Current Report Filing (8-k)

August 25 2015 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 25, 2015

The J. M. Smucker Company

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Ohio |

|

001-05111 |

|

34-0538550 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

One Strawberry Lane

Orrville, Ohio |

|

44667-0280 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (330) 682-3000

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

As was announced in The J. M. Smucker Company’s (the

“Company”) press release dated February 9, 2015, the Board of Directors approved the following executive promotions, which became effective April 1, 2015:

| |

• |

|

Vincent C. Byrd assumed the role of Vice Chairman. |

| |

• |

|

Mark T. Smucker assumed the role of President of the Company and President, Consumer and Natural Foods. |

| |

• |

|

Steven Oakland assumed the role of President, Coffee and Foodservice. |

| |

• |

|

Barry C. Dunaway assumed the role of President, International and Chief Administrative Officer. |

In addition,

following the close of the Big Heart Pet Brands transaction, David J. West assumed the role of President, Big Heart Pet Food and Snacks.

While the

Company’s methodology for calculating segment profit will remain the same for fiscal 2016, the Company’s reportable segments are being modified to align with the way performance is evaluated by the Company’s segment management and

chief operating decision maker (the Company’s chief executive officer) and the way in which information is reported internally subsequent to the aforementioned management changes. Effective May 1, 2015, the Company will present its segment

results in the following manner: U.S. Retail Coffee reportable segment, U.S. Retail Consumer Foods reportable segment, U.S. Retail Pet Foods reportable segment, and International and Foodservice, a combination of all remaining strategic business

areas. The U.S. Retail Consumer Foods reportable segment is a combination of the former U.S. Retail Consumer Foods reportable segment and the Natural Foods strategic business area, previously included in the former International, Foodservice, and

Natural Foods reportable segment.

Attached as Exhibit 99.1 to this Current Report on Form 8-K are the unaudited net sales and segment profit calculations

for the quarterly periods in fiscal 2015 and 2014 modified to reflect the realigned reportable segments.

The information in this Current Report on Form

8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

2

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 99.1 |

|

Unaudited Reportable Segments Supplemental Information |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| THE J. M. SMUCKER COMPANY |

|

|

| By: |

|

/s/ Mark R. Belgya |

| Name: |

|

Mark R. Belgya |

| Title: |

|

Senior Vice President and Chief Financial Officer |

Date: August 25, 2015

4

INDEX OF EXHIBITS

|

|

|

| Exhibit No. |

|

Exhibit Description |

|

|

| 99.1 |

|

Unaudited Reportable Segments Supplemental Information |

5

Exhibit 99.1

The J. M. Smucker Company

Unaudited Reportable Segments Supplemental Information

(Realigned to Reflect the New Reportable Segments)

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

July 31, |

|

| |

|

2014 |

|

|

2013 |

|

| |

|

(Dollars in millions) |

|

| Net sales: |

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

502.7 |

|

|

$ |

514.4 |

|

| U.S. Retail Consumer Foods |

|

|

582.4 |

|

|

|

580.5 |

|

| International and Foodservice |

|

|

238.7 |

|

|

|

256.0 |

|

|

|

|

|

|

|

|

|

|

| Total net sales |

|

$ |

1,323.8 |

|

|

$ |

1,350.9 |

|

|

|

|

|

|

|

|

|

|

| Segment profit: |

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

137.6 |

|

|

$ |

142.6 |

|

| U.S. Retail Consumer Foods |

|

|

118.1 |

|

|

|

102.4 |

|

| International and Foodservice |

|

|

30.5 |

|

|

|

36.2 |

|

|

|

|

|

|

|

|

|

|

| Total segment profit |

|

$ |

286.2 |

|

|

$ |

281.2 |

|

|

|

|

|

|

|

|

|

|

| Interest expense – net |

|

|

(17.4 |

) |

|

|

(23.8 |

) |

| Unallocated derivative (losses) gains |

|

|

(21.4 |

) |

|

|

4.6 |

|

| Cost of products sold – special project costs |

|

|

(0.4 |

) |

|

|

(1.5 |

) |

| Other special project costs |

|

|

(8.6 |

) |

|

|

(5.8 |

) |

| Corporate administrative expenses |

|

|

(64.2 |

) |

|

|

(65.2 |

) |

| Other income – net |

|

|

1.3 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

$ |

175.5 |

|

|

$ |

189.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit margin: |

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

|

27.4 |

% |

|

|

27.7 |

% |

| U.S. Retail Consumer Foods |

|

|

20.3 |

% |

|

|

17.6 |

% |

| International and Foodservice |

|

|

12.8 |

% |

|

|

14.1 |

% |

The J. M. Smucker Company

Unaudited Reportable Segments Supplemental Information

(Realigned to Reflect the New Reportable Segments)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

October 31, |

|

|

Six months ended

October 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| |

|

(Dollars in millions) |

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

533.0 |

|

|

$ |

594.9 |

|

|

$ |

1,035.7 |

|

|

$ |

1,109.3 |

|

| U.S. Retail Consumer Foods |

|

|

664.4 |

|

|

|

668.5 |

|

|

|

1,246.8 |

|

|

|

1,249.0 |

|

| International and Foodservice |

|

|

284.4 |

|

|

|

296.5 |

|

|

|

523.1 |

|

|

|

552.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net sales |

|

$ |

1,481.8 |

|

|

$ |

1,559.9 |

|

|

$ |

2,805.6 |

|

|

$ |

2,910.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

151.2 |

|

|

$ |

180.6 |

|

|

$ |

288.8 |

|

|

$ |

323.2 |

|

| U.S. Retail Consumer Foods |

|

|

125.6 |

|

|

|

108.9 |

|

|

|

243.7 |

|

|

|

211.3 |

|

| International and Foodservice |

|

|

37.6 |

|

|

|

39.2 |

|

|

|

68.1 |

|

|

|

75.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total segment profit |

|

$ |

314.4 |

|

|

$ |

328.7 |

|

|

$ |

600.6 |

|

|

$ |

609.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense – net |

|

|

(16.2 |

) |

|

|

(20.5 |

) |

|

|

(33.6 |

) |

|

|

(44.3 |

) |

| Unallocated derivative gains (losses) |

|

|

7.6 |

|

|

|

(1.5 |

) |

|

|

(13.8 |

) |

|

|

3.1 |

|

| Cost of products sold – special project costs |

|

|

(0.3 |

) |

|

|

(2.3 |

) |

|

|

(0.7 |

) |

|

|

(3.8 |

) |

| Other special project costs |

|

|

(2.8 |

) |

|

|

(6.9 |

) |

|

|

(11.4 |

) |

|

|

(12.7 |

) |

| Corporate administrative expenses |

|

|

(64.1 |

) |

|

|

(67.2 |

) |

|

|

(128.3 |

) |

|

|

(132.4 |

) |

| Other income (expense) – net |

|

|

0.3 |

|

|

|

(0.3 |

) |

|

|

1.6 |

|

|

|

(0.3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

$ |

238.9 |

|

|

$ |

230.0 |

|

|

$ |

414.4 |

|

|

$ |

419.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

|

28.4 |

% |

|

|

30.4 |

% |

|

|

27.9 |

% |

|

|

29.1 |

% |

| U.S. Retail Consumer Foods |

|

|

18.9 |

% |

|

|

16.3 |

% |

|

|

19.5 |

% |

|

|

16.9 |

% |

| International and Foodservice |

|

|

13.2 |

% |

|

|

13.2 |

% |

|

|

13.0 |

% |

|

|

13.6 |

% |

The J. M. Smucker Company

Unaudited Reportable Segments Supplemental Information

(Realigned to Reflect the New Reportable Segments)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

January 31, |

|

|

Nine months ended

January 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Dollars in millions) |

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

571.8 |

|

|

$ |

578.9 |

|

|

$ |

1,607.5 |

|

|

$ |

1,688.2 |

|

| U.S. Retail Consumer Foods |

|

|

600.8 |

|

|

|

610.8 |

|

|

|

1,847.6 |

|

|

|

1,859.8 |

|

| International and Foodservice |

|

|

267.4 |

|

|

|

275.8 |

|

|

|

790.5 |

|

|

|

828.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net sales |

|

$ |

1,440.0 |

|

|

$ |

1,465.5 |

|

|

$ |

4,245.6 |

|

|

$ |

4,376.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

150.5 |

|

|

$ |

181.1 |

|

|

$ |

439.3 |

|

|

$ |

504.3 |

|

| U.S. Retail Consumer Foods |

|

|

120.7 |

|

|

|

110.5 |

|

|

|

364.4 |

|

|

|

321.8 |

|

| International and Foodservice |

|

|

41.7 |

|

|

|

37.1 |

|

|

|

109.8 |

|

|

|

112.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total segment profit |

|

$ |

312.9 |

|

|

$ |

328.7 |

|

|

$ |

913.5 |

|

|

$ |

938.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense – net |

|

|

(16.8 |

) |

|

|

(18.4 |

) |

|

|

(50.4 |

) |

|

|

(62.7 |

) |

| Unallocated derivative gains (losses) |

|

|

13.4 |

|

|

|

4.0 |

|

|

|

(0.4 |

) |

|

|

7.1 |

|

| Cost of products sold – special project costs |

|

|

(0.4 |

) |

|

|

(2.9 |

) |

|

|

(1.1 |

) |

|

|

(6.7 |

) |

| Other special project costs |

|

|

(5.9 |

) |

|

|

(7.1 |

) |

|

|

(17.3 |

) |

|

|

(19.8 |

) |

| Corporate administrative expenses |

|

|

(64.9 |

) |

|

|

(59.2 |

) |

|

|

(193.2 |

) |

|

|

(191.6 |

) |

| Other income – net |

|

|

0.1 |

|

|

|

1.4 |

|

|

|

1.7 |

|

|

|

1.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

$ |

238.4 |

|

|

$ |

246.5 |

|

|

$ |

652.8 |

|

|

$ |

666.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

|

26.3 |

% |

|

|

31.3 |

% |

|

|

27.3 |

% |

|

|

29.9 |

% |

| U.S. Retail Consumer Foods |

|

|

20.1 |

% |

|

|

18.1 |

% |

|

|

19.7 |

% |

|

|

17.3 |

% |

| International and Foodservice |

|

|

15.6 |

% |

|

|

13.5 |

% |

|

|

13.9 |

% |

|

|

13.6 |

% |

The J. M. Smucker Company

Unaudited Reportable Segments Supplemental Information

(Realigned to Reflect the New Reportable Segments)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

April 30, |

|

|

Year ended

April 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Dollars in millions) |

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

468.6 |

|

|

$ |

473.5 |

|

|

$ |

2,076.1 |

|

|

$ |

2,161.7 |

|

| U.S. Retail Consumer Foods |

|

|

483.2 |

|

|

|

520.1 |

|

|

|

2,330.8 |

|

|

|

2,379.9 |

|

| U.S. Retail Pet Foods |

|

|

239.1 |

|

|

|

— |

|

|

|

239.1 |

|

|

|

— |

|

| International and Foodservice |

|

|

256.2 |

|

|

|

240.7 |

|

|

|

1,046.7 |

|

|

|

1,069.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net sales |

|

$ |

1,447.1 |

|

|

$ |

1,234.3 |

|

|

$ |

5,692.7 |

|

|

$ |

5,610.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

$ |

109.9 |

|

|

$ |

135.5 |

|

|

$ |

549.2 |

|

|

$ |

639.8 |

|

| U.S. Retail Consumer Foods |

|

|

94.8 |

|

|

|

98.3 |

|

|

|

459.2 |

|

|

|

420.1 |

|

| U.S. Retail Pet Foods |

|

|

(15.3 |

) |

|

|

— |

|

|

|

(15.3 |

) |

|

|

— |

|

| International and Foodservice |

|

|

30.6 |

|

|

|

28.2 |

|

|

|

140.4 |

|

|

|

140.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total segment profit |

|

$ |

220.0 |

|

|

$ |

262.0 |

|

|

$ |

1,133.5 |

|

|

$ |

1,200.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense – net |

|

|

(29.5 |

) |

|

|

(16.7 |

) |

|

|

(79.9 |

) |

|

|

(79.4 |

) |

| Other debt costs |

|

|

(173.3 |

) |

|

|

— |

|

|

|

(173.3 |

) |

|

|

— |

|

| Unallocated derivative (losses) gains |

|

|

(24.1 |

) |

|

|

(1.8 |

) |

|

|

(24.5 |

) |

|

|

5.3 |

|

| Cost of products sold – special project costs |

|

|

(5.1 |

) |

|

|

(2.7 |

) |

|

|

(6.2 |

) |

|

|

(9.4 |

) |

| Other special project costs |

|

|

(39.3 |

) |

|

|

(5.8 |

) |

|

|

(56.6 |

) |

|

|

(25.6 |

) |

| Corporate administrative expenses |

|

|

(81.0 |

) |

|

|

(60.3 |

) |

|

|

(274.2 |

) |

|

|

(251.9 |

) |

| Other income – net |

|

|

2.5 |

|

|

|

9.0 |

|

|

|

4.2 |

|

|

|

10.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

$ |

(129.8 |

) |

|

$ |

183.7 |

|

|

$ |

523.0 |

|

|

$ |

849.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Retail Coffee |

|

|

23.4 |

% |

|

|

28.6 |

% |

|

|

26.5 |

% |

|

|

29.6 |

% |

| U.S. Retail Consumer Foods |

|

|

19.6 |

% |

|

|

18.9 |

% |

|

|

19.7 |

% |

|

|

17.7 |

% |

| U.S. Retail Pet Foods |

|

|

(6.4 |

%) |

|

|

— |

|

|

|

(6.4 |

%) |

|

|

— |

|

| International and Foodservice |

|

|

11.9 |

% |

|

|

11.7 |

% |

|

|

13.4 |

% |

|

|

13.2 |

% |

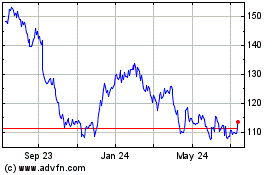

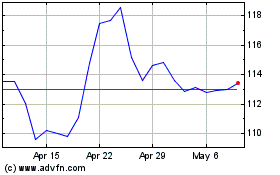

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Apr 2023 to Apr 2024