spending levels; |

| |

• |

|

the impact of food security concerns involving either our products or our competitors’ products; |

| |

• |

|

the impact of accidents, extreme weather, and natural disasters, including crop failures and storm damage; |

| |

• |

|

the concentration of certain of our businesses with key customers and suppliers, including single-source suppliers of certain key raw materials, such as packaging for our Folgers® coffee products, and finished goods, such as K-Cup® pods, and the ability to manage and maintain key relationships;

|

| |

• |

|

the timing and amount of capital expenditures and share repurchases; |

| |

• |

|

impairments in the carrying value of goodwill, other intangible assets, or other long-lived assets or changes in useful lives of other intangible assets; |

| |

• |

|

the impact of new or changes to existing governmental laws and regulations and their application; |

| |

• |

|

the impact of future legal, regulatory, or market measures regarding climate change; |

| |

• |

|

the outcome of current and future tax examinations, changes in tax laws, and other tax matters, and their related impact on our tax positions; |

| |

• |

|

foreign currency and interest rate fluctuations; and |

| |

• |

|

risks related to other factors described under “Risk Factors” in this prospectus supplement and other reports and statements we have filed with the SEC, including our most recent Annual Report on Form 10-K for

the year ended April 30, 2015 and in other reports we file with the SEC in the future. |

S-3

Readers are cautioned not to unduly rely on such forward-looking statements, which speak only as

of the date made, when evaluating the information presented in this prospectus supplement and the accompanying prospectus. We do not undertake any obligation to update or revise these forward-looking statements to reflect new events or

circumstances.

You should read this prospectus supplement, the accompanying prospectus and the documents that are referenced and which

have been incorporated by reference herein and therein, completely and with the understanding that our actual future results may be materially different from what we expect. All forward-looking statements are qualified by these cautionary

statements.

S-4

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information contained elsewhere in this prospectus supplement and the documents incorporated by reference

herein. Please read this entire prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein, and the section entitled “Risk Factors” in this prospectus supplement, the accompanying prospectus and

in our Annual Report on Form 10-K for the fiscal year ended April 30, 2015 and in other reports we file with the SEC in the future, before you decide to invest. In addition, this prospectus supplement and the accompanying prospectus and the

documents incorporated by reference herein include forward-looking information that involves risks and uncertainties. See “Forward-Looking Statements.”

The Company

The J. M. Smucker Company was established in 1897 and was incorporated in Ohio in 1921. We operate principally in one industry, the

manufacturing and marketing of branded food products on a worldwide basis, although the majority of our sales are in the United States. Our operations outside the United States are principally in Canada although products are exported to other

countries as well. Net sales outside the United States, subject to foreign currency exchange, represented approximately 8% of our consolidated net sales for fiscal 2015. Our branded food products include a strong portfolio of trusted, iconic,

market-leading brands that are sold to consumers through retail outlets in North America.

The BAG

Acquisition

On March 23, 2015, the Company completed its acquisition of Big Heart Pet Brands (“Big Heart Pet”), a

leading producer, distributor and marketer of premium quality, branded pet food and pet snacks in the United States, and its parent holding company, Blue Acquisition Group, Inc. (“BAG”), pursuant to that certain Agreement and Plan of

Merger, dated as of February 3, 2015 (the “Merger Agreement”), by and among the Company, BAG, SPF Holdings I, Inc., a Delaware corporation and a wholly owned subsidiary of the Company, SPF Holdings II, LLC, a Delaware limited

liability company and a wholly owned subsidiary of the Company, and for the limited purposes set forth in the Merger Agreement, Blue Holdings, the controlling stockholder of BAG. Pursuant to the terms of the Merger Agreement, the acquisition of BAG

was effected by the way of two mergers (the “Mergers”) as a result of which the assets and liabilities of BAG are now held by a direct wholly owned subsidiary of the Company.

The cash and stock transaction was valued at $5.9 billion, which included the assumption of $2.6 billion in debt that the Company refinanced

at closing. The Company issued 17.9 million shares of common stock to the stockholders of BAG, 17,061,079 shares of which were originally issued to the Selling Shareholder (the “Registrable Shares”) subject to the terms of the

Shareholders Agreement, dated as of February 3, 2015, by and among the Company, Blue Holdings, Kohlberg Kravis Roberts & Co, L.P. (“KKR”), Vestar Capital Partners (“Vestar”), Centerview Capital Management LLC

(“Centerview”), AlpInvest US Holdings, LLC (“AlpInvest”) and certain of their affiliated investment funds (the “Shareholders Agreement”), and paid $1.2 billion in cash, subject to a working capital adjustment. The

Company funded the non-equity portion of the acquisition through the combination of a $1.8 billion bank term loan and $3.7 billion in long-term notes. Previously, on July 15, 2015, the Selling Shareholder sold 4,921,934 shares in an

underwritten secondary offering, which represented 100% of the ownership interests attributable to affiliates of Centerview and AlpInvest (the “July 2015 Secondary Offering”).

Pursuant to the Shareholders Agreement, each of KKR, Vestar and Centerview was granted the right to designate a board observer to the

Company’s Board of Directors, which rights terminate if the applicable investor beneficially owns less than 50% of the shares of the Company initially owned by it upon completion of the Mergers. As previously disclosed, upon completion of the

July 2015 Secondary Offering, Centerview ceased to be the beneficial owner of any of the Company’s shares and lost its right to designate a board observer. The Selling Shareholder has advised the Company that upon completion of the proposed

offering, KKR is expected to lose its right to designate a board observer.

Selling Shareholder

In connection with the Mergers, we originally issued to the Selling Shareholder identified in this prospectus supplement 17,061,079 common

shares of the Company in a private placement exempt from registration under the Securities Act, which we previously registered for resale in accordance with the terms of the Shareholders Agreement. The shares to be sold by the Selling Shareholder

represent 100% of the ownership interests attributable to affiliates of KKR.

S-5

Additional Information

Our principal executive offices are located at One Strawberry Lane, Orrville, Ohio 44667, our telephone number is (330) 682-3000, and our

website is www.jmsmucker.com. Information on our website is not a part of, and we are not incorporating the contents of our website into, this prospectus supplement.

The Offering

| Selling Shareholder |

Blue Holdings I, L.P. |

| Common shares offered by selling shareholder |

8,277,495 shares |

| Common shares outstanding |

119,665,073 shares as of August 28, 2015 |

| Listing |

Our common shares are listed on the New York Stock Exchange under the symbol “SJM.” |

| Use of proceeds |

We will not receive any of the proceeds from the sale of shares by the Selling Shareholder. |

| Dividends |

Subject to the rights of holders of serial preferred shares, if any, holders of our common shares are entitled to receive dividends as, when and if dividends are declared by our board of directors out of assets legally available for the payment

of dividends. |

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors” beginning on page S-7 of this prospectus supplement and any risk factors described in the documents we incorporate by reference, as well as all the

other information set forth in this prospectus supplement, the accompanying prospectus and in the documents we incorporate by reference, before investing in our common stock. |

S-6

RISK FACTORS

Investing in our common shares may involve risks. You should carefully consider the following risk factors, together with all other

information contained in this prospectus supplement or appearing or incorporated by reference in this prospectus supplement. You should also consider the risks, uncertainties and assumptions discussed under “Item 1A. Risk Factors”

beginning on page 7 of our Annual Report on Form 10-K for the year ended April 30, 2015, which is incorporated by reference in this prospectus supplement, and which may be amended, supplemented or superseded from time to time by other reports

we file with the SEC in the future.

The price of our common shares may fluctuate significantly, and you could lose all or part of your

investment.

Volatility in the market price of our common shares may prevent you from being able to sell your common shares at or

above the price you paid for your common shares. The market price for our common shares could fluctuate significantly for various reasons, including:

| |

• |

|

our operating and financial performance and prospects; |

| |

• |

|

our quarterly or annual earnings or those of other companies in our industry; |

| |

• |

|

conditions that impact demand for our products and services; |

| |

• |

|

future announcements concerning our business or our competitors’ businesses; |

| |

• |

|

the public’s reaction to our press releases, other public announcements and filings with the SEC; |

| |

• |

|

changes in earnings estimates or recommendations by securities analysts who track our common shares; |

| |

• |

|

market and industry perception of our success, or lack thereof, in pursuing our growth strategy; |

| |

• |

|

strategic actions by us or our competitors, such as acquisitions or restructurings; |

| |

• |

|

changes in government and environmental regulation; |

| |

• |

|

general market, economic and political conditions; |

| |

• |

|

changes in accounting standards, policies, guidance, interpretations or principles; |

| |

• |

|

arrival and departure of key personnel; |

| |

• |

|

sales of common shares by us or members of our management team; |

| |

• |

|

our ability to successfully integrate acquired and merged businesses in a timely and cost-effective manner and retain key suppliers, customers, and employees; |

| |

• |

|

adverse resolution of new or pending litigation against us; |

| |

• |

|

changes in general market, economic and political conditions in the United States and global economies or financial markets, including those resulting from natural disasters, terrorist attacks, acts of war and responses

to such events; and |

| |

• |

|

the other factors described under “Forward Looking Statements” in this prospectus supplement. |

Future sales or the possibility of future sales of a substantial amount of our common shares may depress the price of our common shares.

Future sales or the availability for sale of substantial amounts of our common shares in the public market could adversely affect the

prevailing market price of our common shares and could impair our ability to raise capital through future sales of equity securities.

We

may issue our common shares or other securities from time to time as consideration for future acquisitions and investments. If any such acquisition or investment is significant, the number of our common shares, or the number or aggregate principal

amount, as the case may be, of other securities that we may issue may in turn be substantial. Subject to the terms of the Shareholders Agreement, we may also grant registration rights covering those shares of our common stock or other securities in

connection with any such acquisitions and investments.

We cannot predict the size of future issuances of our common shares or the effect,

if any, that future issuances and sales of our common shares will have on the market price of our common shares. Sales of substantial amounts of our common shares (including our common shares issued in connection with an acquisition or investment),

or the perception that such sales could occur, may adversely affect prevailing market prices for our common shares.

S-7

Ohio law and our organizational documents may impede or discourage a takeover, which could deprive our

investors of the opportunity to receive a premium for their shares.

Certain provisions of our amended articles of incorporation,

our amended regulations, Ohio law and our shareholder rights plan, which are summarized in the prospectus, may have an antitakeover effect and may delay, defer or prevent a tender offer or takeover attempt that a shareholder might consider in its

best interest, including those attempts that might result in a premium over the market price for the shares held by shareholders.

SUMMARY OF THE UNDERLYING TRANSACTION

On March 23, 2015, the Company completed its acquisition of BAG pursuant to the Merger

Agreement. Pursuant to the terms of the Merger Agreement, the acquisition of BAG was effected by the way of two mergers as a result of which the assets and liabilities of BAG are now held by a direct wholly owned subsidiary of the Company.

In connection with the Mergers, we issued to the Selling Shareholder identified in this prospectus supplement the Registrable Shares in a

private placement exempt from registration under the Securities Act, which we previously registered for resale by the Selling Shareholder. The remaining common shares of the Company issued in the Mergers were issued to current and former management

and employees of BAG and Big Heart Pet in a private placement exempt from registration under the Securities Act and were also previously registered for resale by the Company. Previously, the Selling Shareholder sold 4,921,934 shares in the July 2015

Secondary Offering, which represented 100% of the ownership interests attributable to affiliates of Centerview and AlpInvest. We registered the Registrable Shares in order to fulfill our obligation under the Shareholders Agreement. The Registrable

Shares are subject to certain transfer restrictions pursuant to the Shareholders Agreement.

Pursuant to the Shareholders Agreement, each

of KKR, Vestar, and Centerview was granted the right to designate a board observer to the Company’s Board of Directors, which rights terminate if the applicable investor beneficially owns less than 50% of the shares of the Company initially

owned by it upon completion of the Mergers. Upon completion of the July 2015 Secondary Offering, Centerview ceased to be the beneficial owner of any of the Company’s shares and lost its right to designate a board observer. The Selling

Shareholder has advised the Company that upon completion of the proposed offering, KKR is expected to lose its right to designate a board observer.

USE OF PROCEEDS

We will not receive any proceeds as a result of the sale of the Registrable Shares by the Selling Shareholder described in this prospectus

supplement and the accompanying prospectus.

SELLING SHAREHOLDER

The following table sets forth (i) the Selling Shareholder, (ii) the number and percentage of common shares that the Selling

Shareholder beneficially owned before this offering, (iii) the number of common shares to be sold in this offering by the Selling Shareholder and (iv) the number and percentage of common shares that will be beneficially owned by the

Selling Shareholder after this offering. The number of our common shares outstanding as of August 28, 2015 was 119,665,073 shares. The information contained in the table below in respect of the Selling Shareholder has been obtained from the

Selling Shareholder and has not been independently verified by us.

The amounts and percentage of common stock beneficially owned are

reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares

“voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be

a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed a

beneficial owner of securities as to which he or she has no economic interest.

Except as indicated by footnote, the persons named in the

table below have sole voting and investment power with respect to all common shares as beneficially owned by them.

S-8

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling

Shareholders (1) |

|

Class |

|

Number of Shares

Beneficially

Owned |

|

Percent

of

Class |

|

Number of Shares

Offered |

|

Number of Shares

of Class Beneficially

Owned After

Offering |

|

Percentage of

Shares of Class

Beneficially

Owned After

Offering |

| Blue Holdings I, L.P. (2) |

|

Common shares |

|

12,139,145 |

|

10.1% |

|

8,277,495 |

|

3,861,650 |

|

3.2% |

| (1) |

For information regarding certain material relationships between the Selling Shareholder and the Company, see “Entry into a Material Definitive Agreement—Shareholders Agreement” included in our Form 8-K

filed with the SEC on February 4, 2015, which is incorporated by reference into this prospectus supplement. |

| (2) |

Blue Holdings holds an aggregate of 12,139,145 of the Company common shares, over which Blue Holdings may be deemed to have sole voting power and sole dispositive power. Blue Holdings GP, LLC (“Blue Holdings

GP”) (as the general partner of Blue Holdings) may be deemed to have voting and dispositive power over the Company common shares beneficially owned by Blue Holdings. |

The Company, Blue Holdings, KKR and Vestar and certain of their respective affiliated investment funds are parties to the Shareholders

Agreement, which sets forth certain governance arrangements and provides certain board observer rights and voting arrangements. Each of KKR 2006 Fund L.P. and Vestar/Blue Investments I, L.P. owns membership interests in Blue Holdings GP, the general

partner of Blue Holdings, and has the right to appoint managers to the board of Blue Holdings GP. As a result of ownership by KKR 2006 Fund L.P. and Vestar/Blue Investments I, L.P., of interests in Blue Holdings GP, each of KKR 2006 Fund L.P. and

Vestar/Blue Investments I, L.P. and certain of their respective affiliates may be deemed to beneficially own a portion of the Registrable Shares as further described in this footnote. As such, KKR 2006 Fund L.P. and Vestar/Blue Investments I, L.P.

and certain of their respective affiliates may each be deemed to be a member of a group exercising voting and investment control over the Company’s common shares held by Blue Holdings. However, such persons have made no admission that any of

such persons are members of such a group.

The address of the principal business office of Blue Holdings and Blue Holdings GP is c/o

Kohlberg Kravis Roberts & Co. L.P., 2800 Sand Hill Road, Suite 200, Menlo Park, CA 94025.

KKR 2006 Fund L.P. may be deemed to

have sole voting and dispositive power over 8,277,495 shares (and, upon completion of this offering, no voting or dispositive power over any shares), by virtue of its membership interests in Blue Holdings GP, and its limited partnership interests in

Blue Holdings, which together provide it with the power to direct the voting and disposition of KKR 2006 Fund L.P.’s and certain of its affiliated investment funds’ pro rata portion of the Company common shares held by Blue

Holdings. Each of KKR Associates 2006 L.P. (as the general partner of KKR 2006 Fund L.P.), KKR 2006 GP LLC (as the general partner of KKR Associates 2006 L.P.), KKR Fund Holdings L.P. (as the designated member of KKR 2006 GP LLC), KKR Fund

Holdings GP Limited (as a general partner of KKR Fund Holdings L.P.), KKR Group Holdings L.P. (as a general partner of KKR Fund Holdings L.P. and the sole shareholder of KKR Fund Holdings GP Limited), KKR Group Limited (as the general partner of KKR

Group Holdings L.P.), KKR & Co. L.P. (as the sole shareholder of KKR Group Limited), KKR Management LLC (as the general partner of KKR & Co. L.P.) and Messrs. Henry R. Kravis and George R. Roberts (as the designated members of KKR

Management LLC) may be deemed to have voting and dispositive power over the Company’s common shares beneficially owned by KKR 2006 Fund L.P., and each disclaims beneficial ownership of such shares. KKR 2006 Fund L.P. and each such person

expressly disclaim beneficial ownership with respect to any other Registrable Shares held by Blue Holdings.

The address of the principal

business office of KKR 2006 Fund L.P., KKR Associates 2006 L.P., KKR 2006 GP LLC, KKR Fund Holdings L.P., KKR Fund Holdings GP Limited, KKR Group Holdings L.P., KKR Group Limited, KKR & Co. L.P., KKR Management LLC and Mr. Kravis is

c/o Kohlberg Kravis Roberts & Co. L.P., 9 West 57th Street, Suite 4200, New York, NY 10019. The address of the principal business office of Mr. Roberts is c/o Kohlberg Kravis Roberts & Co. L.P., 2800 Sand Hill

Road, Suite 200, Menlo Park, CA 94025.

Vestar/Blue Investments I L.P. may be deemed to have sole voting and dispositive power over

3,861,650 shares (and, upon completion of this offering, sole voting and dispositive power over 3,861,650 shares) by virtue of its membership interests in Blue Holdings GP, and its limited partnership interests in Blue Holdings, which together

provide it with the power to direct the voting and disposition of its pro rata portion of the Company common shares held by Blue Holdings.

Each of Vestar Associates V, L.P. (as the general partner of Vestar/Blue Investments I L.P.), Vestar Managers V Ltd. (“VMV”) (as the

general partner of Vestar Associates V, L.P.) and Mr. Daniel S. O’Connell (as the sole director of VMV) may be deemed to have voting and dispositive power over the Company common shares beneficially owned by Vestar/Blue Investments I L.P.,

and each disclaims beneficial ownership of such shares. Vestar/Blue Investments I L.P. and each such person expressly disclaim beneficial ownership with respect to any other Registrable Shares held by Blue Holdings.

S-9

The address of the principal business office of Vestar/Blue Investments I L.P., Vestar Associates

V, L.P., VMV and Mr. O’Connell is c/o Vestar Capital Partners, 245 Park Avenue, 41st Floor, New York, New York 10167.

S-10

UNDERWRITING

Under the terms and subject to the conditions contained in an underwriting agreement dated September 21, 2015, the Selling Shareholder

has agreed to sell to Morgan Stanley & Co. LLC, the sole underwriter, 8,277,495 common shares.

The underwriting agreement

provides that the underwriter is obligated to purchase all the common shares in the offering if any are purchased.

The underwriter

proposes initially to offer the common shares directly to the public at the public offering price set forth on the cover page of this prospectus supplement. After the initial offering, the public offering price or any other term of the offering may

be changed by the underwriter. The offering of the common shares by the underwriter is subject to receipt and acceptance and subject to the underwriter’s right to reject any order in whole or in part. The underwriter may effect such

transactions by selling common shares to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriter and/or purchasers of common shares for whom they may act as agents or to

whom they may sell as principal.

The following table shows the public offering price, underwriting discount and proceeds before expenses

to the Selling Shareholder:

|

|

|

|

|

|

|

|

|

| |

|

Per Share |

|

|

Total |

|

| Public offering price |

|

$ |

114.00 |

|

|

$ |

943,634,430.00 |

|

| Underwriting discounts and commissions |

|

$ |

0.69 |

|

|

$ |

5,711,471.55 |

|

| Proceeds to Selling Shareholder, before expenses |

|

$ |

113.31 |

|

|

$ |

937,922,958.45 |

|

The expenses of the offering are estimated at $250,000 and are payable by us. We and the Selling Shareholder

have agreed to indemnify the underwriter against certain liabilities, including liabilities under the Securities Act.

No Sales of Similar Securities

The Selling Shareholder has agreed that, subject to certain customary exceptions, for a period of 30 days from the date of the

underwriting agreement, it will not, without the prior written consent of the underwriter, offer, sell, contract to sell, pledge or otherwise dispose of (or enter into any transaction which is designed to, or might reasonably be expected to, result

in the disposition (whether by actual disposition or effective economic disposition due to cash settlement or otherwise) or establish or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of

Section 16 of the Exchange Act, and the rules and regulations of the SEC promulgated thereunder with respect to, any shares of the Company’s common stock or any securities convertible into, or exercisable or exchangeable for shares of the

Company’s common stock, or publicly announce an intention to effect any such transaction. The underwriter in its sole discretion may release any of the securities subject to this lock-up agreement at any time without notice.

New York Stock Exchange Listing

The

shares are listed on the NYSE under the symbol “SJM.”

Price Stabilization, Short Positions

Until the distribution of the shares is completed, SEC rules may limit the underwriter from bidding for and purchasing our common shares.

However, the underwriter may engage in transactions that stabilize the price of the common shares, such as bids or purchases to peg, fix or maintain that price.

In connection with the offering, the underwriter may purchase and sell our common shares in the open market. These transactions may include

short sales, purchases on the open market to cover positions created by short sales and stabilizing transactions. Short sales involve the sale by the underwriter of a greater number of shares than it is required to purchase in the offering.

Stabilizing transactions consist of various bids for or purchases of common shares made by the underwriter in the open market prior to the completion of the offering.

Similar to other purchase transactions, the underwriter’s purchases to cover short sales may have the effect of raising or maintaining

the market price of our common shares or preventing or retarding a decline in the market price of our common shares. As a result, the price of our common shares may be higher than the price that might otherwise exist in the open market.

S-11

Neither we nor the underwriter make any representation or prediction as to the direction or

magnitude of any effect that the transactions described above may have on the price of our common shares. In addition, neither we nor the underwriter make any representation that the underwriter will engage in these transactions or that these

transactions, once commenced, will not be discontinued without notice.

Electronic Offer, Sale and Distribution of Shares

In connection with the offering, the underwriter or certain of the securities dealers may distribute prospectuses by electronic means, such as

e-mail. In addition, the underwriter may facilitate Internet distribution for this offering to certain of its Internet subscription customers. The underwriter may allocate a limited number of shares for sale to its online brokerage customers. An

electronic prospectus is available on the Internet web site maintained by the underwriter. Other than the prospectus in electronic format, the information on the underwriter’s web site is not part of this prospectus.

Other Relationships

The underwriter and

its affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment,

hedging, financing and brokerage activities. In the ordinary course of its various business activities, the underwriter and its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related

derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investment and

securities activities may involve our securities and instruments. The underwriter and its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may

at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

The

underwriter and its affiliates have engaged in, and may in the future engage in, investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. They have received, or may in the future receive,

customary fees and commissions for these transactions.

Notice to Prospective Investors in the EEA

In relation to each Member State of the European Economic Area (each, a “Relevant Member State”), no offer of shares may be made to

the public in that Relevant Member State other than:

| |

A. |

to any legal entity which is a qualified investor as defined in the Prospectus Directive; |

| |

B. |

to fewer than 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the

underwriter; or |

| |

C. |

in any other circumstances falling within Article 3(2) of the Prospectus Directive, |

provided

that no such offer of shares shall require the Company or the underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive.

Each person in a Relevant Member State who initially acquires any shares or to whom any offer is made will be deemed to have represented,

acknowledged and agreed that it is a “qualified investor” within the meaning of the law in that Relevant Member State implementing Article 2(1)(e) of the Prospectus Directive. In the case of any shares being offered to a financial

intermediary as that term is used in Article 3(2) of the Prospectus Directive, each such financial intermediary will be deemed to have represented, acknowledged and agreed that the shares acquired by it in the offer have not been acquired on a

non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances which may give rise to an offer of any shares to the public other than their offer or resale in a Relevant Member

State to qualified investors as so defined or in circumstances in which the prior consent of the underwriter has been obtained to each such proposed offer or resale.

The Company, the underwriter and their affiliates will rely upon the truth and accuracy of the foregoing representations, acknowledgements and

agreements.

This prospectus supplement has been prepared on the basis that any offer of shares in any Relevant Member State will be made

pursuant to an exemption under the Prospectus Directive from the requirement to publish a prospectus for offers of shares. Accordingly any person making or intending to make an offer in that Relevant Member State of shares which are the subject of

the offering contemplated in this prospectus supplement may only do so in circumstances in which no obligation arises for the Company or the underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive in relation to such

offer. Neither the Company nor the underwriter has authorized, nor do they authorize, the making of any offer of shares in circumstances in which an obligation arises for the Company or the underwriter to publish a prospectus for such offer.

S-12

For the purpose of the above provisions, the expression “an offer to the public” in

relation to any shares in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the shares to be offered so as to enable an investor to decide to purchase or subscribe

for the shares, as the same may be varied in the Relevant Member State by any measure implementing the Prospectus Directive in the Relevant Member State, and the expression “Prospectus Directive” means Directive 2003/71/EC (as amended,

including by Directive 2010/73/EU) and includes any relevant implementing measure in the Relevant Member State.

Notice to Prospective Investors in the

United Kingdom

In addition, in the United Kingdom, this document is being distributed only to, and is directed only at, and any offer

subsequently made may only be directed at persons who are “qualified investors” (as defined in the Prospectus Directive) (i) who have professional experience in matters relating to investments falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”) and/or (ii) who are high net worth companies (or persons to whom it may otherwise be lawfully communicated) falling within Article

49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). This document must not be acted on or relied on in the United Kingdom by persons who are not relevant persons. In the United Kingdom,

any investment or investment activity to which this document relates is only available to, and will be engaged in with, relevant persons.

Notice to

Prospective Investors in Switzerland

The shares may not be publicly offered in Switzerland and will not be listed on the SIX Swiss

Exchange (“SIX”) or on any other stock exchange or regulated trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss

Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this document nor any other

offering or marketing material relating to the shares or the offering may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this document nor any other offering or marketing material relating to the offering, the Company or the shares have been or will be

filed with or approved by any Swiss regulatory authority. In particular, this document will not be filed with, and the offer of shares will not be supervised by, the Swiss Financial Market Supervisory Authority FINMA (“FINMA”), and the

offer of shares has not been and will not be authorized under the Swiss Federal Act on Collective Investment Schemes (“CISA”). The investor protection afforded to acquirers of interests in collective investment schemes under the CISA does

not extend to acquirers of shares.

Notice to Prospective Investors in the Dubai International Financial Centre

This prospectus supplement relates to an Exempt Offer in accordance with the Offered Securities Rules of the Dubai Financial Services Authority

(“DFSA”). This prospectus supplement is intended for distribution only to persons of a type specified in the Offered Securities Rules of the DFSA. It must not be delivered to, or relied on by, any other person. The DFSA has no

responsibility for reviewing or verifying any documents in connection with Exempt Offers. The DFSA has not approved this prospectus supplement nor taken steps to verify the information set forth herein and has no responsibility for the prospectus

supplement. The shares to which this prospectus supplement relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers of the shares offered should conduct their own due diligence on the shares. If you do not

understand the contents of this prospectus supplement you should consult an authorized financial advisor.

LEGAL MATTERS

Certain legal matters in connection with the securities to be offered by this prospectus supplement will be passed upon for us by Calfee,

Halter & Griswold LLP, Cleveland, Ohio. The underwriter has been represented by Davis, Polk & Wardwell LLP, New York, New York and the Selling Shareholder has been represented by Simpson Thacher & Bartlett LLP, New York,

New York.

EXPERTS

The consolidated financial statements of The J. M. Smucker Company included in The J. M. Smucker Company’s 2015

Annual Report to Shareholders and incorporated by reference in The J. M. Smucker Company’s Annual Report on Form 10-K for the year ended April 30, 2015, and the effectiveness of

The J. M. Smucker Company’s internal control over financial reporting as of April 30, 2015, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports

thereon included and incorporated by reference therein, and incorporated herein by reference. Such

S-13

financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP

pertaining to such financial statements and the effectiveness of our internal control over financial reporting as of the respective dates (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of

such firm as experts in accounting and auditing.

The consolidated financial statements of Blue Acquisition Group, Inc. as of

April 27, 2014 and April 28, 2013 and for the fiscal years ended April 27, 2014, April 28, 2013, and April 29, 2012, incorporated by reference in this prospectus supplement from the Form 8-K filed by the Company on

March 23, 2015, as amended on August 19, 2015, have been audited by KPMG LLP, independent auditors, as stated in their report which is incorporated herein by reference.

S-14

PROSPECTUS

THE J. M. SMUCKER COMPANY

Debt Securities

Common Shares

Serial Preferred Shares

Warrants

Units

J.M. SMUCKER LLC

THE FOLGERS COFFEE COMPANY

Guarantees of Debt Securities

We may offer and sell from time to time, in one or more offerings, debt securities, common shares, serial preferred

shares and warrants, as well as units that include any of these securities. We may also offer common shares or serial preferred shares upon conversion of debt securities, common shares upon conversion of serial preferred shares, or common shares,

preferred shares or debt securities upon the exercise of warrants.

This prospectus also relates to guarantees of debt

securities by the subsidiaries identified in this prospectus.

We will provide the specific terms of the securities to be

offered in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also

supplement, update or amend the information contained in this prospectus. You should read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated by reference, carefully

before you invest. This prospectus may not be used to offer and sell our securities unless accompanied by a prospectus supplement describing the method and terms of the offering of those securities.

Our common shares are listed on the New York Stock Exchange under the symbol “SJM.” We have not yet determined whether any of

the other securities that may be offered by this prospectus will be listed on any exchange, inter-dealer quotation system or over-the-counter market. If we decide to seek the listing of any such securities upon issuance, the prospectus supplement

relating to those securities will disclose the exchange, quotation system or market on which the securities will be listed.

Investing in our securities involves risk. See “Risk Factors” on page 5 of this prospectus.

We may offer and sell these securities to or through one or more underwriters, dealers or agents, or directly to

investors, on a continuous or delayed basis.

The applicable prospectus supplement will provide the names of any underwriters,

dealers or agents, the specific terms of the plan of distribution, any over-allotment option and any applicable underwriting discounts and commissions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

The date of this prospectus is July 15, 2014.

TABLE OF CONTENTS

References in this prospectus to the “Company,” “we,” “us” and

“our” are to The J. M. Smucker Company and its consolidated subsidiaries unless otherwise specified or the context requires otherwise. References in the prospectus to the “guarantors” or “subsidiary guarantors” are to

J.M. Smucker LLC and The Folgers Coffee Company unless otherwise specified or the context requires otherwise.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission

(“SEC”) using a “shelf” registration procedure. Under this shelf procedure, we and/or our selling security holders, as applicable, may sell the securities described in this prospectus.

The securities described above may be offered and sold in combination and in one or more offerings. Each time we offer and sell

securities under the registration statement of which this prospectus is a part, we will file with the SEC a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement and any related free

writing prospectus that we may authorize may also add, update, or change information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus. You should carefully read this prospectus, the

applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection with a specific offering, together with the information incorporated herein by reference as described under the heading “Where You Can

Find More Information,” in their entirety. They contain information that you should consider when making your investment decision.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to

which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under

circumstances and in jurisdictions where it is lawful to do so.

The information appearing in this prospectus, any applicable

prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of that document, and any information we have incorporated by reference is accurate only as of the date of the document incorporated by

reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have

changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents

described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed

or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More

Information.”

The registration statement that contains this prospectus contains additional information about our company

and the securities offered under this prospectus. That registration statement can be read at the SEC website or at the SEC reference room mentioned under the heading “Where You Can Find More Information.”

1

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission

(“SEC”). Our SEC filings are available to the public over the Internet at the SEC’s web site at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E.,

Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

The SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information to you by referring you to those documents. The information

incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future

filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), other than any portion of such documents that by statute, designation in such documents or

otherwise are deemed to be furnished, rather than filed, under the applicable SEC rules or are not required to be incorporated herein by reference. We incorporate by reference the following information or documents that we have filed with the SEC:

| |

• |

|

our Annual Report on Form 10-K for the fiscal year ended April 30, 2014; |

| |

• |

|

the description of our common shares contained in our Registration Statement on Form 8-A filed with the SEC on May 23, 2002, and all amendments

and reports filed for the purpose of updating that description; and |

| |

• |

|

the description of our rights to purchase preferred shares contained in our Registration Statement on Form 8-A filed with the SEC on May 21, 2009.

|

The information relating to us contained in this prospectus and any accompanying prospectus supplement

should be read together with the information in the documents incorporated by reference.

You may request a copy of these

filings, at no cost, by writing or telephoning us at our principal executive offices at the following address:

The J. M.

Smucker Company

Attention: Corporate Secretary

One Strawberry Lane

Orrville, Ohio 44667 (330) 682-3000

2

FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus constitute forward-looking statements within the meaning of federal securities laws. The

forward-looking statements may include statements concerning our current expectations, estimates, assumptions, and beliefs concerning future events, conditions, plans, and strategies that are not historical fact. Any statement that is not historical

in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,” “anticipates,” “believes,” “will,” “plans,” and similar phrases.

Federal securities laws provide a safe harbor for forward-looking statements to encourage companies to provide prospective information.

We are providing this cautionary statement in connection with the safe harbor provisions. Readers are cautioned not to place undue reliance on any forward-looking statements, as such statements are by nature subject to risks, uncertainties, and

other factors, many of which are outside of our control and could cause actual results to differ materially from such statements and from our historical results and experience. These risks and uncertainties include, but are not limited to, those set

forth under the caption “Risk Factors” in this prospectus and in our periodic reports under the Exchange Act, as amended, filed with the SEC, as well as the following:

| |

• |

|

volatility of commodity markets from which raw materials, particularly green coffee beans, peanuts, soybean oil, wheat, milk, corn, and sugar, are

procured and the related impact on costs; |

| |

• |

|

risks associated with derivative and purchasing strategies we employ to manage commodity pricing risks, including the risk that such strategies could

result in significant losses and adversely impact our liquidity; |

| |

• |

|

crude oil price trends and their impact on transportation, energy, and packaging costs; |

| |

• |

|

our ability to successfully implement and realize the full benefit of price changes that are intended to ultimately fully recover cost, including the

competitive, retailer, and consumer response, and the impact of the timing of the price changes to profits and cash flow in a particular period; |

| |

• |

|

the success and cost of introducing new products and the competitive response; |

| |

• |

|

the success and cost of marketing and sales programs and strategies intended to promote growth in our businesses; |

| |

• |

|

general competitive activity in the market, including competitors’ pricing practices and promotional spending levels;

|

| |

• |

|

our ability to successfully integrate acquired and merged businesses in a timely and cost effective manner; |

| |

• |

|

the impact of food security concerns involving either our products or our competitors’ products; |

| |

• |

|

the impact of accidents, extreme weather, and natural disasters, including crop failures and storm damage; |

| |

• |

|

the concentration of certain of our businesses with key customers and suppliers, including single-source suppliers of certain key raw materials, such

as packaging for our Folgers® coffee products, and finished goods, such as K-Cup® packs, and our ability to manage and maintain key relationships; |

| |

• |

|

the loss of significant customers, a substantial reduction in orders from such customers, or the bankruptcy of any such customer;

|

| |

• |

|

changes in consumer coffee preferences and other factors affecting our coffee businesses, which represent a substantial portion of our business;

|

| |

• |

|

a change in outlook or downgrade in our public credit ratings by a rating agency; |

| |

• |

|

our ability to obtain any required financing on a timely basis and on acceptable terms; |

3

| |

• |

|

the timing and amount of capital expenditures, share repurchases, and restructuring costs; |

| |

• |

|

impairments in the carrying value of goodwill, other intangible assets, or other long-lived assets or changes in useful lives of other intangible

assets; |

| |

• |

|

the impact of new or changes to existing governmental laws and regulations and their application; |

| |

• |

|

the impact of future legal, regulatory, or market measures regarding climate change; |

| |

• |

|

the outcome of current and future tax examinations, changes in tax laws, and other tax matters, and their related impact on our tax positions;

|

| |

• |

|

foreign currency and interest rate fluctuations; |

| |

• |

|

political or economic disruption; |

| |

• |

|

other factors affecting share prices and capital markets generally; and |

| |

• |

|

risks related to other factors described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended April 30,

2014. |

Readers are cautioned not to unduly rely on such forward-looking statements, which speak only as of

the date made, when evaluating the information contained in this prospectus. There may be other factors that may cause our actual results to differ materially from the forward-looking statements. We do not undertake any obligation to update or

revise these forward-looking statements to reflect new events or circumstances.

You should read this prospectus, any

accompanying prospectus supplement and the documents that are referenced and which have been incorporated by reference herein and therein, completely and with the understanding that our actual future results may be materially different from what we

expect. All forward-looking statements are qualified by these cautionary statements.

4

THE COMPANY

The J. M. Smucker Company was established in 1897 and was incorporated in Ohio in 1921. We operate principally in one industry, the

manufacturing and marketing of branded food products on a worldwide basis, although the majority of our sales are in the United States. Our operations outside the United States are principally in Canada although products are exported to other

countries as well. Sales outside the United States represented approximately eight percent of our consolidated sales for fiscal 2014. Our branded food products include a strong portfolio of trusted, iconic, market-leading brands that are sold to

consumers through retail outlets in North America.

Our principal executive offices are located at One Strawberry Lane,

Orrville, Ohio 44667, and our telephone number is (330) 682-3000.

THE GUARANTORS

Any of the debt securities we issue may include guarantees by J.M. Smucker LLC and/or The Folgers Coffee Company. If so

provided in a prospectus supplement, each of the guarantors named therein will fully and unconditionally guarantee on a joint and several basis our obligations under the debt securities, subject to certain limitations described in such prospectus

supplement.

RISK FACTORS

Investing in our securities may involve risks. You should carefully consider the specific factors discussed under the caption “Risk

Factors” in the applicable prospectus supplement, together with all the other information contained in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and

assumptions discussed under “Item 1A. Risk Factors” beginning on page 6 of our Annual Report on Form 10-K for the year ended April 30, 2014, which is incorporated by reference in this prospectus, and which may be amended, supplemented

or superseded from time to time by other reports we file with the SEC in the future.

5

USE OF PROCEEDS

Unless otherwise indicated in the applicable prospectus supplement relating to a specific issuance of securities or in any free writing

prospectuses we have authorized for use in connection with a specific offering, we intend to use the net proceeds from the sale of the securities for general corporate purposes, which could include, but are not limited to, repayments of outstanding

debt, capital expenditures or working capital or for the funding of possible acquisitions.

RATIO OF

EARNINGS TO FIXED CHARGES

The following table sets forth the ratio of our earnings to our fixed charges for the periods

indicated. The ratio has been computed by dividing earnings by fixed charges. For purposes of computing the ratio, “Earnings” is income before income taxes plus fixed charges, less capitalized interest. “Fixed Charges” is

interest expense plus capitalized interest and the portion of rental expense which is representative of interest expense. For purposes of this calculation, management estimates approximately one-third of rent expense is representative of interest

expense.

|

|

|

|

|

|

|

|

|

| Fiscal Year Ended

April 30, |

| 2014 |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

| 9.1 |

|

7.8 |

|

7.6 |

|

8.9 |

|

9.7 |

6

DESCRIPTION OF CAPITAL STOCK

This section summarizes the terms of our capital stock. The following description of our capital stock is only a summary and does not

purport to be complete and is qualified in its entirety by reference to our amended articles of incorporation, which we refer to as our articles of incorporation, our amended regulations, which we refer to as our regulations, and the rights

agreement with Computershare Trust Company, N.A. relating to our shareholder rights plan, each of which has been publicly filed with the SEC and is incorporated by reference. See “Where You Can Find More Information.”

Authorized Capital Stock

Our authorized capital stock consists of 306,000,000 shares, including:

| |

• |

|

300,000,000 common shares, without par value; and |

| |

• |

|

6,000,000 serial preferred shares, without par value. |

Common Shares

Our articles of incorporation permit the issuance of up to

300,000,000 common shares. This amount can be amended by our board of directors without shareholder approval, to the extent permitted by Chapter 1701 of the Ohio Revised Code.

Voting Rights

Our articles of incorporation provide that, except as

set forth below, each outstanding common share entitles the holder to one vote on each matter properly submitted to the shareholders for their approval, including any vote or consent for the election or removal of our directors.

Notwithstanding the foregoing, holders of our outstanding common shares who have held their common shares for at least four years without

a change in beneficial ownership are entitled to ten votes on each of the following matters properly submitted to the shareholders, to the extent those matters are required to be submitted to the shareholders under Ohio law, our articles of

incorporation or our regulations, stock exchange rules, or are otherwise submitted or presented to our shareholders for their vote, consent, waiver or other action:

| |

• |

|

any matter that relates to or would result in our dissolution or liquidation, whether voluntary or involuntary, and whether pursuant to

Section 1701.86 or 1701.91 of the Ohio Revised Code or otherwise; |

| |

• |

|

the adoption of any amendment to our articles of incorporation or our regulations or the adoption of amended articles of incorporation, other than the

adoption of any amendment or amended articles of incorporation that increases the number of votes to which holders of our common shares are entitled or expands the matters to which the time-phase voting provisions of our articles of incorporation

apply; |

| |

• |

|

any proposal or other action to be taken by our shareholders, whether or not proposed by our shareholders, and whether proposed by authority of our

board of directors or otherwise, relating to our rights plan or any successor plan; |

| |

• |

|

any matter relating to any stock option plan, stock purchase plan, executive compensation plan, executive benefit plan, or other similar plan,

arrangement, or agreement; |

| |

• |

|

adoption of any agreement or plan of or for the merger, consolidation or majority share acquisition of us or any of our subsidiaries with or into any

other person, whether domestic or foreign, corporate or noncorporate or the authorization of the lease, sale, exchange, transfer or other disposition of all, or substantially all, of our assets; |

7

| |

• |

|

any matter submitted to our shareholders pursuant to Article Fifth (interested shareholder provision) or Article Seventh (control share provision) of

our articles of incorporation, as they may be further amended, or any issuance of our common shares for which shareholder approval is required by applicable stock exchange rules; and |

| |

• |

|

any matter relating to the issuance of our common shares or the repurchase of our common shares that our board of directors determines is required or

appropriate to be submitted to our shareholders under Ohio law or applicable stock exchange rules. |

Upon any