UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 30, 2015

The J. M. Smucker Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Ohio |

|

001-05111 |

|

34-0538550 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

| One Strawberry Lane, Orrville, Ohio |

|

44667-0280 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (330) 682-3000

Not Applicable

Former

Name or Former Address, if Changed Since Last Report

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

As previously disclosed, on March 23, 2015, The J. M. Smucker

Company (the “Company”) completed its acquisition of Big Heart Pet Brands (the “Big Heart Acquisition”) pursuant to an Agreement and Plan of Merger (the “Merger Agreement”), dated February 3, 2015, by and among

Blue Acquisition Group, Inc., a Delaware corporation (“BAG”) and the parent company of Big Heart Pet Brands, SPF Holdings I, Inc., a Delaware corporation and a wholly-owned subsidiary of the Company, SPF Holdings II, LLC, a Delaware

limited liability company and a wholly-owned subsidiary of the Company, and for the limited purposes set forth in the Merger Agreement, Blue Holdings I, L.P., the controlling stockholder of BAG. The Company is disclosing certain updated pro forma

financial information with respect to the transaction in this Current Report on Form 8-K.

2

Cautionary Statement Regarding Forward-Looking Statements

Certain statements included in this Current Report on Form 8-K contain forward-looking statements within the meaning of federal securities

laws. The forward-looking statements may include statements concerning our current expectations, estimates, assumptions, and beliefs concerning future events, conditions, plans, and strategies that are not historical fact. Any statement that is not

historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expect,” “anticipate,” “believe,” “intend,” “will,” “plan,” and similar

phrases.

Federal securities laws provide a safe harbor for forward-looking statements to encourage companies to provide prospective

information. We are providing this cautionary statement in connection with the safe harbor provisions. Readers are cautioned not to place undue reliance on any forward-looking statements, as such statements are by nature subject to risks,

uncertainties, and other factors, many of which are outside of our control and could cause actual results to differ materially from such statements and from our historical results and experience. These risks and uncertainties include, but are not

limited to, those set forth under the caption “Risk Factors” in our Annual Report on Form 10-K, as well as the following:

| |

• |

|

our ability to successfully integrate acquired and merged businesses in a timely and cost-effective manner and retain key suppliers, customers, and employees; |

| |

• |

|

our ability to achieve synergies and cost savings related to the Big Heart Acquisition in the amounts and within the time frames currently anticipated; |

| |

• |

|

our ability to generate sufficient cash flow to meet our deleveraging objectives within the time frames currently anticipated; |

| |

• |

|

a change in outlook or downgrade in our public credit ratings by a rating agency below investment grade; |

| |

• |

|

our ability to obtain any required financing on a timely basis and on acceptable terms; |

| |

• |

|

volatility of commodity markets from which raw materials, particularly green coffee beans, peanuts, soybean oil, wheat, milk, corn, sugar, poultry meal, and soybean meal, are procured and the related impact on costs;

|

| |

• |

|

risks associated with derivative and purchasing strategies we employ to manage commodity pricing risks, including the risk that such strategies could result in significant losses and adversely impact our liquidity;

|

| |

• |

|

crude oil price trends and their impact on transportation, energy, and packaging costs; |

| |

• |

|

the availability of reliable transportation, which may be affected by the cost of fuel, regulations affecting the industry, labor shortages, service failures by third-party service providers, accidents, or natural

disasters, on acceptable terms; |

| |

• |

|

our ability to successfully implement and realize the full benefit of price changes that are intended to ultimately fully recover cost, including the competitive, retailer, and consumer response, and the impact of the

timing of the price changes to profits and cash flow in a particular period; |

| |

• |

|

the success and cost of introducing new products and the competitive response; |

| |

• |

|

the success and cost of marketing and sales programs and strategies intended to promote growth in our businesses; |

| |

• |

|

general competitive activity in the market, including competitors’ pricing practices and promotional spending levels; |

| |

• |

|

the impact of food security concerns involving either our products or our competitors’ products; |

| |

• |

|

the impact of accidents, extreme weather, and natural disasters, including crop failures and storm damage; |

| |

• |

|

the concentration of certain of our businesses with key customers and suppliers, including single-source suppliers of certain key raw materials, such as packaging for our Folgers coffee products, and finished

goods, such as K-Cup® pods, and the ability to manage and maintain key relationships; |

| |

• |

|

the loss of significant customers, a substantial reduction in orders from these customers, or the bankruptcy of any such customer; |

| |

• |

|

the timing and amount of capital expenditures and share repurchases; |

| |

• |

|

impairments in the carrying value of goodwill, other intangible assets, or other long-lived assets or changes in useful lives of other intangible assets; |

| |

• |

|

the impact of new or changes to existing governmental laws and regulations and their application; |

3

| |

• |

|

the impact of future legal, regulatory, or market measures regarding climate change; |

| |

• |

|

the outcome of current and future tax examinations, changes in tax laws, and other tax matters, and their related impact on our tax positions; |

| |

• |

|

foreign currency and interest rate fluctuations; |

| |

• |

|

political or economic disruption; |

| |

• |

|

other factors affecting share prices and capital markets generally; |

| |

• |

|

actual results may differ materially from those presented in the Unaudited Pro Forma Condensed Combined Statement of Income; and |

| |

• |

|

risks related to other factors described under “Risk Factors” in other reports and statements we have filed with the Securities and Exchange Commission. |

Readers are cautioned not to unduly rely on such forward-looking statements, which speak only as of the date made, when evaluating the

information presented in this Current Report on Form 8-K. The Company does not undertake any obligation to update or revise these forward-looking statements to reflect new events or circumstances.

| Item 9.01. |

Financial Statements and Exhibits. |

(a) Financial Statements of Businesses

Acquired.

Not applicable.

(b) Pro Forma Financial Information.

The Unaudited Pro Forma Condensed Combined Statement of Income for the Fiscal Year Ended April 30, 2015 is filed as Exhibit 99.1 hereto

and incorporated herein by reference.

(c) Shell Company Transactions.

Not applicable.

(d)

Exhibits. The following exhibits are provided as part of this Form 8-K:

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Unaudited Pro Forma Condensed Combined Statement of Income for the Fiscal Year Ended April 30, 2015. |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE J. M. SMUCKER COMPANY |

|

|

|

|

| Date: June 30, 2015 |

|

|

|

By: |

|

/s/ Jeannette L. Knudsen |

|

|

|

|

Name: |

|

Jeannette L. Knudsen |

|

|

|

|

Title: |

|

Vice President, General Counsel and Corporate Secretary |

5

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Unaudited Pro Forma Condensed Combined Statement of Income for the Fiscal Year Ended April 30, 2015. |

6

Exhibit 99.1

As used below, except where otherwise specified or unless the context otherwise requires, the terms “Smucker,” the “Company,”

“we,” “us,” and “our” refer to The J. M. Smucker Company, an Ohio corporation, and its consolidated subsidiaries, and the term “Big Heart Pet” or “BHPB” refers to Big Heart Pet Brands, a

Delaware corporation, and its consolidated subsidiaries. As used herein, the term “Merger Agreement” refers to the Agreement and Plan of Merger, dated as of February 3, 2015, by and among the Company, Blue Acquisition Group, Inc., a

Delaware corporation (“BAG”) and the parent of Big Heart Pet, SPF Holdings I, Inc., a Delaware corporation and a wholly-owned subsidiary of the Company, SPF Holdings II, LLC, a Delaware limited liability company and a wholly-owned

subsidiary of the Company, and for the limited purposes set forth in the Merger Agreement, Blue Holdings I, L.P., the controlling stockholder of BAG prior to the Mergers (as defined below), pursuant to which the Company acquired BAG on the terms and

subject to the conditions set forth in the Merger Agreement.

The term “Mergers” refers to the acquisition by Smucker of BAG pursuant to the

Merger Agreement, and references to the “combined company” as used herein refer to Smucker and its consolidated subsidiaries after giving pro forma effect to the Mergers. You should not assume that the information set forth below is

accurate as of any date other than June 30, 2015.

Unaudited Pro Forma Condensed Combined Statement of Income of Smucker

Pursuant to the closing of the Mergers on March 23, 2015, the Company acquired BAG, the holding company of Big Heart Pet. The following Unaudited Pro

Forma Condensed Combined Statement of Income has been prepared by Smucker based on the separate historical consolidated financial statements of Smucker and BAG, and gives effect to the Mergers and the consummation of Smucker’s financing

transactions related to the Mergers, including pro forma assumptions and adjustments, as described in the accompanying notes to the Unaudited Pro Forma Condensed Combined Statement of Income.

The unaudited pro forma condensed combined financial information has been prepared using the acquisition method of accounting based on Accounting Standards

Codification (“ASC”) 805, Business Combinations, and uses the fair value concepts defined in ASC 820, Fair Value Measurements and Disclosures. Smucker is the acquirer for accounting purposes. The unaudited pro forma condensed

combined financial information is based on a preliminary purchase price allocation which includes estimates of the fair value of assets acquired and liabilities assumed, and the related income tax impact of the acquisition accounting adjustments.

The final allocation of the purchase price will be determined after completion of a final analysis to determine the estimated fair values of the tangible assets, identifiable intangible assets, and liabilities as of the acquisition date.

Accordingly, the final purchase accounting adjustments may be materially different from the pro forma adjustments presented. This may impact the Unaudited Pro Forma Condensed Combined Statement of Income due to an increase or decrease in the amount

of amortization or depreciation of the adjusted assets, among other items.

The Unaudited Pro Forma Condensed Combined Statement of Income combines

BAG’s unaudited historical Consolidated Statement of Operations for the three hundred and twenty nine days in the period from April 28, 2014 through March 22, 2015, with Smucker’s audited historical Statement of Consolidated

Income for the fiscal year ended April 30, 2015 (which includes the operating results of BAG from the date of acquisition) to reflect the Mergers and the financing transactions as if they had occurred on May 1, 2014.

The preparation of the unaudited Pro Forma Condensed Combined Statement of Income and related adjustments require

management to make certain assumptions and estimates. The historical consolidated financial information has been adjusted to give effect to pro forma adjustments that are:

| |

• |

|

directly attributable to the Mergers; |

| |

• |

|

reclassifications made to conform BAG’s presentations to those of Smucker; |

| |

• |

|

reflective of Smucker’s financing transactions related to the Mergers; and |

The Unaudited Pro Forma Condensed Combined Statement of Income should be read in

conjunction with:

| |

• |

|

the accompanying notes to the Unaudited Pro Forma Condensed Combined Statement of Income; |

| |

• |

|

Smucker’s audited historical consolidated financial statements and accompanying notes for the year ended April 30, 2015, included in the Annual Report on Form 10-K of Smucker for the fiscal year ended

April 30, 2015; and |

| |

• |

|

BAG’s audited historical consolidated financial statements for the year ended April 27, 2014, filed by Smucker as Exhibit 99.2 on Form 8-K on March 23, 2015, and unaudited historical condensed

consolidated financial statements for the nine months ended January 25, 2015, filed by Smucker as Exhibit 99.3 on Form 8-K on March 23, 2015. |

The Unaudited Pro Forma Condensed Combined Statement of Income has been prepared for illustrative purposes only, and is not necessarily indicative of the

operating results that would have occurred if the Mergers had been consummated on the dates indicated, nor are they necessarily indicative of any future operating results. See “Risk Factors” in the Annual Report on Form 10-K of Smucker for

the fiscal year ended April 30, 2015, for additional discussion of risk factors associated with the pro forma financial information.

Items Not

Reflected in the Unaudited Pro Forma Condensed Combined Statement of Income

The Unaudited Pro Forma Condensed Combined Statement of Income does not

include any discontinued operations for BAG; adjustments related to future restructuring or one-time charges; future initiatives related to potential profit improvements or potential cost savings, which may result from the Mergers; or the result of

final valuations of tangible and intangible assets and liabilities. Accordingly, no additional adjustments with respect to these costs were required to be reflected in the Unaudited Pro Forma Condensed Combined Statement of Income. Smucker is

currently integrating the operations of Smucker and BAG, which may involve material costs. Smucker expects to incur approximately $225.0 million in one-time costs related to the transaction, of which approximately $150.0 million are expected to be

cash charges. These one-time costs are anticipated to be incurred primarily over the next three years, beginning in the period immediately following the Mergers, with one-half of the costs expected to be recognized in fiscal 2016. As of

April 30, 2015, we have incurred $36.0 million with respect to these one-time costs. Smucker expects that its integration and cost savings initiatives, as well as other potential synergies, will result in anticipated profit improvements of

approximately $200.0 million, which are expected to be fully realized by fiscal 2018. The synergies are expected to come from the efficiencies of combining Smucker and BAG and leveraging the current administrative, information services, and selling

and marketing functions, along with Smucker’s supply chain and distribution network. Integration teams have been formed to further develop and execute detailed implementation programs, the related costs of which have not been determined.

2

Unaudited Pro Forma Condensed Combined Statement of Income

For the Fiscal Year Ended April 30, 2015 for Smucker

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Historical |

|

|

Pro Forma |

|

| |

|

Smucker |

|

|

BAG |

|

|

|

|

|

|

|

|

|

|

| |

|

fiscal year |

|

|

329 days |

|

|

|

|

|

|

|

|

|

|

| |

|

ended |

|

|

ended |

|

|

|

|

|

|

|

|

|

|

| (in millions, except per share data) |

|

April 30, 2015 |

|

|

March 22, 2015 |

|

|

Adjustments |

|

|

|

|

|

Combined |

|

| Net sales |

|

$ |

5,692.7 |

|

|

$ |

2,039.8 |

|

|

$ |

— |

|

|

|

|

|

|

$ |

7,732.5 |

|

| Cost of products sold |

|

|

3,724.0 |

|

|

|

1,255.5 |

|

|

|

25.3 |

|

|

|

(A |

) |

|

|

5,004.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

|

|

1,968.7 |

|

|

|

784.3 |

|

|

|

(25.3 |

) |

|

|

|

|

|

|

2,727.7 |

|

| Selling, distribution, and administrative expenses |

|

|

1,031.3 |

|

|

|

577.0 |

|

|

|

(101.1 |

) |

|

|

(B |

) |

|

|

1,507.2 |

|

| Amortization |

|

|

110.9 |

|

|

|

43.3 |

|

|

|

56.3 |

|

|

|

(C |

) |

|

|

210.5 |

|

| Other special project costs |

|

|

56.6 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

56.6 |

|

| Other operating income – net |

|

|

(2.1 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

(2.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income |

|

|

772.0 |

|

|

|

164.0 |

|

|

|

19.5 |

|

|

|

|

|

|

|

955.5 |

|

| Interest expense – net |

|

|

(79.9 |

) |

|

|

(127.0 |

) |

|

|

46.5 |

|

|

|

(D |

) |

|

|

(160.4 |

) |

| Other debt costs |

|

|

(173.3 |

) |

|

|

— |

|

|

|

173.3 |

|

|

|

(E |

) |

|

|

— |

|

| Other income (expense) – net |

|

|

4.2 |

|

|

|

(19.4 |

) |

|

|

— |

|

|

|

|

|

|

|

(15.2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from Continuing Operations Before Income Taxes |

|

|

523.0 |

|

|

|

17.6 |

|

|

|

239.3 |

|

|

|

|

|

|

|

779.9 |

|

| Income taxes |

|

|

178.1 |

|

|

|

14.1 |

|

|

|

90.9 |

|

|

|

(F |

) |

|

|

283.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income from Continuing Operations |

|

$ |

344.9 |

|

|

$ |

3.5 |

|

|

$ |

148.4 |

|

|

|

|

|

|

$ |

496.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income from Continuing Operations per common share |

|

$ |

3.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

4.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income from Continuing Operations per common share – assuming dilution |

|

$ |

3.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

4.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding |

|

|

103.0 |

|

|

|

|

|

|

|

|

|

|

|

(G |

) |

|

|

119.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding – assuming dilution |

|

|

103.0 |

|

|

|

|

|

|

|

|

|

|

|

(G |

) |

|

|

119.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

THE J. M. SMUCKER COMPANY

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED

STATEMENT OF INCOME

(dollars in millions, except per share data)

Note 1—Basis of Pro Forma Presentation

The

unaudited pro forma condensed combined financial information related to the Mergers and the related financing transactions is included for the fiscal year ended April 30, 2015. Upon completion of the Mergers on March 23, 2015, BAG became a

wholly-owned subsidiary of Smucker.

Certain amounts in the historical financial statements of BAG have been reclassified to conform with Smucker’s

historical financial presentation. The Unaudited Pro Forma Condensed Combined Statement of Income presented in this document does not necessarily indicate the results of operations that would have resulted had the Mergers been completed at the

beginning of the applicable period presented, nor is it indicative of the results of operations in future periods of the combined company.

Note

2—Pro Forma Adjustments

The pro forma adjustments included in the Unaudited Pro Forma Condensed Combined Statement of Income are as follows:

| |

(A) |

Depreciation expense related to property, plant, and equipment will increase as a result of the adjustment to record BAG’s personal and real property at estimated fair values and useful lives. For purposes of

determining the impact on the Unaudited Pro Forma Condensed Combined Statement of Income, the fair value of personal and real property acquired is being depreciated using a straight-line method over an estimated weighted-average useful life of

approximately 7 years and 17 years, respectively. The total impact of the depreciation adjustment is an increase in pro forma depreciation expense of $21.4, of which $14.2 was recorded in cost of sales and $7.2 was recorded in selling, distribution,

and administrative expenses. |

We will also recognize repairs and maintenance expense as a result of the preliminary

adjustment to record maintenance, repair, and operational parts held by BAG at estimated fair values. For purposes of determining the impact on the Unaudited Pro Forma Condensed Combined Statement of Income, the fair value adjustment is being

amortized using a straight-line method over approximately one year. The adjustment for pro forma presentation is $11.1 in incremental repairs and maintenance expense.

| |

(B) |

Selling, distribution, and administrative expenses have been adjusted to eliminate nonrecurring acquisition costs incurred by BAG prior to acquisition, including $91.2 in transaction-related costs and $17.1 in

incremental compensation costs due to change in control provisions on outstanding stock options. In addition to this, selling, distribution, and administrative expenses have been adjusted to include $7.2 of incremental depreciation on personal and

real property as discussed in item (A) above. |

| |

(C) |

Amortization expense will increase as a result of the preliminary adjustment to record identifiable finite-lived intangible assets of BAG at their preliminary estimated fair values. For purposes of determining the

impact on the Unaudited Pro Forma Condensed Combined Statement of Income, the finite-lived intangible assets are being amortized using a straight-line method over an estimated weighted-average useful life of approximately 24 years.

|

4

| |

(D) |

Interest expense, including the amortization of capitalized debt issuance costs, original issue discounts, and other related fees, as well as the impact of interest rate swaps, will increase as a result of the financing

transactions described in our Annual Report on Form 10-K for the fiscal year ended April 30, 2015, and Form 8-K filed on March 23, 2015. For purposes of determining the impact on the Unaudited Pro Forma Condensed Combined Statement of

Income, historical interest expense related to extinguished debt was eliminated, and a full year of interest expense was estimated based on the financing transactions related to the Mergers. Interest expense on our bond debt is fixed and has been

calculated using the respective coupon rates on the bonds, ranging from 1.75% to 4.38%. Our term loan bears interest on the prevailing U.S. Prime Rate or London Interbank Offered Rate, based on our election. Interest expense on our term loan was

calculated using a rate of 1.52%, which represents the weighted-average interest rate effective on the date of the Mergers. |

|

|

|

|

|

| |

|

Year Ended

April 30, 2015 |

|

| Elimination of BAG’s historical interest expense |

|

$ |

127.0 |

|

| Elimination of Smucker’s historical interest expense associated with refinanced debt |

|

|

54.1 |

|

| Interest expense related to new borrowings |

|

|

(134.6 |

) |

|

|

|

|

|

| Net change in interest expense |

|

$ |

46.5 |

|

|

|

|

|

|

A variation in interest rate of 12.5 basis points would impact the interest expense presented in the Unaudited

Pro Forma Condensed Combined Statement of Income by approximately $2.0.

| |

(E) |

As a result of our financing of the Mergers, we incurred $173.3 in other debt costs consisting primarily of $163.3 in make-whole payments incurred as a result of the prepayment of our private placement notes and $21.5

in bridge loan financing fees, offset by the write-off of the remaining fair value interest rate swap gain. No balances were drawn on the temporary bridge loan and the facility was terminated. These charges related to the Mergers are not anticipated

to recur in the future, and therefore have been adjusted accordingly. |

| |

(F) |

Estimated income tax expense related to the pro forma adjustments is calculated based on a tax rate of 38%. This represents Smucker’s best estimate of the blended income tax rate related to BAG operations for all

jurisdictions. |

| |

(G) |

Pro forma per share data is based on the weighted-average common shares outstanding of Smucker for the period presented and includes the issuance of approximately 17.9 million Smucker common shares at the closing

of the Mergers. Smucker’s historical earnings per share is computed based on the allocation of Smucker’s net income to common shareholders divided by the weighted-average common shares outstanding in accordance with the two-class method.

For purposes of these pro forma financial statements, the allocation of net income is not presented. |

5

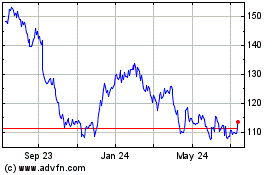

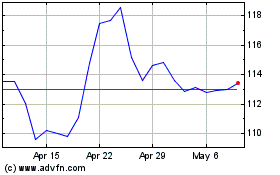

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Apr 2023 to Apr 2024