UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 23, 2015

The J. M. Smucker Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Ohio |

|

001-05111 |

|

34-0538550 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| One Strawberry Lane, Orrville, Ohio |

|

44667-0280 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (330) 682-3000

Not Applicable

Former

Name or Former Address, if Changed Since Last Report

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

On February 23, 2015, The J. M. Smucker Company (the “Company”) entered into Amendment No. 1 (the “Amendment”) to

the Third Amended and Restated Credit Agreement dated as of September 6, 2013, among the Company and Smucker Foods of Canada Corp., as borrowers, the lenders and guarantors party thereto, and Bank of Montreal, as administrative agent (the

“Credit Agreement”).

Among other matters, the Amendment increases the maximum total leverage ratio permitted under the total

leverage ratio covenant upon the closing of the Company’s previously announced pending acquisition (the “Pending Acquisition”) of Blue Acquisition Group, Inc., the parent of Big Heart Pet Brands, to (i) 4.75 to 1.00 for all

periods ending on or prior to April 29, 2016, (ii) 4.25 to 1.00 for all periods ending between April 30, 2016 and April 29, 2017, (iii) 3.75 to 1.00 for all periods ending between April 30, 2017 and April 29, 2018,

and (iv) 3.50 to 1.00 for all periods ending on or after April 30, 2018. The Amendment also modifies various other covenants to permit the Pending Acquisition.

Several of the lenders under the Credit Agreement and their affiliates have various relationships with the Company and its subsidiaries

involving the provision of financial services, including investment banking, commercial banking, advisory, cash management, custody and trust services, for which they receive customary fees and may do so in the future.

The Credit Agreement was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on September 10, 2013. A copy of

the Amendment to the Credit Agreement is included herein as Exhibit 10.1 and is incorporated herein by reference. The foregoing description of the Amendment is qualified in its entirety by reference to the full text of the Amendment.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure contained in Item 1.01 above is incorporated in this Item 2.03 by reference.

Item 9.01 Financial Statements and Exhibits.

| |

(a) |

Financial Statements of Businesses Acquired. |

Not applicable

| |

(b) |

Pro Forma Financial Information. |

Not applicable.

| |

(c) |

Shell Company Transactions. |

Not applicable.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Amendment No. 1 dated as of February 23, 2015, to the Third Amended and Restated Credit Agreement dated as of September 6, 2013, among the Company and Smucker Foods of Canada Corp., as borrowers, the lenders and guarantors party

thereto, and Bank of Montreal, as administrative agent. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE J. M. SMUCKER COMPANY |

|

|

|

|

| Date: February 24, 2015 |

|

|

|

By: |

|

/s/ Mark R. Belgya |

|

|

|

|

Name: |

|

Mark R. Belgya |

|

|

|

|

Title: |

|

Senior Vice President and Chief Financial Officer |

3

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Amendment No. 1 dated as of February 23, 2015, to the Third Amended and Restated Credit Agreement dated as of September 6, 2013, among the Company and Smucker Foods of Canada Corp., as borrowers, the lenders and guarantors party

thereto, and Bank of Montreal, as administrative agent. |

4

Exhibit 10.1

EXECUTION VERSION

AMENDMENT NO. 1 TO CREDIT AGREEMENT

This AMENDMENT NO. 1 TO CREDIT AGREEMENT (this “Amendment”), dated as of February 23, 2015, is by and among The J. M.

Smucker Company, an Ohio corporation (the “U.S. Borrower”), Smucker Foods of Canada Corp., a federally incorporated Canadian corporation (together with the U.S. Borrower, the “Borrowers”), Bank of Montreal, a

Canadian chartered bank acting through its Chicago branch, as Administrative Agent (in such capacity, the “Administrative Agent”) and as a Lender, and the other Lenders and Guarantors party hereto.

RECITALS

A. The Borrowers, the

Administrative Agent, the Lenders and the Guarantors entered into that certain Third Amended and Restated Credit Agreement, dated as of September 6, 2013 (as amended, supplemented, restated or otherwise modified from time to time, the

“Credit Agreement”), pursuant to which, among other things, the Lenders committed to make certain Loans to the Borrowers.

B. The Borrowers, the Guarantors, the Administrative Agent, the L/C Issuer, the Swingline Lender and Lenders constituting the Required Lenders

have agreed to amend certain provisions of the Credit Agreement upon the terms and conditions set forth below.

NOW THEREFORE, in

consideration of the matters set forth in the recitals and the covenants and other provisions herein set forth, and other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

AGREEMENT

Section 1.

Definitions. Capitalized terms used herein and not otherwise defined herein shall have the meanings ascribed thereto in the Credit Agreement.

Section 2. Amendments to Credit Agreement. Effective as of the Amendment No. 1 Effective Date (as defined below):

| |

a. |

Section 1.3(b) of the Credit Agreement is hereby amended by deleting the word “Borrowers” where it first appears in the second sentence of such Section and inserting in replacement thereof the words

“relevant Borrower”. |

| |

b. |

Section 1.3(c) of the Credit Agreement is hereby amended by: (i) deleting the words “the Borrowers” where they first appear and inserting in replacement thereof “each Borrower” and

(ii) inserting the words “originally requested by such Borrower” immediately after the words “for all drawings under a Letter of Credit”. |

| |

c. |

Section 1.3(d) of the Credit Agreement is hereby amended by inserting the word “its” immediately after the words “Each Borrower’s obligation to reimburse” at the beginning of

Section 1.3(d). |

| |

d. |

Section 1.14 of the Credit Agreement is hereby amended by deleting the words “Borrower receives a claim from any Lender for” where they first appear and inserting in replacement thereof the words

“Lender becomes entitled to”. |

| |

e. |

Section 2.1 of the Credit Agreement is hereby amended by deleting the words “Borrowers shall” where they first appear and inserting in replacement thereof the words “U.S. Borrower shall pay or cause

the relevant Loan Party to”. |

| |

f. |

Section 3.1 of the Credit Agreement is hereby amended by: (i) inserting the words “of a Borrower” immediately after the words “collections received in respect of the Obligations” where they

appear in the second paragraph of Section 3.1, (ii) inserting the words “owed by such Borrower” immediately after the words “second, to the payment of the Swing Loans” where they appear clause (b) of

Section 3.1, (iii) inserting the words “from each Borrower” immediately after the words “third, to the payment of any outstanding interest and fees due” where they appear in clause (c) of Section 3.1,

(iv) inserting the words “, in each case of such Borrower,” immediately after the words “the Lenders and L/C Issuer” where they appear in clause (d) of Section 3.1 and (v) inserting the words “of such

Borrower” immediately after the words “fifth, to the payment of all other unpaid Obligations” where they appear in clause (e) of Section 3.1. |

| |

g. |

Section 4.1 of the Credit Agreement is hereby amended by inserting the words “(excluding, in each case, any FSHCO, unless such FSHCO shall act as a guarantor for any Material Indebtedness of the U.S.

Borrower)” immediately after the words “future Domestic Subsidiary or group of Domestic Subsidiaries”. |

| |

h. |

Section 5.1 of the Credit Agreement is hereby amended by adding the following definitions in appropriate alphabetical order: |

“Amendment No. 1” means Amendment No. 1 to this Agreement dated as of February 23, 2015.

“Amendment No. 1 Effective Date” means February 23, 2015, 2015, the date of effectiveness of

Amendment No. 1.

“Blue Acquisition” means the acquisition of Blue Acquisition Group, Inc. by the

U.S. Borrower and certain merger subsidiaries pursuant to the Blue Acquisition Agreement.

“Blue Acquisition

Agreement” means the Agreement and Plan of Merger, dated as of February 3, 2015, governing the acquisition of Blue Acquisition Group, Inc. by the U.S. Borrower and certain merger subsidiaries.

“Blue Acquisition Closing Date” means the date of the consummation of the Blue Acquisition.

“Blue Acquisition Shareholders’ Agreement” means any agreement entered into by the U.S. Borrower and one

or more shareholders in connection with the Blue Acquisition.

“Blue Transactions” means (i) the

consummation of the Blue Acquisition, (ii) the U.S. Borrower’s incurrence, replacement, redemption, repayment, defeasance, discharge, constructive discharge or refinancing of Debt (including Debt of the U.S. Borrower and Blue Acquisition

Group, Inc. and their respective subsidiaries) in connection therewith and (iii) the payment of fees and expenses incurred in connection with the foregoing.

2

“Bridge Commitment Letter” means that certain Commitment Letter

to provide a 364-day senior unsecured bridge term loan credit facility, dated February 3, 2015, among The J. M. Smucker Company, Bank of America, N.A. and Merrill Lynch, Pierce, Fenner & Smith Incorporated (including all Exhibits

thereto and any related fee letter).

“Bridge Facility” means that certain 364-day senior unsecured bridge

term loan credit facility described in the Bridge Commitment Letter.

“FSHCO” means any Domestic

Subsidiary that owns no material assets other than the equity interests of one or more Foreign Subsidiaries that are “controlled foreign corporations” within the meaning of Section 957(a) of the Code and/or of one or more FSHCOs.

“Permanent Financing” means an issuance of senior unsecured notes through a public offering or in a private

placement and/or entry into one or more unsecured term loan credit facilities (including the Term Facility), in each case the proceeds of which are used to consummate the Blue Transactions or to refinance or replace the Bridge Facility or any other

interim financing for the Blue Transactions.

“Private Placement Notes” means any and all notes issued by

the U.S. Borrower under (i) that certain Note Purchase Agreement dated May 31, 2007 (as amended), relating to the $400,000,000 5.55% senior notes due April 1, 2022, (ii) that certain Note Purchase Agreement dated October 23,

2008 (as amended), relating to $376,000,000 6.63% senior notes due November 1, 2018 and $24,000,000 6.12% senior notes due November 1, 2015, and (iii) Note Purchase Agreement dated June 15, 2010 (as amended), relating to

$400,000,000 4.50% senior notes due June 1, 2025.

“Private Placement Repayment” means either

(i) the payment in full and cancellation of the Private Placement Notes or (ii) the delivery of a notice of redemption with respect to the Private Placement Notes in connection with the Blue Transactions and the deposit by the U.S.

Borrower or any of its Subsidiaries of cash with or for the benefit of the trustees or holders of such Private Placement Notes in order to fund the repayment in full and cancellation or redemption of such Private Placement Notes.

“Subsidiary Guarantor” means a Guarantor that is a Subsidiary of the U.S. Borrower.

“Term Facility” means one or more unsecured term credit facilities entered into as part of the Permanent

Financing.

| |

i. |

The definition of “EBITDA” in Section 5.1 of the Credit Agreement is hereby amended and restated as follows: |

“EBITDA” means, with reference to any period, Net Income for such period plus all amounts deducted in

arriving at such Net Income amount in respect of (a) Interest Expense for such period, (b) federal, state, and local income taxes for such period, (c) depreciation and amortization expense for such period, (d) non-cash share

based compensation expense and other non-cash expenses, losses and charges (other than those representing a reserve for or actual cash item in any future period) for such period, (e)(i) all non-recurring fees and expenses in connection with the Blue

Transactions (including the prepayment, repayment or retirement of Debt in connection therewith), limited to

3

| |

$250,000,000 in the aggregate and (ii) any other non-recurring charges and expenses in connection with any other Permitted Acquisitions (whether or not successful) and extraordinary losses

and charges for such period limited, in case of this clause (e)(ii), to $125,000,000 in any period of twelve (12) consecutive months, (f) merger and integration costs in connection with the Blue Transactions, limited, in the case of cash

merger and integration costs, to $200,000,000 in the aggregate, and (g) cash restructuring charges limited to $25,000,000 in the aggregate, minus (h) all non-cash gains for such period; provided, that the EBITDA for any

Acquired Business acquired by any Borrower or any Subsidiary pursuant to a Permitted Acquisition (including restructuring charges, operating synergies or other expense reductions and adjustments permitted by Article XI of Regulation S-X promulgated by the Securities and Exchange Commission) during such period shall be included on a pro forma basis for such period (assuming the consummation of such acquisition and the incurrence or

assumption of any Indebtedness for Borrowed Money of any Borrower or any Subsidiary in connection therewith incurred as of the first day of such period), and provided further that the EBITDA for any entity sold by any Borrower or any Subsidiary

shall be deducted on a pro forma basis for such period (assuming the consummation of such sale or other disposition occurred on the first day of such period). |

| |

j. |

The definition of “Indebtedness for Borrowed Money” in Section 5.1 of the Credit Agreement is hereby amended and restated as follows: |

“Indebtedness for Borrowed Money” means for any Person (without duplication) (a) all obligations of such

Person for money borrowed (including by the issuance of debt securities), (b) all obligations of such Person for the deferred purchase price of property or services (other than trade accounts payable arising in the ordinary course of business),

(c) all obligations of others secured by any Lien upon Property of such Person, whether or not such Person has assumed such indebtedness, (d) all Capitalized Lease Obligations of such Person, and (e) all obligations of such Person

constituting reimbursement obligations of such Person with respect to drawn letters of credit and bankers’ acceptances issued for the account of such Person.

| |

k. |

The definition of “Loan Documents” in Section 5.1 of the Credit Agreement is hereby amended by adding the words “(and any amendments hereto)” after the words “this Agreement”.

|

| |

l. |

The definition of “Total Leverage Ratio” in Section 5.1 of the Credit Agreement is hereby amended by adding the following after the end of the current definition: |

At all times prior to the earlier of (x) the Blue Acquisition Closing Date and (y) the date the Blue Acquisition

Agreement is terminated or expires, for the purposes of the calculation of the Total Leverage Ratio, the amount of any Permanent Financing consummated in connection with, and prior to consummation of, the Blue Acquisition shall not be included in

the calculation of Total Funded Debt of the U.S. Borrower and its Subsidiaries, except to the extent the proceeds thereof are applied to prepay principal under any existing Debt of the U.S. Borrower or its Subsidiaries.

| |

m. |

The definition of “Permitted Acquisition” in Section 5.1 of the Credit Agreement is hereby amended by deleting the following words

“any Acquisition with respect to which |

4

| |

all of the following conditions have been satisfied” immediately after the word “means” and inserting in replacement thereof the following words “(i) the Blue Acquisition or

(ii) any other Acquisition with respect to which all of the following conditions have been satisfied”. |

| |

n. |

Section 5.2 of the Credit Agreement is hereby amended by adding the following as a new paragraph at the end thereof: |

For purposes of the definitions of Debt and Indebtedness for Borrowed Money, any Debt or Indebtedness for Borrowed Money of the

U.S. Borrower or any of its Subsidiaries in respect of which a notice of prepayment or redemption has been delivered in connection with the Blue Transactions and for which the U.S. Borrower or any of its Subsidiaries has deposited cash with or for

the benefit of the trustee or holder of such Debt or Indebtedness for Borrowed Money to fund such repayment or redemption shall be considered repaid or redeemed; provided that if any applicable deposit is returned with the consent or

acquiescence of the U.S. Borrower and the corresponding Debt or Indebtedness for Borrowed Money of the U.S. Borrower or any of its Subsidiaries is not redeemed or cancelled, but remain outstanding, this paragraph shall not apply.

| |

o. |

Section 6.4 of the Credit Agreement is hereby amended by deleting the words “to refinance commercial paper issued by them,” in the first sentence thereof. |

| |

p. |

Section 6.7 of the Credit Agreement is hereby amended and restated as follows: |

Full Disclosure. The written information furnished to the Administrative Agent and the Lenders in connection with the

negotiation of this Agreement and the other Loan Documents and the commitments by the Lenders to provide all or part of the financing contemplated hereby (as modified or supplemented by other information so furnished or publicly available in

periodic and other reports, proxy statements and other materials filed by the U.S. Borrower or any Subsidiary with the Securities and Exchange Commission), taken as a whole, do not contain any material misstatement of fact or omit to state any

material fact necessary to make the material statements therein, in the light of the circumstances under which they were made, not materially misleading; provided that, with respect to projected financial information, and other

forward-looking statements furnished to the Administrative Agent and the Lenders in connection with the negotiation of this Agreement and the other Loan Documents and the commitments by the Lenders to provide all or part of the financing

contemplated hereby, the Borrowers represent only that such information was prepared in good faith based upon assumptions believed to be reasonable at the time prepared. For the avoidance of doubt, with respect to any information relating to the

Acquired Business in the Blue Transactions delivered on or prior to the consummation of the Blue Transactions, such representation is made solely to the best of the U.S. Borrower’s knowledge.

| |

q. |

Section 7.1 of the Credit Agreement is hereby amended: (i) in clause (a) by deleting the words “for the purpose of refinancing commercial paper”; (ii) by inserting the word “and”

at the end of clause (b) and inserting a “.” in place of the “;” at the end of clause (c) and (iii) by deleting clause (d). |

| |

r. |

Section 8.5(b) of the Credit Agreement is hereby amended by: (i) deleting the word “unqualified” immediately after the words

“accompanied by an” and (ii) inserting the |

5

| |

words “(without a “going concern” qualification or exception or qualification as to the scope of the audit, other than a “going concern” statement that is due to the

impending maturity of the Bridge Facility, the Term Facility, any other Permanent Financing or the Agreement in the following 12 months)” immediately before the words “of Ernst & Young”. |

| |

s. |

Section 8.7 of the Credit Agreement is hereby amended by renumbering current clauses (g) and (h) as (i) and (j) respectively and adding the following new clauses: |

(g) guarantees by any Subsidiary that is not a Subsidiary Guarantor of any Debt of any other Subsidiary that is not a

Subsidiary Guarantor and guarantees by any Borrower or any Subsidiary Guarantor of any Debt of any Borrower or any Subsidiary Guarantor;

(h) unsecured Debt or guarantees incurred by the U.S. Borrower and any Subsidiary Guarantor under or with respect to the Bridge

Facility and any Permanent Financing, subject to an aggregate cap of $5,500,000,000;

| |

t. |

Section 8.8 of the Credit Agreement is hereby amended by: (i) deleting “and” as the last word of clause (i), and inserting “;” at the end of clause (j) and deleting the corresponding

“.” and (ii) inserting the following new clauses: |

(k) Liens on cash deposits securing Debt of

U.S. Borrower and its Subsidiaries pending application of such cash deposits to repay such Debt in connection with the Blue Transactions; and

(l) Liens on cash deposits to backstop letters of credit or to secure swap obligations of the Acquired Business for the Blue

Transaction or any of its subsidiaries, in each case that are outstanding on the Blue Acquisition Closing Date.

| |

u. |

Section 8.15 of the Credit Agreement is hereby amended by: (i) amending and restating clause (b) as follows “any transaction between a Borrower or a Subsidiary and an Affiliate that is a Borrower or

a Subsidiary”; (ii) deleting “or” immediately prior to “(d)” and replacing the “.” at the end of clause (d) with a “,” and (iii) inserting the following words immediately after clause

(d) “(e) Restricted Payments not prohibited by Section 8.11, (f) transactions pursuant to the Blue Acquisition Shareholders’ Agreement and (g) transactions undertaken in connection with the Blue Transactions.”

|

| |

v. |

Section 8.17 of the Credit Agreement is hereby amended and restated in its entirety as follows: |

Change in Nature of Business. No Borrower shall, nor shall it permit any Subsidiary to, engage in any material line of

business if as a result thereof the general nature of the business conducted by the U.S. Borrower and its Subsidiaries would be substantially changed from the general nature of the business conducted by the U.S. Borrower and its Subsidiaries on the

Amendment No. 1 Effective Date or any business reasonably related, complementary, synergistic or ancillary thereto or reasonable extensions thereof (it being agreed for the avoidance of doubt that any additional lines of business conducted by

the Borrowers and their Subsidiaries as a result of the consummation of the Blue Transactions are permitted by this Section 8.17).

6

| |

w. |

Section 8.19 of the Credit Agreement is hereby amended and restated as follows: |

Except as provided herein, no Borrower shall, nor shall it permit any Subsidiary to, directly or indirectly create or otherwise

cause or suffer to exist or become effective any consensual encumbrance or restriction of any kind on the ability of any Subsidiary to: (a) pay dividends or make any other distribution on any Subsidiary’s capital stock or other equity

interests owned by such Borrower or any other Subsidiary, (b) pay any indebtedness owed to a Borrower or any other Subsidiary, (c) make loans or advances to any Borrower or any other Subsidiary, (d) transfer any of its Property to any

Borrower or any other Subsidiary, or (e) guarantee the Obligations as required by the Loan Documents, except for such encumbrances or restrictions existing under or by reason of (i) applicable law, (ii) customary non-assignment

provisions in leases or other agreement entered into in the ordinary course of business, (iii) customary restrictions in security agreements or mortgages securing Indebtedness for Borrowed Money of any Borrower or any of their Subsidiaries, or

any Capital Lease, of any Borrower or any Subsidiary to the extent such restrictions shall only restrict the transfer of the Property subject to such agreement, mortgage or Capital Lease, (iv) restrictions in agreements governing Indebtedness

for Borrowed Money of any Borrower or any of their Subsidiaries to the extent that the incurrence of such Indebtedness for Borrowed Money is not prohibited by Section 8.7 hereof, (v) any restrictions existing with respect to any Person or

assets acquired by any Borrower or any Subsidiary and existing at the time of (and not entered into in contemplation of) such acquisition, which restrictions are not applicable to any Person or the assets of any Person other than such Person or such

assets acquired, (vi) customary provisions in joint venture agreements or similar agreements applicable to joint ventures entered into in the ordinary course of business, (vii) customary restrictions and conditions contained in any

agreement relating to the sale of any asset permitted under Section 8.10 applicable to the asset to be sold pending the consummation of such sale, (viii) restrictions on cash or other deposits or net worth imposed by customers under

contracts entered into in the ordinary course of business, (ix)(1) customary provisions restricting the subletting or assignment of any lease governing a leasehold interest or (2) customary restrictions imposed on the transfer of trademarked,

copyrighted or patented materials or provisions in agreements that restrict the assignment of such agreements or any rights thereunder, and (x) any extensions, renewals, refinancings or replacements of any of the foregoing that are no less

favorable in any material respect to the Lenders than those restrictions that are then in effect and are being extended, refinanced, renewed or replaced.

| |

x. |

Section 8.20(a) of the Credit Agreement is hereby amended and restated as follows: |

Total Leverage Ratio. As of the last day of each fiscal quarter of the Borrowers, (i) if the Blue Acquisition

Closing Date shall not have occurred, the Borrowers shall not permit the Total Leverage Ratio to be greater than 3.50 to 1.00 and (ii) otherwise, the Borrowers shall not permit the Total Leverage Ratio to be greater than, (1) for all

periods ending on or prior to April 29, 2016, 4.75 to 1.00, (2) for all periods ending between (and including) April 30, 2016 and April 29, 2017, 4.25 to 1.00, (3) for all periods ending between (and including)

April 30, 2017 and April 29, 2018, 3.75 to 1.00 and (4) for all periods ending on or after April 30, 2018, 3.50 to 1.00.

| |

y. |

Section 8.21 of the Credit Agreement is hereby deleted in its entirety and any Financial Covenants applicable to the Borrower or the Guarantors

as a result of Section 8.21 shall cease to apply; provided, however that notwithstanding the foregoing, if (a) the Private |

7

| |

Placement Repayment shall not have occurred on or prior to, and be continuing on, the earlier of (i) the Termination Date (as defined in the Blue Acquisition Agreement as in effect on the

date hereof) or the earlier termination of the Blue Acquisition Agreement and (ii) the Blue Acquisition Closing Date (such earlier date, the “Trigger Date”), or (b) with respect to any Private Placement Notes,

notwithstanding the occurrence of the Private Placement Repayment pursuant to clause (ii) of the definition thereof, any applicable deposit is returned with the consent or acquiescence of the U.S. Borrower and the corresponding Private

Placement Notes are not redeemed or cancelled, but remain outstanding following the Trigger Date, then upon the earlier to occur of (a) or (b), Section 8.21 shall be reinstated in full and deemed reinserted into the Credit Agreement as

though the Amendment No. 1 Effective Date shall have never occurred, and the Administrative Agent is hereby authorized by the Borrowers and the Lenders party hereto to reinsert such Section 8.21 to give effect to this sentence without

further consent from any Person. |

| |

z. |

Section 10.3(a) of the Credit Agreement is hereby amended by deleting the words “Borrowers shall be obligated” where they appear in the last sentence of such Section 10.3(a) and inserting in

replacement thereof the words “U.S. Borrower shall pay or cause the relevant Loan Party”. |

| |

aa. |

Section 12.3 of the Credit Agreement is hereby amended by deleting the words “Borrowers and the Guarantors under this Agreement and all other Loan Documents” where they appear in the first sentence of

Section 12.3 and inserting in replacement thereof the words “relevant Borrowers and Guarantors under this Agreement and all other Loan Documents have been paid”. |

| |

bb. |

Schedule I to Compliance Certificate is hereby amended and restated, as set forth on Exhibit A hereto. |

Section 3. Binding Effect. This Amendment shall become effective and legally binding on the date hereof when the Administrative

Agent shall have received from each of the Loan Parties and the Required Lenders a counterpart of this Agreement signed on behalf of such party. This Amendment shall bind each party’s successors and assigns, including any Person to whom any

Lender party hereto assigns any of its interests, rights and obligations under the Credit Agreement.

Section 4.

Representations. Each Loan Party hereby represents and warrants for the benefit of the Lenders and the Administrative Agent that: (a) each Loan Party has the corporate and other organizational authority to enter into this Amendment and

to perform all of its obligations hereunder; (b) this Amendment has been duly authorized, executed, and delivered by such Loan Party and constitutes valid and binding obligations of such Loan Party enforceable against it in accordance with

their terms, except as enforceability may be limited by bankruptcy, insolvency, fraudulent conveyance or similar laws affecting creditors’ rights generally and general principles of equity (regardless of whether the application of such

principles is considered in a proceeding in equity or at law); (c) this Amendment does not, nor does the performance or observance by any Loan Party of any of the matters and things herein provided for, (i) contravene or constitute a

default under any provision of law except to the extent such contravention or default would not reasonably be expected to have a Material Adverse Effect, (ii) contravene any material judgment, injunction, order or decree binding upon any Loan

Party or any provision of the organizational documents (e.g., charter, certificate or articles of incorporation and by-laws, certificate or articles of association and operating agreement, partnership

agreement, or other similar organizational documents) of any Loan Party, (iii) contravene or constitute a default under any indenture or agreement for Material Indebtedness of any Loan Party, or (iv) result in the creation or imposition of

any Lien on any Property of any Loan Party.

8

Section 5. Effectiveness of Amendment. The amendments set forth in Section 2

above shall become effective upon satisfaction of the following conditions precedent (the date of satisfaction of such conditions precedent, the “Amendment No. 1 Effective Date”):

(a) the U.S. Borrower shall have paid all fees and expenses (including, without limitation, all fees and expenses of counsel) to the

Administrative Agent and Bank of America, N.A., in each case incurred in connection with this Amendment and the transactions contemplated hereby for which an invoice has been submitted to the U.S. Borrower;

(b) each of the representations and warranties set forth herein and in the Loan Documents shall be and remain true and correct in all material

respects as of said time, except to the extent the same expressly relate to an earlier date, provided that any representation and warranty that is qualified as to “materiality”, “Material Adverse Effect” or

similar language shall be true and correct in all respects;

(c) no Default or Event of Default shall have occurred and be continuing or

would occur as a result of the execution and delivery hereof by the Borrowers; and

(d) the Administrative Agent shall have received a

certificate of an appropriate officer of the Borrowers, certifying on behalf of the Borrowers that all of the conditions set forth in clauses (b) and (c) above have been satisfied on the Amendment No. 1 Effective Date.

Section 6. Certain Consequences of Effectiveness.

(a) Except as expressly set forth herein, this Amendment shall not by implication or otherwise limit, impair, constitute a waiver of, or

otherwise affect the rights and remedies of the Lenders, the Administrative Agent, any Borrower, any Guarantor or any other party under the Credit Agreement or any other Loan Document, and shall not alter, modify, amend or in any way affect any of

the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall continue in full force and effect.

(b) Nothing herein shall be deemed to entitle any Borrower or Guarantor to a consent to, or a waiver, amendment, modification or other change

of, any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document in similar or different circumstances.

Section 7. Miscellaneous.

(a) Counterparts. This Amendment may be executed in any number of counterparts and by the different parties on separate counterparts,

and each such counterpart shall be deemed to be an original, but all such counterparts shall together constitute but one and the same Amendment. Delivery of an executed counterpart of this Amendment by facsimile or electronic mail shall be as

effective as delivery of an original executed counterpart to this Amendment.

(b) Severability. The illegality or unenforceability

of any provision of this Amendment or any instrument or agreement required hereunder shall not in any way affect or impair the legality or enforceability of the remaining provisions of this Amendment or any instrument or agreement required

hereunder.

9

(c) Entire Agreement. This Amendment, together with the Credit Agreement (as modified

hereby) and the other Loan Documents, embodies the entire agreement and understanding among the parties hereto and supersedes all prior or contemporaneous agreements and understandings of such Persons, verbal or written, relating to the subject

matter hereof.

(d) References. This Amendment is a Loan Document. Any reference to the Credit Agreement contained in any notice,

request, certificate, or other document executed concurrently with or after the execution and delivery of this Amendment shall be deemed to include this Amendment unless the context shall otherwise require. Any reference set forth in this Amendment,

the Credit Agreement or any other Loan Document to the Credit Agreement shall be a reference to the Credit Agreement as amended hereby and as further amended, modified, restated, supplemented or extended from time to time.

(e) Governing Law. This Amendment and the rights and obligations of the parties hereunder shall be governed by, and shall be construed

and enforced in accordance with, the laws of the State of New York.

[Signature Pages Follow]

10

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their

respective authorized officers as of the day and year first above written.

|

|

|

| BORROWERS: |

|

| THE J. M. SMUCKER COMPANY |

|

|

| By: |

|

/s/ Debra A. Marthey |

| Name: |

|

Debra A. Marthey |

| Title: |

|

Vice President, Treasurer |

|

| SMUCKER FOODS OF CANADA CORP. |

|

|

| By: |

|

/s/ Debra A. Marthey |

| Name: |

|

Debra A. Marthey |

| Title: |

|

Treasurer |

|

| GUARANTORS: |

|

| THE J. M. SMUCKER COMPANY |

|

|

| By: |

|

/s/ Debra A. Marthey |

| Name: |

|

Debra A. Marthey |

| Title: |

|

Vice President, Treasurer |

|

| J.M. SMUCKER LLC |

|

|

| By: |

|

/s/ Debra A. Marthey |

| Name: |

|

Debra A. Marthey |

| Title: |

|

Vice President, Treasurer |

|

| THE FOLGERS COFFEE COMPANY |

|

|

| By: |

|

/s/ Debra A. Marthey |

| Name: |

|

Debra A. Marthey |

| Title: |

|

Vice President, Treasurer |

|

|

|

| BANK OF MONTREAL, as Administrative Agent and as a Lender |

|

|

| By: |

|

/s/ Philip Langheim |

| Name: |

|

Philip Langheim |

| Title: |

|

Managing Director |

|

|

|

| BANK OF AMERICA, N.A., as a Lender |

|

|

| By: |

|

/s/ J. Casey Cosgrove |

| Name: |

|

J. Casey Cosgrove |

| Title: |

|

Director |

|

|

|

| JPMORGAN CHASE BANK, N.A., as a Lender |

|

|

| By: |

|

/s/ Brendan Korb |

| Name: |

|

Brendan Korb |

| Title: |

|

Vice President |

|

|

|

| PNC BANK NATIONAL ASSOCIATION, as a Lender |

|

|

| By: |

|

/s/ Joseph G. Moran |

| Name: |

|

Joseph G. Moran |

| Title: |

|

Senior Vice President |

|

|

|

| FIFTH THIRD BANK, as a Lender |

|

|

| By: |

|

/s/ Marc Crady |

| Name: |

|

Marc Crady |

| Title: |

|

Vice President |

|

|

|

| FIFTH THIRD BANK, operating through its Canadian Branch, as a Lender |

|

|

| By: |

|

/s/ Ramin Ganjavi |

| Name: |

|

Ramin Ganjavi |

| Title: |

|

Director |

|

|

|

| U.S. BANK NATIONAL ASSOCIATION, as a Lender |

|

|

| By: |

|

/s/ Ken Gorski |

| Name: |

|

Ken Gorski |

| Title: |

|

Vice President |

|

|

| By: |

|

/s/ John Rehob |

| Name: |

|

John Rehob |

| Title: |

|

Principal Officer |

|

|

|

| SunTrust Bank, as a Lender |

|

|

| By: |

|

/s/ David West |

| Name: |

|

David West |

| Title: |

|

Vice President |

|

|

|

| Wells Fargo Bank, NA, as a Lender |

|

|

| By: |

|

/s/ Daniel R. Van Aken |

| Name: |

|

Daniel R. Van Aken |

| Title: |

|

Director |

|

|

|

| THE HUNTINGTON NATIONAL BANK, as a Lender |

|

|

| By: |

|

/s/ William F. Sweeney |

| Name: |

|

William F. Sweeney |

| Title: |

|

Senior Vice President |

|

|

|

| CoBank, ACB, as a Lender |

|

|

| By: |

|

/s/ Hal Nelson |

| Name: |

|

Hal Nelson |

| Title: |

|

Vice President |

|

|

|

| AGFIRST FARM CREDIT BANK, as a Lender |

|

|

| By: |

|

/s/ Neda K. Beal |

| Name: |

|

Neda K. Beal |

| Title: |

|

Vice President |

EXHIBIT A

SCHEDULE I

TO COMPLIANCE CERTIFICATE

THE J. M. SMUCKER COMPANY

SMUCKER FOODS OF CANADA CORP.

COMPLIANCE CALCULATIONS

FOR THIRD AMENDED AND RESTATED CREDIT

AGREEMENT DATED AS OF SEPTEMBER 6, 2013

CALCULATIONS AS OF ,

|

|

|

|

|

|

|

| A. Total Leverage Ratio (Section 8.20(a)) |

|

|

|

|

|

|

|

| 1. |

|

Total Funded Debt |

|

$ |

|

|

|

|

|

| 2. |

|

Net Income for past 4 quarters |

|

|

|

|

|

|

|

| 3. |

|

Interest Expense for past 4 quarters |

|

|

|

|

|

|

|

| 4. |

|

Income taxes for past 4 quarters |

|

|

|

|

|

|

|

| 5. |

|

Depreciation and Amortization Expense for past 4 quarters |

|

|

|

|

|

|

|

| 6. |

|

Non-cash share based compensation expense for past 4 quarters |

|

|

|

|

|

|

|

| 7. |

|

Non-recurring fees and expenses in connection with the Blue Transactions (up to $250,000,000) |

|

|

|

|

|

|

|

| 8. |

|

Other non-recurring charges and expenses in connection with any Permitted Acquisition (other than the Blue Transactions) and extraordinary losses and charges (up to $125,000,000 in any period of twelve (12) consecutive

months) for past 4 quarters |

|

|

|

|

|

|

|

| 9. |

|

Merger and integration costs in connection with the Blue Transactions (up to $200,000,000 in the case of cash merger and integration costs) |

|

|

|

|

|

|

|

| 10. |

|

Cash restructuring charges for the U.S. Borrower (up to $25,000,000) |

|

|

|

|

|

|

|

| 11. |

|

EBITDA of Acquired Business for past 4 quarters |

|

|

|

|

|

|

|

| 12. |

|

Non-cash gains for past 4 quarters |

|

|

|

|

|

|

|

| 13. |

|

EBITDA of divested business for past 4 quarters |

|

|

|

|

A-1

|

|

|

|

|

|

|

|

|

|

| 14. |

|

Sum of Lines A2, A3, A4, A5, A6, A7, A8, A9, A10 and A11 minus Lines A12 and A13 (“EBITDA”) |

|

|

|

|

|

|

|

| 15. |

|

Ratio of Line A1 to A14 |

|

|

:1.0 |

|

|

|

|

| 16. |

|

Line A15 ratio must not exceed |

|

|

[ ]1:1.0 |

|

|

|

|

| 17. |

|

The Borrowers are in compliance (circle yes or no) |

|

|

yes/no |

|

|

|

| B. Interest Coverage Ratio (Section 8.20(b)) |

|

|

|

|

|

|

|

| 1. |

|

EBITDA for past 4 quarters |

|

$ |

|

|

|

|

|

| 2. |

|

Interest Expense for past 4 quarters |

|

$ |

|

|

|

|

|

| 3. |

|

Ratio of Line B1 to Line B2 |

|

|

:1.0 |

|

|

|

|

| 4. |

|

Line B3 ratio must not be less than |

|

|

3.5:1.0 |

|

|

|

|

| 5. |

|

The Borrowers are in compliance (circle yes or no) |

|

|

yes/no |

|

| 1 |

Applicable Total Leverage Ratio to be inserted. |

A-2

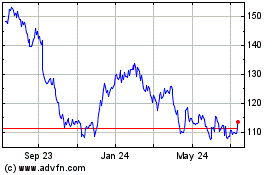

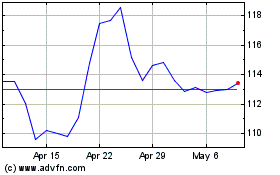

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JM Smucker (NYSE:SJM)

Historical Stock Chart

From Apr 2023 to Apr 2024